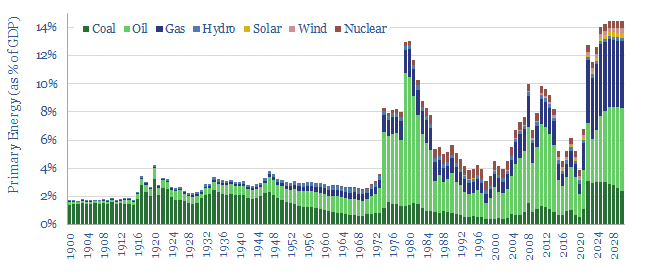

Is the global energy system on the precipice of persistent shortages, and record prices, in the mid-late 2020s? We worry that cumulative under-investment in the global energy system has now surpassed $1trn since 2015, relative to our energy transition roadmap. Our top ten slides into global energy ‘macro’ are set out in this presentation.

2022 saw the joint highest energy prices on record, matching the peaks of the 1979-80 oil shock ($100/bbl Brent, $6.5/mcf Henry Hub, $40/mcf European gas, $18/mcf LNG, $385/ton Australian coal).

Our best guess is that 2023 will bring weak macro conditions, as high inflation and rising interest rates ripple through the financial system. This will temporarily mute energy demand and prices. In turn, this will result in even further under-investment.

Thus as demand recovers in the mid-late 2020s, will the recent trends result in energy shortages and record energy prices in order to destroy unsatisfiable demand?

The purpose of this ten-page presentation is to weigh up the evidence around these energy-related anxieties.

The outlook covers surprising coal upgrades, an interpretation of record oil demand, LNG tensions, wind and solar upside vs bottlenecks, combustion energy capex trends, an estimate of global energy under-investment since 2015, our latest energy supply-demand balances, debates over supply growth, and debates over demand destruction.