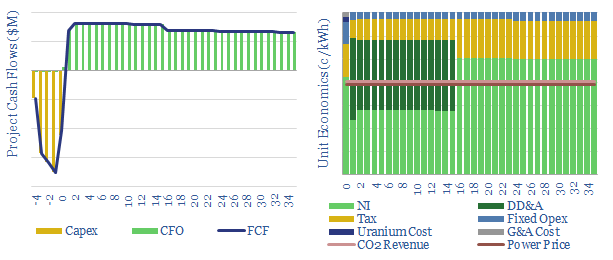

This data-file models the costs of a nuclear power project, based on technical papers and past projects around the industry. An up-front capex cost of $6,000/kW might yield a levelized cost of 15c/kWh. But 6-10c/kWh is achievable via a renaissance in next-generation nuclear.

Nuclear power plants generate 2,800 TWH per year, which is 10% of the world’s electricity and around c4% of the world’s total energy supply. Nuclear’s share of global electricity demand peaked at 17.5% in 1996 and has since lost share.

The historical challenges have included high capex costs and long construction cycles. This means that a CO2 price of $270/ton is required before new nuclear projects would outcompete new gas projects, on an apples-to-apples basis.

Again, this is why capex deflation matters, and can underpin a renaissance in the nuclear industry, especially amidst persistent energy shortages, and growing demands for low-carbon, baseload power.

Uranium only comprises 3% of total levelized costs (at $50/lb U3O8 prices), which makes nuclear power economics less sensitive to fuel costs than combustion-based power technologies.

Energy efficiency of nuclear power projects can be quantified and stress-tested in the data-file in GWH/ton and percentage terms.

Levelized costs also have limitations as a metric. Economics can be compared with coal, gas, hydrogen, wind or solar. Further nuclear details are in our recent nuclear research.