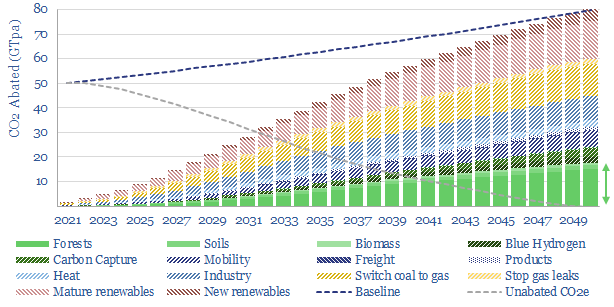

Hydrocarbons denote commodities that are extracted from the Earth, composed of carbon and hydrogen, refined, and then combusted for energy or converted into useful materials. Hydrocarbons currently supply over 80% of the world’s useful energy, evenly split across natural gas (methane), oil products and coal. A crucial objective in the energy transition is to maintain hydrocarbon supplies, economically, in order to prevent debilitating energy shortages, and to fuel the transition itself. Other crucial objectives are to reduce hydrocarbons’ CO2 intensity (Scope 1&2), shift to lower-carbon hydrocarbons (e.g., coal to gas switching), improve efficiency factors; and then abate all of the remaining CO2, including via pre-combustion CCS, post-combustion CCS and nature-based solutions. Opportunities in our recent hydrocarbon research are explored below.

Oil Research

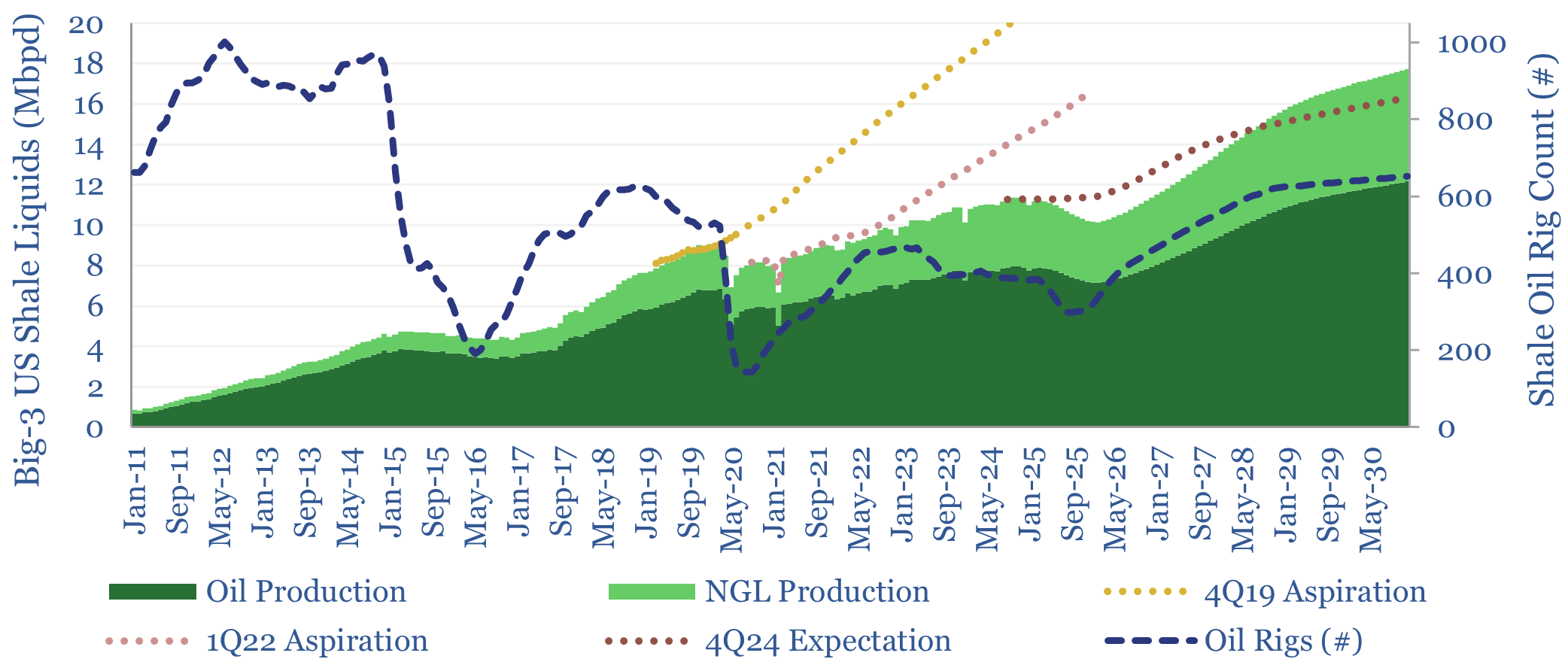

US shale: outlook and forecasts?

Download

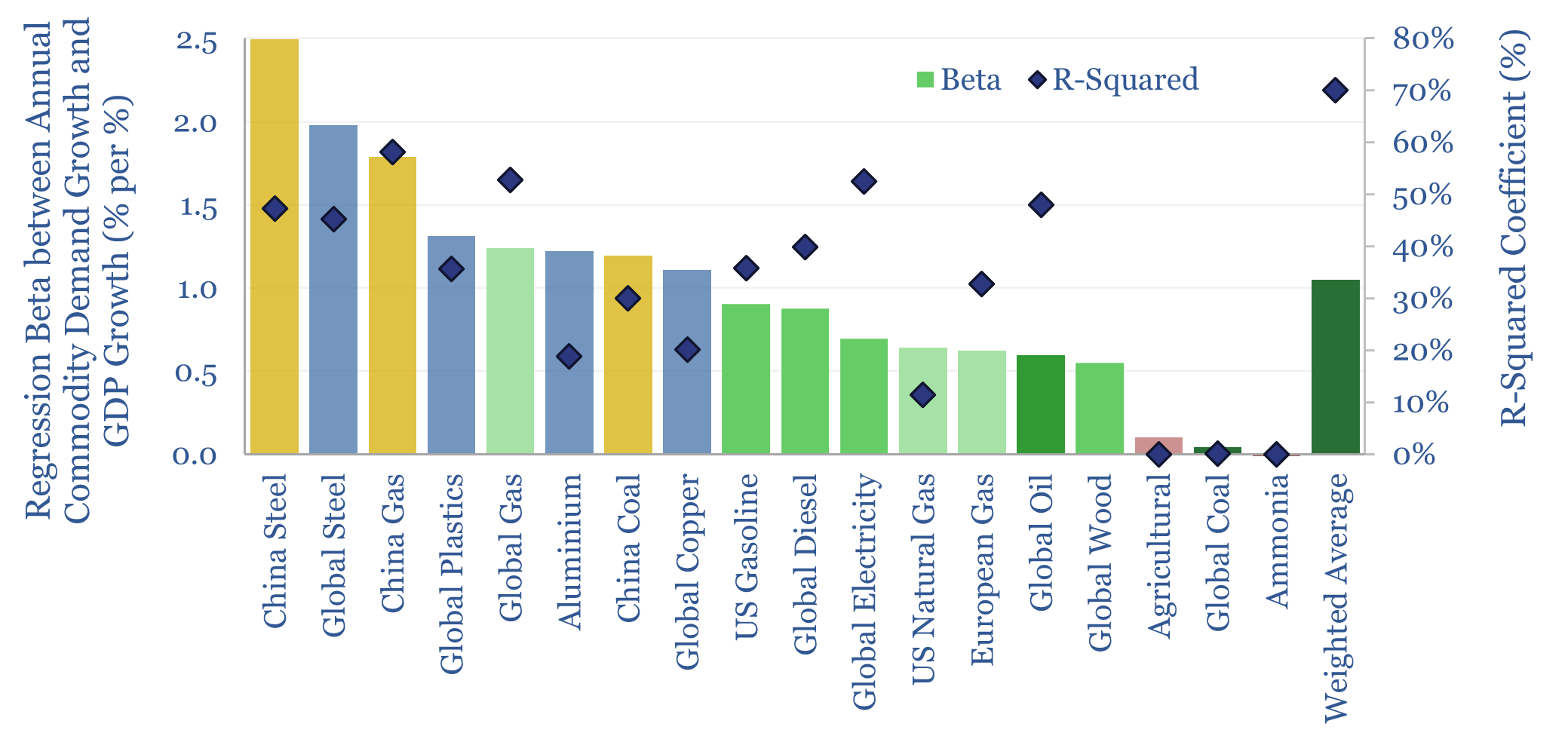

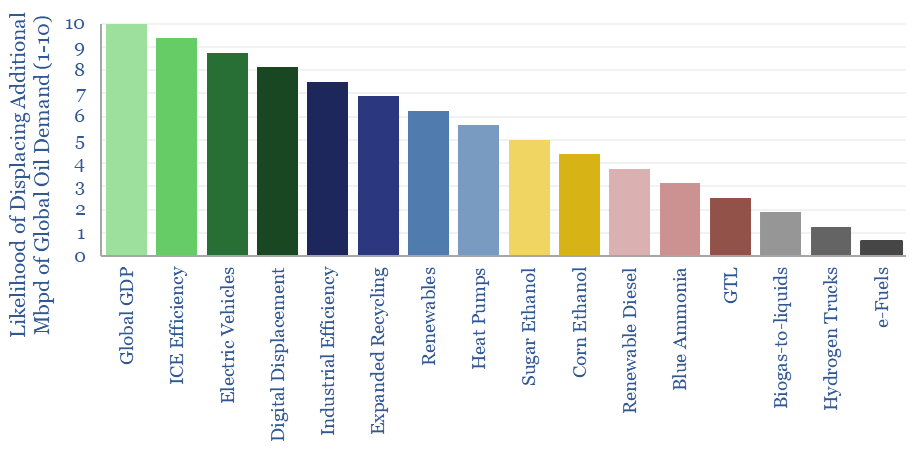

Commodity demand: how sensitive to GDP growth?

Download

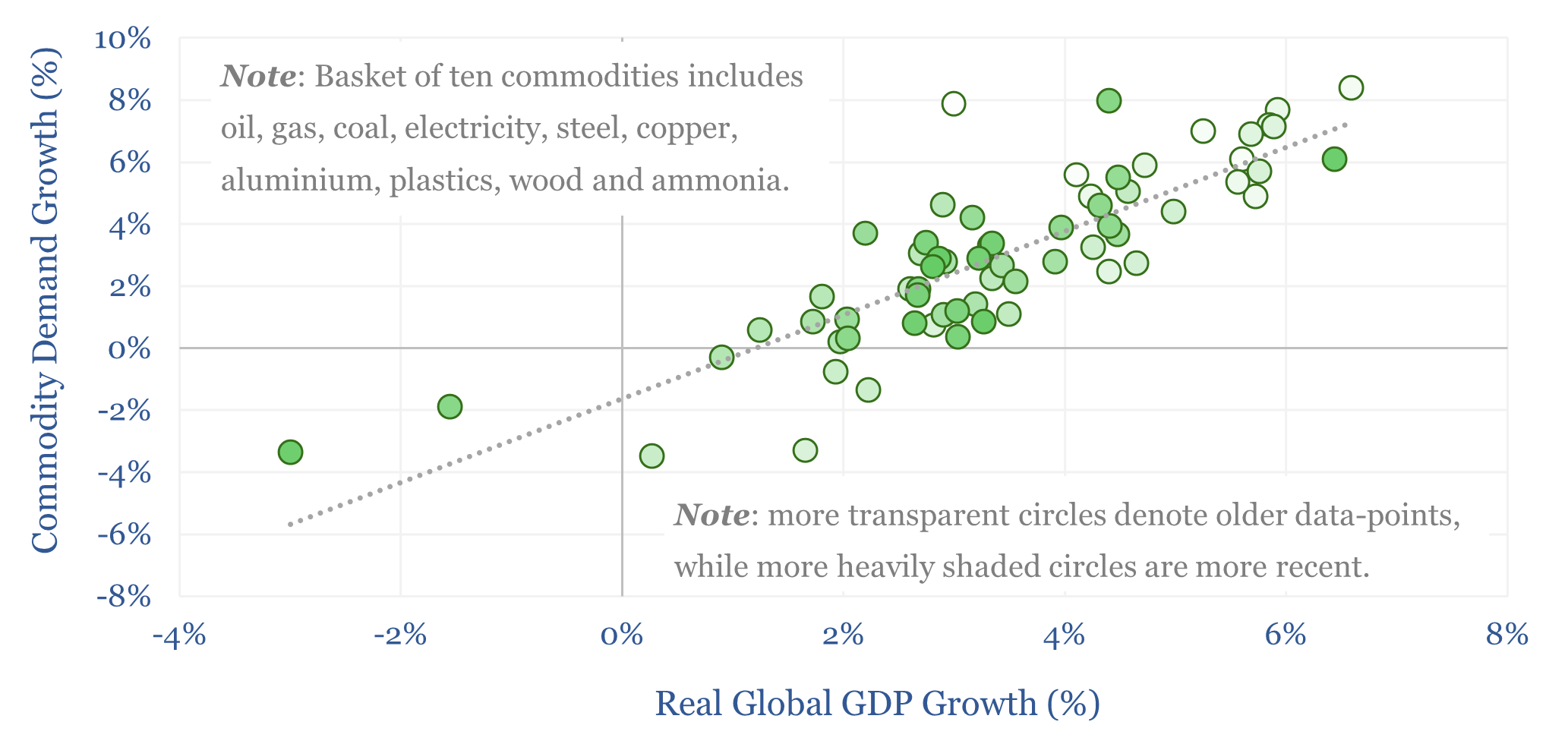

Global commodity demand: sensitivity to GDP?

