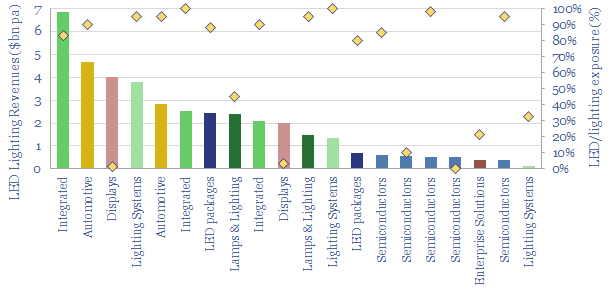

20 leading companies in LED lighting are compared in this data-file, mostly mid-caps with $2-10bn market cap and $1-8bn of lighting revenues, listed in the US, Europe, Japan, Taiwan. In 2022, operating margins averaged 8%, due to high competition, fragmentation and inorganic activity. The value chain ranges from LED semiconductor dyes to service providers installing increasingly efficient lighting systems as part of the energy transition.

The global LED industry is worth $80bn per year, with LEDs used in lighting indoor and outdoor spaces, in the automotive industry and to back-light the screens associated with the rise of the internet.

Leading companies in LED lighting range from specialists manufacturing semiconductor dyes, other specialists combining these components with other conductors and phosphors into LED packages, others encasing this product into LED lamps, others adding further drivers and housings to yield LED luminaires, and others ultimately selling entire lighting systems.

Integration versus fragmentation. Some companies are involved in the entire, integrated value chain discussed above, while others specialise in specific parts, e.g., dye/phosphor specialists upstream, or enterprise solutions businesses that design and implement overall lighting systems for corporate customers.

This data-file profiles 20 leading companies in LED lighting and the broader lighting industry. For each company, we have quantified size, recent financial metrics (e.g., revenue, operating margins), estimated exposure to the LED lighting industry and tabulated key notes. Backup tabs in the file cover LED costs, LED payback periods and LED efficiency.

Competition is high in the LED lighting industry and the average company reported an 8% operating margin in 2022.

Fragmentation is high, as the largest company in the screen derives just $7bn per annum of LED-related revenues. All 20 companies in our screen generated c$40bn of revenue in 2022.

Company sizing is therefore more skewed towards mid-cap and smaller-cap names than other company screens we have undertaken, with the larger companies in the screen having market caps in the range of $2-10bn.

Acquisition activity in the LED lighting industry has been high, and half a dozen of the companies in our screen have recently changed hands or been spun out. Details are in the data-file. For example, Philips Lighting was IPO’ed as Signify in 2016 and remains the largest integrated LED lighting company in the world.

Industry leaders in LED lighting include listed companies in the Netherlands, Japan, the US, Taiwan, China, Austria and Germany.