Next-generation membranes for carbon capture could separate out 95% of the CO2 in a flue gas, into a 95% pure permeate, for a cost of $20/ton and an energy penalty below 10%. This is better than the best amines. Hence our 15-page note lays out ten key questions, to help decision makers de-risk next-generation CCS membranes. The technology is early-stage. Companies are also noted.

CCS denotes any energy technology that prevents CO2 from combustion being released into the atmosphere. Our roadmap to net zero assumes 6 GTpa of CCS by 2050, of which half, or 3 GTpa is conventional CCS, largely using the amine process. Typical costs and energy penalties of the amine process are benchmarked on page 2.

The simplest separation membranes are molecular sieves, with tiny holes, at the exact right size, so one gas will pass through the membrane (permeate) and other gases will not (retentate). There are already ‘hundreds’ of deployments for CO2/CH4 separations in the gas industry. But membrane CCS require more than simple molecular sieving (page 3).

CCS membranes are envisaged to perform a kind of magic, achieving >100x more selectivity for CO2 than other similarly-sized gas particles, by harnessing differences in their solubilities, diffusivities and other physio-chemical interactions with the membrane (pages 4-5).

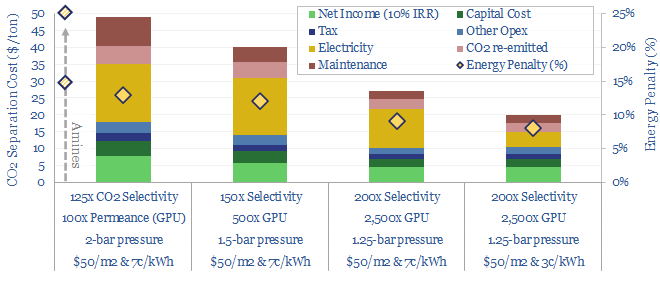

The goal of this research note is to avoid writing a long, boring textbook; and instead to frame ten key questions, which decision makers can keep in mind, if they are appraising next-generation membranes for CCS. I.e., what kinds of numbers start to get exciting, across the key dimensions, to unlock $20-50/ton separation costs (model here).

Important dimensions for CO2 separation membranes include selectivity (pages 4-5), gas permeance (page 6), compression energy (page 7), membrane costs (page 8), membrane processability (page 9), membrane stability (page 10), resistance to impurities (page 11).

The pathway to commercialization is discussed on pages 12-13, including our observations about the competitive landscape. While membranes for carbon capture are an exciting future technology, we are not de-risking them yet in our roadmap to net zero.

Next-gen membrane companies that have crossed our screens are profiled on pages 14-15. This includes growth stage companies, building on their experiences with gas/petrochemical membrane separations. Surprisingly, it also includes a Japanese materials large-cap. And on the other end of the spectrum, early-stage spin-outs from Academia.

As always, please contact us if we can help you explore any other companies in this interesting, and fast-evolving universe of membranes for carbon capture. We hope this report is a useful reference for decision-makers appraising the space. All of our CCS research to-date is linked on our CCS category page.