Download

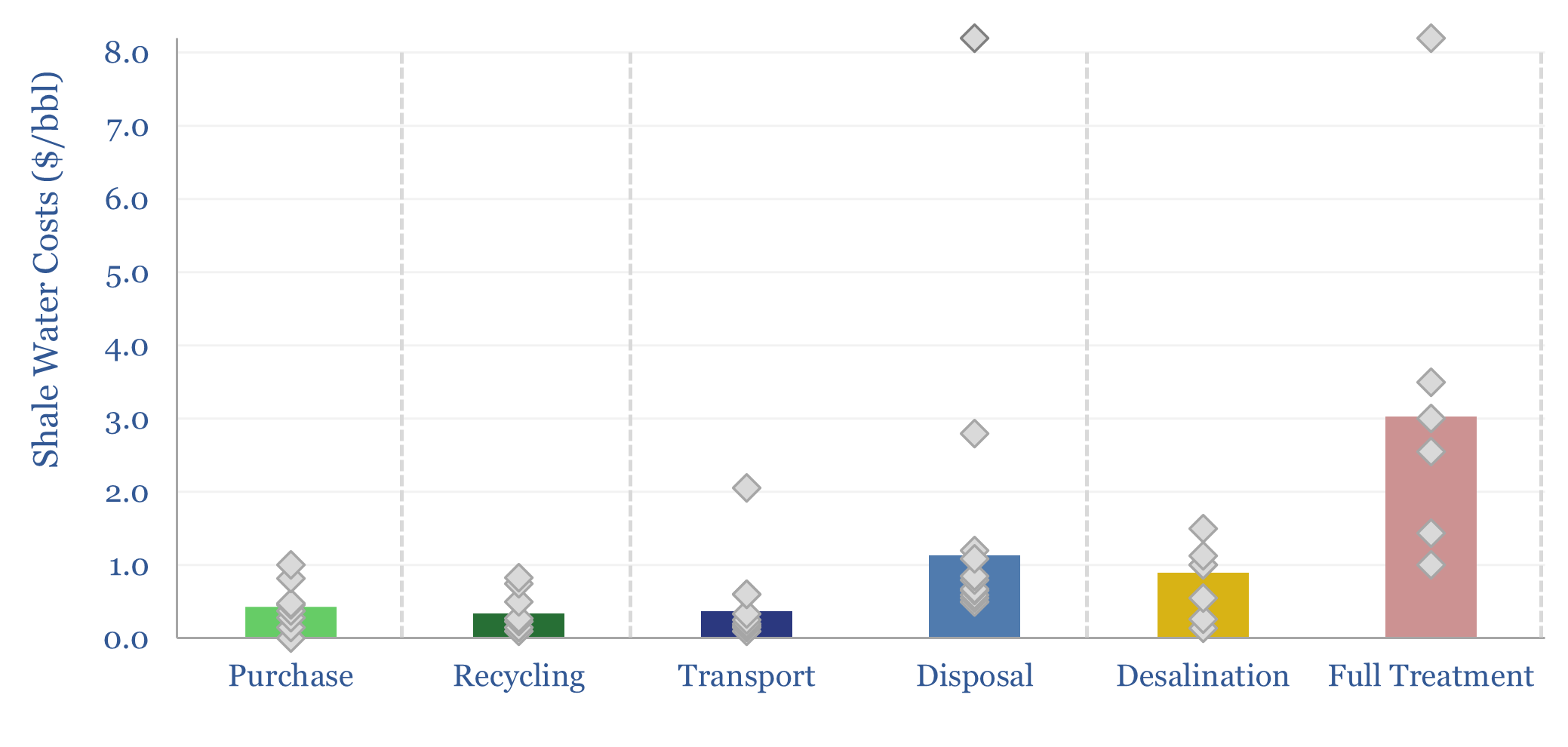

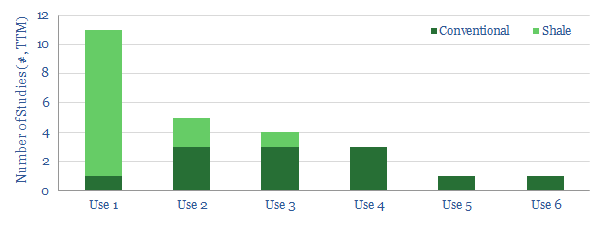

Shale water costs: transport, treatment and disposal?

Download

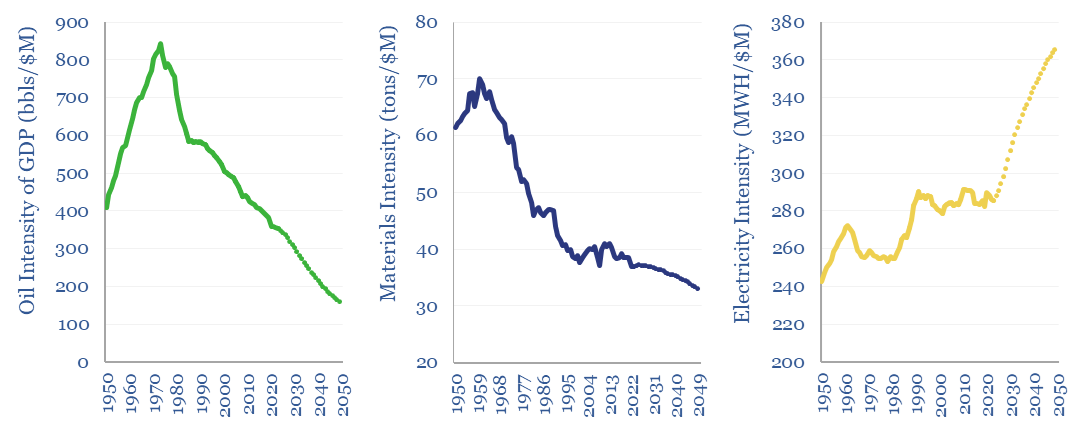

Commodity intensity of global GDP in 30 key charts?

Download

Oil demand: making millions?

Download

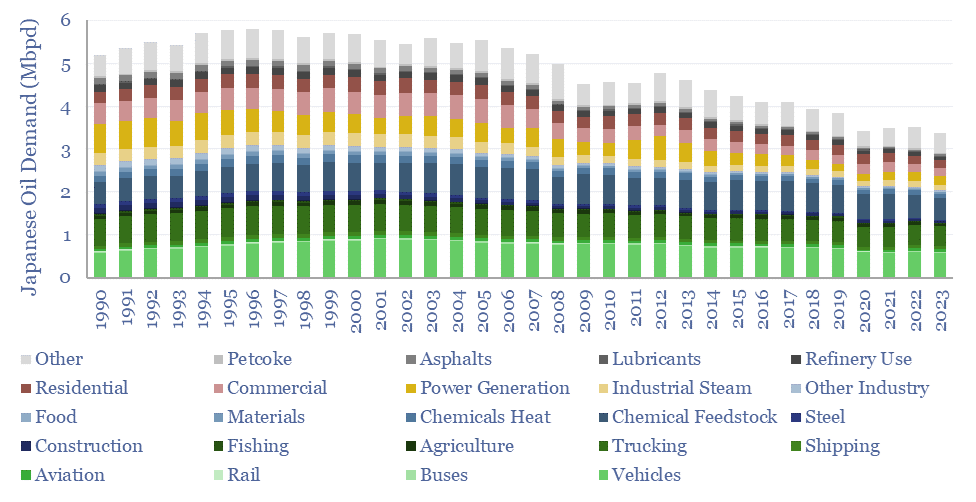

Japan oil demand: breakdown over time?

Download

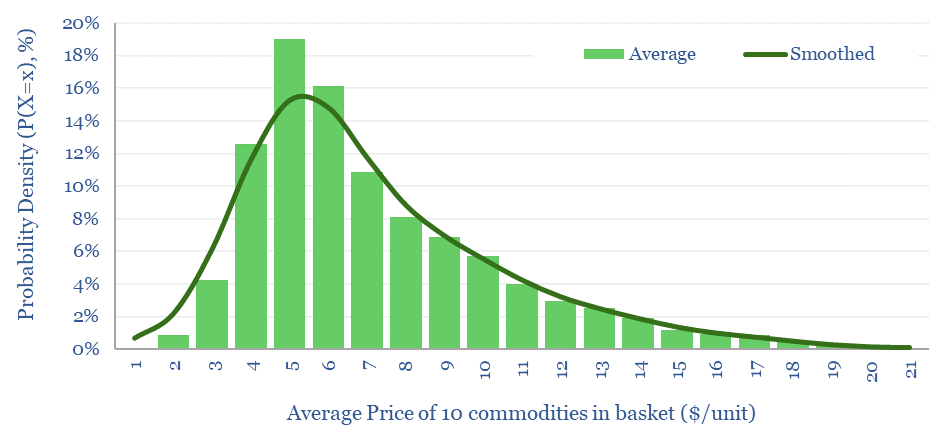

Commodity price volatility: energy, metals and ags?

Download

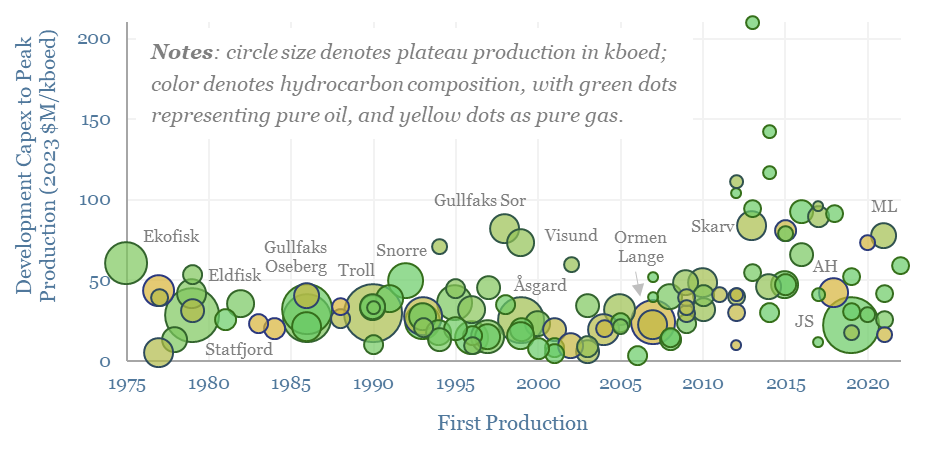

Offshore oilfields: development capex over time in Norway?

Download

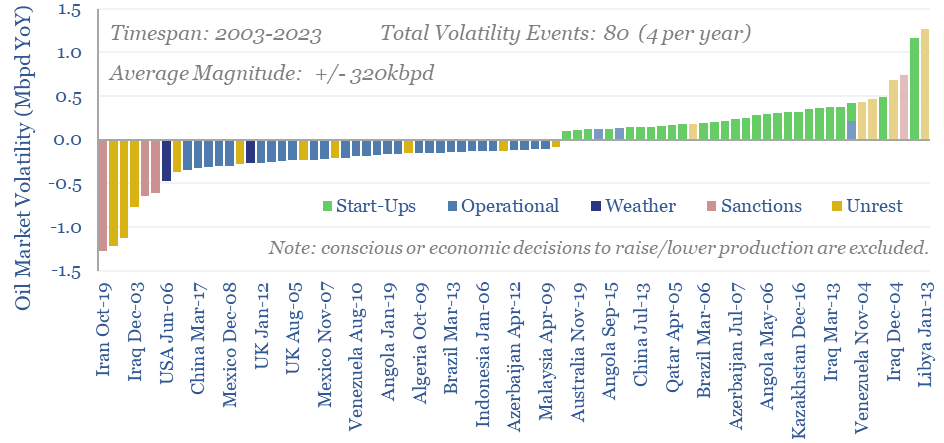

Oil markets: rising volatility?

