Modelling Europe’s gas balances currently feels like grasping at straws. Yet this 10-page note makes five predictions through 2030. Thus our new European gas outlook revises our views on how fast new energies ramp, which gas gets displaced first, which energy sources are no longer ‘in the firing line’, and how gas pricing will evolve from here.

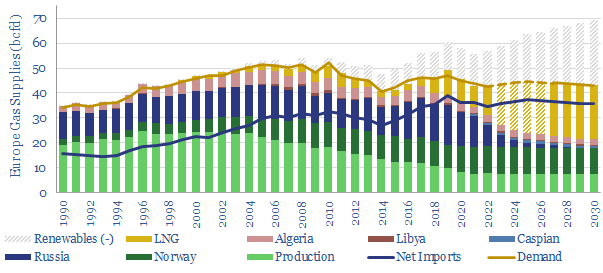

Our starting point for understanding Europe’s gas market in 2022 to 2030 is to consider the ramp up of new energies. We see enough growth from wind and solar to displace the equivalent of 14 bcfd from Europe’s 45bcfd gas market by 2030 (page 2).

Who is in the firing line to be displaced? Russia’s gas supplies to Europe are discussed on page 3, including our latest gas supply modelling.

Who is no longer in the firing line? If the ramp up of renewables primarily displaces Russian gas, then we would need to upgrade our estimates for indigenous European gas production, coal consumption, nuclear generation, uranium consumption and LNG imports. The numbers are quite interesting and material, spelled out on page 4.

But timing matters. The ramp up of renewables is gradual. Conversely, Russian supplies could be offline through 2023, 2024. A 3-10bcfd gas shortage in Europe may persist through 2025, 2026. The moving pieces are described on pages 5-6.

Our pricing outlook is that 2023, 2024 could be worse than 2022. We think gas prices can continue making new highs for as long as policymakers continue to subsidise gas and cushion against demand destruction. Some numbers, in $/mcf, are thrown around on page 7-8.

Ultimately policymakers may need to change tack, and act to reduce demand. The higher gas prices go in 2023, 2024, then the more likely this will happen. Our European gas outlook, pricing scenario, and possible ‘rationing options’, are spelled out on pages 9-10.