What are the typical ramp-rates of LNG plants, and how volatile are these ramp-ups? We have monthly data on several facilities in our LNG supply-demand model, implying that 4-5MTpa LNG trains tend to ramp at +0.7MTpa/month, with a +/- 35% monthly volatility around this trajectory. Thus do LNG ramps create upside for energy traders?

Qatar is expanding its LNG capacity from 77MTpa to 142MTpa, by adding 8 x 8.1MTpa mega-trains into the 400MTpa global LNG market.

For perspective, 65MTpa of new LNG capacity is almost 1,000 TWH pa of primary energy, whereas the total global solar industry added +400 TWH of generation in 2023 (our latest solar outlook is linked here).

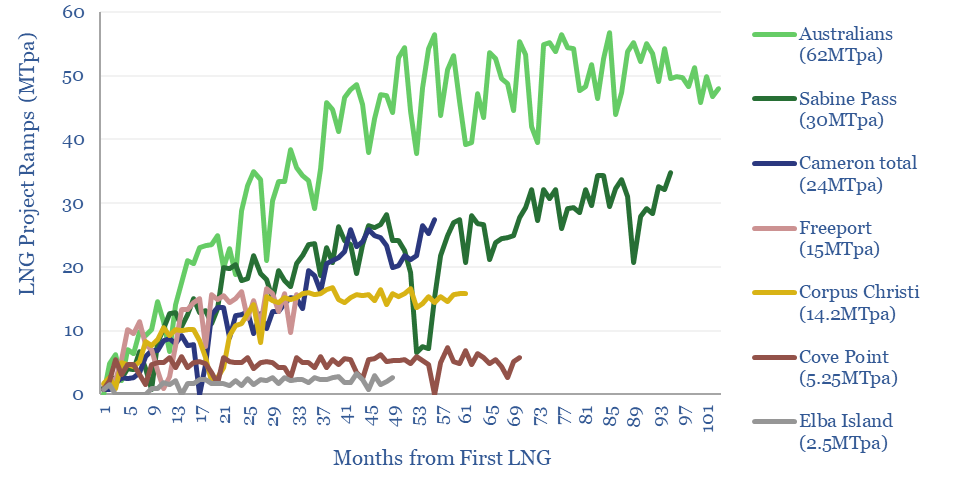

Hence we wonder how fast large LNG projects ramp up? Month-by-month ramp-ups of different LNG facilities are plotted above, where we can get the data, as an excerpt from our LNG supply-demand model.

The historic precedent sees LNG facilities ramp up 4-5MTpa trains at 0.2-2MTpa/month, with an average ramp rate of 0.7MTpa/month.

The ramp-ups are also volatile, with a +/- 35% standard error around the trajectory implied by a perfectly smooth ramp-up. Volatility may benefit energy traders? Let us review some examples below.

Australia ramped up 7 mega-projects with 62MTpa of capacity from 2015 to 2019, over four-years (+1.1MTpa/month), and with surprisingly high volatility (+/- 35% standard error above/below the 1.1MTpa ramp rate). In bottom quartile months, annualized output fell by -1.2MTpa and in bottom decile months if fell by -4.3MTpa.

Sabine Pass ramped up 6 x 5MTpa trains from 2016 to 2022, which also took five years (0.4MTpa/month), and included volatility (+/- 55% standard error), a -2MTpa annualized decline in one-quarter of the months and -3MTpa decline in one-tenth. For example, the facility shut down in August 2020 due to Hurricane Laura.

Freeport LNG ramped up at 0.7MTpa/month with +/- 45% standard error, with a particularly disrupted ramp-up, due to an explosion in June-2022, which took 9 months to remedy. The incident was blamed on deficient valve-testing procedures, which allowed LNG to become isolated, heat up, expand, breach the pipeline and explode. US regulators asked for information on 64 items before permitting a restart, which speaks to the complexity of these ramp-ups (!).

Other LNG facilities have also had volatility during their ramp-ups. Elba Island LNG went offline in May-2020 after a fire. Sabine, Corpus and Freeport cut volumes by 70% peak-to-trough during the worst of the COVID crisis. The average project in our data set ramped up 4-5MTpa LNG trains at 0.7MTpa/month with +/- 35% standard error.

Hence our conclusion is that the start-up of Qatar’s first two LNG trains in 2026 will be gradual, rather than a sudden 16MTpa shock to LNG markets, while LNG traders could even benefit from the volatility? For more perspectives, please see our outlook on the LNG industry.