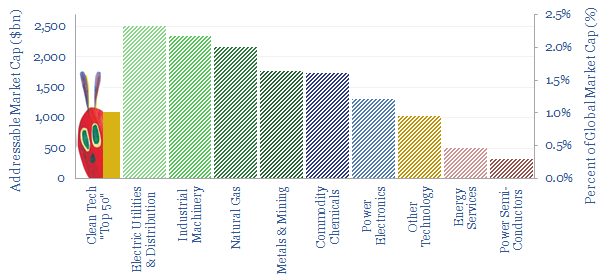

The universe of energy transition stocks seems small at first. 50 clean tech companies have $1trn in combined value, less than 1% of all global equities. But decarbonizing the world is insatiable. Consuming ever more sectors. In our attempt to map out all of the moving pieces, we are now following over $15trn of market cap across new energies, (clean) conventional energy, utilities, capital goods, mining, materials, energy services, semiconductors.

In one of the all time great works of literature, a tiny and very hungry caterpillar hatches into the world. Then over a period of several days, the caterpillar gobbles up substantively everything that it encounters: an apple on Monday, two pears on Tuesday, three plums on Wednesday, four strawberries on Thursday. No matter how much the insatiable little creature eats, it is still hungry. Although one day, it does eventually morph into a beautiful butterfly. And everyone lives happily ever after.

The energy transition is like the hungry caterpillar. At first it seems small. Confined to a few niche companies. But over time, it feels like the theme is also liable to gobble up whatever it encounters. We think the world will achieve an energy transition. The thermodynamics of renewables-electrification are simply astounding. And helping decision makers to find economic opportunities in the energy transition is the focus of TSE’s research.

But after four years, our definitions of ‘energy transition stocks’ seem to be getting ever broader. Consuming ever more sectors.

Five themes still dominate in the minds of many investors. 60% of the market cap in these themes is concentrated in 50 clean tech companies. But are there growing risks of crowding in some of these ‘obvious’ energy transition stocks? (pages 2-3).

Consuming the electric sector. We count c$4trn of addressable market cap in sectors linked to electrification, across utilities, power electronics and semiconductors. Some of the names that have stood out in our research are noted on pages 4-5.

Consuming the metals and materials sector. We count $2trn of addressable market cap in sectors linked to raw materials, across metals, mining, mining equipment. Some of the names and themes that have stood out in our research are noted on pages 6-7.

Consuming the commodity chemicals sector. “If you want to make an apple pie from scratch, first you must invent the universe”. There is no modern wind, solar, batteries without carbon fiber, ethylene vinyl acetate, fluorinated polymers; and in turn, these are some of the most sophisticated and complex value chains in human history. Commodity chemicals companies that have stood out in our research are noted on pages 8-9.

Consuming the energy sector. Building out new energies is a boot-strapping process, pulling on today’s traditional energies, while cleaner fuels such as natural gas double in volumes in our overall roadmap to net zero (page 10).

Consuming other sectors too? We explore the read across from energy transition to financial services, bio-sciences, aerospace and defence, consumer goods and healthcare, along with some broader conclusions about energy transition stocks, on pages 11-12.