A global overview of recycling is laid out in numbers in this data-file, covering steel, paper, glass, plastics such as PET and HDPE and other metals, such as copper and aluminium. In each case, we cover the market size (in MTpa), the recycling rate (in %), primary energy use (MWH/ton), CO2 intensity (tons/ton) and the possible savings from recycling.

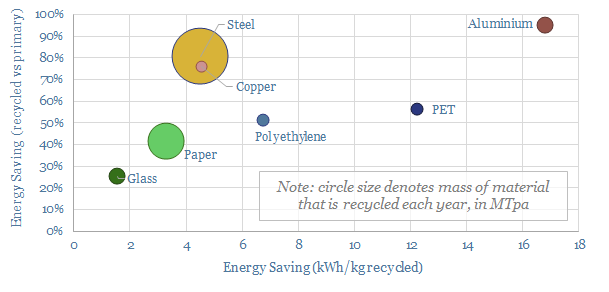

We estimate that 1GTpa of waste material is recycled globally, as 35% of these products’ total markets are sourced from scrap. As a good rule of thumb, recycling saves 5MWH of primary energy and 2 tons of CO2 per ton of material, or around 70% of the footprint of primary production, although the precise numbers vary category-by-category.

In the energy transition, we estimate global CO2 savings from recycling are already around 2GTpa. Rising energy and CO2 prices would incentivize more recycling, and save another 2GTpa of future CO2, we estimate.

Steel is the largest category, as around 30% of the 2GTpa market is sourced from scrap, or c600MTpa, avoiding c80% of the energy and c90% of the CO2 associated with primary production, and saving 1GTpa of global CO2 (models here and here). This is also the area where economic opportunity seems largest: at 6c/kWh average energy prices and a $50/ton CO2 price, these ‘savings’ can avoid half of the typical costs of primary steel production. Leading steel-recycling companies, in electric arc furnaces include Nucor, CMC and Celsa Group.

Paper is the second largest category, as more than half of the world’s 400MTpa paper market is sourced from recycled pulp. Energy, CO2 and energy/CO2 cost savings are around 30-40%, compared with virgin paper (model here). One of Europe’s largest listed paper recyclers is DS Smith, managing 6MTpa of material each year.

Aluminium offers the third largest energy and CO2 savings from recycling, out of the materials in our data-file. Despite a smaller market by mass, at c70MTpa, the energy and CO2 associated with secondary production is around 90-95% lower than primary production (model here), which also helps avoid c40% of production costs (at 6c/kWh energy, $50/ton CO2). The world’s largest aluminium recycler is Novelis, which is owned by Hindalco.

Copper recycling has mixed numbers. In absolute terms, around one-third of the world’s 28MTpa copper demand comes from secondary sources. And, secondary production saves c75% of the energy and CO2 of primary copper production, avoiding 4-5MWH/ton of energy and around 3 tons/ton of CO2 (model here). However, the value of these savings is relatively low in normal times, compared to $7-10/kg copper prices. But higher energy and CO2 prices in the 2020s may increase the relative value of secondary production. One of the world’s largest copper recyclers is Aurubis (TSE note here), while Boliden recycles copper and other metals, such as nickel (TSE note here).

The glass industry comprises over 1,200 companies, across 2,160 sites, outputting over 200MTpa of products. c20% is from recycled material. However, this is likely to be the category with the energy and CO2 savings from recycling, both in absolute and relative terms, at about 25-35% (morel here).

Global plastics only see a c10% recycling rate, which in turn is dominated by PET and HDPE. Energy and CO2 savings in these categories are estimated at 50-60% (models here and here). An array of next generation plastic recycling companies, which can handle a wider variety of feedstocks, has excited us in our research (screen here, note here).

The data-file linked below contains our numbers and workings, to derive the energy, CO2 and cost savings in each category, as a useful reference.

Further research. Our recent commentary on global recycling and energy savings is linked here.