Download

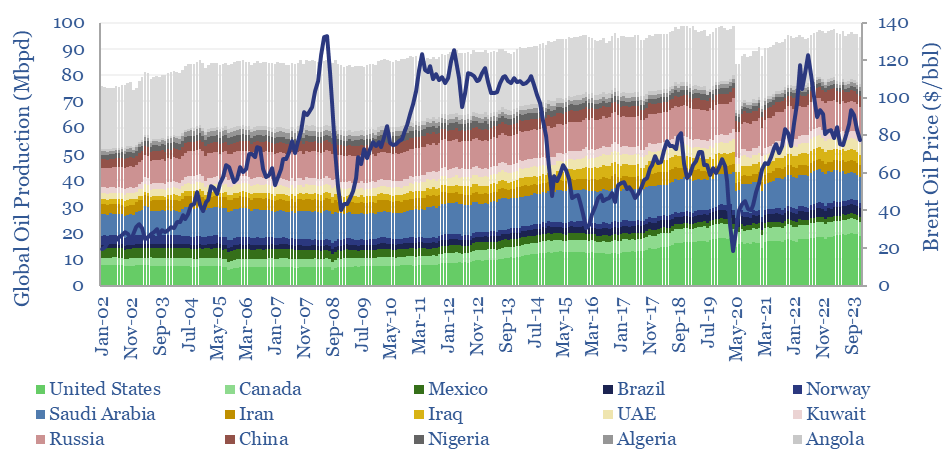

Global oil production by country?

Download

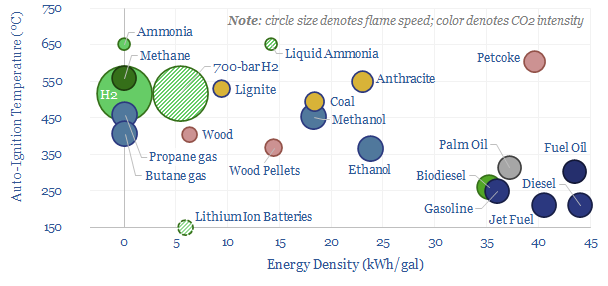

Combustion fuels: density, ignition temperature and flame speed?

Download

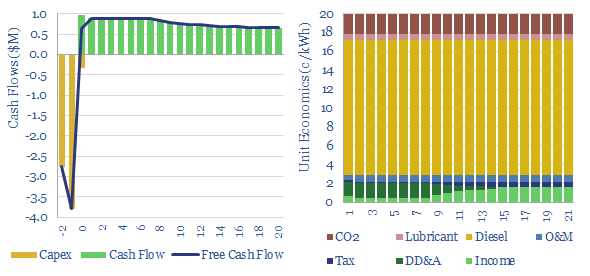

Diesel power generation: levelized costs?

Download

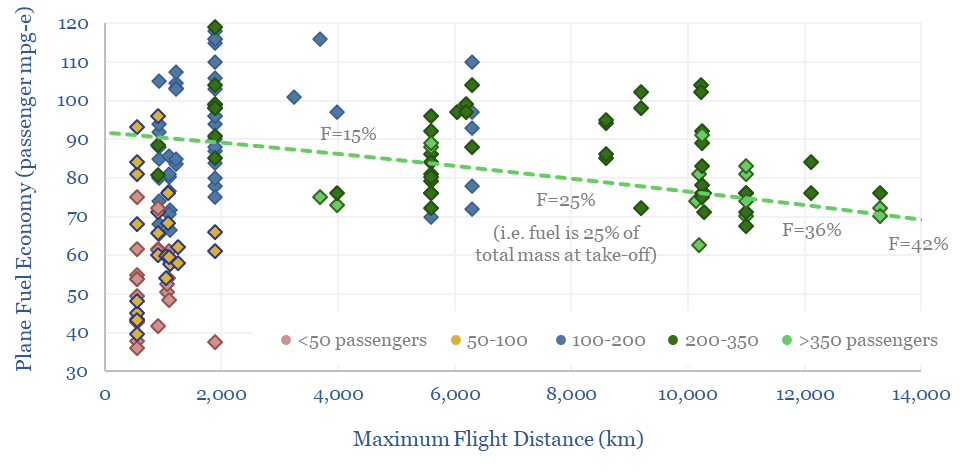

Commercial aviation: fuel economy of planes?

Download

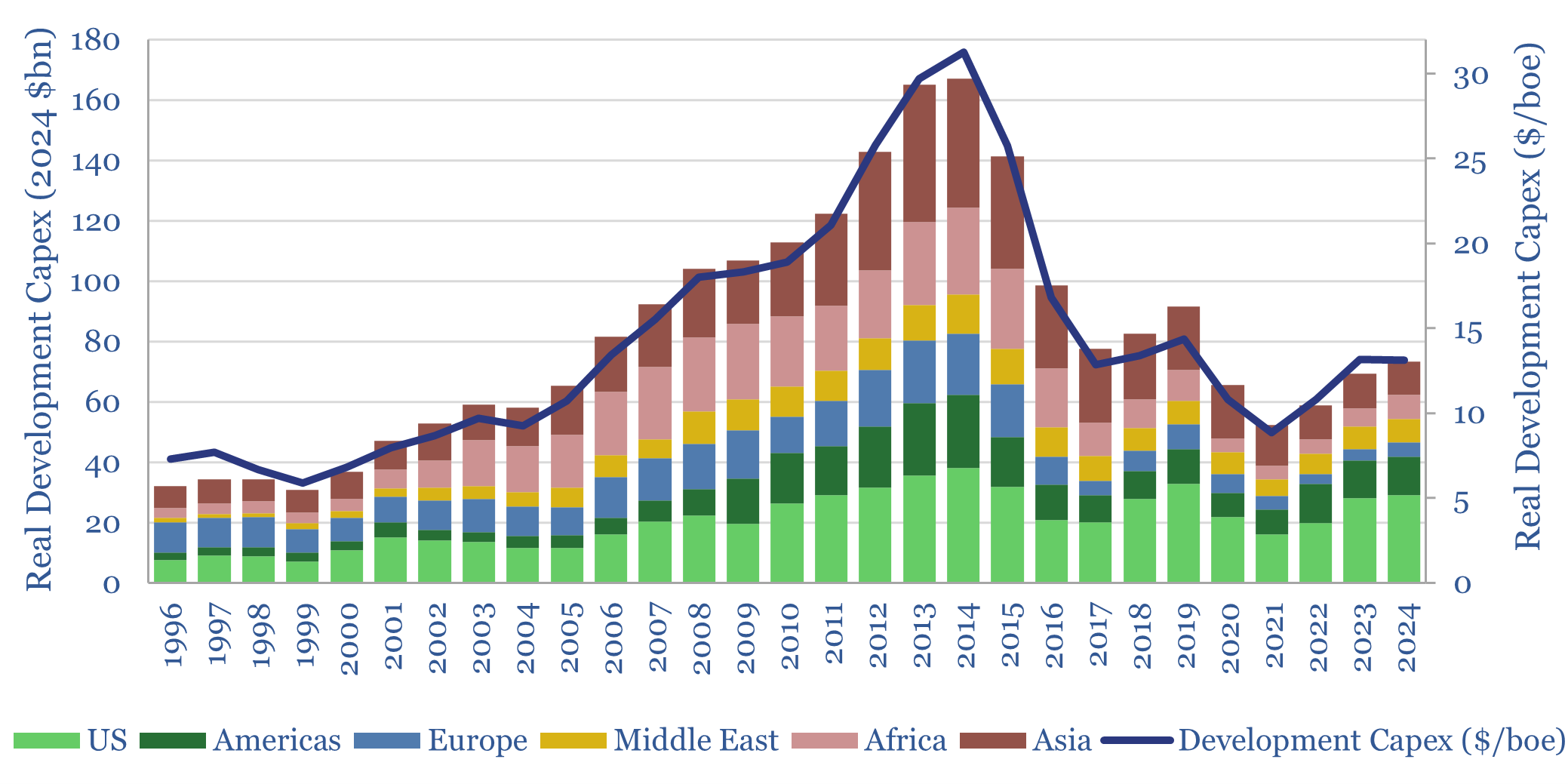

Development capex: long-term spending from Oil Majors?

Download

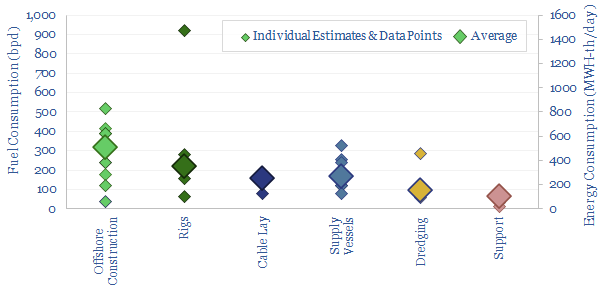

Offshore vessels: fuel consumption?

Download

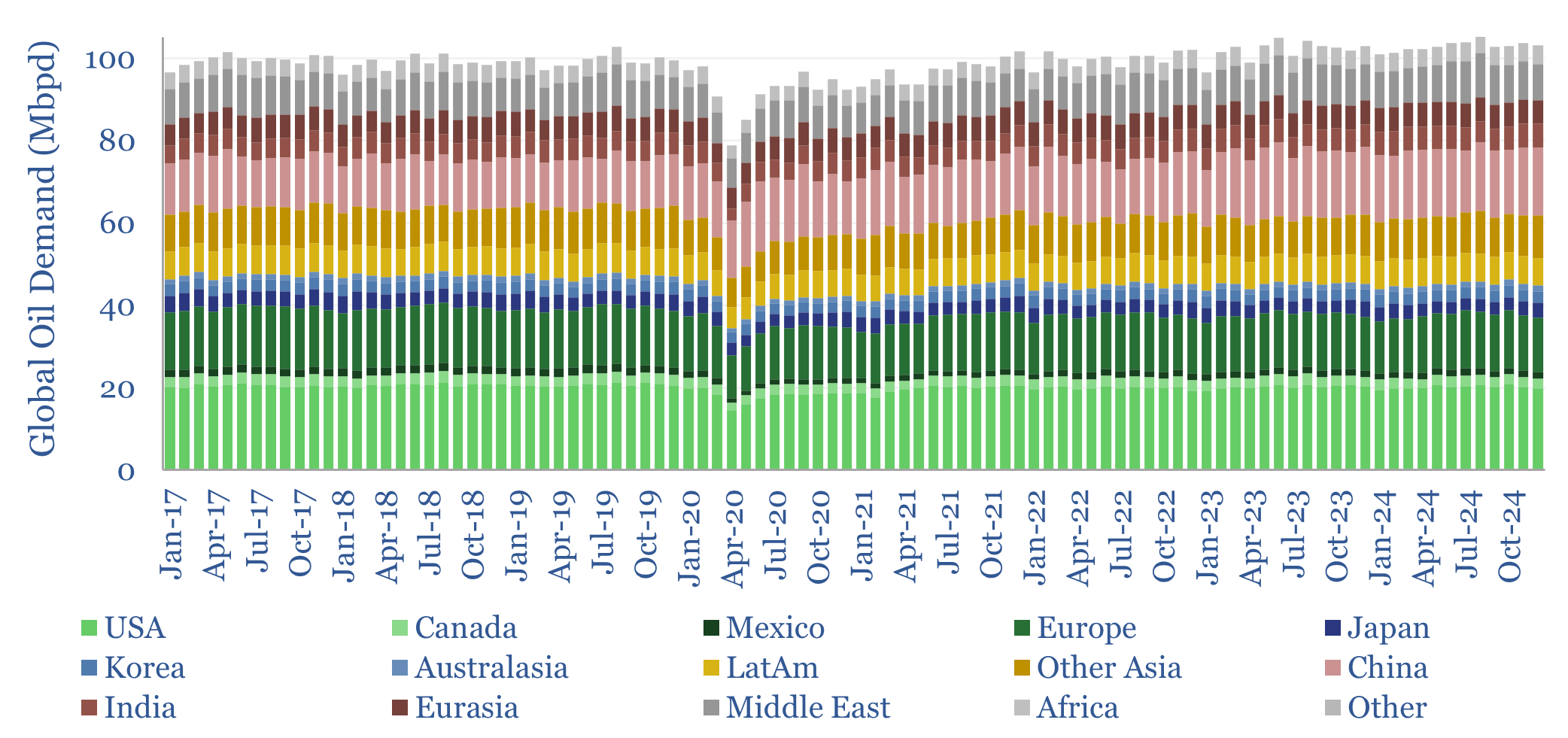

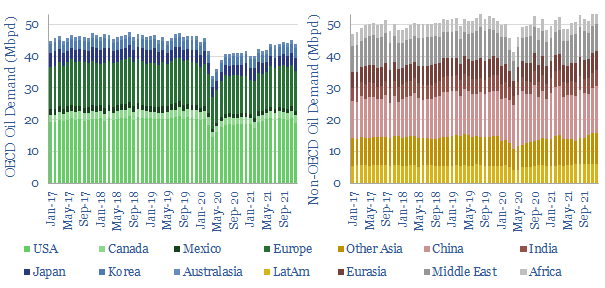

Global oil demand: breakdown by product by country?

