Chips must usually be kept below 27ºC, hence 10-20% of both the capex and energy consumption of a typical data-center is cooling, as explored in this 14-page report. How much does climate matter? What changes lie ahead? And which companies sell into this soon-to-double market for data-center cooling equipment?

Our base case outlook for AI considers 150GW of AI data-centers globally by 2030, underpinning 1,000 TWH pa of new electricity demand. However, at $30,000 per GPU, it is not advisable to cook your chips. 150GW-e of AI data-centers requires 150GW-th of data-center cooling. Hence the data-center cooling market is summarized on page 2.

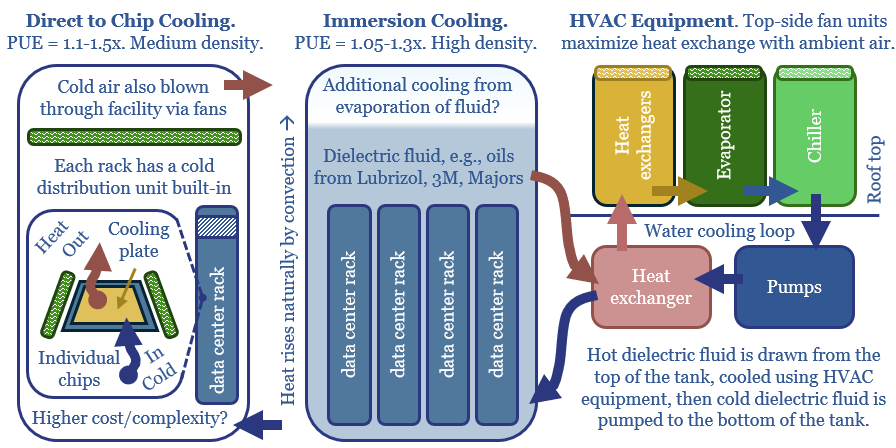

The commercial cooling industry hinges on industrial HVAC, across heat exchangers, water evaporator units and industrial chillers, and explained from first principles on pages 3-4.

An underlying observation is that increasing demand for chilling capacity pulls on many capital goods categories such as compressors, heat-exchangers, pumps, fans and blowers, storage tanks, piping, VFDs, switchgear, grid connections and engineering and construction. All of the capex ultimately goes somewhere.

The economics of commercial cooling are broken down across capex, electricity, maintenance, utilization and operating decisions on page 4-5.

Another feature of our model is that we can stress-test PUEs and capex costs according to different inputs and outputs, for example, to control for water use (currently up to 10-30ml per GPT query), different climates, or tolerating higher temperatures at the chip-level.

Specifically for data-centers, the market is unusual in that it tolerates higher temperatures than other cooling sub-segments (which typically chill water to 7ºC), but also higher cooling density in kW/rack (pages 6-7).

Location matters. For example, how are the PUEs and capex costs of data-centers different in cool locations such as Norway and Calgary, versus hot, arid locations such as West Texas and the Middle East? Answers for core cooling and overall data-centers are on pages 8-9.

Immersion cooling may offer advantages over direct-to-chip cooling, and thus gain market share, for reasons outlined on pages 10-11.

Ten companies control 60% of the $15bn pa data-center cooling market, including two Western leaders. Best-known is Vertiv. #2 is a global capital goods giant. Key conclusions from our company screen are on pages 12-14.