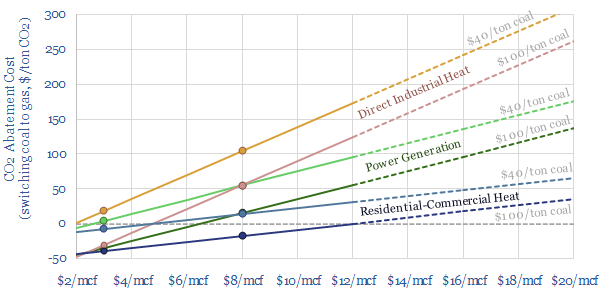

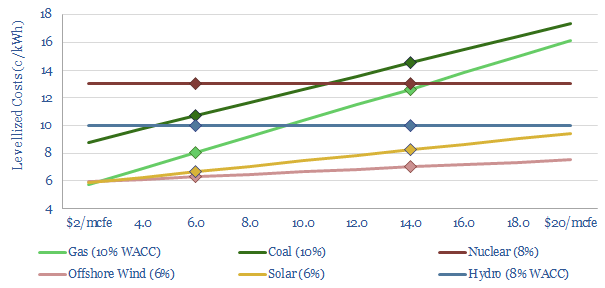

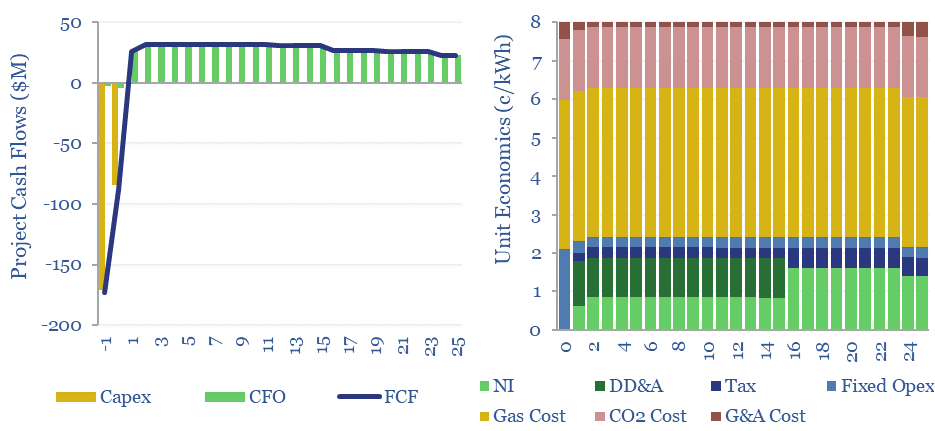

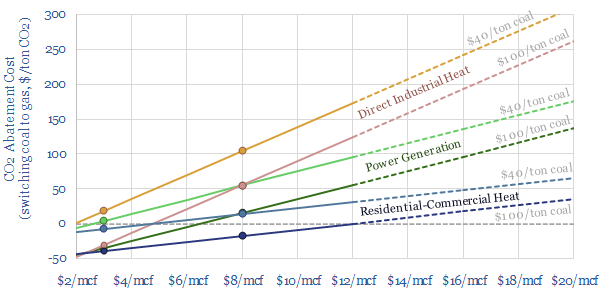

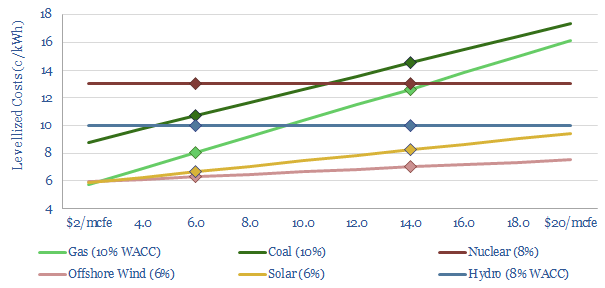

…of gas averaged $8.2/mcf, which translates into 2.7c/kWh-th. Thus the premium for natural gas was around 1.5c/kWh-th. Directly substituting coal fuel for gas fuel therefore incurred a cost of $80/ton…

