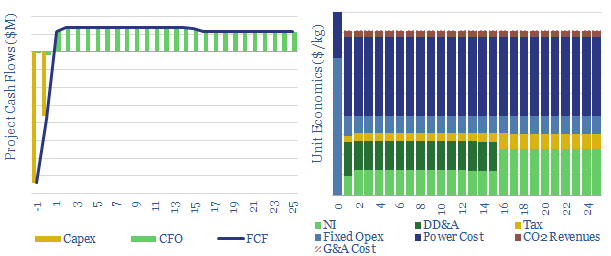

This data-file models the economics and costs of green hydrogen production via the electrolysis of water, powered by renewable energy. IRRs and NPVs are calculated incorporating our best estimates of capex costs, opex costs, power prices, CO2 prices, utilization rates and conversion efficiencies.

A base case hydrogen price around $8/kg ($60/mcfe) is required to earn a 10% unlevered return on a green hydrogen project. The most challenging input is not cost or efficiency, but utilization rate, if a green hydrogen project is to be truly green, and fully powered by renewables.

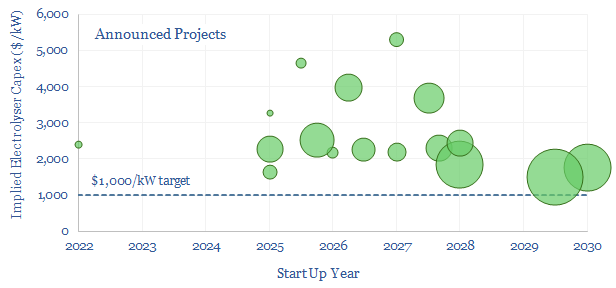

Our base case input assumption for the cost of a hydrogen electrolyser is around $1,000/kW. We do expect electrolyser costs to deflate. However we also note that projects moving forwards in 2023 seem to have capex costs above $2,000/kW.

A full cost breakdown is calculated, on a bottom up basis, covering c40 cost lines, including materials, manufacturing and the balance of plant. We have also shown data to disaggregate electrolysers’ total system efficiency.

Our numbers are indexed at the electrolyser plant gate. On top of this, a full value chain requires hydrogen storage, hydrogen transport, and hydrogen use in a prime mover such as a fuel cell or fuel cell vehicle.

A more recent question mark has arisen over the degradation rates of electrolysers, if they are powered by wind and solar inputs, with high second-by-second volatility. As a rule of thumb, a 5-10% annual degradation rate raises levelized cost by $1/kg. And our data-file aggregates results from technical papers to substantiate this number.

The full model contains a short summary of our conclusions, and allows you to flex our input assumptions to stress-test the economics. Sensitivity analyses are also included, varying capex, utilization, H2 prices and electricity costs.

We remain cautious over the high costs and energy penalties of green hydrogen. $8/kg is equivalent to $70/mcfe, implying a CO2 abatement cost above $1,000/ton when compared against a baseline of using $3-10/mcf natural gas. In our view, based on studying heat engines, converting from electricity back into a fuel is the thermodynamic equivalent of printing out your emails. And it may not be feasible at all in a world that is persistently short of energy. For more perspectives, please see our hydrogen research conclusions.