The global nickel market will grow from $30bn pa to $300bn pa as part of the energy transition, including a 5x increase in volumes and 2x increase in prices. This 15-page note evaluates the nickel supply chain for electric vehicle battery cathodes. Deficits are looming, plus inflationary feedback loops, hence we end by screening nickel names.

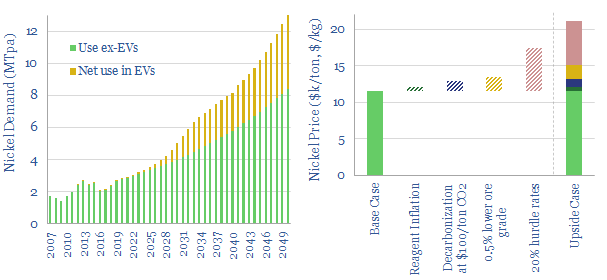

An overview of global nickel demand is set out on pages 2-4. We see stainless demand growing with GDP and EV battery demand rising c30x through 2050.

An overview of global nickel supply is set out on pages 5-9. This is a complex supply chain. Only a subset of processes and nickel grades can satiate demand for EV cathodes. We focus in on a laterite – HPAL – MHP – nickel sulphate pathway in this work.

Nickels and dimes. Economics of producing battery grade nickel (in $/ton) are captured on page 10, as a function of a dozen input variables, which can be stress-tested. Our marginal cost estimate is around $11,500/ton with a CO2 intensity of 15 tons/ton.

Nickel bars. There are three bottlenecks to ramping up battery grade nickel production, outlined on pages 11-12. We argue these may settle long-term future prices closer to $20,000/ton.

Upside for nickel in the energy transition is compared with other materials that have crossed our screens on page 13. It is one of the toppier examples.

A screen of nickel companies is presented on page 14-15, covering incumbents, diversified miners, specialists and growth projects.

To find out which companies dominate the world’s nickel production, please see our article here.