This 14-page report re-visits our wind industry outlook. Our long-term forecasts are reluctantly being revised downwards by 25%, especially for offshore wind, where levelized costs have reinflated by 30% to 13c/kWh. Material costs are widely blamed. But rising rates are the greater evil. Upscaling is also stalling. What options to right this ship?

For some mysterious reason, energy commentators often like to lump wind and solar together, under the rubric ‘renewables’. Why though? In our view, solar and wind are really about as similar as pasta and turnips, whose main commonality is that in the world of carbohydrates they are “both not bread”. Vast differences between wind and solar, their costs, their technology gains, and their outlooks are discussed on page 3.

Upscaling wind turbines is hitting its limits. Two years ago, in a note entitled Offshore wind: can costs follow Moore’s Law?, we noted that “The IEA expects levelized costs for offshore wind in Europe to deflate from 7.5c/kWh to 2.5c/kWh by 2050. This assumption looks dangerously wrong to us… Physics punishes larger turbines. They incur greater physical stresses. We illustrate this point by reviewing 50 recent patents from Siemens Gamesa”. We gently recommend re-visiting this long-forgotten research note. Key points are re-capped on page 4.

What are the realistic costs of offshore wind in 2023? Why have costs re-inflated by over 30% since 2019? How much is one-off material cost reinflation, versus higher interest rates? What are the economic sensitivities? We have expanded our commodity price databases and offshore wind models to answer these questions on pages 6-9.

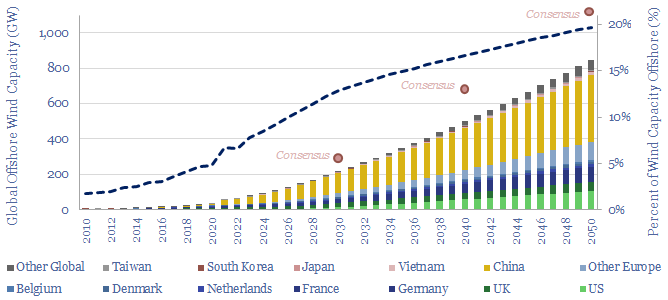

What forecasts for global offshore wind capacity and offshore wind installations? What targets have been published in different regions globally? How much can we de-risk delivery of those targets, amidst the current industry outlook? And what would we need to see, for the tide to turn, to start getting more excited about the offshore wind industry outlook again? Our answers are on pages 10-12.

How is our roadmap to net zero changing? The overarching goal in our research is to model what we consider to be the ‘most likely’ route to Net Zero by 2050. Our long-term wind forecasts are being revised downwards by around 25%. Accordingly, we see a larger share of electricity sector decarbonization coming from solar (large 10% upgrades by 2050, in our models here), and to a lesser extent, gas and CCS.