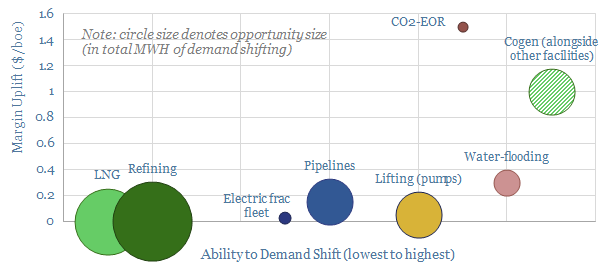

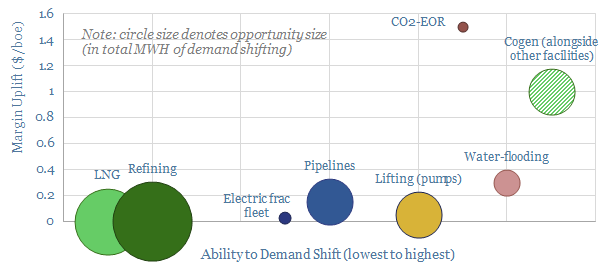

…report is to assess whether the oil and gas industry can generate any incremental income via demand-shifting. We find oil and gas assets are generally less capable of demand-shifting, compared…

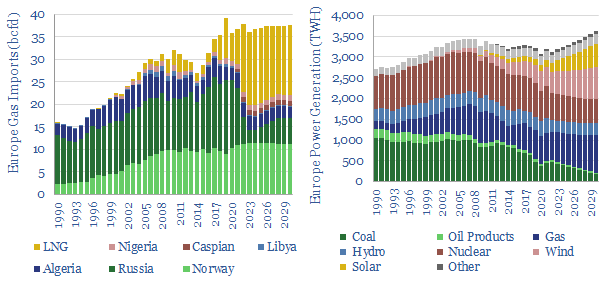

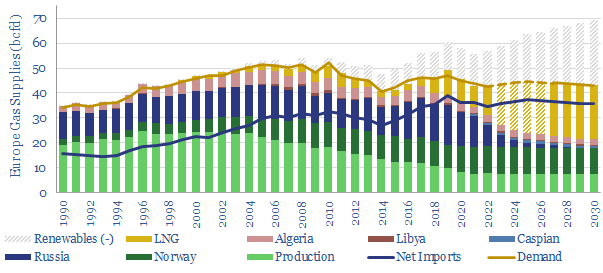

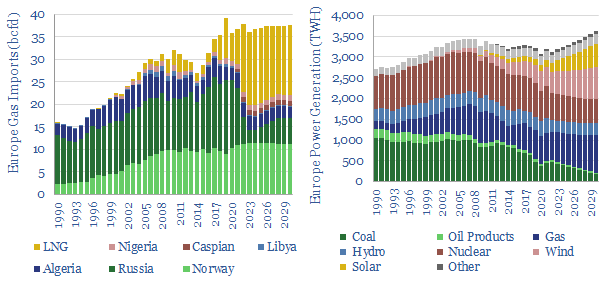

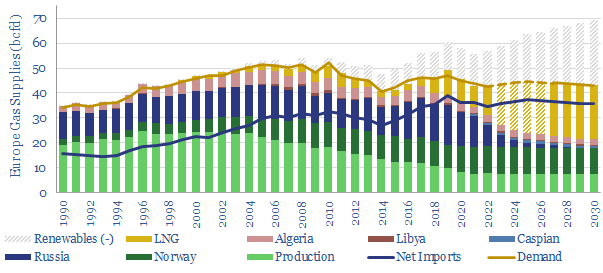

This data-file is our European gas supply demand model. Balances are assessed in European gas and power markets from 1990 to 2030, reflecting all of our research into the energy…

