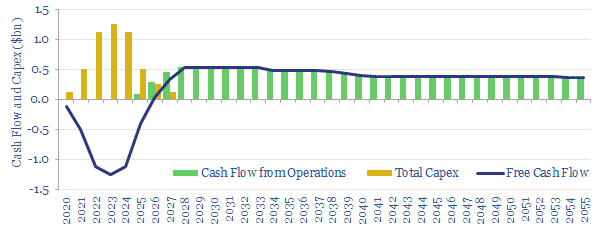

This model captures the economics for a typical LNG liquefaction project, breaking down IRRs and NPVs as a function of key input-variables. In our base case, a new LNG project costing $750/Tpa must charge a $3.6/mcf liquefaction spread for a 10% IRR.

The InputsOutputs tab allows you to flex key variables such as: LNG sales price, Capex/tpa, Opex/mcf, Utilization, Thermal Efficiency, LNG shipping distance, LNG tanker rates, and liquids cuts.

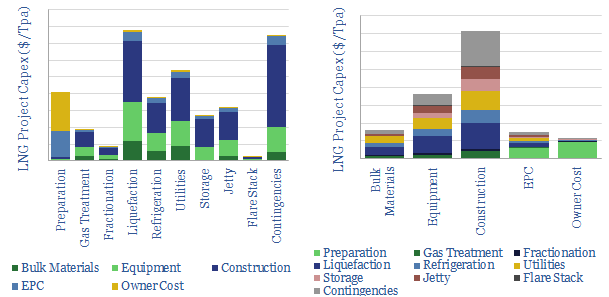

LNG project capex is modeled in detail, built up across 5 x 10 categories, averaging $750/Tpa for a new project in the US Gulf Coast region. A detailed capex breakdown is also provided (below).

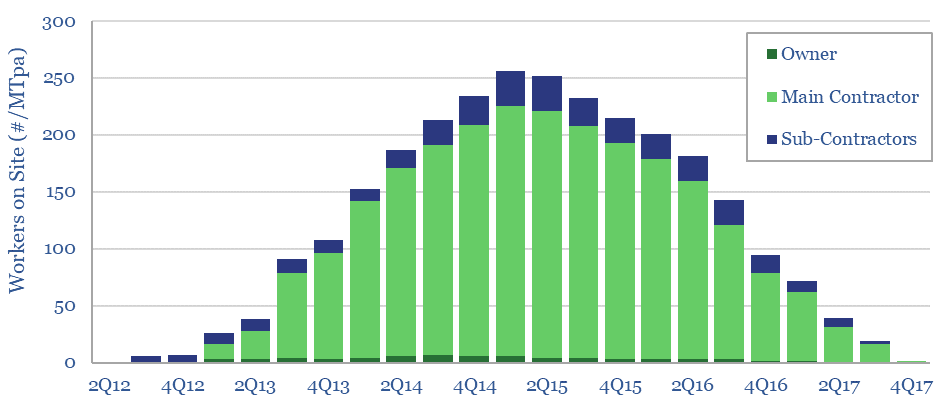

Construction is the largest contributor to costs. Statistically, each MTpa of capacity is going to require around 250 workers on-site when construction activity peaks, so building 10-20MTpa of capacity can easily require 2,500 – 5,000 workers, each paid an average of $100k pa, and directly absorbing $2.5-5bn pa of capex. Efficient construction is crucial. A typical project also invests $2bn for manufactured parts, across over 50 manufacturers.

LNG project economics? A base LNG case project is likely to earn a c10% real, unlevered IRR at $7.5/mcf. The economics are most sensitive to gas pricing and capex; and somewhat less sensitive to the other variables.

Our base case numbers above include LNG shipping costs but exclude LNG regasification costs. Energy costs of LNG liquefaction, including different process technologies, are covered in our overview here.

All of our research into LNG in the energy transition is summarized here, and all of our broader research into natural gas in the energy transition is summarized here.