Download

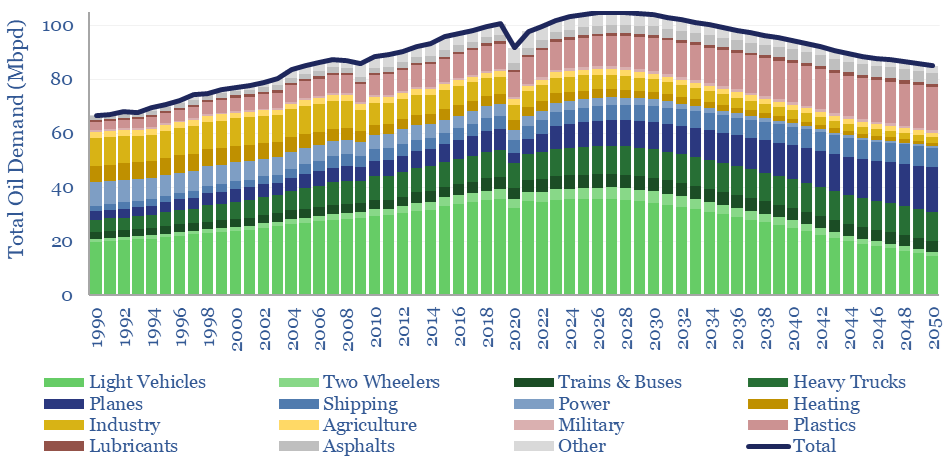

Global oil demand forecasts: by end use, by product, by region?

Download

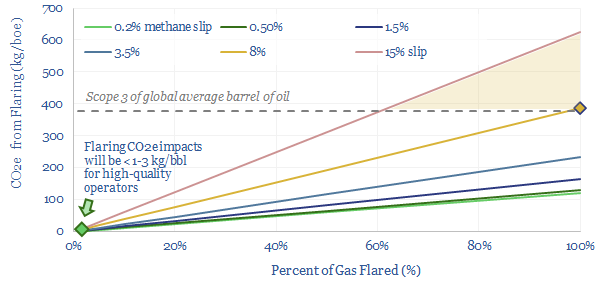

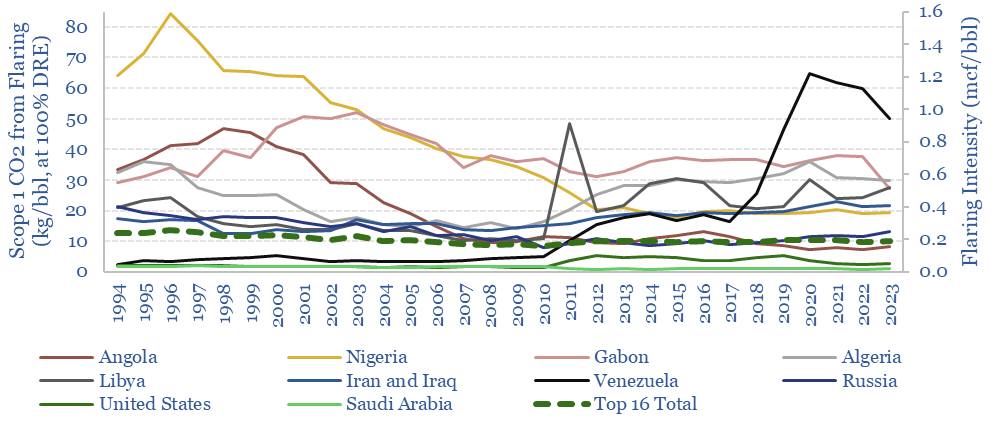

Flaring reduction: fire extinguishers?

Download

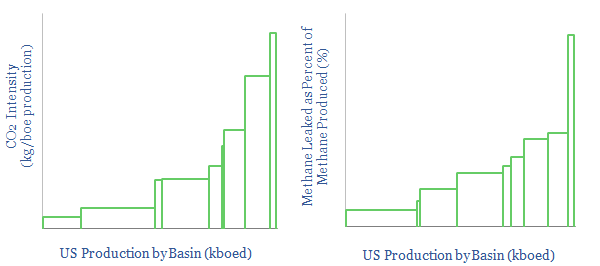

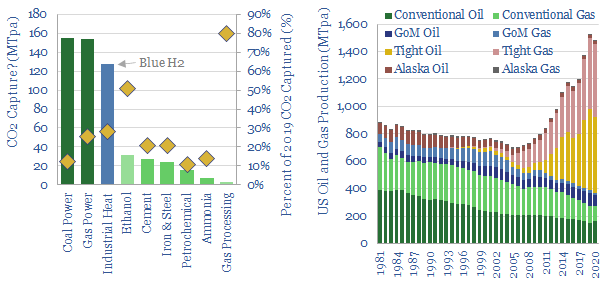

US CO2 and Methane Intensity by Basin

Download

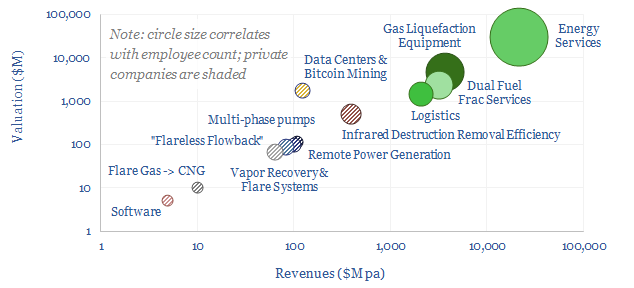

Flaring reduction: screen of service and equipment companies?

Download

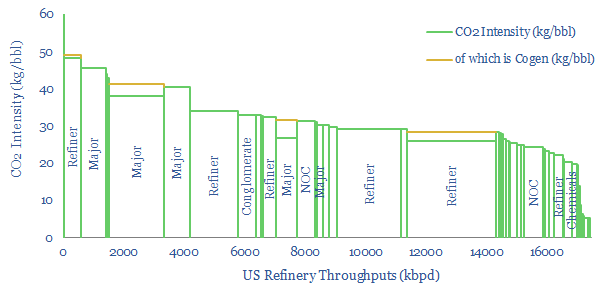

US Refinery Database: CO2 intensity by facility?

Download

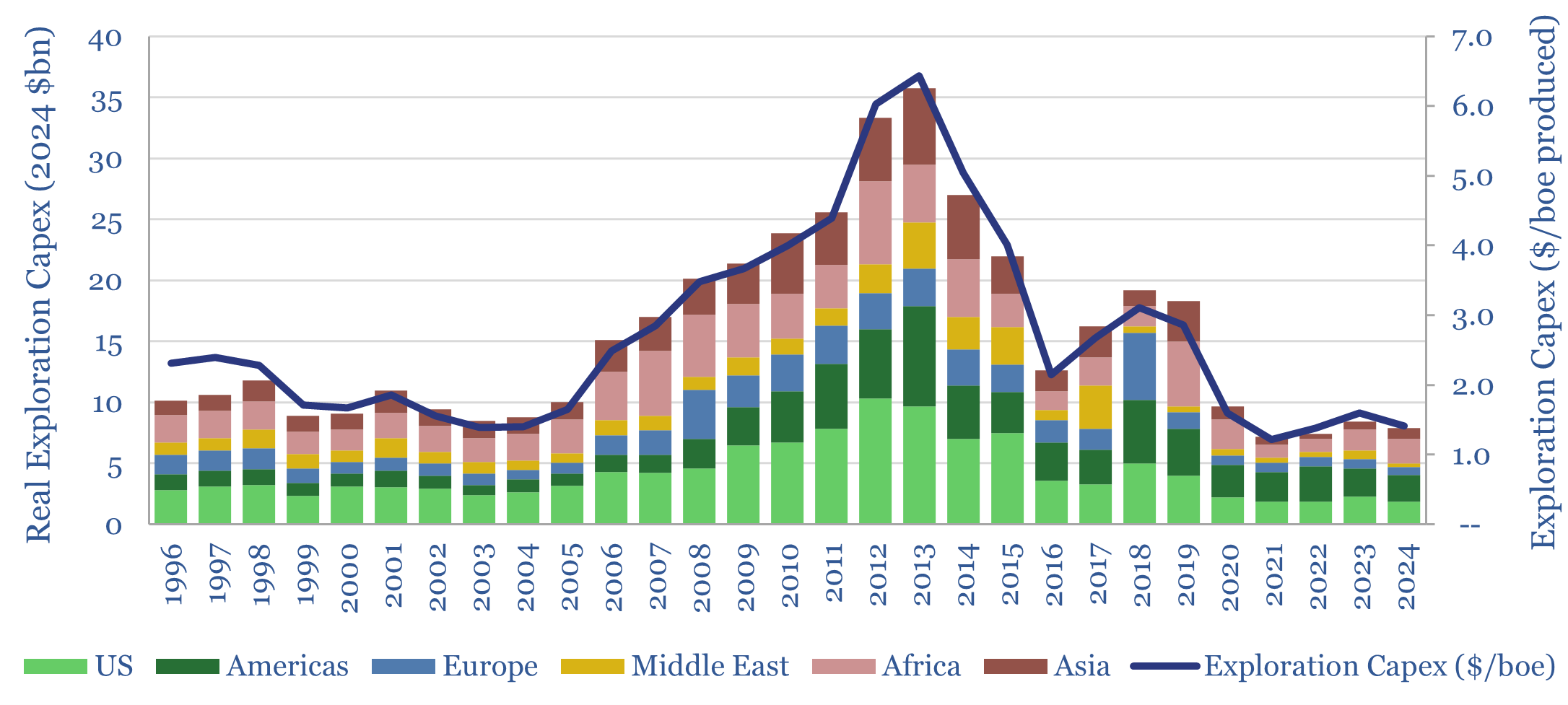

Exploration capex: long-term spending from Oil Majors?

Download

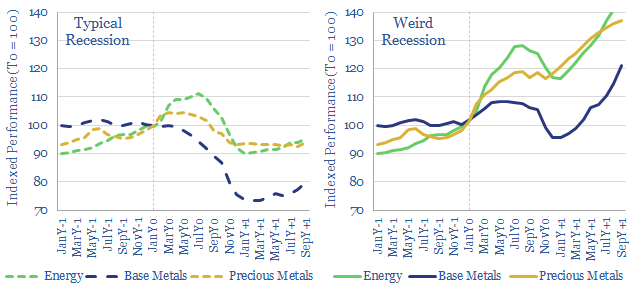

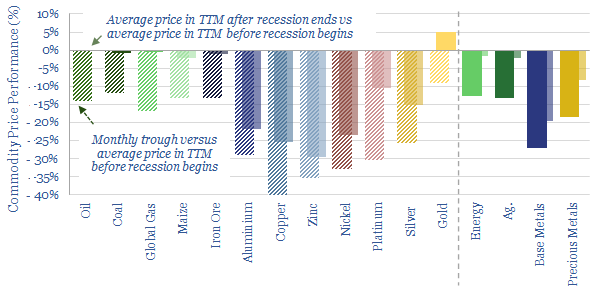

Weird recessions: can commodities de-couple?

Download

How do commodities perform during recessions?

Download

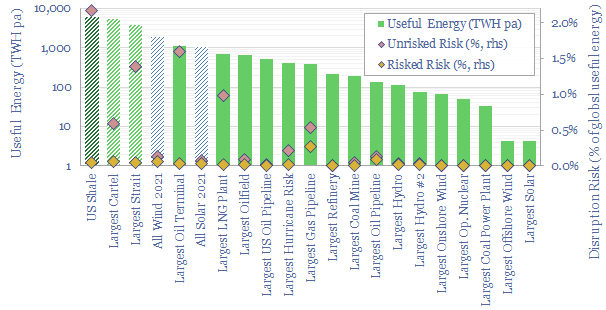

World’s largest energy assets: by category and risk?

