This 14-page report explores whether global industrial activity is set to become ever more concentrated in a few advantaged locations, especially the US Gulf Coast, China and the Middle East. Industries form ecosystems. Different species cluster together. Elsewhere, in our view, you can no more re-shore a few select industries than introduce dung beetles onto the moon. These mega-trends matter for economic forecasts and valuations.

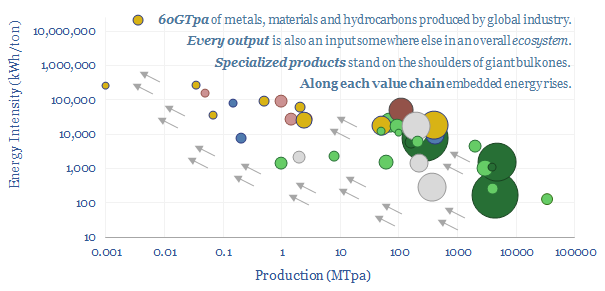

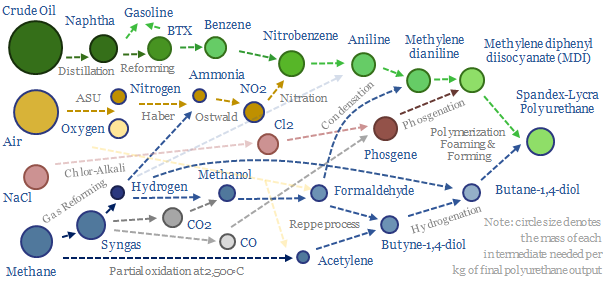

Over the past five years, we have mapped 150 industrial value chains for our energy transition models. As a general observation, value chains form ecosystems, clustering together, as outputs from one industrial process are inputs for the next. This is under-appreciated and has profound consequences for the world.

Direct links. A single commodity chemical facility often supports 20 downstream processes. While a naphtha cracker produces seven main petrochemical feedstocks, and offtakers must be found for all seven. To illustrate the inherent clustering tendencies of industrial ecosystems, some of our favorite examples and rules of thumb are spelled out on pages 2-10.

Surprising links. Some semiconductor materials are produced at larger metals refineries (for example, indium is a by-product of refining zinc for galvanized steel), and in turn, metals refineries often tend to cluster around oil refineries (for petcoke, industrial gases, heat).

Global transportation is always possible, but typically adds 3-5% in transportation costs of individual materials, eating into c20% typical EBIT margins, cascading along industrial value chains that can include up to 20 intermediates, and introducing risks (page 8).

Network effects allow larger industrial ecosystems to share ever better infrastructure. For example, the US Gulf Coast already has 900 miles of hydrogen pipelines. Yet here in the Baltics, we do not have a complete 2-lane highway to Western Europe (video below, more on page 9).

The US Gulf Coast stands out. It has a unique combination of geopolitical security and stability, low energy costs, a coastal location, world-class infrastructure, world class companies, and a credible long-term route to decarbonization. Our growing view is that the energy transition will see activity boom in the US Gulf Coast and its surrounding industrial ecosystem, with consequences for economic growth and valuations (pages 11-12).

Elsewhere in the developed world, we remain concerned that reshoring efforts will fall flat, due to high energy costs and unclear policies. You cannot re-shore “just one or two select industries like solar” any more than you can introduce dung beetles onto the moon. Viable conditions are needed for an entire industrial ecosystem (page 13).

Ecosystem approach? If industrial activity does become ever more concentrated in the energy transition, then investors may wish to consider geographic alignments of companies (some of our favorite examples are on page 14); companies may wish to grow their exposure to thriving industrial ecosystems (and exit waning regions); while policymakers should prioritize competitiveness.