Industrial facilities that can shift electricity demand to coincide with excess renewables generation will effectively start printing money as renewables get over-built. They also help more renewables integrate into the grid. Oil and gas assets are generally less able to demand-shift than other industries. But this note outlines the best opportunities we can find, uplifting cash margins by 3-10%.

What is demand shifting and who benefits?

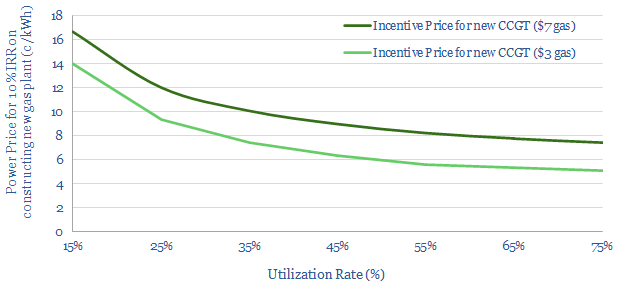

Demand-shifting is one of the most exciting opportunities for companies in the energy transition. Specifically, the idea is that renewables are going to get ‘over-built’ (chart below). In turn, this means that power prices will become increasingly volatile. Around one-third of the time, when the wind is blowing and the sun is shining, power could effectively be free. Another one-third of the time, when these renewable assets are not generating, power prices will likely spike to 15-30c/kWh.

Why does this create an opportunity? If you run an industrial asset where the electricity demand is flexible, you can lower your overall operating costs by timing the demand for when power prices are very low and NOT timing the demand for when power prices are high. This could lower aggregate power prices, and help accommodate another 10pp of renewables in the grid (note below).

The number of industries that can demand shift is much larger than one might expect at first glance. They include electric arc furnaces, industrial gases, internet companies, EV chargers, greenhouse agriculture, water utilities, commercial heating. Generally, the more you look for these opportunities, the more you find. And to re-iterate, these demand shifting opportunities are going to come into the money long before grid-scale batteries or hydrogen come anywhere close.

Not all industries can demand shift. It is not a good idea for life-support machines! It is only going to work where there is minimal operational disruption. Ideally, there may also be an energy saving for electrifying and demand-shifting a process (examples below).

Who is best placed? The ideal demand-shifting opportunity has four criteria, based on our models. (1) Electricity is one of the largest input costs (2) cash margins are low (3) the industry is not highly capital intensive and (4) utilization rates are naturally constrained by some other factor. The reason that (1) and (2) matter is that a reduction in electricity costs will have a disproportionately large impact. The reason that (3) and (4) matter is that demand shifting requires an asset NOT to run at the times when renewables are not generating and power prices are expensive. But amortizing high capex costs over fewer units of output cost can dramatically increase unit costs.

Can the oil and gas industry demand shift?

The purpose of this report is to assess whether the oil and gas industry can generate any incremental income via demand-shifting. We find oil and gas assets are generally less capable of demand-shifting, compared with other industrial assets. This means the over-building of renewables places other industries at a greater relative advantage

Oil and gas assets generally have some of the highest utilization rates of any assets, as quantified in our data-file below. The average manufacturing facility in the US runs at a 78% utilization rate. Refineries and oil and gas processing plants actually lead the screen, with utilization rates sometimes surpassing 90%. It takes days to re-start a refinery or an LNG plant after an outage. This makes them poorly placed for demand shifting.

Oil and gas assets have some of the highest capital costs of any assets. We all know the stories of $50bn+ mega-projects. Once you have built an LNG plant costing $750/Tpa (chart below), you want to run it flat out to recover your capex costs.

Oil and gas assets may be less likely to use electricity, because they naturally have a cheap alternative on site (i.e., oil and gas). For example, in our model below of an ethane cracker, the natural energy source to power the two most energy intensive units (feedstock pre-heater and main ethane cracker unit) is the off-gas coming out of the reactor itself, which would otherwise need to be cleaned up and recirculated, at a cost.

Can some oil and gas processes become demand-flexible?

