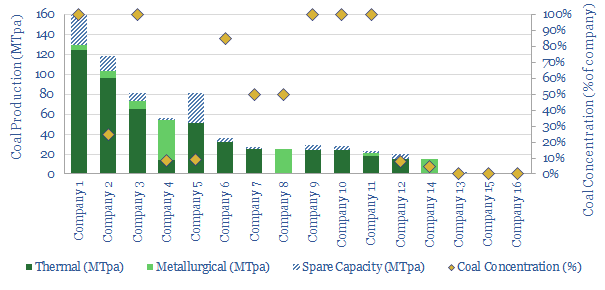

This data-file aims to screen coal companies, especially fifteen of the largest Western coal producers. This group produces around 500MTpa of thermal coal and 100MTpa of metallurgical coal from the US, Canada, Europe and Australia in 2022. Key trends for the coal industry in 2022+ are drawn out from the companies’ recent disclosures.

In normal times, thermal coal producers have debatable ESG credentials, owing to being the highest carbon fossil fuel, and 2-3x higher CO2 intensity per MWH of useful energy than natural gas.

However, in 2022-25, we could be in a market where deployment of important energy transition technologies is insufficient, resulting in energy shortages, which pull on the demand for thermal coal.

Energy Transition Insurance. Some decision-makers might even view exposure to seaborne thermal coal markets as a kind of insurance policy. If the world fails to achieve sufficient pragmatic progress in the energy transition, the result will be energy under-supply, and sharp price spikes for high carbon energy. You can rationally buy auto insurance in case of a car accident, while also really not wanting to get into a car accident.

Hence this data-file covers $80bn of coaly market cap across 15 companies. The average company is 50% exposed to coal mining, producing 34MTpa of thermal coal and 6MTpa of metallurgical coal. We have profiled each company, its main assets, and company commentary, in both 2021 and 2022 (the YoY makes a nice comparison).

The market does not believe 2022’s thermal coal boom will persist, as three companies have dividend yields above 10% at the time of writing.

Coal exposure but no energy shortage exposure? One reason to be careful with this peer group is that some coal companies are not really exposed to the theme of future global energy shortages. For example, Peabody and Arch are two of the larger coal producers in the screen, but over 80% of their production is land-locked in Wyoming/Colorado, and still only achieved very low realizations in 2022 (numbers in the data-file).

Exits also continue. 80% of the coal producers in the screen want to shift away from thermal coal towards metallurgical coal. TransAlta and Vale already exited all coal in 2021. Anglo American exited thermal coal in January 2022. In early 2023, Teck Resources announced plans to separate its metals business (Teck Metals) from its steelmaking coal business (Elk Valley Resources). Glencore liked the idea so much that it has offered $23bn to buy all of Teck Resources, then split the combined companies into a MetalsCo (listed on LSE) and a CoalCo (listed on NYSE). RWE will exit coal-fired generation by 2030. CEZ will exit coal production by 2038. So which coal companies remain, if you are going to explore this ‘insurance’ idea?

This data-file aims to screen 15 Western coal producers, picking out three names with material, long-term exposure to seaborne thermal coal prices. Some of these companies are exploring CCS and nature-based solutions, while others are less focused on decarbonization, and simply focusing on production, operations, safety.

The screen highlights each company, its size, concentration to coal, its asset base and other details around its longer-term strategy.

Chinese coal producers are noted in our overview of China’s coal mining industry. Further models and data-files can be found amidst our broader coal research.