The levelized cost of onshore wind is estimated in this economic model, at 5-7c/kWh to generate 5-10% levered IRRs on new wind project costing $1,000-3,000/kW. The model also contains a granular breakdown of wind capex costs, operating costs, and other economic assumptions for wind projects.

This data-file models the costs and the economics of constructing a new onshore wind power project, based on technical papers and a detailed line-by-line capex cost build-up.

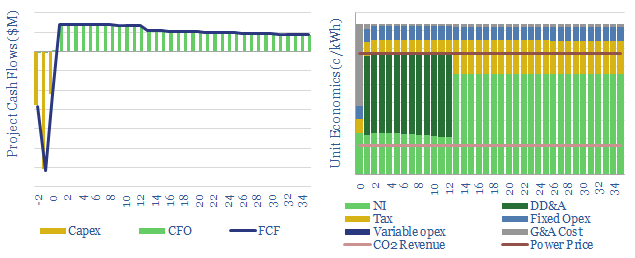

A typical onshore wind project requires a 6-7 c/kWh power price and a $50/ton CO2 price in order to generate an unlevered IRR of 10%.

In the past, decision-makers have been inclined to view 5-6% IRRs as acceptable, lowering the incentive price to 5-6c/kWh even without a carbon price. Although this is clearly changing amidst higher inflation and interest rates post-2022 (note here).

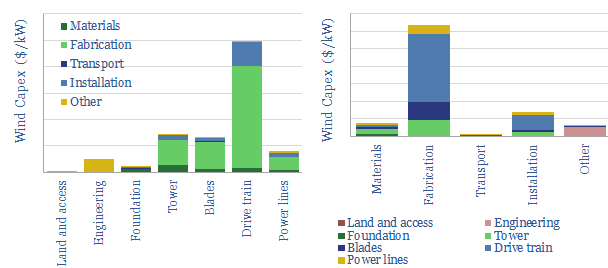

The main cost is capex, which varies between $1,000-3,000/kW (below), depending on materials costs and scaling factors.

The data-file gives a detailed breakdown for the levelized cost of onshore wind, across materials, fabrication, transport, installation and linking to our other models. Larger turbines will reduce future costs, as stress-tested in the cost tab, and following on from the physics of wind turbines. Our recent note on up-scaling wind turbines is linked here.

Operating costs of an onshore wind turbine are estimated in the range of $25-75/kW-year, based on our data-file here. And the single largest way to lower costs is through up-scaling, spreading relatively fixed costs across larger turbines and larger overall assets.

For comparison, our economic model for offshore wind projects is linked here. The levelized costs of onshore wind are about 50% lower than offshore wind, comparing our base case estimates, apples to apples. All of our broader research into wind is linked here. For further comparison, our other power market models and conclusions are linked here.