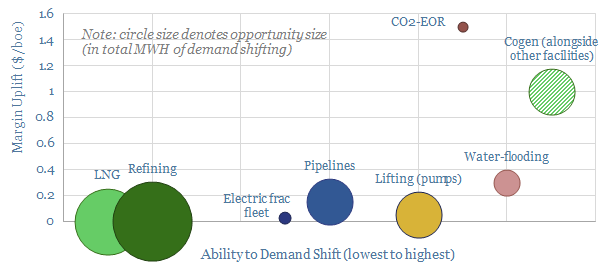

The best examples we can find around the oil and gas industry are in lifting and in EOR at mature oilfields. These processes actually meet all of the criteria we laid out above for good demand-shifting opportunities.

CO2-EOR operation is the best of the best examples we can find. Across CO2-compression and lifting operations, we estimate there could be as much as 35kWh of electricity used per barrel of oil production. CO2 injection does not need to take place constantly, but compressors may have spare capacity to dial up and dial down their activity over a period of days-weeks, as long as the overall volume of CO2 injection hits a monthly target. Lowering the average electricity price from 7.5c/kWh to 3c/kWh uplifts cash margins by around 10%. Our note on CO2-EOR is below.

Water injection operations have a similar demand flexibility, but the economics are not as compelling. Specifically, a water-flood will aim to inject 0.75-1.25 barrels of water per barrel of fluid that is lifted out of a reservoir, in order to achieve a particular voidage replacement ratio. But again, this is only a monthly basis, allowing the injection rates to vary day-by-day. Only 12kWh/bbl of electricity is assumed in our model below. Hence the margin uplift from flexing demand is a mere 3%.

Similarly, at mature fields, pumps may not operate all of the time lifting oil out of the reservoir. They may periodically turn on and turn off, in order to allow the reservoir near to the wellbore to ‘re-charge’. Or there may be an optimal production rate that is well below the full-time production capacity of the pump. Maybe these pumps use 1.5kWh/bbl on average, and it is possible to save around 5c/bbl.

Finally, pipelines may have spare capacity, and may be able to dial-up or dial-down their power draw depending on grid prices. Generally, we assume pipelines run at high utilization rates, while the energy needed to move each mcf of gas through a 1,000km pipeline is relatively low, at around 0.5kWh per mcf. While the power may not be very material in absolute terms, it could yield a 2-5% uplift, when you think that the average cash margin for a 1,000km pipeline is around $1/mcf.

Co-generation: the best of both worlds?

Despite their high uptime requirements and their usual reliance on on-site oil and gas for the majority of process energy, many industrial facilities in the oil and gas industry also use electricity. Often this electricity is generated on site, using a co-generation facility. This is an excellent opportunity for grid-smoothing.

The idea is to absorb cheap renewable electricity from the grid when it is available in abundance (i.e., whenever the power price is cheaper than your on-site generation costs). And then produce your own power whenever renewables are not available. Our economic model for a gas-fired co-gen facility are here. If your baseline power price is 7c/kWh, you might be able to generate 2c/kWh overall savings by absorbing cheap renewables and running the gas turbines less frequently?

Returning to our ethane cracker example above, we estimate that each ton of ethane requires 24mcf of gas (around 7,000kWh of energy) to provide process heat, but the plant also uses around 1,200kWh of electricity to power compressors and coolers. If we can lower our overall power price from 7c/kWh to 5c/kWh, this is equivalent to uplifting cash margins by around 3%, or around $1/bbl. This is a good opportunity.

If this is correct, then we would expect an expansion of cogen capacity at large industrial assets, as a counter-balance to the overbuilding of renewables. We argue this remains one of the most exciting and direct ways to gain exposure to the theme. Our research note on the topic is linked below. Within it, there is a screen of relevant turbine makers.

Please contact us, if you would like to discuss other demand-shifting opportunities, or if you would be interested in a deeper-dive into the demand-shifting opportunities within your own asset base or portfolio.