Search results for: “refining”

-

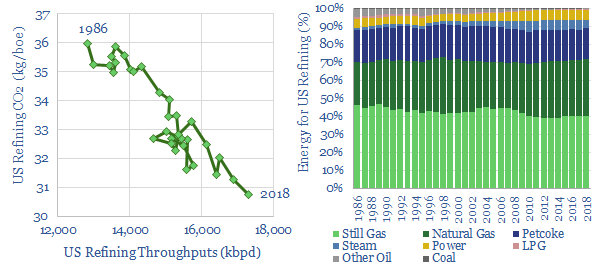

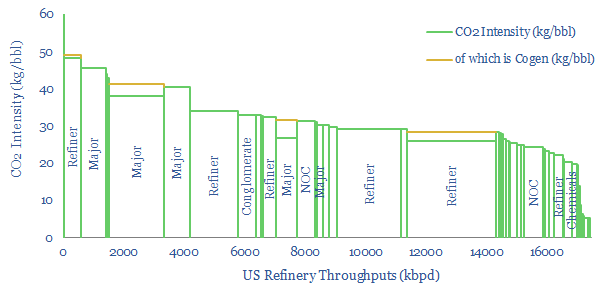

US Refining: energy and CO2 intensity

Emissions of refining a barrel of crude in the US has fallen at a 0.5% CAGR over the past c30-years, from 36kg/boe in 1986 to 31kg/boe in 2018. US refineries are also increasingly fueled by natural gas and merchant steam, while own use of oil, coal and oil products have been phased out.

-

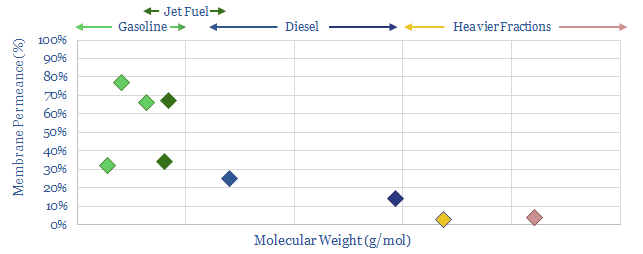

Low-carbon refining: insane in the membrane?

1% of global CO2 comes from distilling crude oil at refineries. An alternative uses precisely engineered polymer membranes to separate crude fractions, eliminating 50-80% of the costs and 97% of the CO2. We reviewed 1,000 patents, including a major breakthrough in 2020. This 14-page note presents the opportunity.

-

US Refinery Database: CO2 intensity by facility?

This US refinery database covers 125 US refining facilities, with an average capacity of 150kbpd, and an average CO2 intensity of 33 kg/bbl. Upper quartile performers emitted less than 20 kg/bbl, while lower quartile performers emitted over 40 kg/bbl. The goal of this refinery database is to disaggregate US refining CO2 intensity by company and…

-

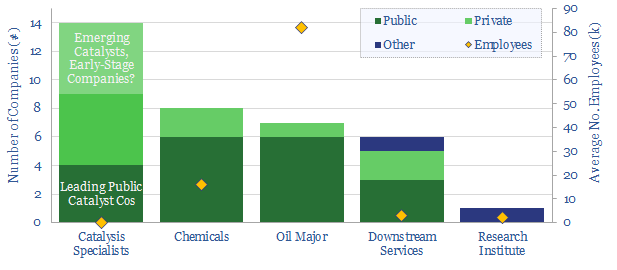

Overview of Downstream Catalyst Companies

This data-file tabulates headline details of c35 companies commercialising catalysts for the refining industry, in order to improve conversion efficiencies and lower CO2 emissions. Five early-stage private companies stand out, while we also profile which Majors have recently filed the most patents to improve downstream catalysis.

-

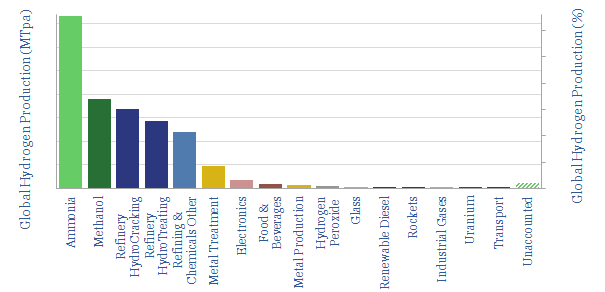

Global hydrogen: market breakdown?

This data-file is a global hydrogen market breakdown, disaggregating the 110MTpa market (mainly ammonia, methanol and refining), how it is met via different production technologies, and our estimates of those technologies’ costs (in $/kg) and CO2 intensities (in kg/kg or tons/ton).

-

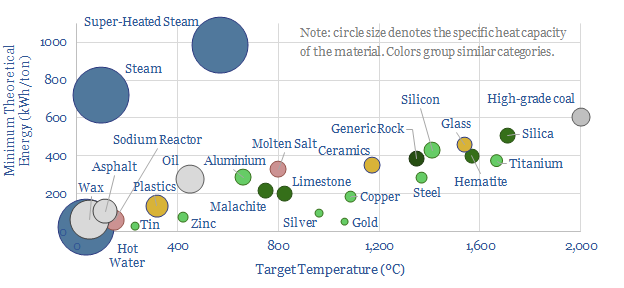

Heating-melting: how much energy is needed?

How do we quantify the minimum energy needed to heat materials and melt materials? This data-file calculates values, in kWh/ton, from first principles, based on target temperatures, specific heat capacities and latent heat capacities. A good rule of thumb is 25 kWh of useful energy to heat each ton of material by each 100ºC.

-

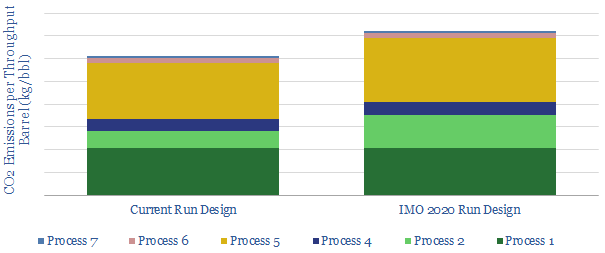

Carbon Costs of IMO 2020?

CO2 intensity of oil refineries could rise by 20% due to IMO 2020 sulphur regulations, if all high-sulphur fuel oil is upgraded into low-sulphur diesel, we estimate. The drivers are an extra stage of cracking, plus higher-temperature hydrotreating, which will also increase hydrogen demands. This one change could undo 30-years of efficiency gains.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)