-

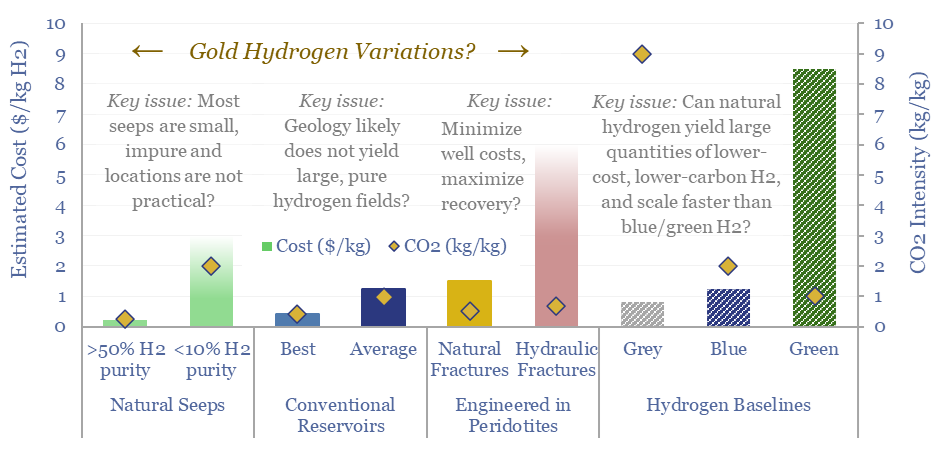

Natural hydrogen: going for gold?

Vast quantities of hydrogen are produced in the Earth’s subsurface, via the serpentinization of iron-containing Peridotite rocks. Gold, white and orange hydrogen variations aim to harness this hydrogen. This 19-page note explores opportunities, costs and challenges for harvesting H2 out of natural seeps, hydrogen reservoirs or fraccing/flooding Peridotites.

-

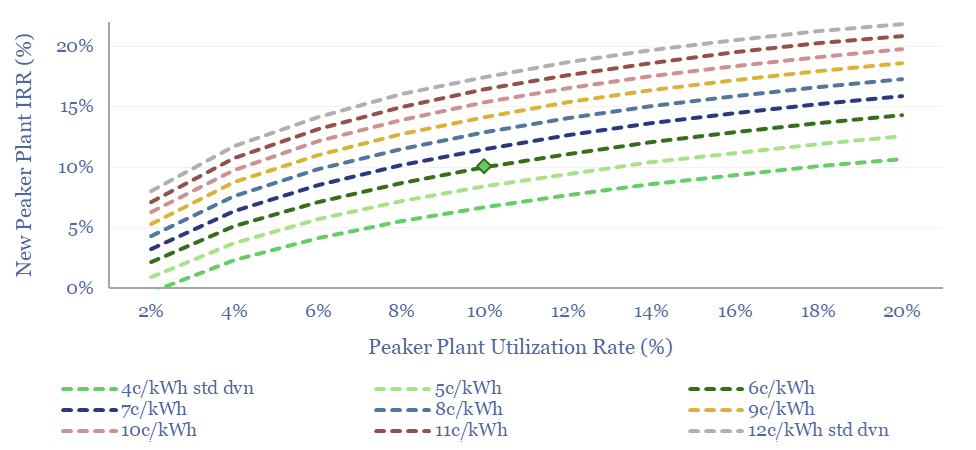

Peaker plants: finding the balance?

Today’s power grids fire up peaker plants to meet peak demand. But the grid is changing rapidly. Hence this 17-page report outlines the economics of gas peaker plants. Rising volatility will increase earnings and returns by 40-50%, before grid-scale batteries come into the money for peaking?

-

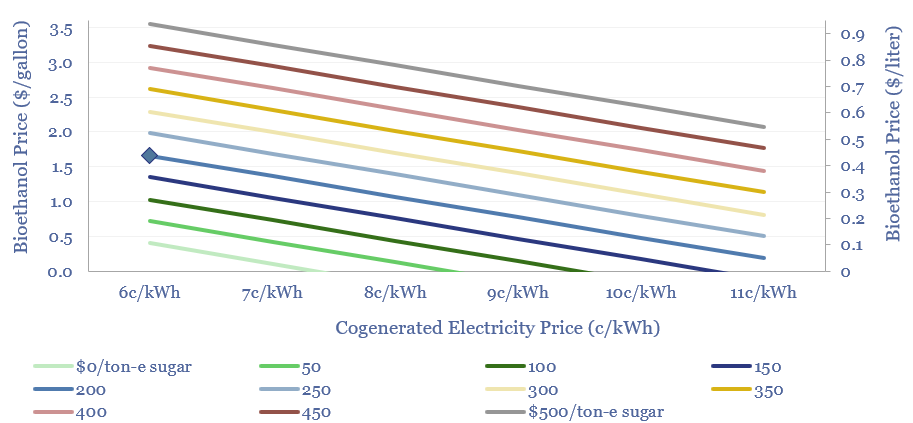

Sugar to ethanol: value in volatility?

