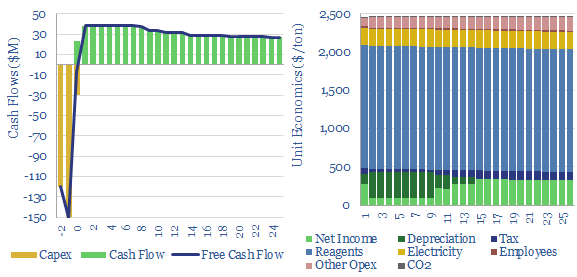

Electrowinning costs and energy economics are built up in this data-file. A charge of $900/ton is required to earn a 10% IRR on a $3,000/kTpa plant with a median energy consumption of 2-3 MWH/ton. Although this will vary metal by metal.

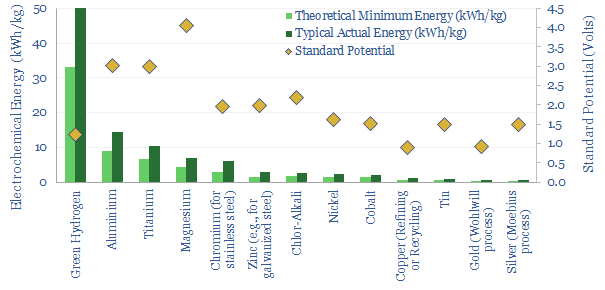

Electrowinning is used to purify metals, such as zinc, copper, tin, nickel, cobalt, magnesium, PGMs and Rare Earths. Even aluminium, chlor-alkali and green hydrogen are debatably electro-winning processes, or at the least electro-chemical processes whose energy economics can all be modeled using Faraday’s Law of electrolysis.

Electrorefining of metals was developed in the second half of the 19th century, applied first to copper, then gold and silver; in order to produce higher purity metals than was possible with pyrometallurgy. Britain’s J. B. Elkington patented a copper electro-refining process in 1865. The world’s first electrorefinery started in 1869 at the Pembrey Copper works, Burry Port, Wales. The Wohlwill process to refine gold was invented in 1874 and the Moebius process for silver in 1884.

This model includes an example from the 13MTpa global zinc production industry, where a 10% IRR requires an electrowinning plant to charge a spread of $900/ton of zinc, to earn a 10% IRR on $3,000/kTpa capex, and around 50-60% of the remaining cash opex is electricity, at 2,8000 kWh/ton.

The energy costs of different electrowinning processes are built up from first principles in the data-file, using the standard potentials of redox chemistry and Faraday’s Law of electrolysis. Zinc electrowinning is not far from the median, of 2,500 kWh/ton of electricity demand. Producing magnesium, titanium, aluminium and hydrogen is most energy intensive.

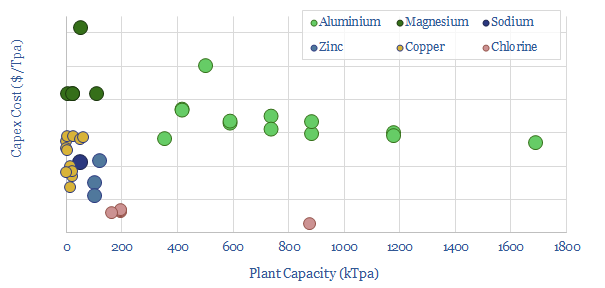

The capex costs of different electrowinning plants are also tabulated in the data-file, based on technical papers. A good mid-point is $3,000/kTpa, although this varies (chart below).

Our full model of electrowinning costs and energy economics is intended as a useful ‘building block’ together with our models of crushing-grinding and flotation, as we delve deeper into the cost curves of mining processes, which are increasingly important for energy transition. Interesting, we also think almost all of these mining technology can smooth our volatile power grids by demand shifting.

We have also constructed specific models of other electrochemical production processes, giving more detail on aluminium production, chlor-alkali production, nickel production, green hydrogen production.