Helion is developing a linear fusion reactor, which has entirely re-thought the technology (like the ‘Tesla of nuclear fusion’). It could have costs of 1-6c/kWh, be deployed at 50-200MWe modular scale and overcome many challenges of tokamaks. Progress so far includes 100MºC and a $2.2bn fund-raise, the largest of any private fusion company to-date. This note sets out its ‘top ten’ features.

Our overview of nuclear fusion is linked above, spelling out the technology’s game-changing potential in the energy transition. However, fourteen challenges still need to be overcome.

Self-defeatingly, many fusion reactor designs aim to deal with technical complexity via adding engineering complexity. You can do this, but it inherently makes the engineering more costly, with mature reactors likely to surpass 15c/kWh in delivered power.

Helion has taken a different approach, to engineering a fusion reactor. Our ‘top ten features’ are set out below. If you read back through the original fusion report, you will see how different this is…

(1) Costs. Helion has said the reactor will be 1,000x smaller and 500x cheaper than a conventional fusion reactor, with eventual costs seen at 1-6c/kWh. This would indeed be a world-changer for zero carbon electricity (chart below).

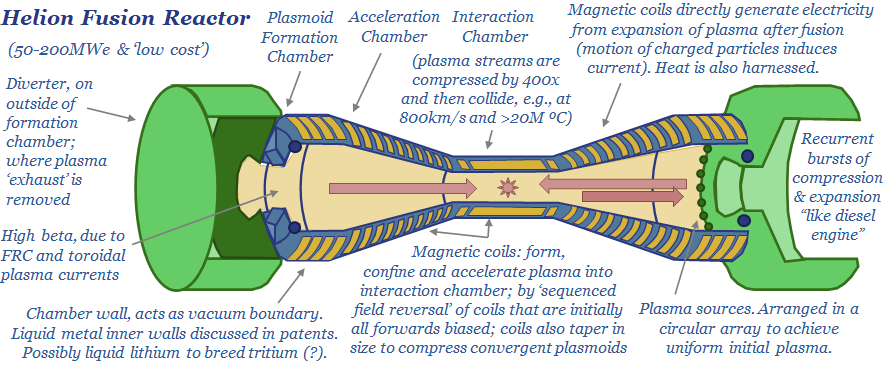

(2) Linear Reactor. This is not a tokamak, stellarator or inertial confinement machine (see note). It is a simple, linear design, where pulsed magnetic fields accelerate plasma into a burn-chamber at 1M mph. Colliding plasma particles fuse. The fusion causes the plasma to expand. Energy is then captured from the expanding plasma. It is like fuel in a diesel engine.

(3) Direct electricity generation. Most power generators work by producing heat. The heat turns water into high-pressure steam, which then drives a turbine. Within the turbine, electricity is generated by Faraday’s law, as a moving magnetic field induces a current in stator coils of the turbine (see our note below for a primer on power-electronics). However, a linear reactor containing can exploit Faraday’s law directly. Plasma particles are electro-magnetically charged. So as they expand, they will also induce a current. Some online sources have suggested 95% of the energy released from the plasmas could be converted to electricity, versus c40% in a typical turbine.

(4) Reactor size. The average nuclear fission plant today is around 1GW. Very large fusion plants are gearing up to be similar in size. However, Helion’s linear reactor is seen on the order of c50MW. This is something on the magnitude that can be deployed by individual power consumers, or more ambitiously, on mobile applications, such as in commercial shipping vessels or aviation.

(5) Fewer neutrons. Helion’s target fuel is Helium-3. This is interesting because fusing 2 x Helium-3 nuclei yields a Helium-3 nucleus plus two hydrogen nuclei. There are no net neutron emissions and resultant radioactivity issues (see fusion note). However, the Helium-3 would need to be bred from Deuterium, which is apparently one of the goals in the Polaris demonstration reactor (see below).

(6) Beta. Getting a fusion reactor to work energy-efficiently requires maximizing ‘beta’. Beta is the ratio of plasma field energy to confining magnetic field energy. Helion’s patents cover a field reversed configuration of magnets which will “have the highest betas of any plasma confining system”. During compression, different field coils with successively smaller radius are activated in sequence to compress and accelerate the plasmoids “into a radially converging magnetic field”. Helion is targeting a beta close to 100%, while tokamaks typically achieve closer to 5%.

(7) Capital. In November-2021, Helion raised a $2.2bn Series-E funding round. This is the largest private fusion raise on record (database below). It is structured as a $500M up-front investment, with an additional $1.7bn tied to performance milestones.

(8) Progress so far. In 2021, Helion became the first private fusion company to heat a fusion plasma to 100MºC. It has sustained plasma for 1ms. It has confined them with magnetic fields over 10 Teslas. Its Trenta prototype has run “nearly every day” for 16-months and completed over 10,000 high-power pulses.

(9) Roadmap to commerciality? Helion is aiming to develop a seventh prototype reactor, named Polaris, which will produce a net electricity gain, hopefully by 2024. It has said in the past that fully commercial reactors could be ‘ready’ by around 2029-30.

(10) Technical Risk. We usually look to de-risk technologies by reviewing their patents. This is not possible for Helion, because we can only find a small number of its patents in the usual public patent databases. Developing a commercial fusion reactor still has enormous challenges. What helps is a landscape of different companies exploring different solutions. For a review of how this has helped to de-risk, for example, plastic pyrolysis, see our recent update below: 60% of the companies have face steeper setbacks than hoped, but a handful are now reaching commercial scale-up.

Other exciting next-generation nuclear companies to cross our screen our highlighted in the data-files below…

To read more about our outlook on nuclear flexibility and how we see nuclear growth accelerating, please see our article here.