Lighting is 2% of global energy, 6% of electricity, 25% of buildings’ energy. LEDs are 2-20x more efficient than alternatives. Hence this 16-page report presents our outlook for LEDs in the energy transition. We think LED market share doubles to c100% in the 2030s, to save energy, especially in solar-heavy grids. But demand is also rising due to ‘rebound effects’ and use in digital devices. We have screened 20 mature and (mostly) profitable pure plays.

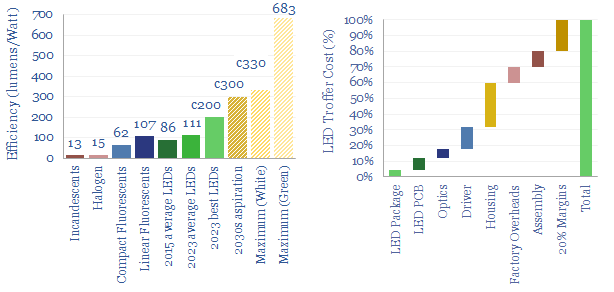

LEDs generate light as a direct current passes across a PN junction, and electrons recombine with holes. Loosely, this makes them ‘solar panels in reverse’. A concise overview of the physics and different LED components — dyes, phosphors, packages, lamps and luminaires — is on pages 2-3.

What outlook for LEDs? We think LEDs will ascent from <50% adoption today to almost 100% in the early 2030s. Market sizing context, reasoned explanations and comparison with the pace of other technology transitions, are on pages 4-5.

Regulations support this unusually strong outlook. New regulations came into force in summer of 2023, banning non-LEDs in the US (July-23) and Europe (September-23).

Rebound effects are also growing the market, as more efficient lighting creates new demand for lighting. The Sphere at the Venetian contains 54,000m2 of Jevons paradox. More broadly, LEDs are used in the rise of electric vehicles and the rise of the internet (pages 6-7).

But the main reason for writing this market outlook for LEDs is that all roads lead to Rome. Several TSE research reports in 2023 augur well for LEDs, and an accelerating pace of adoption. The top three drivers are explored on pages 8-10.

LED costs and payback periods? As a rule of thumb, the higher the night-time electricity price, the larger the budget for efficient LED lighting. Costs, payback periods and IRRs are stress tested on pages 11-12.

Light infantry: leading companies? 20 leading LED and lighting companies derive $40bn of cumulative revenues from across the value chain, with typical operating margins around 8%. Many are midcaps. But in our view, it is unusual to find growing, profitable companies with pure-play exposure to an obvious energy transition theme (solar in reverse!) on undemanding multiples (pages 13-15).

Light conclusions. New technologies, comments about China exposure, and our overall outlook for LEDs are spelled out on page 16.