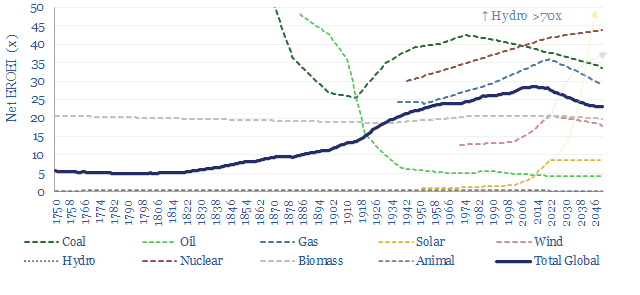

Net energy return on energy invested (EROEI) is the best metric for comparing end-to-end energy efficiencies. Wind and solar currently have EROEIs that are lower and ‘slower’ than today’s global energy mix; stoking upside to energy demand and capex. But future wind and solar EROEIs could improve 2-6x. This will be a make-or-break factor determining the ultimate share of renewables?

This 13-page report quantifies net EROEIs, draws five conclusions for the energy transition, and explores how much wind and solar EROEIs could improve over time?

Energy efficiency matters because it determines how much primary energy needs to be supplied, in order to meet the ultimate energy demands of human civilization. If energy efficiency surprises to the upside, then the demand for coal, oil and gas will surprise to the downside. Or vice versa. We are worried that over-optimistic assumptions about future energy efficiency gains will culminate in energy shortages (here, here and here) (page 2).

So what is the ‘efficiency’ of wind or solar? Maybe 80-90%? The question is more complicated than it sounds. For a heat engine, efficiency is easily calculated by dividing electrical energy outputs by fuel energy inputs. But for a wind or solar asset, there is no fuel input. We are harnessing something that would otherwise have dissipated (page 3).

Net energy return on energy invested is the best way to compare total life cycle efficiencies of different energy sources, apples-to-apples. For example, it takes 100kWh of energy inputs to mine 1 ton of coal, which contains 6,500 kWh of thermal energy (65x gross EROEI), and then yields 4,000 kWh of useful heat and power (40x net EROEI) (page 4).

Renewables today. Our best estimates are that the net EROEI for wind today is around 23x and the net EROEI for solar today is around 12x. It has taken us about four years to build up these numbers, across dozens of different economic models. Of course, the numbers vary case by case, especially based on where these renewables are deployed (page 5).

There are five key conclusions from net EROEI. Renewables have net energy returns on energy investment that are ‘lower and slower’ than today’s blended average global energy, especially coal and gas (page 6), which is not the end of the world (page 7), but does mean the scale-up of wind and solar produces some questionable reversals of 300-year mega-trends (page 8), global energy demand is likely to surprise to the upside (page 9) and global energy capex must treble to $4trn per year (page 10).

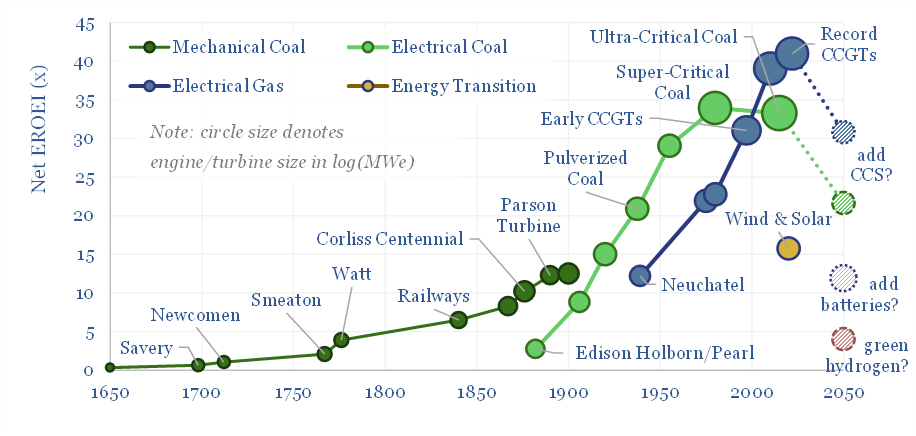

The most interesting prospect for renewables to take greater share of the future energy mix, and overcome some of the issues above, is to improve their net EROEIs. Could solar ultimately surpass the net EROEI of coal and gas by over 2x? There is historical precedent for fundamentally new energy technologies to improve over time, looking back at the development of steam cycles, early electrical generators, gas turbines (chart below). Improving net EROEIs may determine the ultimate share of renewables in the future energy system? (pages 11-13).