Download

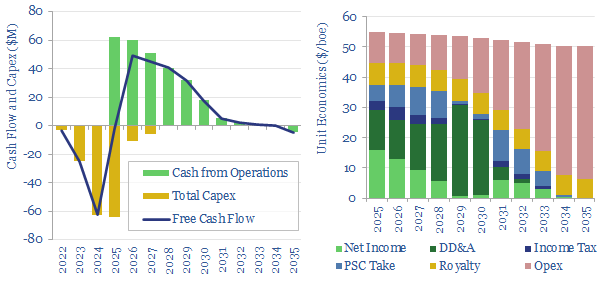

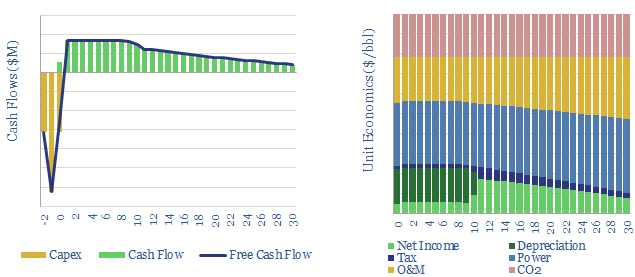

Offshore oil: marginal cost?

Download

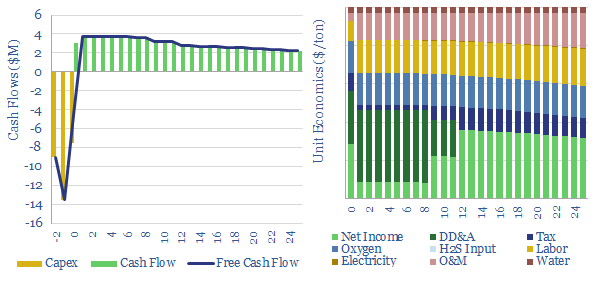

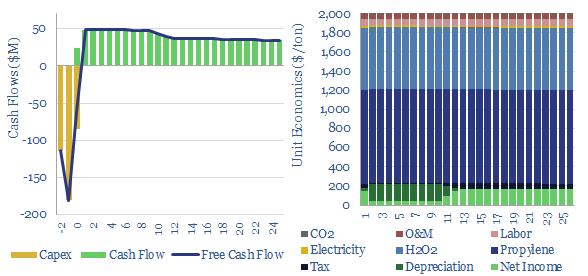

Sulphur recovery units: Claus process economics?

Download

Energy security: the return of long-term contracts?

Download

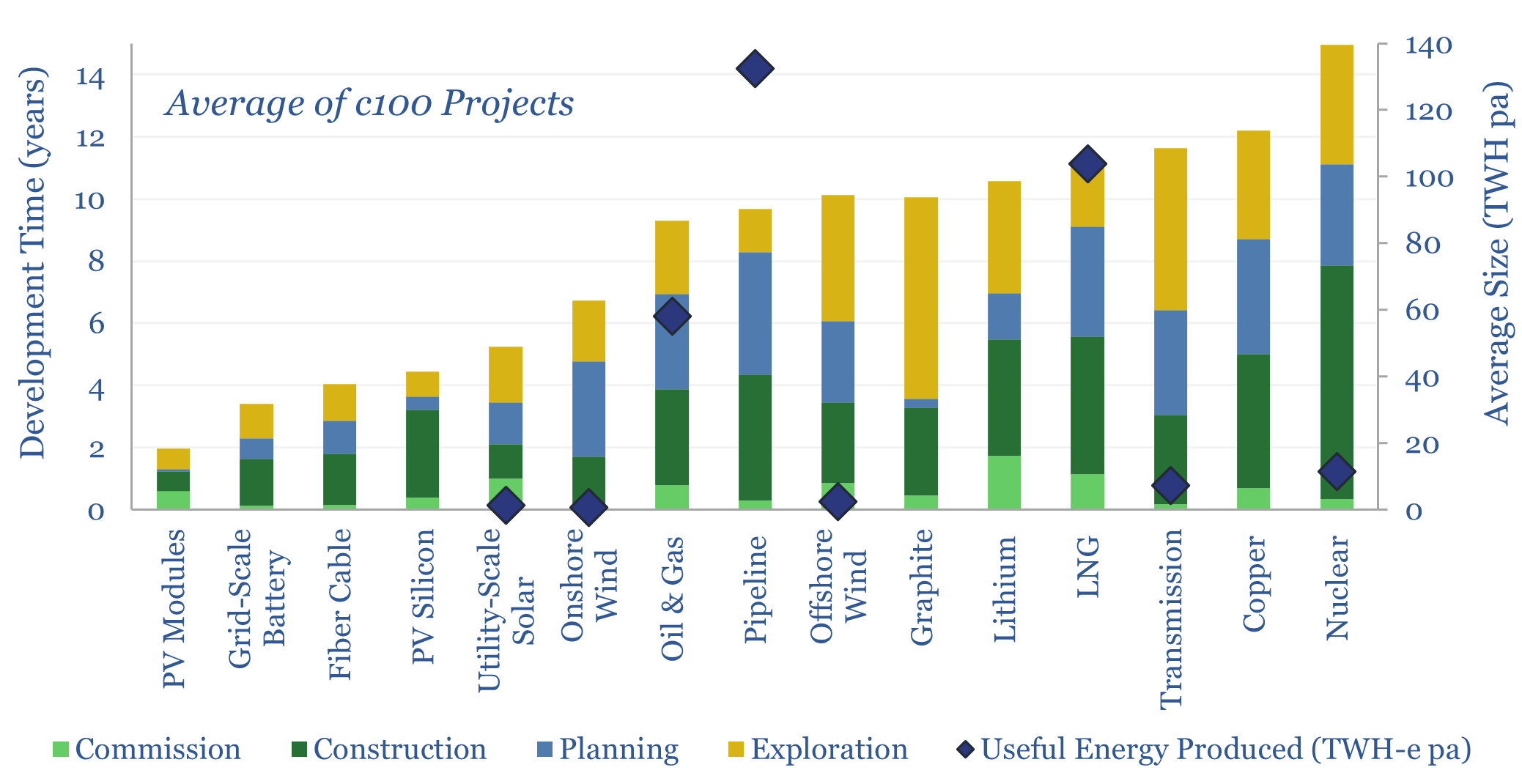

Energy development times: first consideration to full production?

Download

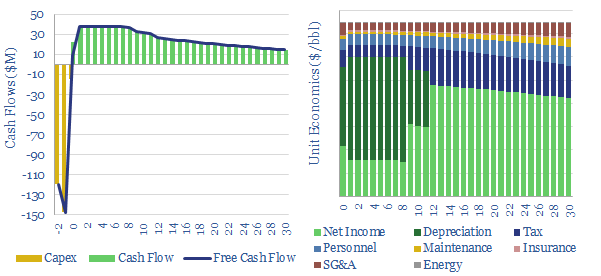

Oil storage terminals: the economics?

Download

Global oil demand: rumors of my death?

Download

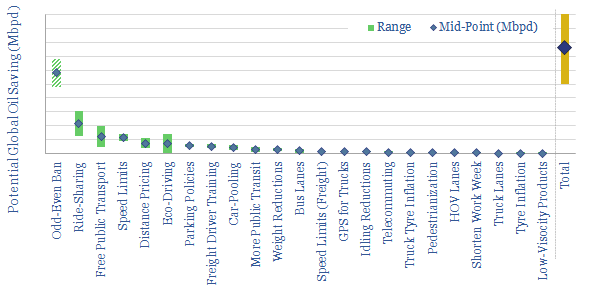

Oil demand: how much can you save in a crisis?

Download

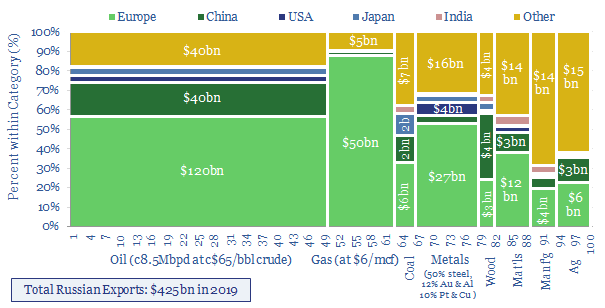

Russia: a breakdown of export revenues?

Download

US CCS: market sizing?

Download

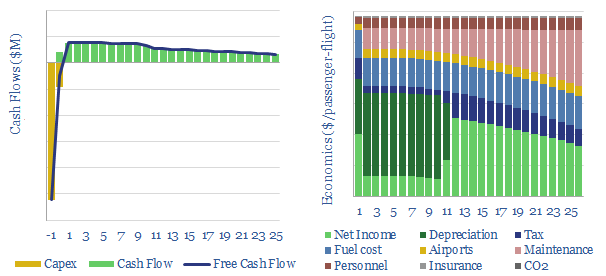

Commercial aviation: air travel economics?

Download

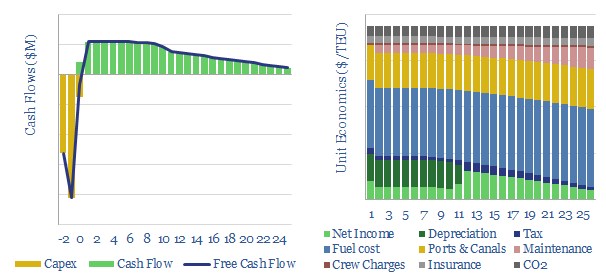

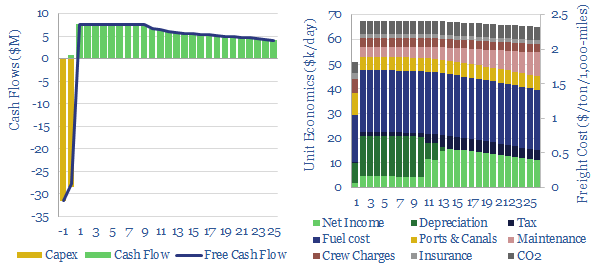

Container freight: shipping economics?

Download

Electro-fuels: start out as a billionaire?

Download

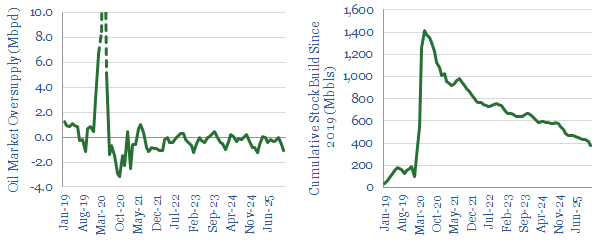

Oil markets: more balanced than ever before?

Download

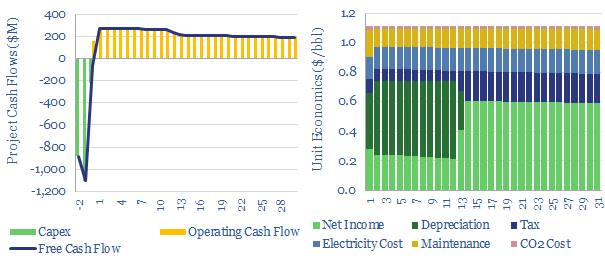

Power-to-liquids: the economics?

Download

Shale Research

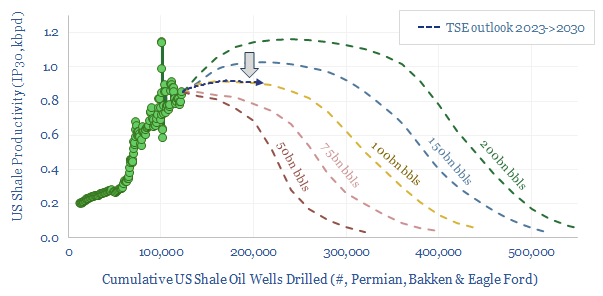

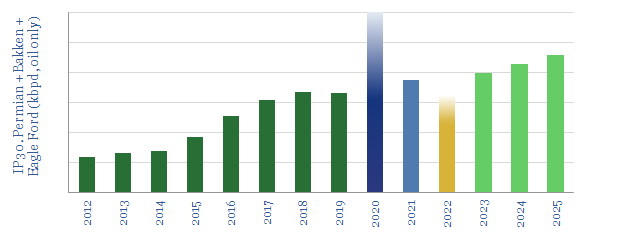

US shale: outlook and forecasts?

Download

Shale water costs: transport, treatment and disposal?

Download

Shale oil: fractured forecasts?

Download

Flaring reduction: fire extinguishers?

Download

US CO2 and Methane Intensity by Basin

Download

Flaring reduction: screen of service and equipment companies?

