Search results for: “inflation”

-

Inflation: will it de-rail the energy transition?

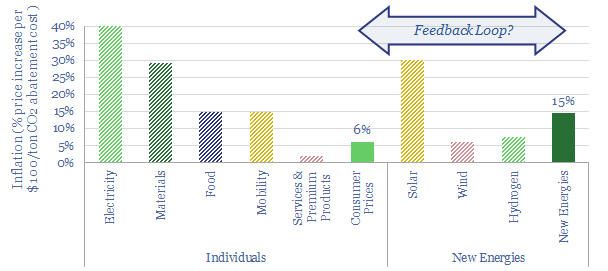

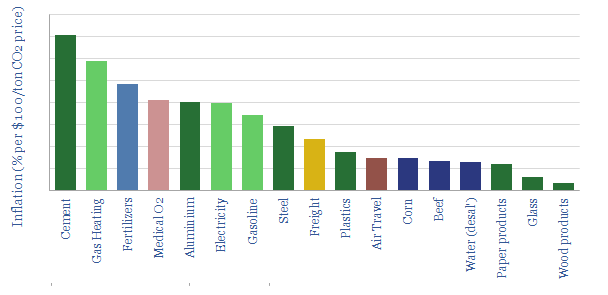

New energy policies will exacerbate inflation in the developed world, raising price levels by 20-30%. Or more, due to feedback loops. We find this inflation could also cause new energies costs to rise over time, not fall. As inflation concerns accelerate, policymakers may need to choose between delaying decarbonization or lower-cost transition pathways.

-

Runaway train: energy, interest rates and inflation?

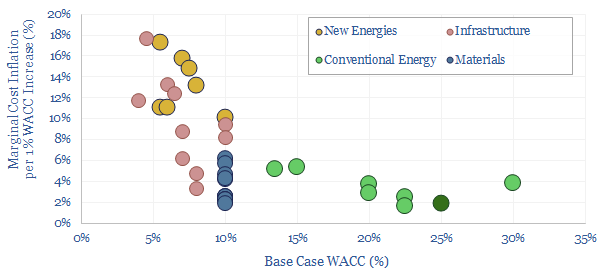

In the strange world of 2022-30, raising interest rates would not mute inflation, but would actually deepen it. By deepening the very energy shortages that are driving inflation itself. Each 1% increase in capital costs re-inflates new energies 10-20%, infrastructure 2-20%, materials 2-6%, and conventional energy 2-5%. What implications?

-

Inflation in the energy transition?

This data-file aims to estimate how much inflation is likely to result from policies to decarbonize the global economy. Aggregate price levels might rise by 6% per $100/ton of CO2 abatement costs. New energies costs rise by 6-30%. Mobility and food rise by 15%. And materials costs rise by an average of 40%.

-

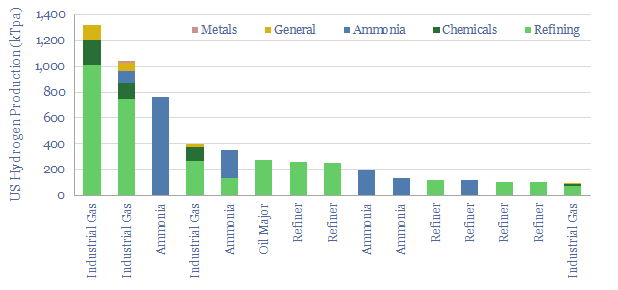

US hydrogen production: by facility and by company?

10MTpa of hydrogen is produced in the US, of which 40% is sold by industrial gas companies, 20-25% is generated on site at refineries, 20% at ammonia plants and 15-20% in chemicals/methanol. This datafile breaks down US hydrogen production by facility. Owners of existing steam methane reforming units may readily be able to capture CO2…

-

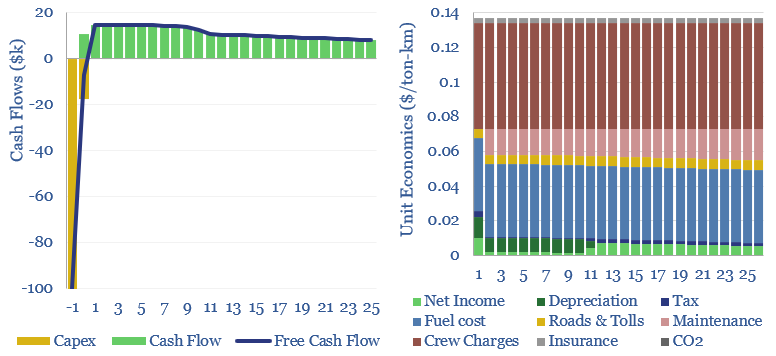

Heavy truck costs: diesel, gas, electric or hydrogen?

Heavy truck costs are estimated at $0.14 per ton-kilometer, for a truck typically carrying 15 tons of load and traversing over 150,000 miles per annum. Today these trucks consume 10Mbpd of diesel and their costs absorb 4% of post-tax incomes. Electric trucks would be 20-50% most costly, and hydrogen trucks would be 45-75% more, which…

-

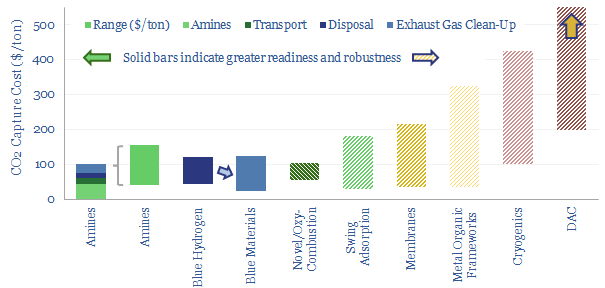

Carbon capture and storage: research conclusions?