Sugar cane is an amazing energy crop, yielding 70 tons per hectare per year, of which 10-15% is sugar and 20-25% is bagasse. Crushing facilities create value from sugar, ethanol and cogenerated power. This 11-page note argues that more volatile electricity prices could halve ethanol costs or raise cash margins by 2-4x.

-

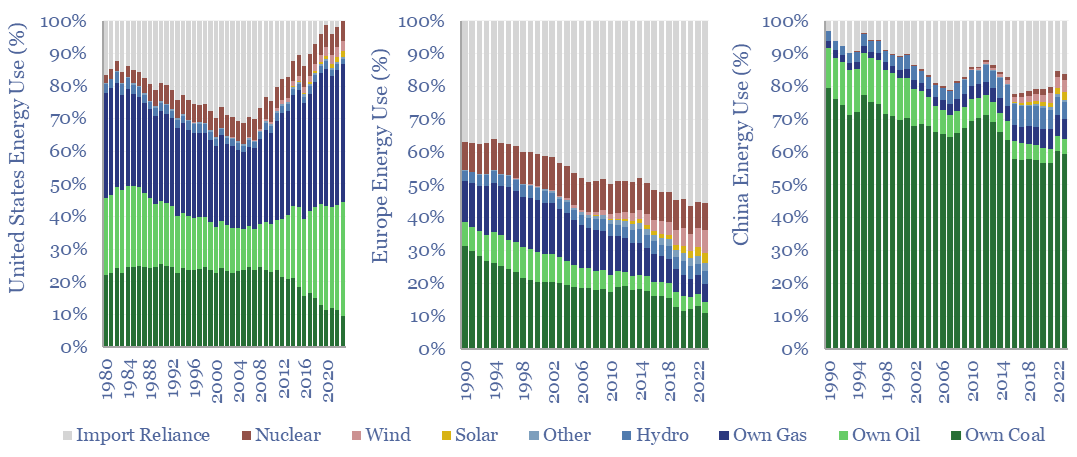

Energy security: right to self-determine?

The average major economy produces 70% of its own energy and imports the other 30%. This 12-page note explores energy security by country. We draw three key conclusions: into US isolationism; Europe’s survival; and the pace of EV adoption, both in China and in LNG-importing nations.

-

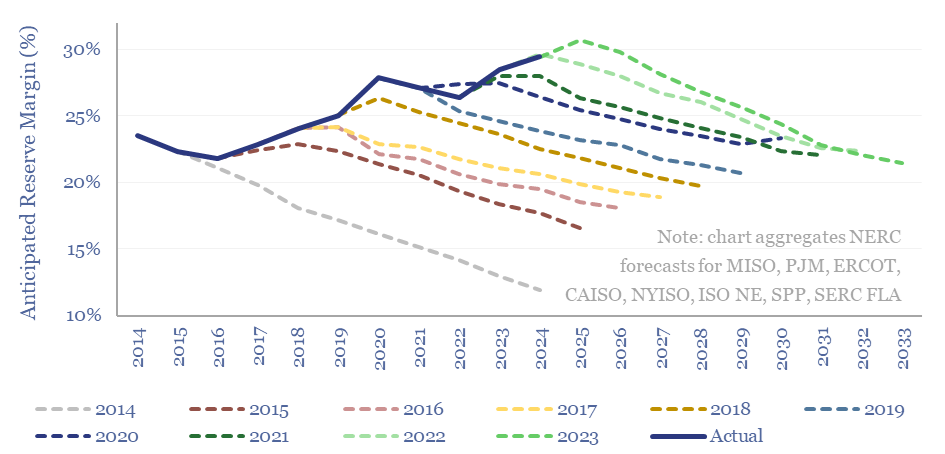

Grid capacity: a wolf at the door?

This 17-page note outlines how capacity markets work, in order to stabilize global power grids. We argue reserve margins in the US grid are not as healthy as they look (in the chart above). Data centers are like wolves at the door. Capacity prices must rise. This boosts gas plants, grid-scale batteries and non-regulated utilities?

