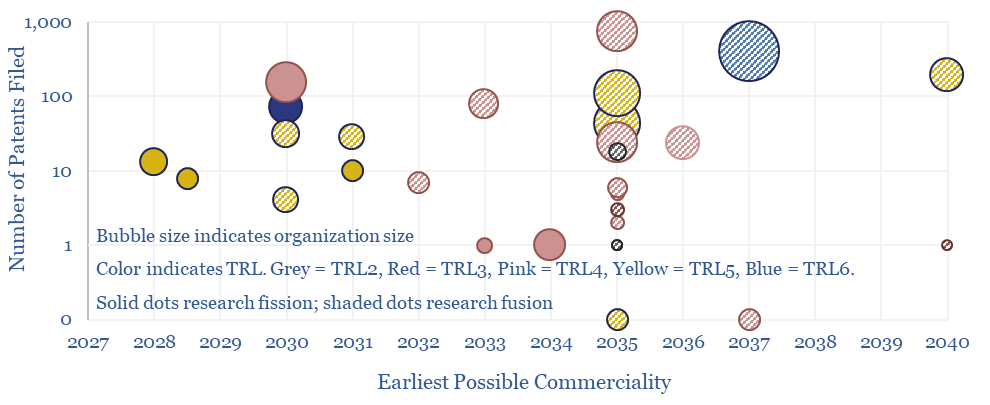

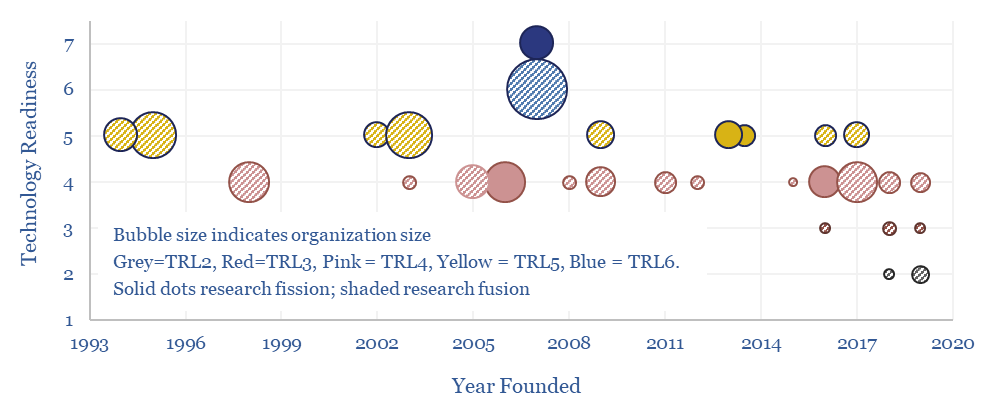

This data-file screens c30 next-generation nuclear companies at the cutting edge of fission and fusion technology. The median one employs 100 people, is developing a 150MWe reactor, and could reach commerciality by 2035. But how has this landscape of companies progressed in the past few years?

Next-gen nuclear is in many ways the perfect way to power continued electrification in the energy transition, and especially AI data-centers, with round-the-clock, zero-carbon electricity at 7-15 c/kWh. But are we any closer to commercialization?

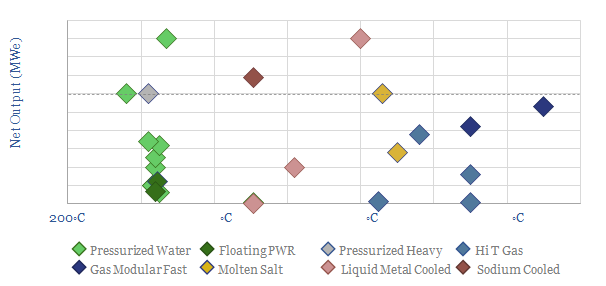

This data-file tracks the progress of 30 next-generation nuclear companies. The median one employs 100 people, is developing a 150MWe reactor, and could reach commerciality by 2035.

However, in the past 2-years, 6 companies (i.e., 20%) saw delays or setbacks, especially those that had previously seemed closer to commercialization: e.g., NuScale‘s Utah cancellation and defects in ITER‘s thermal shields.

Conversely, only one company (i.e., 3%) is perhaps progressing faster than anticipated. 5 companies also shut down (15%), while 4 new companies were added to screen, for a 15% churn rate.

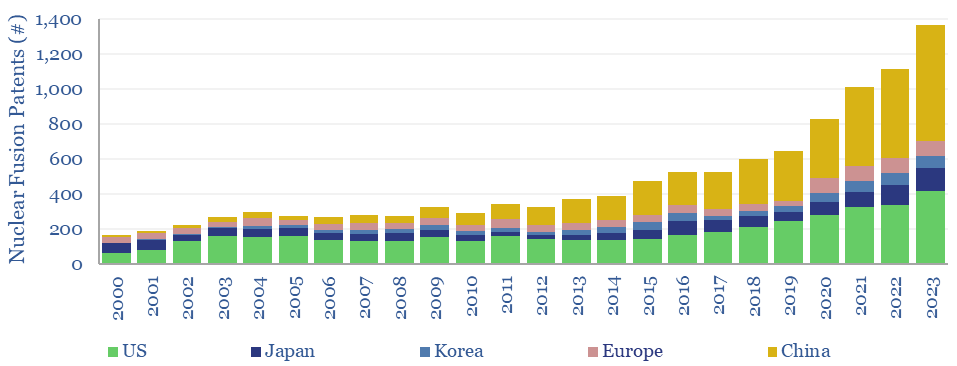

The best case scenario could see fusion reactors commercialised in the 2030s, but technical challenges remain. The pace of progress is however accelerating slowly (chart below).

This is all typical of new technology development. Next-gen nuclear is exciting. Our nuclear outlook does expect nuclear generation to double by 2050. But most AI data-centers before 2030 will most likely be gas-fired.

This database summarises each company, including its technology, location, employee count, notable backers, technical readiness, earliest potential commercial date and recent milestones. Our notes also cover SMRs (below), expected costs or technical details that have been disclosed.