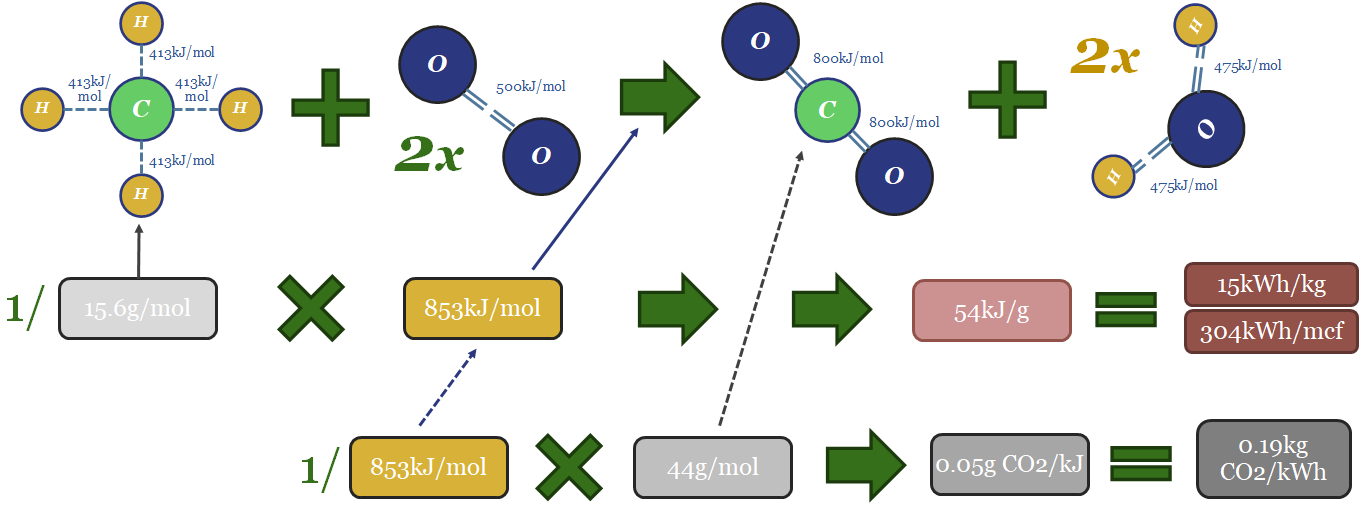

…combined cycle gas plants average 57% efficiencies, and we are particularly excited about emerging gas-fired CHP systems that can reach 80-90% total thermal efficiencies (note below). https://thundersaidenergy.com/2021/07/01/gas-turbines-what-market-size-in-energy-transition/ (3) What about…

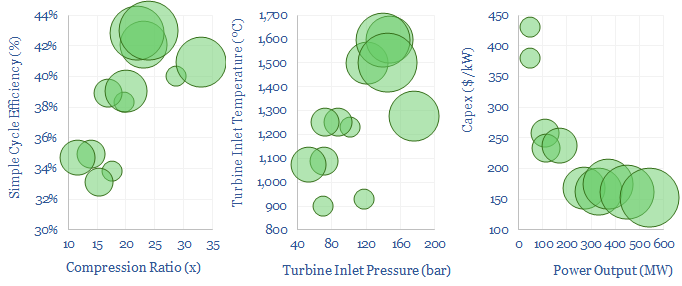

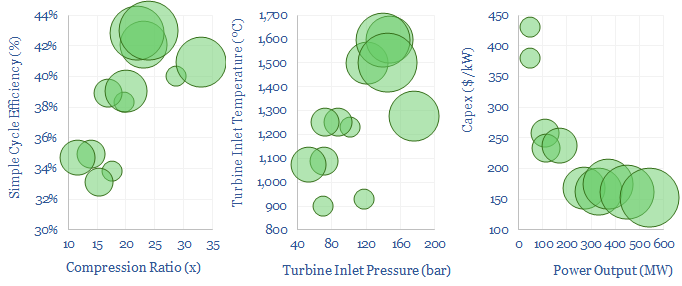

…for gas turbines in the energy transition is published here. Leading companies in gas turbines are profiled here. Gas turbine operating parameters are compiled for a dozen gas turbine models…

…and power-electronics; and less gas, until gas prices normalized. Self-defeatingly, we would also expect less short-term decarbonization via coal-to-gas switching. Across our research we have modelled over 150 different technologies…

…model has power rising from c40% to c50% of the US gas market by 2030, compensated by lower use in residential heat. https://thundersaidenergy.com/downloads/us-co2-and-methane-intensity-by-basin https://thundersaidenergy.com/downloads/gas-gathering-how-much-co2-and-methane https://thundersaidenergy.com/downloads/gas-pipelines-how-much-energy-co2-and-methane-leaks https://thundersaidenergy.com/downloads/gas-industry-co2-per-barrel https://thundersaidenergy.com/downloads/methane-leaks-from-downstream-gas-distribution https://thundersaidenergy.com/downloads/methane-slip-how-much-gas-evades-combustion https://thundersaidenergy.com/2019/12/15/global-gas-catch-methane-if-you-can https://thundersaidenergy.com/downloads/decarbonization-of-the-united-states-with-a-co2-price…

