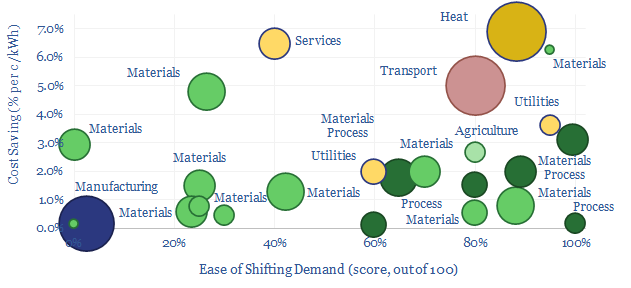

Demand shifting is the process of flexing electrical loads in a power grid, in order to smooth out volatility. Especially short to medium-duration volatility associated with wind and solar. This database scores technical potential and economical potential of different electricity-consuming processes to shift demand, across materials, manufacturing, industrial heat, transportation, utilities, residential HVAC and commercial loads.

Renewable output is volatile. Solar generation is volatile. Wind generation is volatile. The volatility spans from second-to-second volatility, through to minute-by-minute, hour-by-hour, day-by-day, season-by-season and even year-by-year.

Demand shifting is an excellent solution. It may be easy. It may cost nothing. It may not incur any energy penalties. Unlike batteries and hydrogen. And we think that ultimately 20-30% of the power grid may ultimately able be able to shift demand in some way.

To put it more bluntly, if your investment thesis for grid-scale batteries and green hydrogen is that electrolysers will be able to mop up “free power” at times when excess renewables “have nowhere else to do”, then here is a catalogue of 25+ other commercial and industrial that can literally start printing money first, simply using smart logic and power electronics, but without having to make any major new capital investments.

What is demand shifting? Demand shifting might involve turning an electrical load off when renewables are not generating, and turning it back on when renewables are generating. Or as a less extreme example, demand shifting might involve turning an electrical load down when renewables are not generating, and turning it back up when renewables are generating.

Electric vehicle chargers can slow their current flow minute-by-minute, or time non-critical charging activities for off peak times (note here, model here).

In residential heat, likewise, imagine a house that has both a gas-fired boiler and/or a heat pump and/or a resistive electrical heater in its well-insulated hot water tank. It is trivial to shift loads by a few minutes-hours, or switch between gas heating and electrical heating depending on prevailing prices. Especially with help from smart energy systems or predictive AIs.

In utilities, a nice example is the production of water by reverse osmosis, which yields 35bn tons of desalinated water each year, absorbing 250 TWH of electricity, as pumps force water molecules – but not salt ions – across a semi-permeable membrane, using about 3-4 kWh/m3 of pumping energy. Pumps can easily ramp up and shut down, and each 1c/kWh saved would decrease the cost of desalinated water by around 3.5% (membrane note here, osmosis model here). Similar examples include pipelines and utility pumps.

In the tech industry, the internet uses 1% of all global energy and 2% of all global electricity, of which one-third is data-centers (note here). But around 40% of data center loads can be shifted, of which two-thirds is temporal shifting and one-third is routing process loads to a data center at a different geographic location (more here).

In materials, there is great opportunity for demand shifting, because EBIT margins are usually around 20% and electricity is often c10% of total costs. If demand shifting save around 1c/kWh, or around 1pp of electricity cost, this is tantamount to a 5% uplift on EBIT, and by extension, a 5pp uplift on ROCE.

Whether materials can demand shift is highly dependent on the material production process, which itself can get quite complex. A “simple” pulp and paper plant has 18 separate stages, from de-barking (easy to flex) to pressing and drying (the process may need to be precisely controlled in order to make specialty grades of paper).

Across the materials industry, this data-file considers cement plants, industrial gas production, electric arc furnaces, aluminium, chlor-alkali, polymers, paper, silicon, sulphur, glass, hydrofluoric acid, small-scale hydrogen and hydrogen cyanide.

A best to worst ranking depends on the technical potential and economic potential. An electric arc furnace for steel recycling might typically have a low utilization as it is constrained by the ability to source scrap. A cement plant might use 110kWh/ton of electricity, of which 100kWh/ton is a non-time-critical comminnution circuit, grinding input rocks and output clinker into talcum powder. It may be easy to flex these loads and offer large savings. Conversely, you probably do not want to tinker with the process flows in a 1,100ºC process moving toxic gases when making Hydrogen Cyanide, or risk damaging semiconductors as pure silicon boules are crystallized out at 25 mm per hour in the Czochralski process.

Mining processes perhaps screen best of all? Processes such as communition, flotation, heap leaching and electrowinning screen as some of the most flexible processes in our entire data-file. And indeed, the Super-Majors of energy transition may include Super-Miners, as metals and materials demand booms.

In industrial gases, there is also a fascinating shift underway, where pressuring swing adsorption (using compressors and vacuum pumps, note here) is much more flexible than cryogenic plants that take days to cool down (note here).

Manufacturing operations may generally find it harder to demand shift. Consider that a modern auto plant might assemble a car by moving each vehicle along a production line with c1,000 x 1-minute discrete stages, in a continous process, where pausing any one stage effectively halts the entire line; and a full scale auto plant employs 1,000-3,000 people, whose sudden idling would be very expensive for the auto-maker (model here).

This data-file will serve as our reference file for which processes can shift demand and use demand shifting to integrate more renewables. We will continue building the data-file out over time.