Download

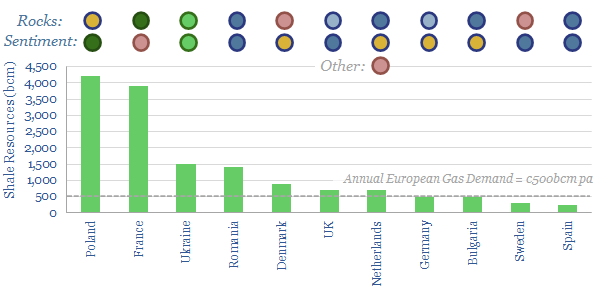

European shale: an overview?

Download

Marcellus shale: well by well production database?

Download

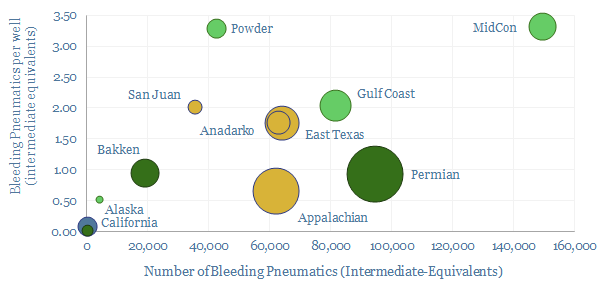

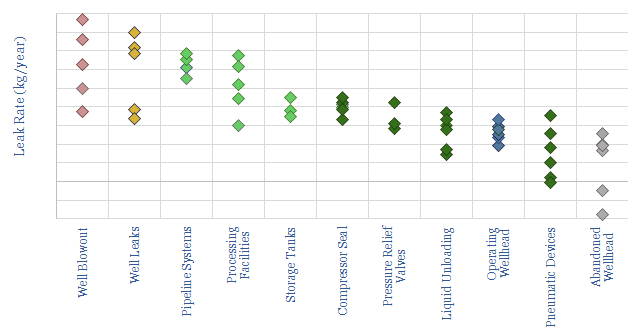

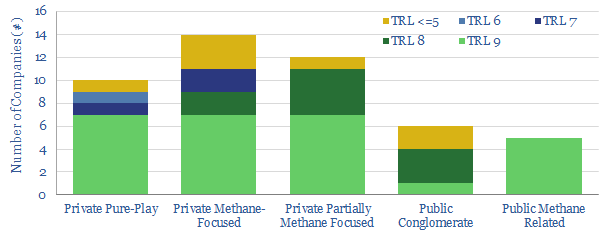

Methane emissions from pneumatic devices: by operator, by basin?

Download

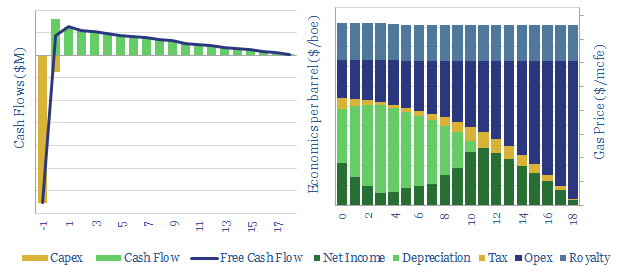

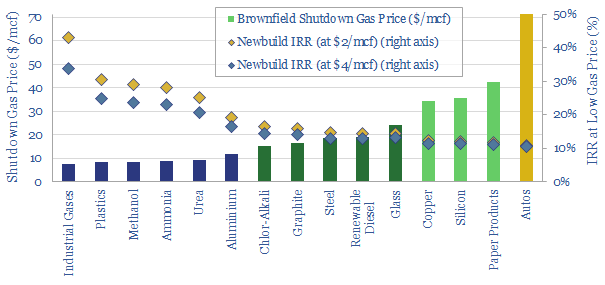

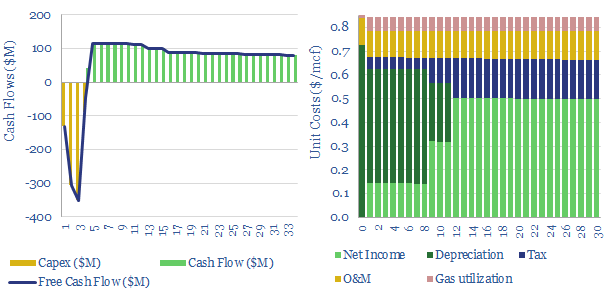

US shale gas: the economics?

Download

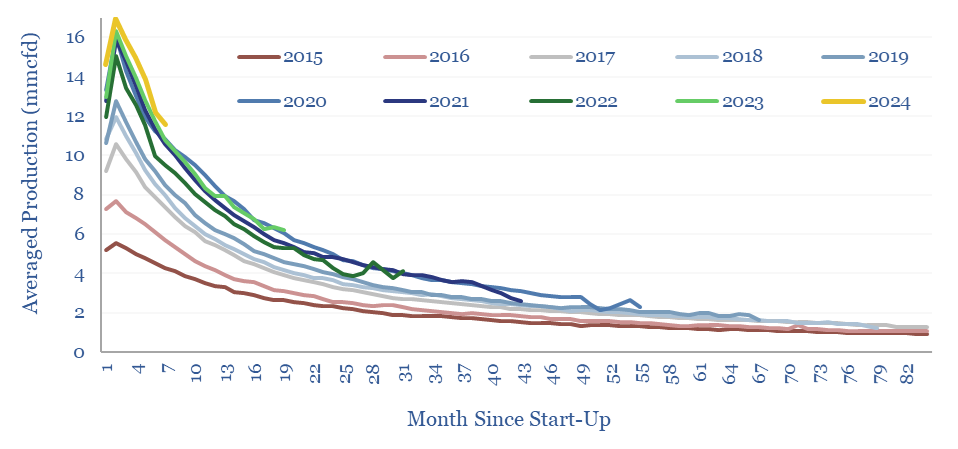

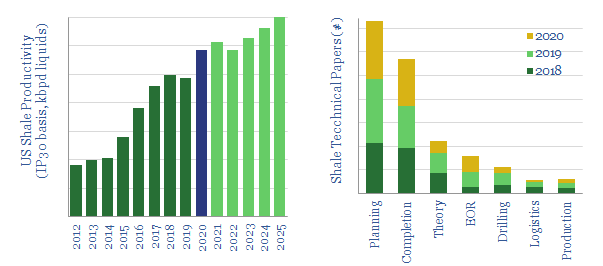

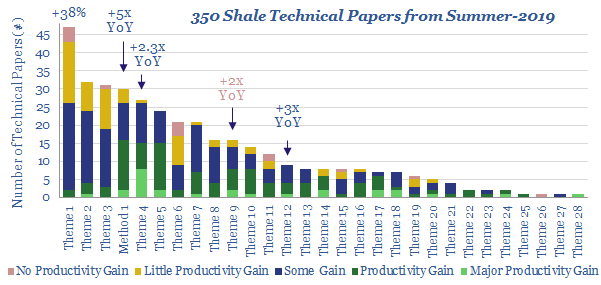

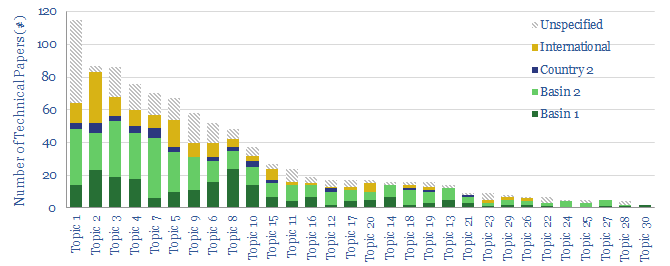

Shale productivity: snakes and ladders?

Download

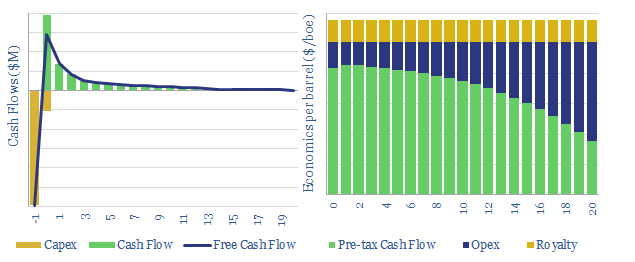

US shale: the economics?

Download

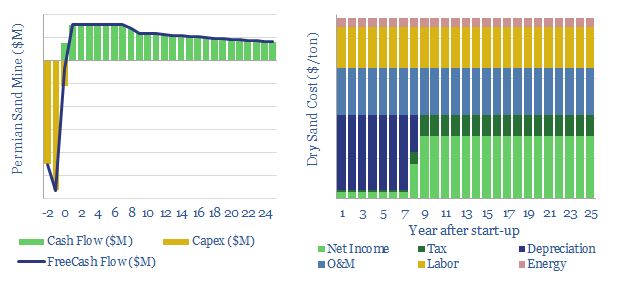

US shale sand mines: simple economics?

Download

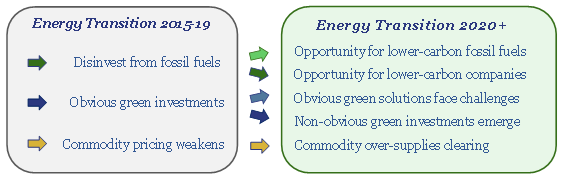

US shale: our outlook in the energy transition?

Download

US Shale: the second coming?

Download

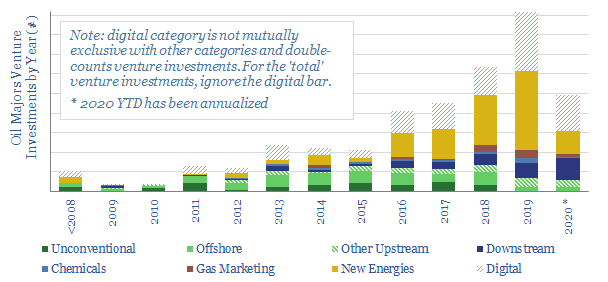

Ventures for an Energy Transition?

Download

US shale: the quick and the dead?

Download

Fugitive methane: what components are leaking?

