What if the world is entering an era of persistent power grid bottlenecks, with long delays to interconnect new loads? Everything changes. This 16-page report looks across the energy and industrial landscape, to rank the implications of grid bottlenecks across different sectors and companies.

Our growing fear is that power grids are shaping up to be the biggest bottleneck in the energy transition. Hence what if the developed world is entering a strange, new era, where grid tie-ins cost an order of magnitude more, and take an order of magnitude longer?

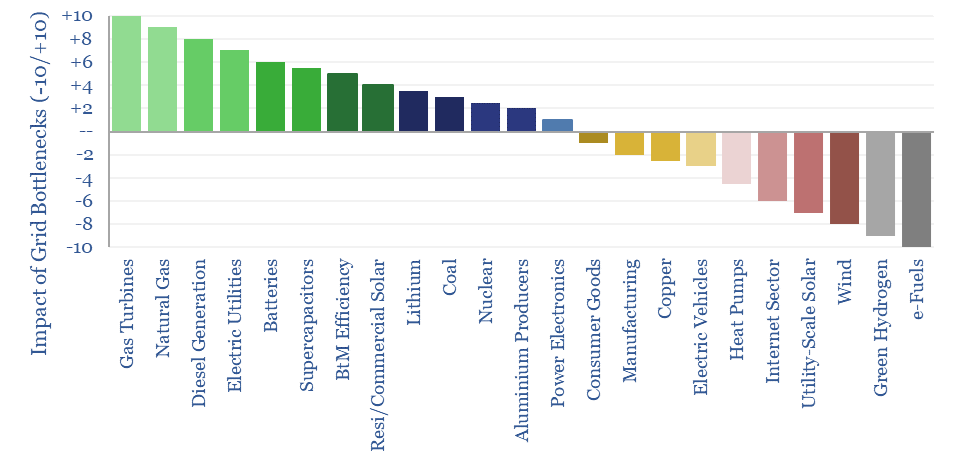

The implications of grid bottlenecks extend across every sector that consumes electricity and every energy source that produces electricity (ranked by size on page 3).

The biggest impacts are seen for the rise of the internet, manufacturing, and consumer prices, leading to inflation (pages 4-5).

Most impacted are new energies categories that rely upon timely electricity supplies from the grid, although our outlook differs for green hydrogen, heat pumps and electric vehicles (pages 6-7).

Most controversial are the outlooks for power electronics, power cables and underlying materials such as copper (pages 7-8).

Renewables growth is also impacted, but again, our outlook differs for wind versus solar, and along their supply chains (pages 9-10).

The first half of the report focuses on challenges in these different industries, so that we can understand the best way of resolving them.

The second half of the report assesses the outlook for other generation sources, across natural gas, smaller-scale gas, diesel generation, batteries, coal and nuclear (pages 12-13).

A growing number of facilities need ratable, round-the-clock power, yet are struggling to secure this from the grid. The best metric is the Levelized Cost of Total Electricity (page 11).

Energy savings behind the meter also become more valuable, especially where they can reduce the peak sizes of grid connections. Our favorite ideas range from growth-stage niches to mega-caps (pages 14-16).