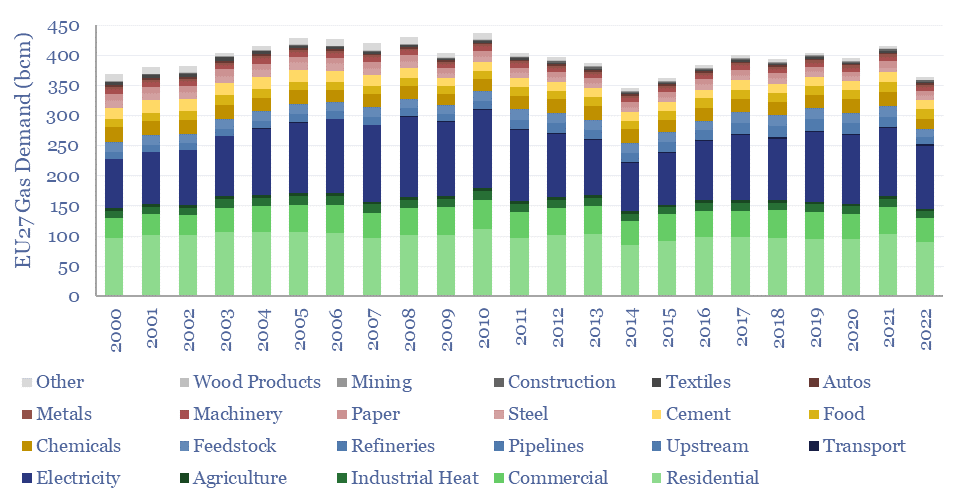

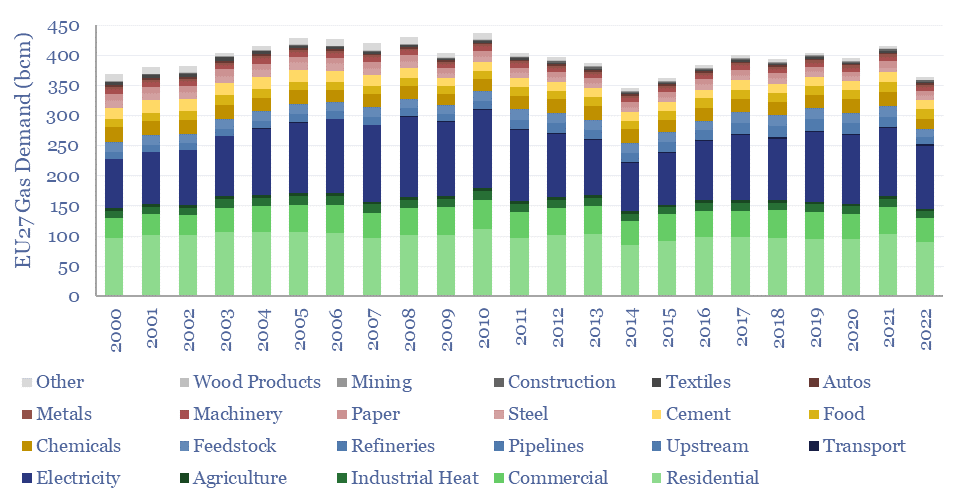

…conclusions. We have scrubbed the data and updated our European gas and power model (below). https://thundersaidenergy.com/downloads/european-natural-gas-demand-model/ European gas demand (EU27 basis) fell from 414 bcm in 2021 to 363 bcm…

…to provide mechanical drive (including the inlet compressor) and generate electricity. There is c4% CO2 in the exhaust gas. In a simple-cycle configuration, exhaust gases exit from the gas turbine…

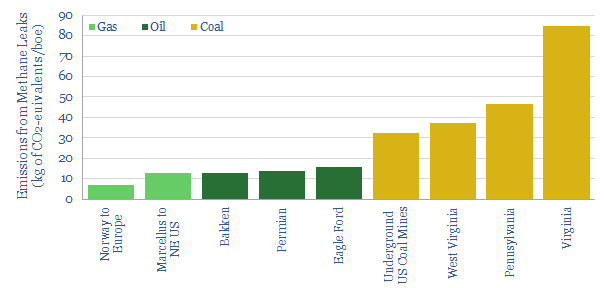

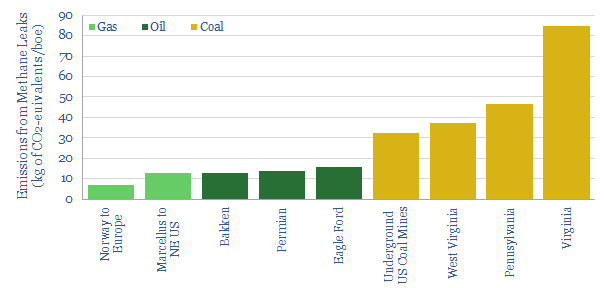

…be much higher for associated gas in oil basins than non-associated gas in gas basins. The Marcellus is the lowest-leak basin in our sample at 0.1%, versus the Permian, Bakken…