Download

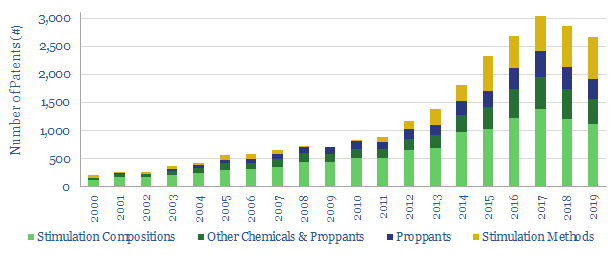

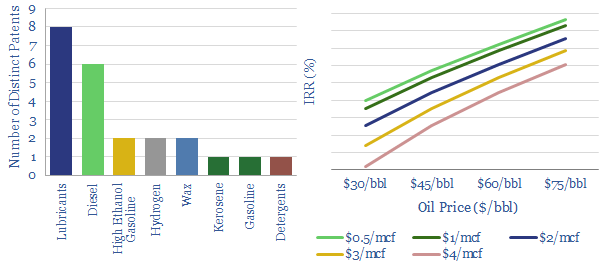

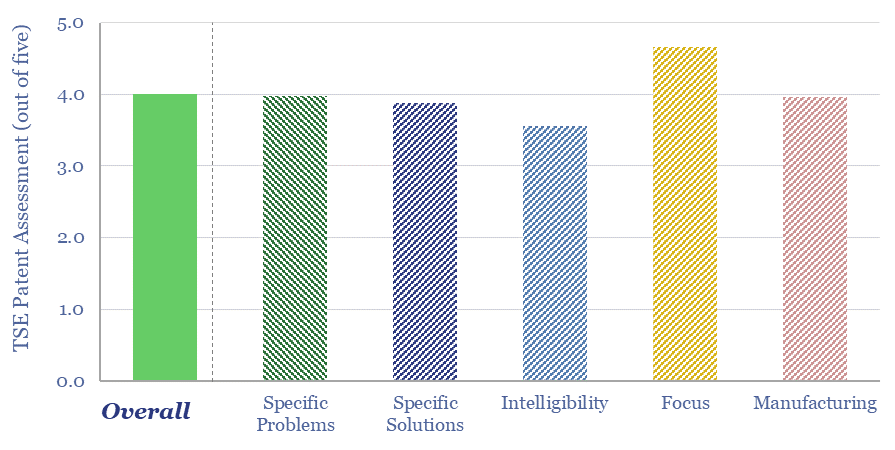

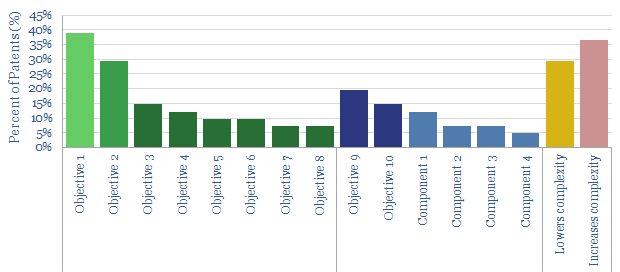

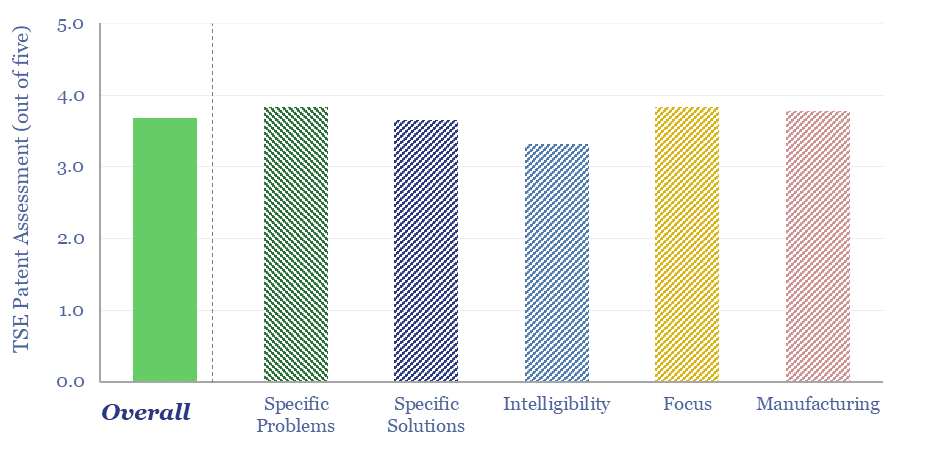

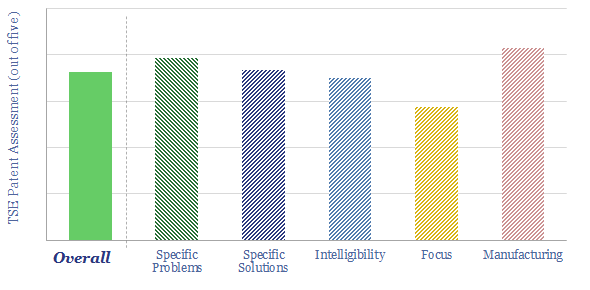

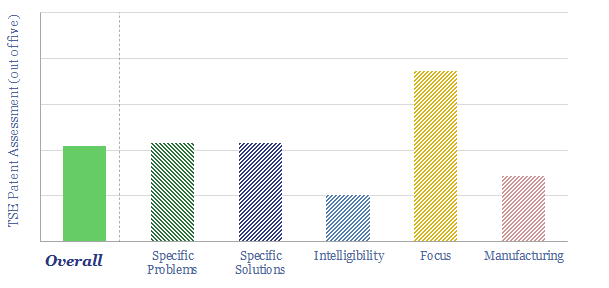

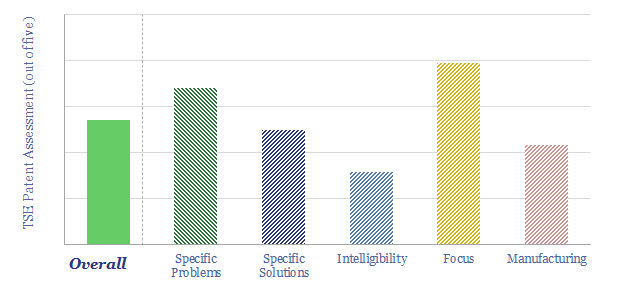

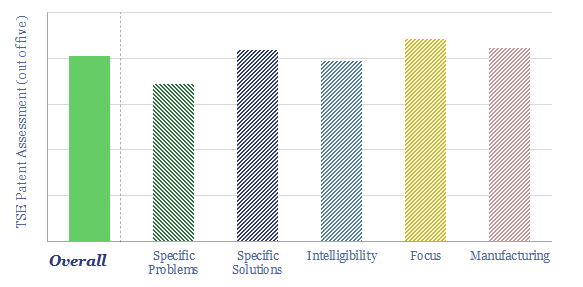

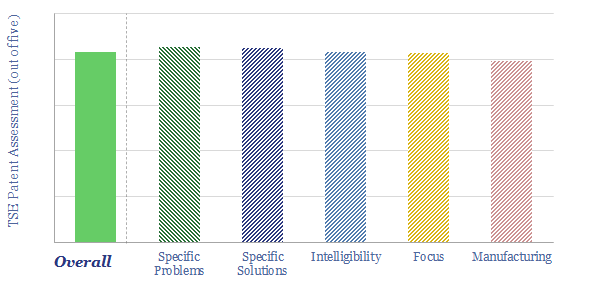

Hydraulic Fracturing: where’s the IP?

Download

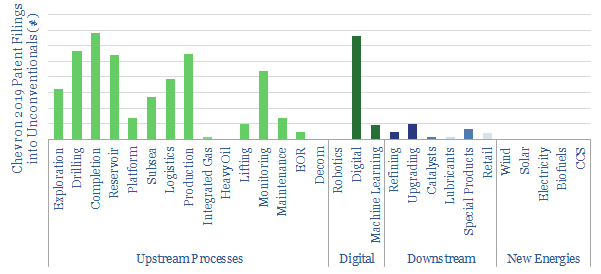

Chevron: SuperMajor Shale in 2020?

Download

EOG’s Digitization: Pumped-Up?

Download

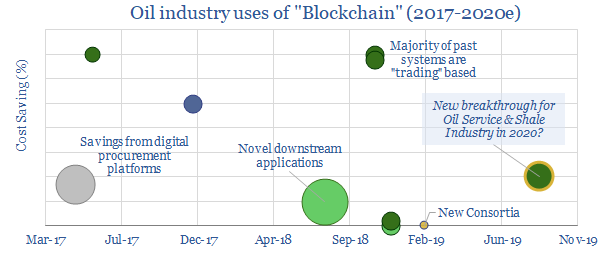

Blockchain in the Oil & Gas Supply Chain

Download

Ten Themes for Energy in 2020

Download

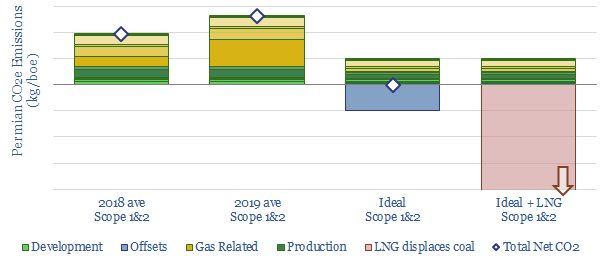

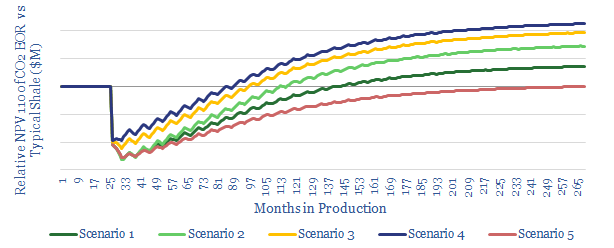

Shale growth: what if the Permian went CO2-neutral?

Download

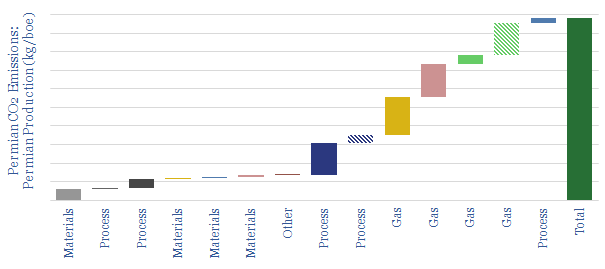

CO2 intensity of shale: breakdown by category?

Download

Screen of companies detecting methane leaks?

Download

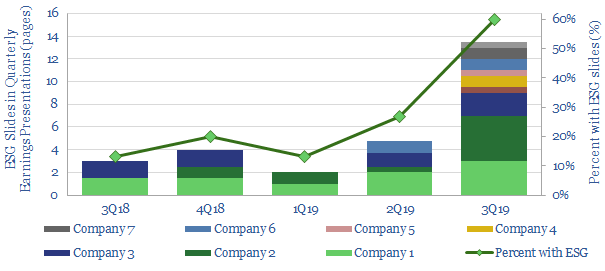

US E&Ps turn to ESG?

Download

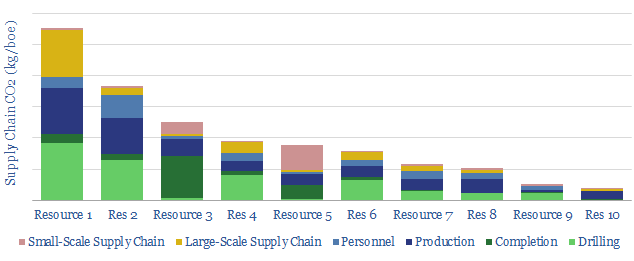

CO2 Intensity of Oilfield Supply Chains

Download

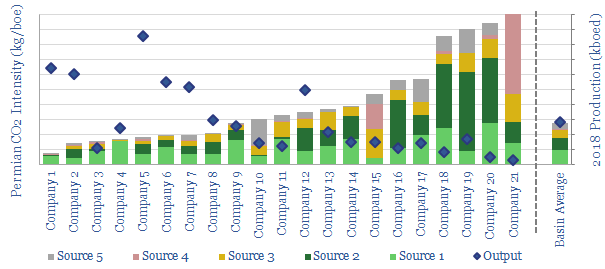

Permian CO2 Emissions by Producer

Download

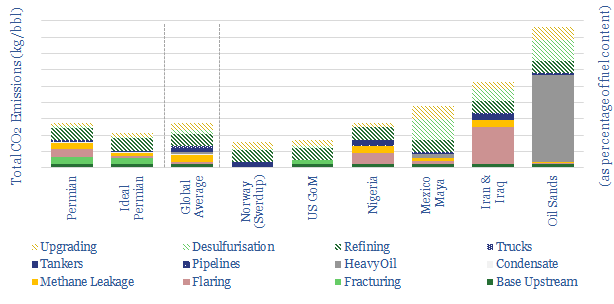

Oil industry CO2 per barrel?

Download

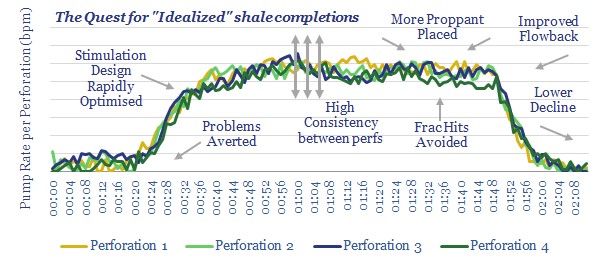

US Shale: No Country for Old Completion Designs

Download

US Shale Gas to Liquids?

Download

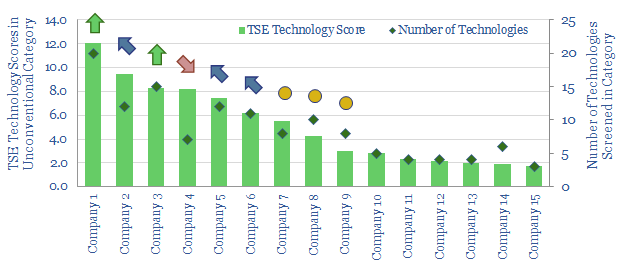

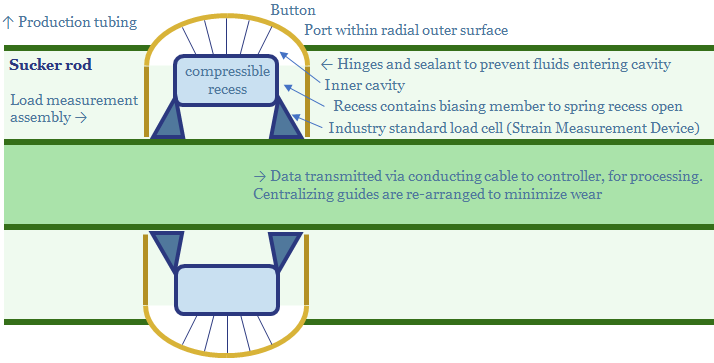

The cutting edge of shale technology?

