This data-file tracks some of the leading solar inverter companies and inverter costs, efficiency and power electronic properties. As China now supplies 85% of all global inverters, at 30-50% lower $/W pricing than Western companies, a key question explored in the data-file is around price versus quality.

Solar inverters convert the DC output from solar modules in an AC waveform that can be transmitted across power grids or used in electronic devices. This is achieved via pulse width modulation (explained here) using IGBTs and MOSFETs (explained here).

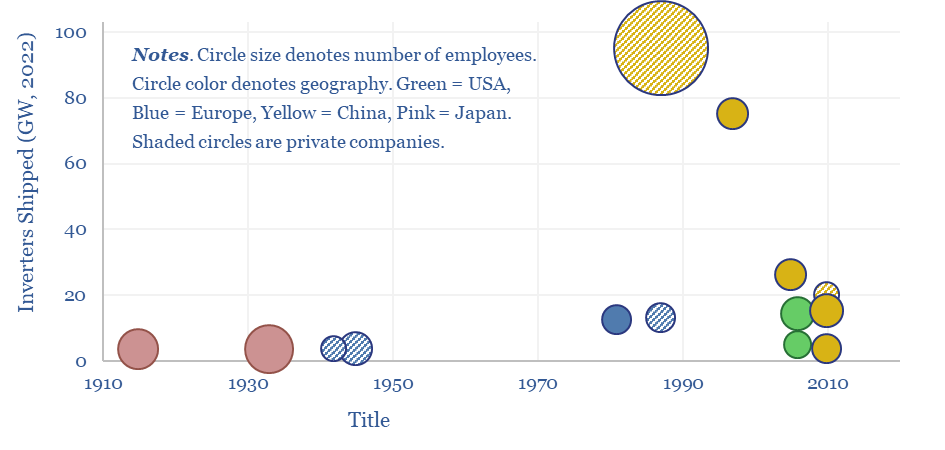

This data-file covers solar inverter companies and the costs of solar inverters. Twenty companies account for about 90% of global inverter shipments, and the ‘top five’ account for two-thirds of inverters, of which four are Chinese companies, such as Huawei and Sungrow, while we have also explored electronics from SolarEdge.

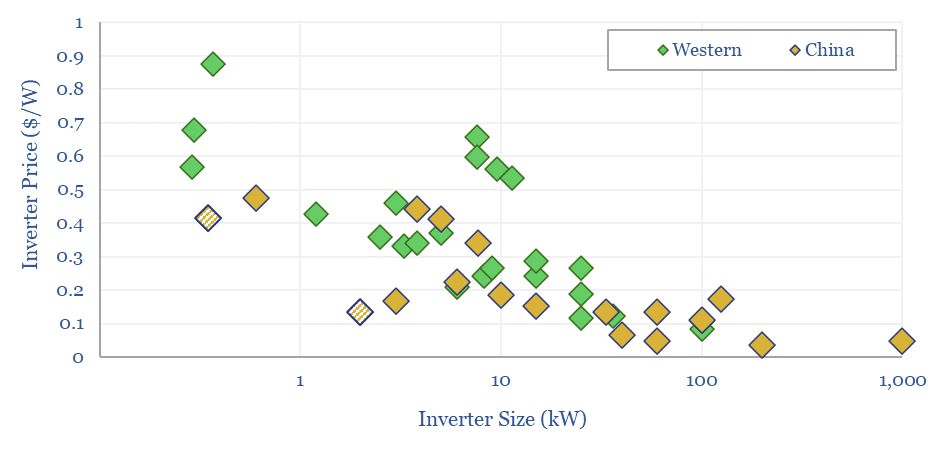

Our utility-scale solar cost models assume $0.1/W inverter costs, and this is borne out by the data-file. Although costs per watt approximately double for every 10x reduction in inverter size.

Chinese manufacturers sell inverters for 30-50% less than Western companies, suggesting challenged margins and strong competition.

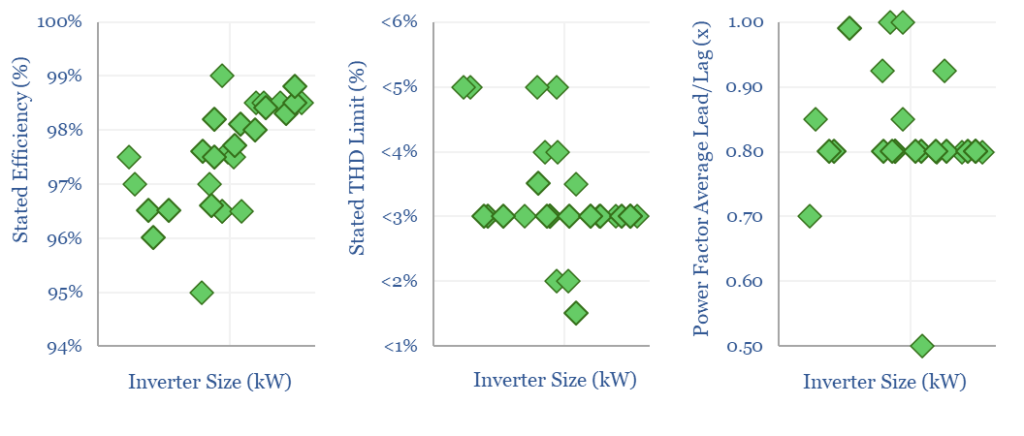

Decent inverters on the market in 2024 convert 98% of the incoming DC electricity into AC electricity, and have advanced power electronics. The ability to control reactive power with a +/- 0.8 leading/lagging power factor is typical. As is the ability to limit total harmonic distortion below 3% (charts below).

While Chinese-made inverters are 30-50% lower cost than Western-made inverters, a key question explored in the data-file is whether this also comes at the cost of lower power quality. Our views and their implications are summarized in the first tab of the data-file. The backup tabs contain the full data behind all of the other charts above.