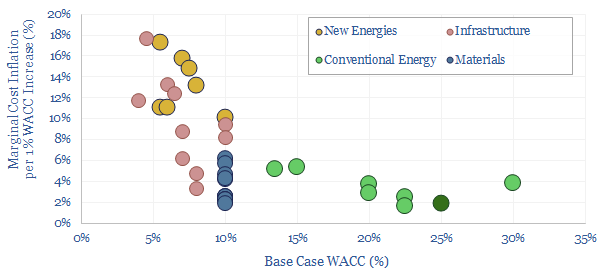

In the under-supplied world of 2022-30, raising interest rates might not mute inflation, but could actually deepen it. By deterring the investments needed to cure inflation itself. Each 1% increase in capital costs re-inflates new energies 10-20%, infrastructure 2-20%, materials 2-6%, and conventional energy 2-5%. This 12-page note outlines the tension between energy transition versus interest rates. And the implications.

Inflation in the energy transition. In 2021, we began to worry about inflation. In May-2021, we asked if it would de-rail important goals in the energy transition (note here). In December-2021 we started forecasting double-digit inflation across the whole world (note here – indeed, this note is both interesting and dispiriting to re-read from today’s vantage point).

There are nasty feedback loops, where the deeper you delve into commodity chemicals, the more unfortunate cascades you will find (the best recent example is here). So inflation can become self-reinforcing (page 2).

So can persistently high inflation be averted by raising interest rates? The first consequence of higher rates is to de-value financial assets. Not only bonds (page 3). But many wind and solar projects with fixed-price PPAs would also become impacted, possibly even distressed, which is not going to help the energy transition to progress (pages 4-5).

Developing more energy also becomes harder. Energy is capital intensive (page 6). Providers of capital require higher returns when interest rates rise. This re-inflates the costs of developing additional energy supplies (page 7). And because of their financial characteristics, wind, solar, hydro, nuclear are about 5x harder-hit than conventional energies (page 8).

Developing more infrastructure becomes harder. It is not enough to produce wind and solar. You must construct power grid infrastructure too. This is also capital intensive, and prone to re-inflating with higher interest rates (page 9).

Developing more materials becomes harder. Unfortunately solar panels do not grow on trees. Building more solar requires building more PV silicon, or silver, or copper production facilities. These are also capital intensive, and prone to re-inflating with higher interest rates (page 10).

Our conclusion is that raising interest rates would be an unbridled disaster for the energy industry. Policy-makers face a dilemma between curing energy shortages versus interest rates. Between energy transition versus interest rates. Forecasts are set out on page 11.

What does it mean for investors and other decision-makers? Our best ideas for navigating this environment are summarized on page 12.