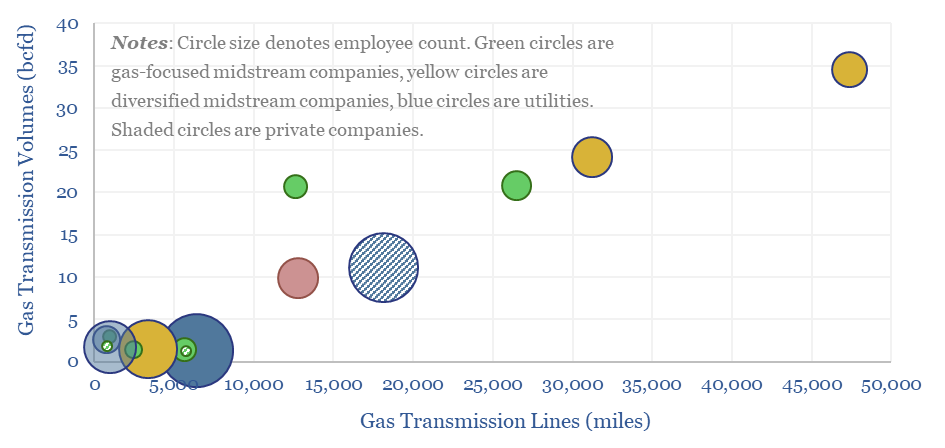

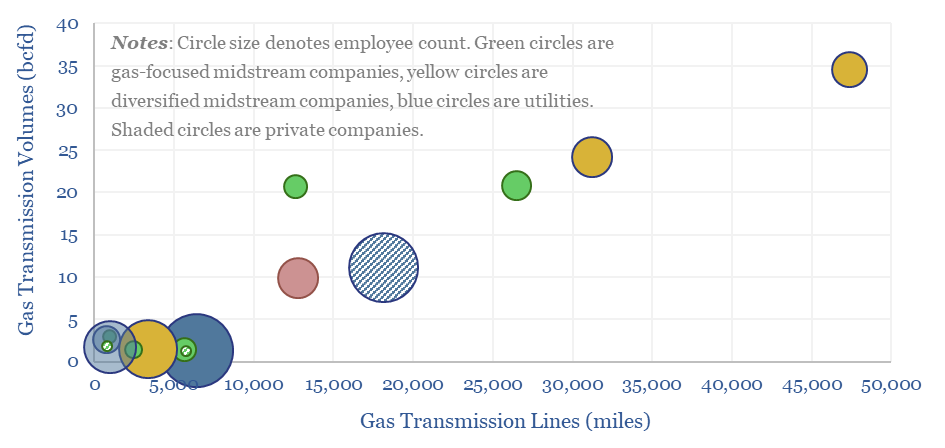

This data-file aggregates granular data into US gas transmission, by company and by pipeline, for 40 major US gas pipelines which transport 45TCF of gas per annum across 185,000 miles;…

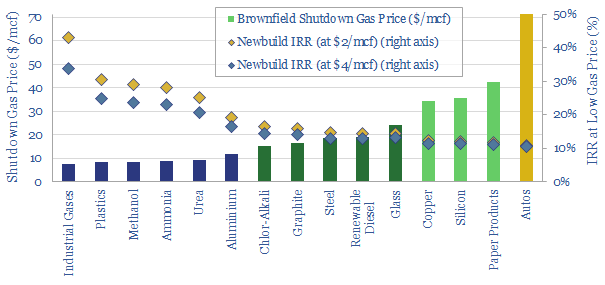

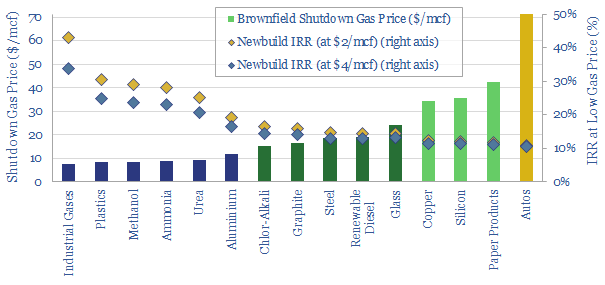

…to gas-rich countries, compared with exporting their gas. They are quantified on pages 13-14. Who benefits? We outline examples of leading companies in gas-rich countries on pages 15-16. This includes…

