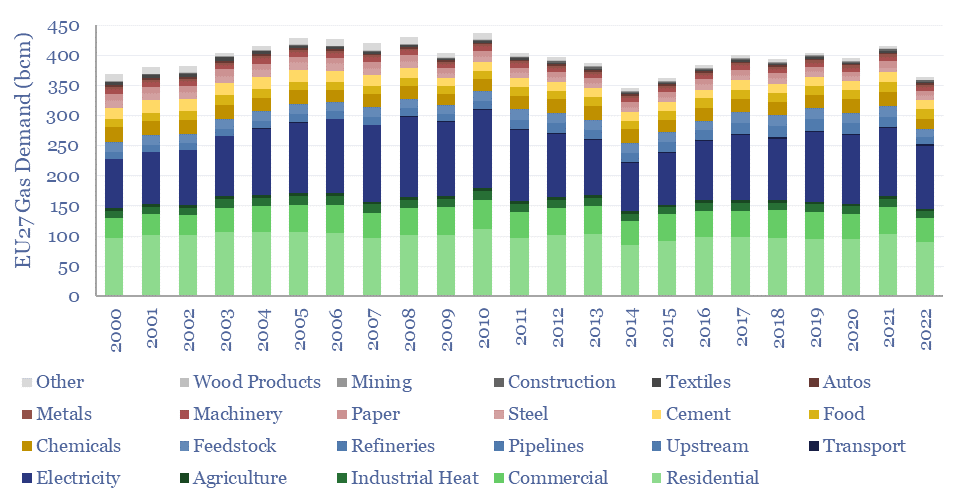

Europe suffered a full-blown energy crisis in 2022, hence what happened to gas demand, as prices rose 5x from 2019 levels? European gas demand in 2022 fell -13% overall, including -13% for heating, -6% for electricity and -17% for industry. The data suggest upside for future European gas, global LNG and gas as the leading backup to renewables. Underlying data are available for stress-testing in our gas and power model.

Energy data from Eurostat have pros and cons. The pro is 100 lines of gas market granularity across 27 EU member countries. The cons are that the full 2022 data were only posted online in March-2024, and require careful scrubbing in order to derive meaningful conclusions. We have scrubbed the data and updated our European gas and power model (below).

European gas demand (EU27 basis) fell from 414 bcm in 2021 to 363 bcm in 2022, for a decline of -52 bcm, or -13%. The first conclusion is about price inelasticity. Gas prices averaged $29/mcf in 2022, up 110% YoY, and up 5x from 2019 levels, yet gas demand only fell by 13%. Energy price inelasticity allows for energy market volatility, which we think is structurally increasing in the global energy system, benefitting energy traders, midstream companies and load-shifters (note below).

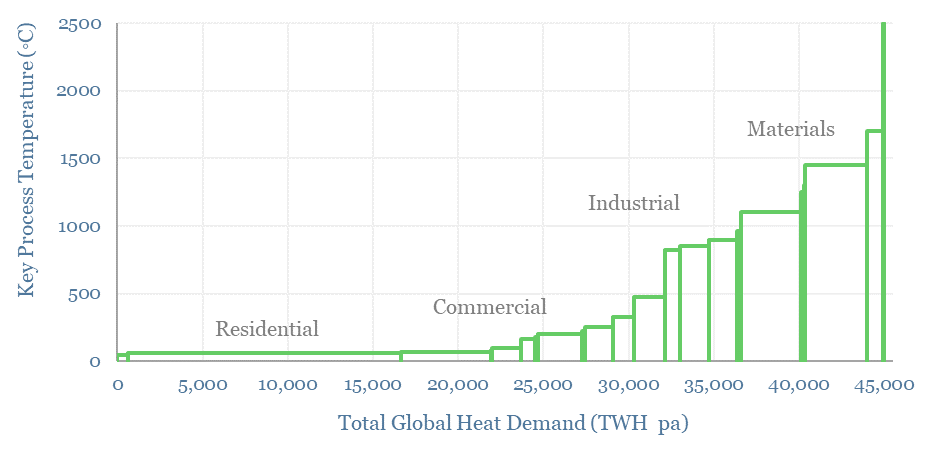

Heating comprises 40% of Europe’s gas demand, of which 24pp is residential, 11pp is commercial, 3pp is heat/steam sold from power plants to industry and 1pp is agriculture (yes, 1% of Europe’s gas is burned to keep livestock warm). Total heating demand fell -13% in 2022, in line with the total market trend, and demonstrating similar price-inelasticity.

Electricity comprises 30% of Europe’s gas demand, and our thesis has been that gas power will surprise to the upside, entrenching as the leading backup for renewables (note below). 2022 supports this thesis. Gas demand for electricity only fell by -6%, the lowest decline of any major category; and total gas demand for power, at 105bcm was exactly the same as in 2012, despite 3x higher gas prices and doubling wind and solar from 9% to 22% of the mix. These are remarkable and surprising numbers.

Industry comprises 30% of Europe’s gas demand. What is fascinating is how YoY gas demand varied by industry in 2022. Most resilient were the production and distribution of gas itself (-1% YoY), manufacturing food products (-6%) and auto production (-6%). The biggest reductions in gas demand were refineries (-41%) and wood products (-26%) because both can readily switch to other heat sources amidst gas price volatility. Other large reductions in gas demand occurred for chemicals (-26%) and construction (-24%) due to weak economic conditions.

Most strikingly, the European chemicals industry shed a full 1bcfd of gas demand YoY in 2022. This is the portion of European gas demand that seems most at risk to us in the long-term, as the US can produce the same materials, at lower feedstock costs, while possibly also decarbonizing at source, via blue hydrogen value chains (examples below).

The latest data from Eurostat and the IEA both imply that Europe’s total gas demand fell by a further -7% in 2023, due to exceptionally mild weather (heating degree days are also tabulated in our gas and power model). In other words, total European gas demand remains -8bcfd lower than in 2021, equivalent to 60MTpa of LNG, and we wonder how much of this demand can come back with LNG capacity additions, thereby muting fears of over-supplied LNG markets.