Global ethylene production is around 200MTpa, one of the most important building blocks of the petrochemical industry, produced by cracking ethane (C2H6) into ethylene (C2H4), yielding hydrogen (H2) as a waste production. A typical ethane cracker costs $1,100/Tpa in capex and requires an ethylene price of $1,000/ton to earn a 10-15% IRR. This economic model captures the costs of ethylene production.

This data-file captures the costs of ethylene production, by cracking ethane in order to produce ethylene, the most basic building block of the petrochemical industry, which matters due to rising demand for plastics in the energy transition.

Specifically, ethane and steam are pre-heated to 500-680°C. Next they are mixed, in a 0.65:0.35 ratio, at 750-875°C in the main reactor, heated by radiant tubes, fired by natural gas combustion. There are up to 42 reaction steps. 70% of the feedstock might be converted with olefin yields of c50%. Most often the products are separated via cryogenics and distillation.

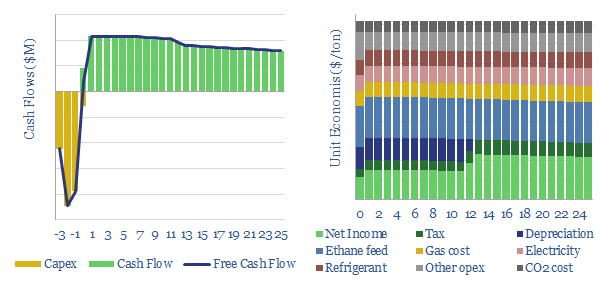

We estimate that a typical US Gulf Coast facility could generate 10-15% IRRs at typical capex cost of $1,100/Tpa and selling ethylene close to $1,000/ton. The numbers are most sensitive to the cost of ethane feed, in turn derived from fractionating natural gas.

What is the energy intensity of ethylene production? Gas use (in mcf/ton) and electricity use (in kWh/ton) are captured in the model, and built up across pyrolysis, compression and separation. At $3/mcf gas and 7c/kWh electricity prices, gas and power will comprise c20% of the total economic costs of ethylene production.

CO2 intensity can be as high as 1.7T of CO2 per ton of ethylene, or potentially lower depending on the facility’s use of energy recovery and heat re-capture. Our base case model includes a CO2 price of $30/ton, but this can be flexed depending on the region. A $100/ton CO2 price would tend to add c20% to the marginal cost of ethylene, which may impact competitiveness in the absence of a carbon border price.

For decarbonization of ethylene production, proposals that have crossed our screens include increasing blends of renewables into the electricity mix, and even using small modular nuclear reactors to source low carbon heat and power. This solution can work well, as there are minimal process emissions, other than the heat and power demands. Although passable ethylene economics should avoid inflating electricity prices.

Please download the model to stress-test sensitivities around the costs of ethane cracking. Economics can also be compared and contrasted with naphtha crackers, which use naphtha as their starting point and yield a more diversified product mix, modeled here.