Carbon capture and storage (CCS) prevents CO2 from entering the atmosphere. Options include the amine process, blue hydrogen, novel combustion technologies and cutting edge sorbents and membranes. Total CCS costs range from $80-130/ton, while blue value chains seem to be accelerating rapidly in the US. This article summarizes the top conclusions from our carbon capture…

-

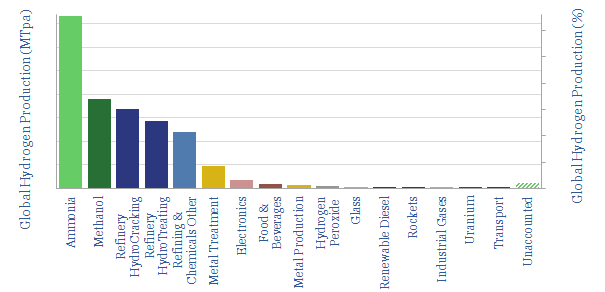

Global hydrogen: market breakdown?

This data-file is a global hydrogen market breakdown, disaggregating the 110MTpa market (mainly ammonia, methanol and refining), how it is met via different production technologies, and our estimates of those technologies’ costs (in $/kg) and CO2 intensities (in kg/kg or tons/ton).

-

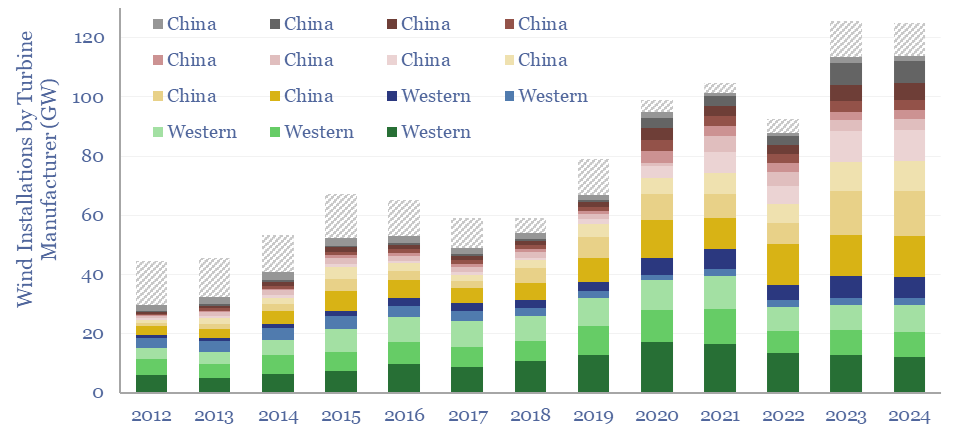

Wind turbine manufacturers: market share over time?

This data-file tracks wind turbine manufacturers, their market shares and their margins over time. By 2024, fifteen companies account for 95% of global wind turbine installations. This includes large Western incumbents, and a growing share for Chinese entrants, which now comprise over half of the total market, limiting sector-wide operating margins to c3%.

-

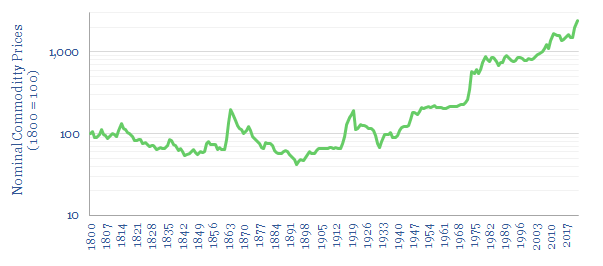

Very long term historical commodity prices and disruptions?

This data-file aggregates long-term historical commodity prices back to 1800, predominantly in the US, using academic records and census data. Historical commodity prices generally fell 30-70% in the 19th and early 20th century, punctuated by supply disruptions due to wars, then rose by 12.5x from 1945 to the present day.

-

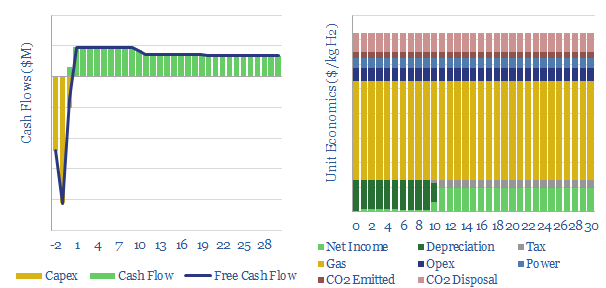

Methane reforming: costs of grey hydrogen, costs of blue hydrogen?

This data-file captures the economics of blue hydrogen production via reforming natural gas: either steam-methane reforming or auto-thermal reforming. Costs and operating parameters are compiled from technical papers. Blue hydrogen can be cost-competitive with CCS, while overall costs are most sensitive to gas prices.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (822)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (124)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)