-

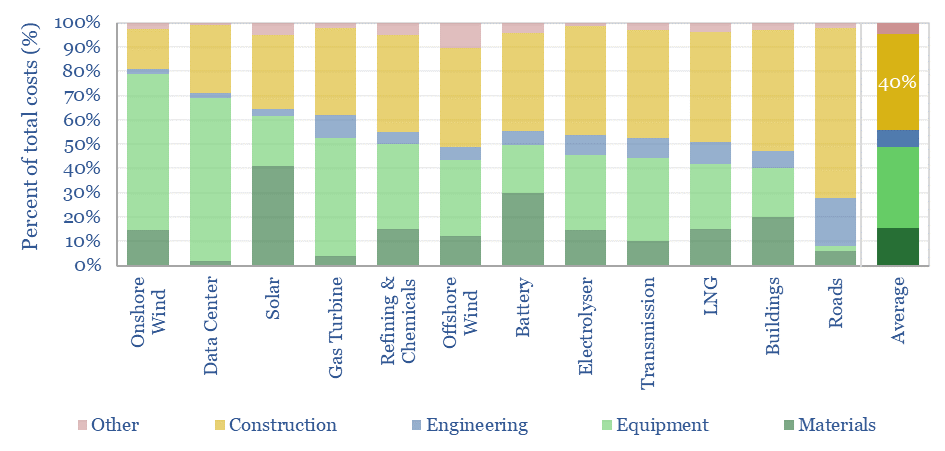

Building energy infrastructure: constructive margin?

Energy transition is the largest construction project in history, with capex costs ultimately ramping up to $9trn per year. Overall, 40% of capex costs accrue to construction firms. Hence this 10-page note evaluates energy infrastructure construction companies, their EBIT margin drivers, and who benefits from expanding power grids?

-

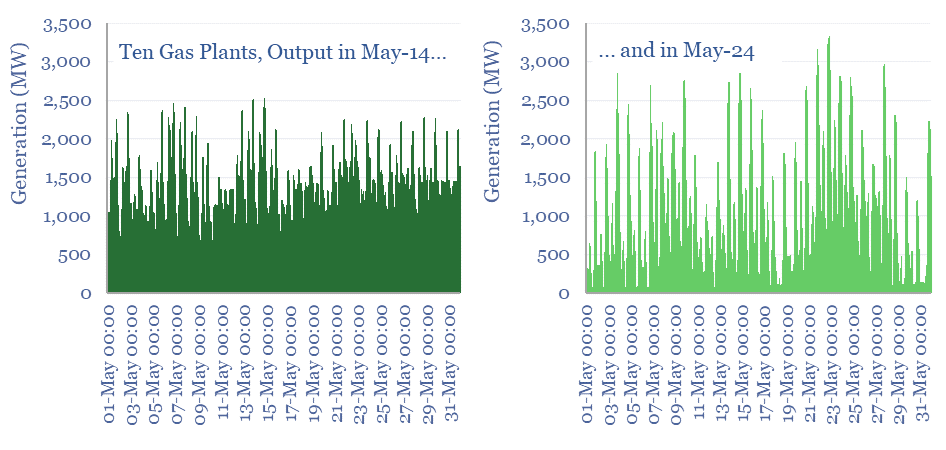

Back up: does ramping renewables displace gas?

This 12-page note studies the generation profiles at 10 of the largest gas plants in Australia, at 5-minute intervals, as renewables gained share from 2014 to 2024. Ramping renewables to c30% of Australia’s electricity mix has not only entrenched gas-fired back-up generation, but actually increased the need for peakers?

-

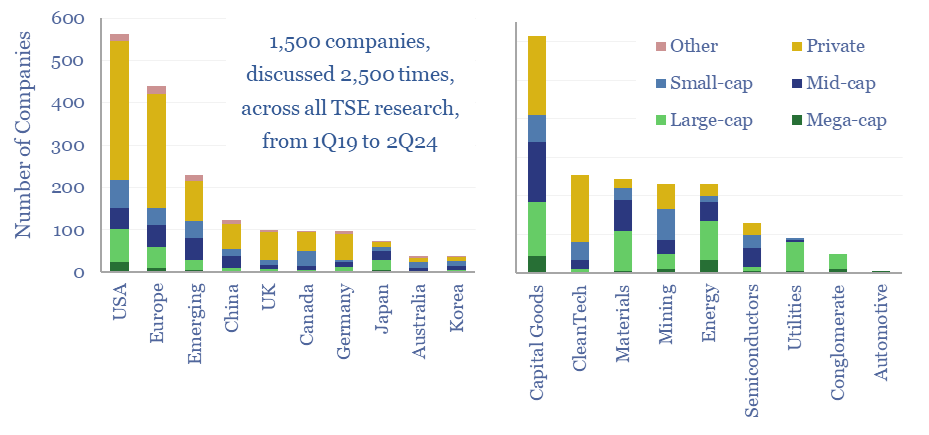

Energy transition in 1H24: 101 companies and the rise of AI?