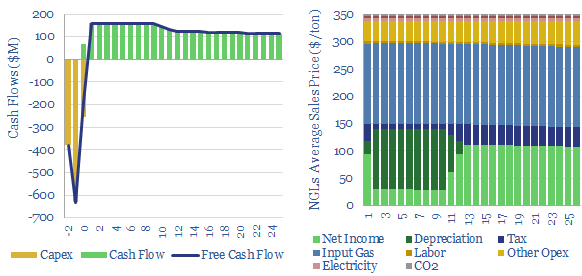

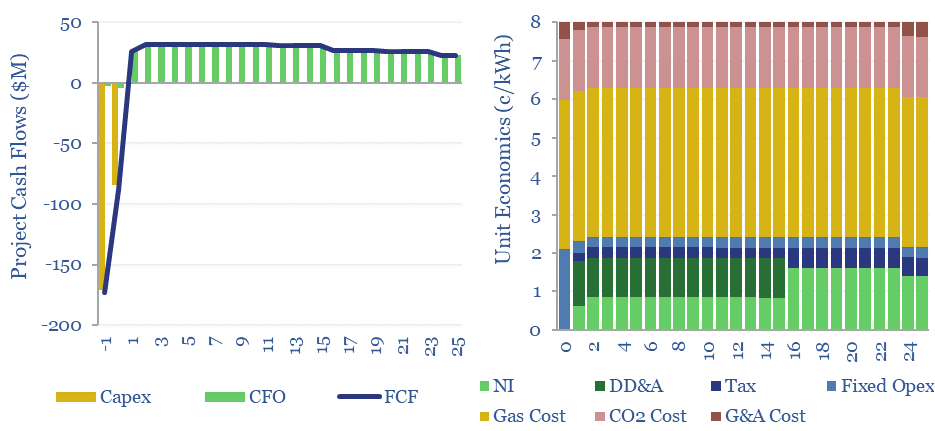

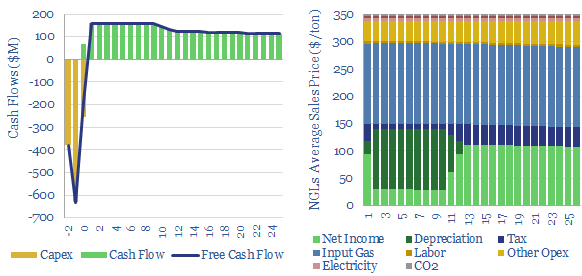

…energy. The costs of gas fractionation require a gas processing spread of $0.7/mcf for a 10% IRR off $2/mcf input gas, or in turn, an average NGL sales price of…

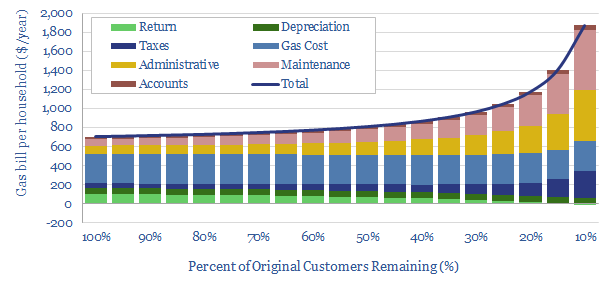

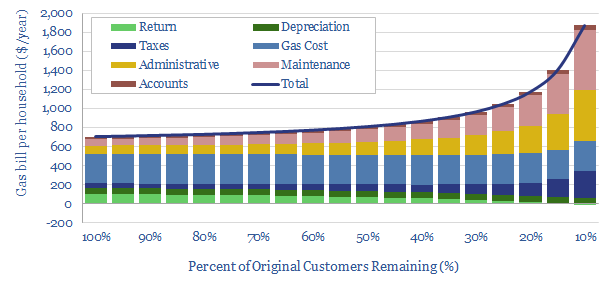

…(note and data-file below). https://thundersaidenergy.com/2019/12/15/global-gas-catch-methane-if-you-can/ https://thundersaidenergy.com/downloads/gas-pipelines-how-much-energy-co2-and-methane-leaks/ (4) Bankrupted distributors? Once c75% of the customers have left a gas network, it will become very difficult for these gas distributors to remain…