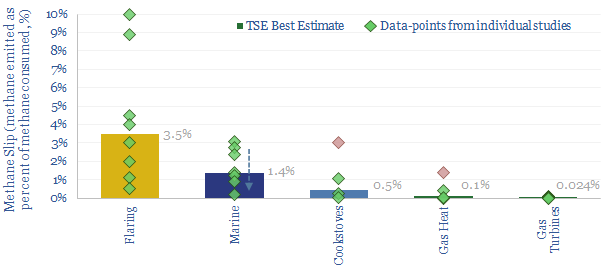

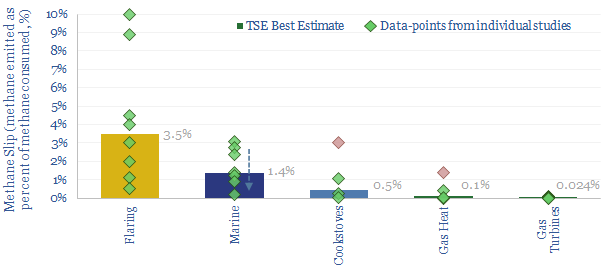

…This data-file reviews technical papers. Methane slip is very low at gas turbines and gas heating (less than 0.1%), rising to 0.5 – 3% in cookstoves and some dual-fuel marine…

Modelling Europe’s gas balances currently feels like grasping at straws. Yet this 10-page note makes five predictions through 2030. Thus our new European gas outlook revises our views on how…

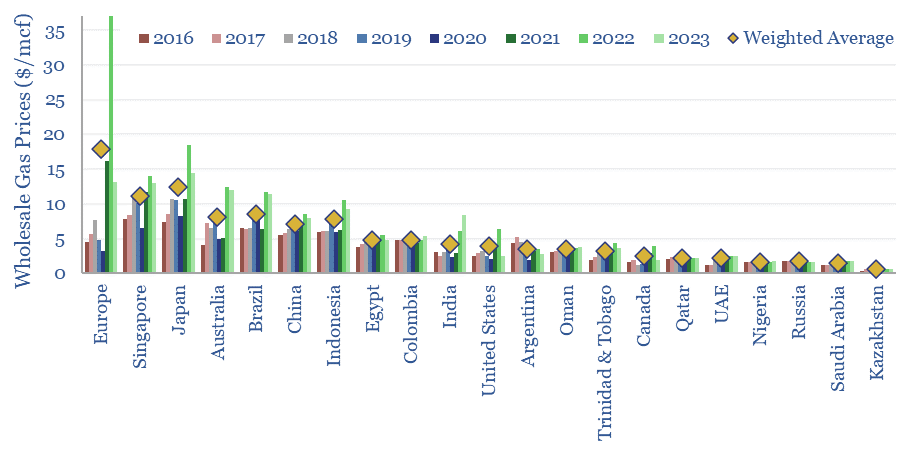

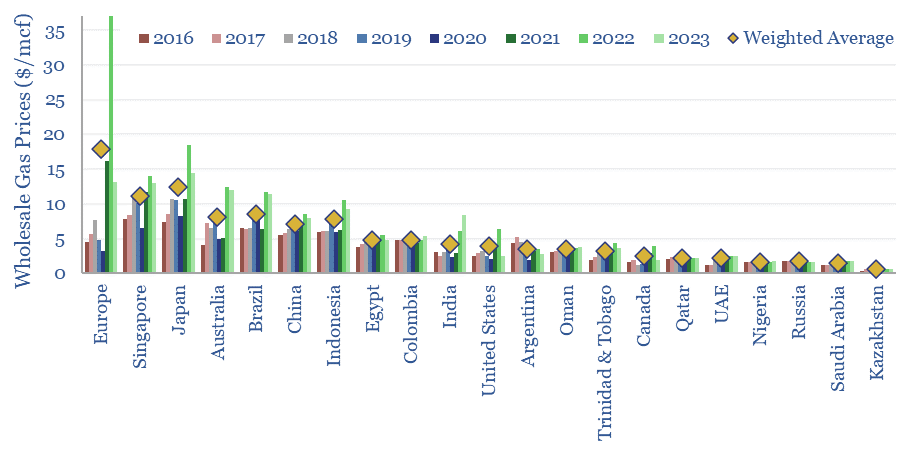

…interquartile range of $2-6/mcf, or in other words, a period of exceptionally low and stable gas prices. Conversely, 2021-22 saw gas prices rise, but most of all, it is the…

