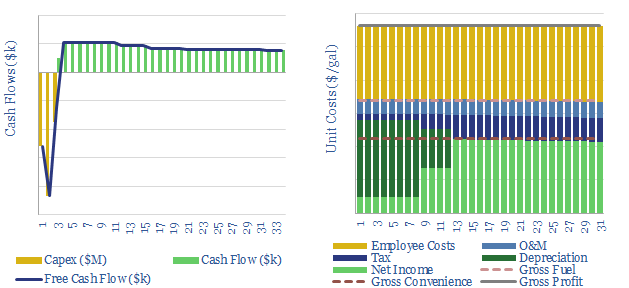

This data-file captures fuel retail economics covering the costs and margins of a typical fuel-retailing petrol station to earn a 10% unlevered IRR, based on data from companies in the space, covering capex, opex, margins and costs.

The typical EBIT margin of a fuel retail station is around 17c/gallon. This is derived from a c6% margin on direct fuel sales; but in addition, around 10-20% of revenues are from selling convenience retail products at a higher, c25-30% margin.

Economics are more attractive at larger service stations with higher throughput volumes, which in turn, allows for lower fuel retail margins. Please download the data-file to stress test the economics.

Fuel retail largely about volumes and competition. In our base case numbers, we have

assumed that our fuel retail station sells 0.75M gallons of fuel each year. This is the

average across Europe. But it varies by country.

The capex costs of a new fuel retail station will average $1.75M, and these costs are broken down across a dozen cost lines in the data-file.

Our recent 14-page note compares the economics of EV charging stations with conventional fuel retail stations. They are fundamentally different. Our main question is whether EV chargers will ultimately get over-built, as retailers look to improve their footfall and accelerate the energy transition.

All of our downstream oil sector research is summarized here, from refining, to petrochemicals to fuel retail, to decarbonization using nature based solutions.