After five years researching the energy transition, we believe it favors active managers. Within the energy transition, active managers can add value by ranging across this vast mega-trend, balancing risk factors in a portfolio, timing volatility, understanding complexity, unearthing specific opportunities and benchmarking ESG leaders and laggards.

We recently enjoyed exploring this topic on the Capital Cyclists podcast. The theme matters because total associated investment needs to treble to $9trn per year to achieve an energy transition, and this is not going to happen if capital is misallocated. This short note explores ten advantages for active managers in the energy transition.

(1) Energy transition is a structural mega-trend. Not an isolated niche. It is the largest construction project in the history of human civilization, impacting markets worth $25 trn per year today and doubling them to $50 trn per year by 2050; re-shaping terms of trade for industrial eco-systems across the entire global economy; re-shaping ever more sectors that at first glance have nothing to do with the energy transition (note below). Net Zero means zero net CO2 emissions for every sector in the market. Hence in our view, the impacts of energy transition need to be considered across entire portfolios.

(2) Managing risk factors. Investing involves being paid to take risk. Energy transition investing involves at least ten risks (below). Constructing a portfolio involves minimizing overall risk via diversification. And on top of this, at any given point in time, the market may be willing to over-pay you to take some risks and under-pay you for taking others. The role of an active manager is that they are constantly appraising these risks, their balance and their relative attractiveness (as explored in the link below).

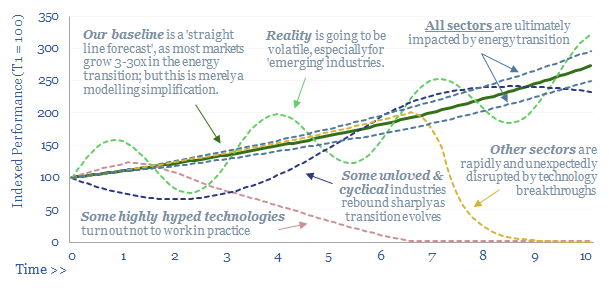

(3) Times are changing. We are told that we are one of few research firms with a fully modeled roadmap to net zero, including the resultant pull on all of the different themes, sectors, materials and commodities. The average one gains in size by 3-30x in the energy transition. Vast new markets scale up in Wind, Solar, Electric Vehicles, Batteries, underlying Metals and Materials, next-gen Nuclear, Electrification, the Rise of AI, Hydrogen, CCS, Nature. And yet vast value remains in oil, gas, LNG, plastics, possibly even coal. Vast changes — and the expectation of vast changes — are particularly likely to create dislocations in the ‘correct’ market prices of securities.

(4) Timing matters. There are many themes that we want to scale up as part of the energy transition. And ultimately they will scale up. But the trajectory will not be a straight line. We have recently seen share prices crushed in offshore wind (forewarned here) or PV silicon (forewarned here). Active managers can add value by avoiding looming walls of over-supply, or conversely, by finding industries that may pivot from unloved to station central (we have some ideas on this front too).

(5) Technical expertise is rewarded. Many of the big questions in energy transition come down to technology, which frankly, can only be understood by building up technical expertise. Will the rise of the solar industry add 40% to total global silver demand, or will silver be entirely thrifted out? (note here). Will the entire lithium mining industry be rendered obsolete by direct extraction from brines? (note here). Does CCS actually work? (note here). Our perspective is that active managers can add value where they build up a technical understanding of complex market debates (video below).

(6) Second order consequences? In an efficient market, obvious opportunities are quickly seized. Thus in our experience, the best opportunities are non-obvious opportunities, which markets have not yet fully grasped. If you are constructive on electric vehicles, then clearly “most obvious” is to own Tesla (the fact that it is 2% of the S&P 500 at 73x PE perhaps indicates the “obviousness”). Next most obvious is to own bottlenecked battery materials. Less obvious is the possibility that the rise of EVs will unexpectedly double the margins of polyurethane and textile fiber producers, which can source increasingly cheap BTX feedstocks as demand for gasoline declines (note below). Across all of our work, our biggest focus is to help our clients find non-obvious market dislocations.

(7) Fast evolving. We noted above that some markets in the energy transition are changing vastly. But others are also changing rapidly. Technology is advancing faster than ever before with 7M patents now filed each year and accelerating further due to AI. One thing we have observed in our research is that new themes can emerge very quickly. For example, in the past twelve months, after passing IRA regulations, the US is seeing a boom in blue hydrogen, blue ammonia, blue steel, blue chemicals. This has come out of nowhere. We think active managers can add value by latching on to new themes quickly.

(8) Bubble risks. It is also important to latch onto the right themes. Fantasy thinking can become commonplace during times of vast changes. We have worried that some themes in the energy transition show similarities with past bubbles (note below). A strange feature of index fund is that the more a security price inflates, the more of the security the index fund will own (by definition). Our favorite antidote to getting ruined by bubbles is sound economic modeling, hence we have built up a library of 170 economic models.

(9) Benchmarking leaders and laggards. Within individual sectors, markets are likely to reward ESG leaders and punish ESG laggards. But appraising leaders and laggards is not always simple. Our favorite example is illustrated in the refinery database below, as well as c50 broader data-files appraising CO2 intensity by industry.

(10) Technology opportunities? Finally, earlier-stage companies are increasingly raising capital, even becoming listed in public equity markets, despite being quite a binary ‘bet’ on an unproven technology. Is the technology real? Will it work? Does it have a moat? Will it change the world? Or could it be another Theranos? Index funds often do not get to ask these questions. But active managers do. And so do our patent screens.

Energy transition: active managers? Our view is that energy transition favors active managers, to appraise the market dislocations and complexities discussed above. For more information on our energy transition research, how we work with our clients, or if we can help you with an introduction on this front, then please do contact us.