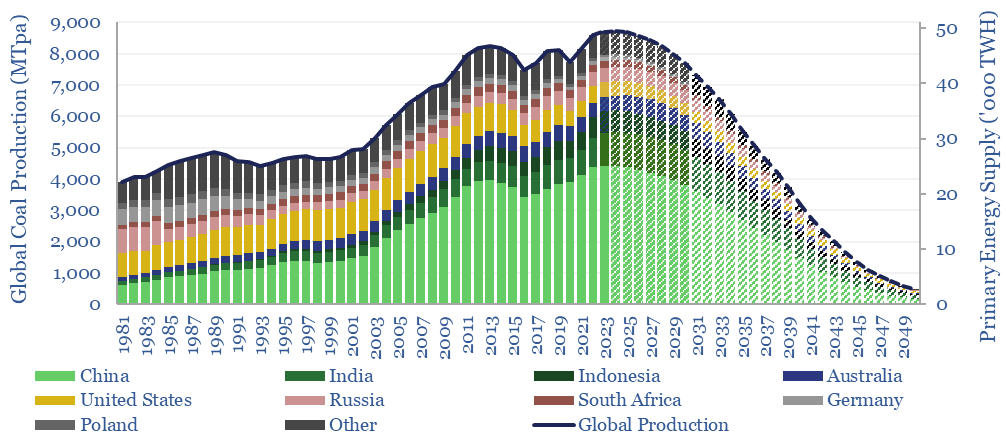

Global coal production likely hit a new all-time peak of 8.7GTpa in 2023, of which 7.5GTpa is thermal coal and 1.2GTpa is metallurgical. The largest countries are China (4.4GTpa), India (1GTpa), other Asia (0.7GTpa), Europe (0.5GTpa) and the US (0.5GTpa). This model explores what is required to meet our energy transition aspirations.

Coal can be the cheapest thermal energy source on the planet. In normal times, coal costs $60/ton (coal mining model here) and contains 6,250 kWh/ton of thermal energy, implying a cost of 1c/kWh-th.

Coal-fired power can thus cost 2-4c/kWh (model here) and an existing coal plant is cheaper than other levelized costs of power.

Coal is the highest-carbon fossil fuel, with an average CO2 intensity of 0.37 kg/kWh-th (data here), which is 2x more than gas (note here).

The CO2 disparity is amplified further when considering coal’s Scope 1+2 emissions, as often coal mining leaks more methane than gas itself. And Rankine steam cycles fueled by coal have efficiency drawbacks (note here) and also relatively low flexibility (data here).

Hence our Roadmap to Net Zero would need to see coal consumption flat-lining from 2022, then declining at 8% pa in the 2030s and 17% pa in the 2040s, to well below 500MTpa (which in turn is abated by CCS or nature-based solutions).

This is sheer fantasy, unless wind, solar and natural gas ramp up enormously, especially in China, India and other parts of the Emerging World. Coal-to-gas switching economics are profiled here.

Some encouraging precedent come from the US, where coal production peaked at 1GTpa in the 2010s, before shale gas ramped to 80bcfd. Thus US coal declined to 500MTpa in 2021. Although questions about the continued phase-back of US coal are now being raised, due to pipeline bottlenecks from the Marcellus, and energy crisis in Europe, requiring a substitution of Russian energy supplies (oil, coal and gas).

There is always a danger of drawing lines on charts, which simply reflect aspirations, blindly projected out to 2050. The real world may not follow a straight line of pragmatic progress, but instead fluctuate between fantasy and crisis.

During times of energy crisis, such as 2022, international coal prices have spiked to $340/ton. Remarkably, this took thermal coal prices above metallurgical coal, and even above oil on a per-btu basis. Western coal producers are screened here.

Metallurgical coal may be particularly challenging to substitute. We have reviewed the costs of green steel here. We have seen some interesting but smaller-scale options in bio-coke. We have been less excited by hydrogen or syngas from gasification of coal.

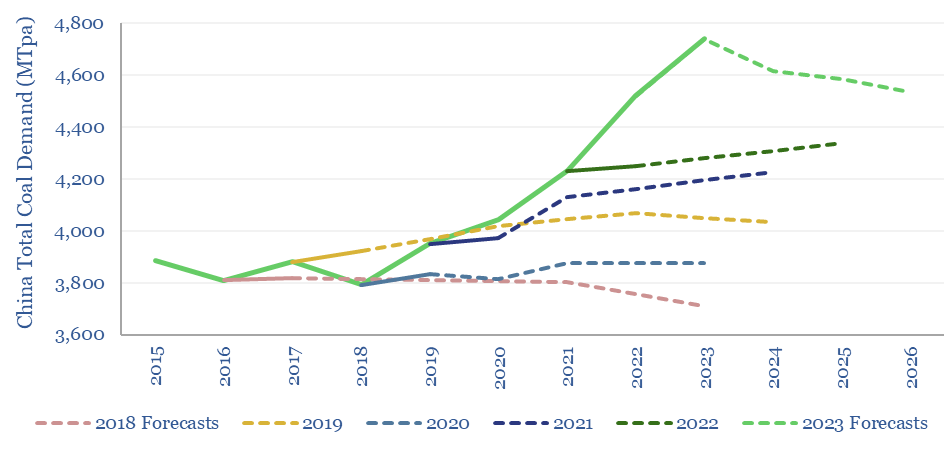

Around 1GTpa of new coal projects are in planning or under construction, of which half are in China. Chinese coal production is something of a ‘wildcard’, explored in our short note here, and often defying expectations to the upside, despite rising renewables (chart below). Helping China to decarbonize might require 300bcfd of gas (roadmap here).

India’s coal use has also doubled since 2007, rising at 6% pa. It remains “the engine of global coal demand”, according to the IEA, rising +70MTpa, to 1.1GTpa in 2022, 1.3GTpa in 2023 and 1.4GTpa in 2026.

Please download the data-file to stress-test assumptions around coal mine additions, decline rates, phase-downs and coal-to-gas switching.