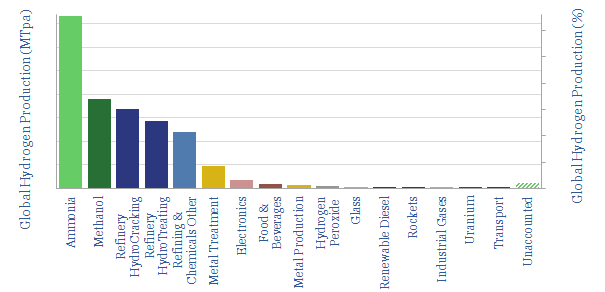

This data-file is a breakdown of the global hydrogen market, which is 110MTpa today, worth around $110bn pa at $1/kg H2 prices. Today’s hydrogen is mostly used for producing ammonia, methanol and in refining. The data-file looks industry by industry, and also covers different hydrogen production technologies, used to supply today’s 110MTpa market.

The ammonia industry uses one-third of the world’s hydrogen today, at 0.19 kg per kg of NH3. But our models suggest fertilizer prices could rise 3.5x with a switch to green H2. This raises the spectre of inflation, including for food prices, which will be a common theme.

The refining industry uses 28% of the world’s H2 to make lower-sulphur fuels via hydro-cracking (1,200 scf/bbl) and hydro-treating (400 scf/bbl). Again, switching to green H2 may increase the cost of hydro-processed fuels by $0.4/gallon, abating CO2 at about $700/ton.

The methanol industry uses 17% of the world’s H2, to make adhesives, to treat wood, for fuel additives and in industrial intermediates. Again, switching to green H2 inflates cost by 5x. We remain more excited by blue- and bio-methanol decarbonization pathways (note here).

The other c20% of the world’s hydrogen is spread across an amazingly broad set of use cases: purifying many of the metals used in lithium ion batteries; hydrogenating fats to make 10MTpa of margarine or 300kbpd of renewable diesel; making 4.5MTpa of H2O2 for bleaching paper; or pouring out 70MTpa of ultra-smooth glass on a contaminant-free bed of molten tin.

Use of green hydrogen in transport still remains very small, across several thousand vehicles (i.e., not several million). One thing that would improve our outlook on green hydrogen might be to see its successful adoption across some of the hydrogen-using industries shown above.

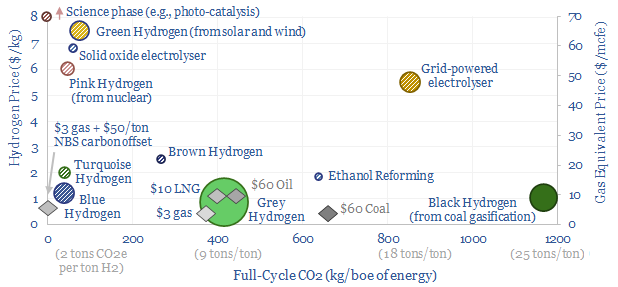

Covered technologies used to generate today’s hydrogen include steam methane reforming, coal gasification (with an eye watering 25 tons of CO2 per ton of hydrogen), pyrolysis, renewable electrolysis, fuel cell electrolysis, solar photoelectrocatalysis and solar photocatalysis.

Our conclusion is that natural gas remains the most viable fuel source on a weighted basis, considering both cost and carbon emissions, It may also be easier to de-carbonise natural gas directly than via the hydrogen route.

This data-file is a global hydrogen market breakdown, disaggregating the 110MTpa market (mainly ammonia, methanol and refining), how it is met via different production technologies, and our estimates of those technologies’ costs (in $/kg) and CO2 intensities (in kg/kg or tons/ton).