This 13-page note summarizes the key conclusions across all of our research from 1H24, concisely, for busy decison-makers. We highlight 101 companies, which have come up in our recent work, to enable the rise of AI, and debottleneck its electricity supplies, out of 1,500 companies that have now crossed our screens overall.

-

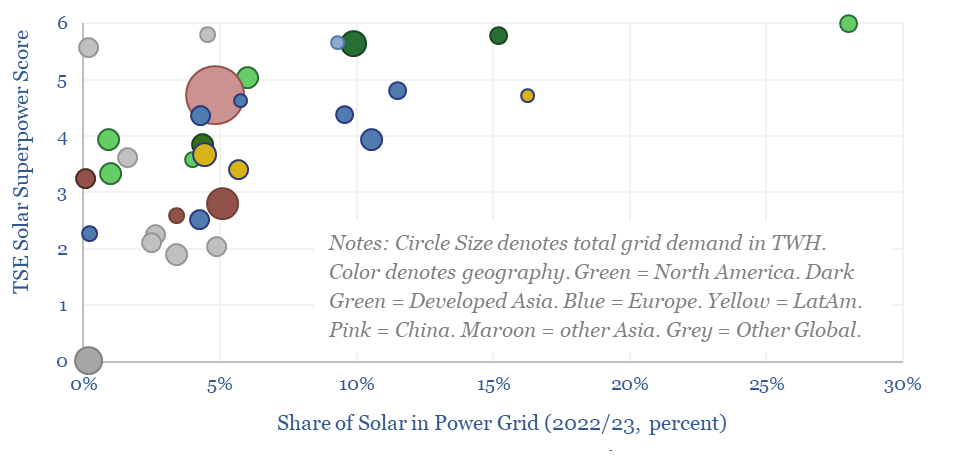

Solar Superpowers: ten qualities?

Solar ramps from 6% of global electricity in 2023, to 35% in 2050. But could any regions become Solar Superpowers and reach 50% solar in their grids? And which regions will deploy most solar? This 15-page note proposes ten criteria and ranks 30 countries. The biggest surprises will be due to capital costs, grid bottlenecks…

-

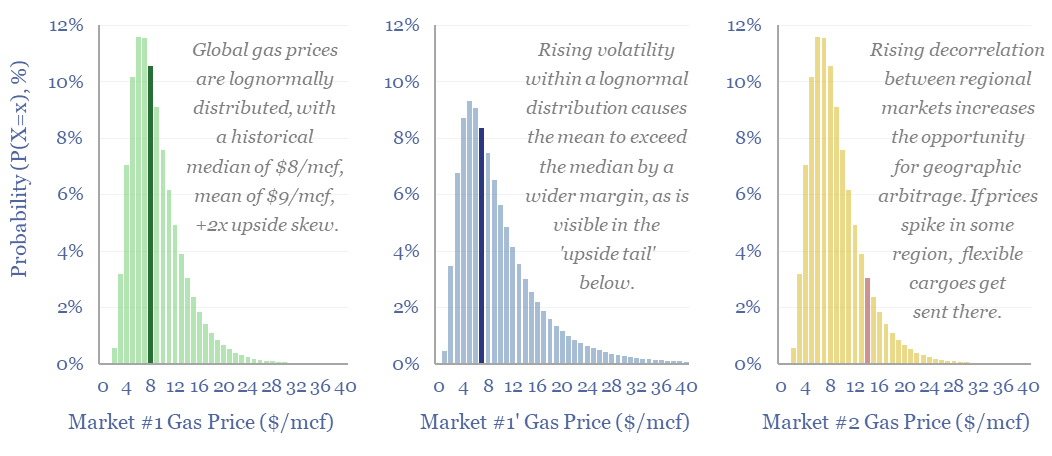

Energy trading: value in volatility?

Could renewables increase hydrocarbon realizations? Or possibly even double the value in flexible LNG portfolios? Our reasoning includes rising regional arbitrages, and growing volatility amidst lognormal price distributions (i.e., prices deviate more to the upside than the downside). This 14-page note explores the upside for energy trading in the energy transition. What implications and who…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)