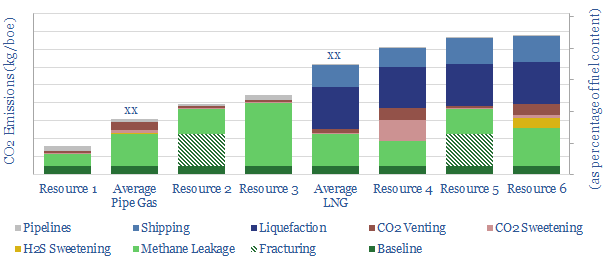

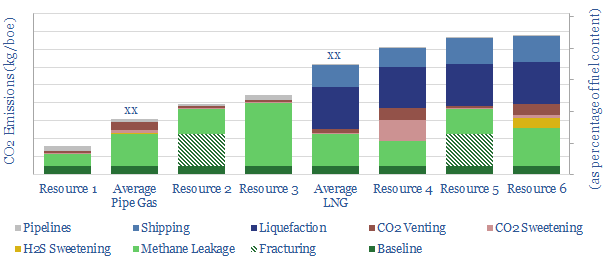

…gas resources and c10x across LNG resources, compared with c7-10x for oil. This supports the rationale for oil-to-gas switching, as commercialising gas will likely emit 0-80% lower CO2 per boe;…

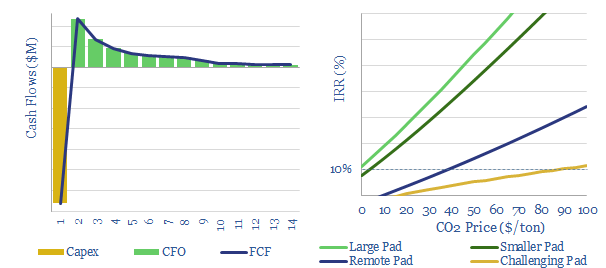

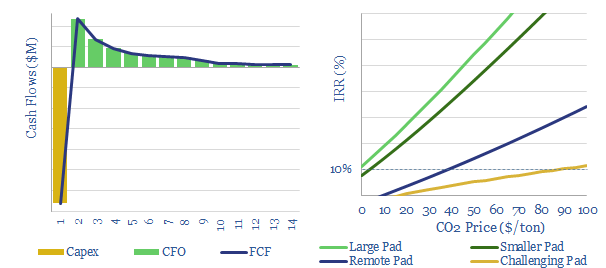

…the gas, cleaning the gas, and compressing the gas into a regional pipeline. $399.00 – Purchase Checkout Added to cart Generally, double-digit returns are achievable at a large new shale pad, by…

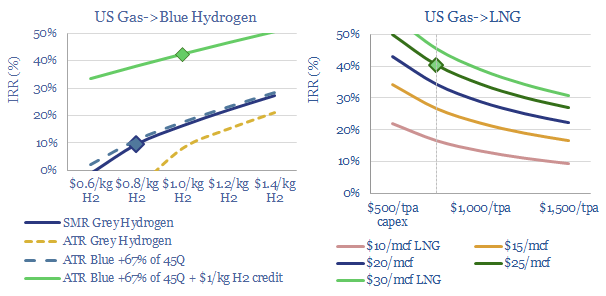

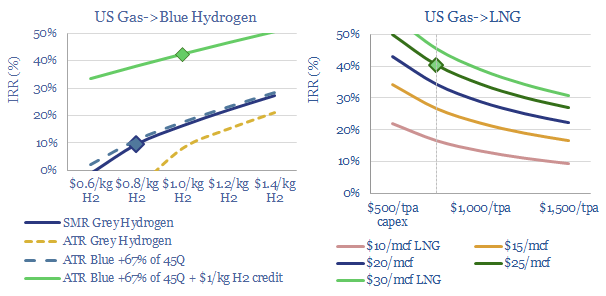

…US gas producers. https://thundersaidenergy.com/downloads/the-ascent-of-shale/ How does the US blue hydrogen boom impact US LNG economics? Natural gas is the key input for both blue hydrogen ATRs and LNG plants. Effectively,…