Download

CO2-EOR in Shale: the economics

Download

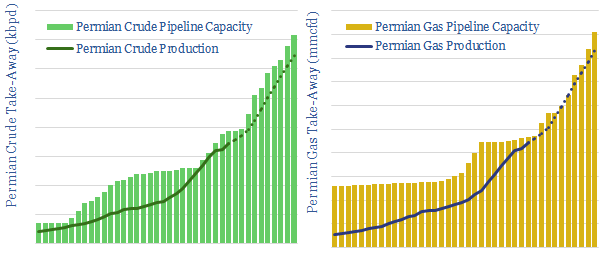

Permian Pipeline Bottlenecks?

Download

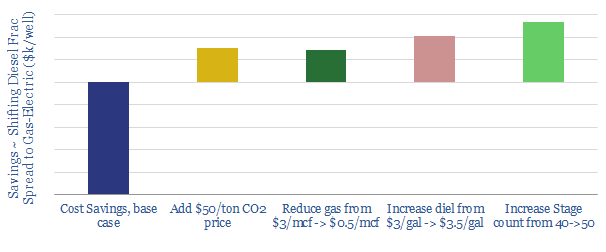

Dreaming of Electric Frac Fleets?

Download

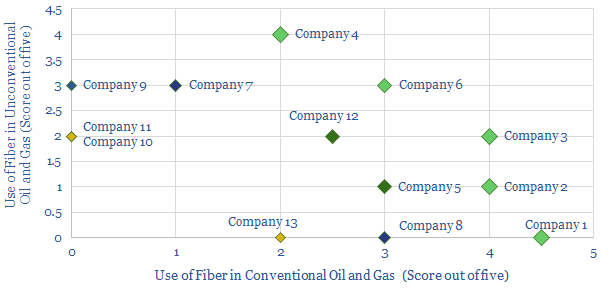

Shale: Upgrade to Fiber?

Download

Leading Companies in DAS?

Download

DAS. At the cutting edge in shale?

Download

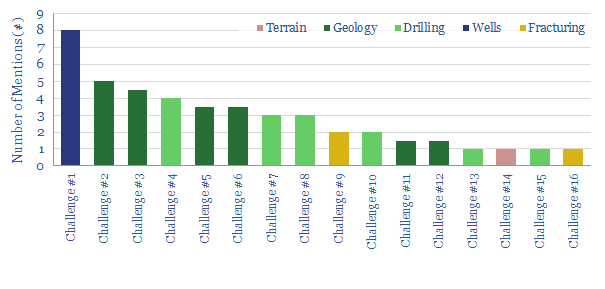

China’s Shale Challenge?

Download

Natural Gas Research

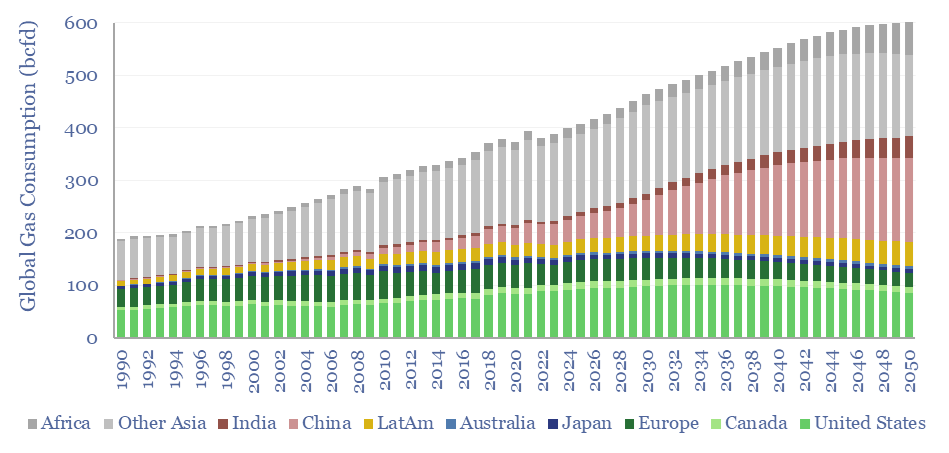

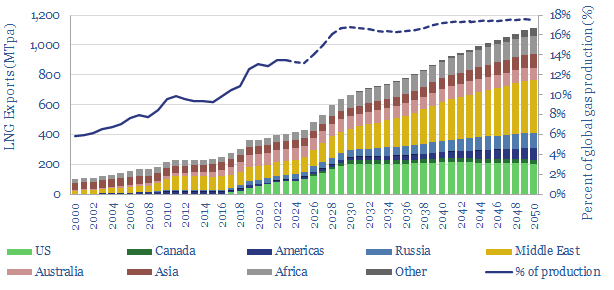

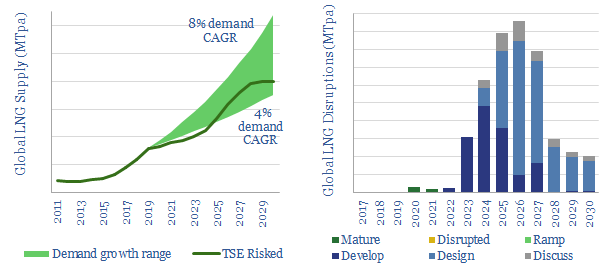

Global gas supply-demand in energy transition?

Download

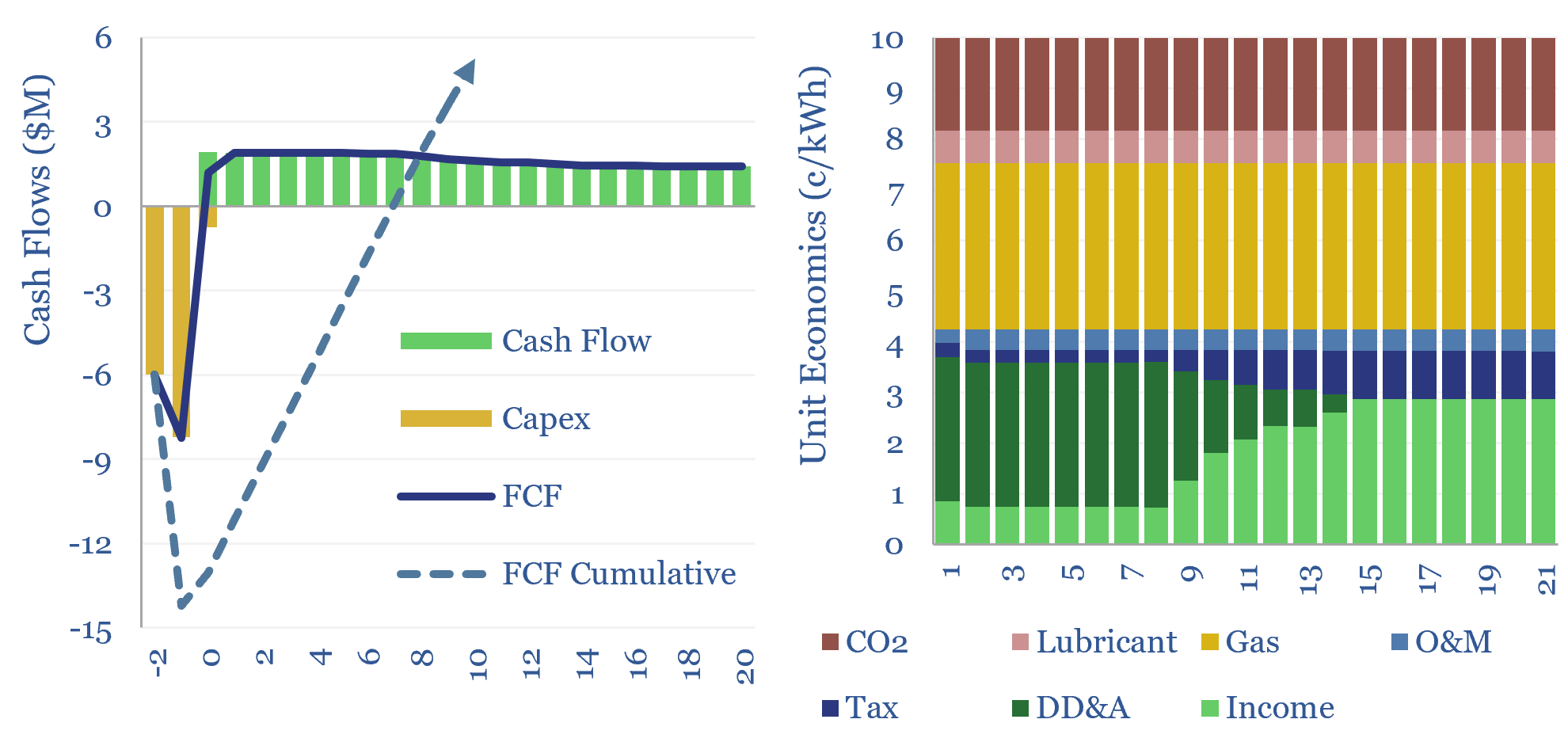

Reciprocating gas engines: levelized costs?

Download

Gas generation: what kind of bear is best?

Download

VoltaGrid: mobile micro-grid technology?

Download

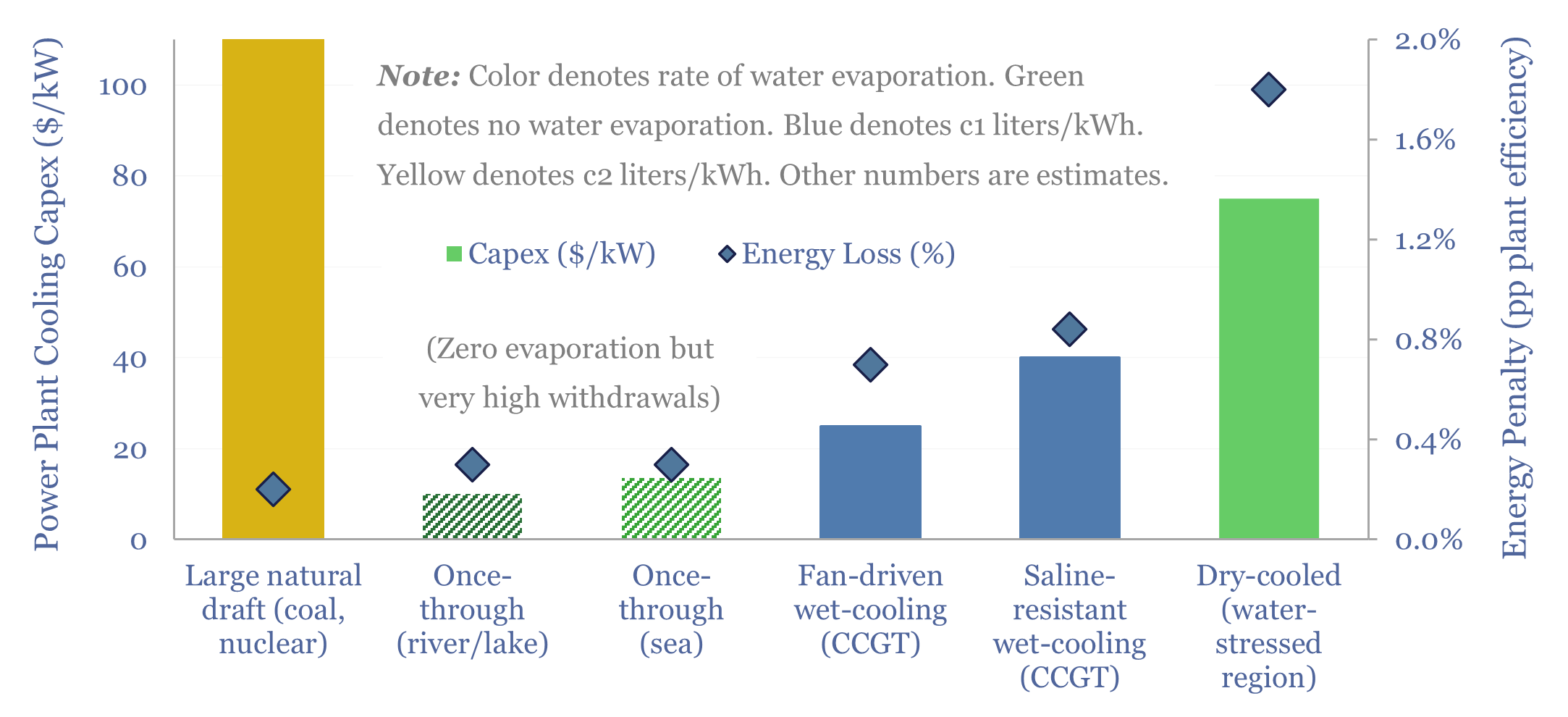

Power plant cooling: adapting for water scarcity?

Download

Doosan Enerbility: gas turbine technology?

Download

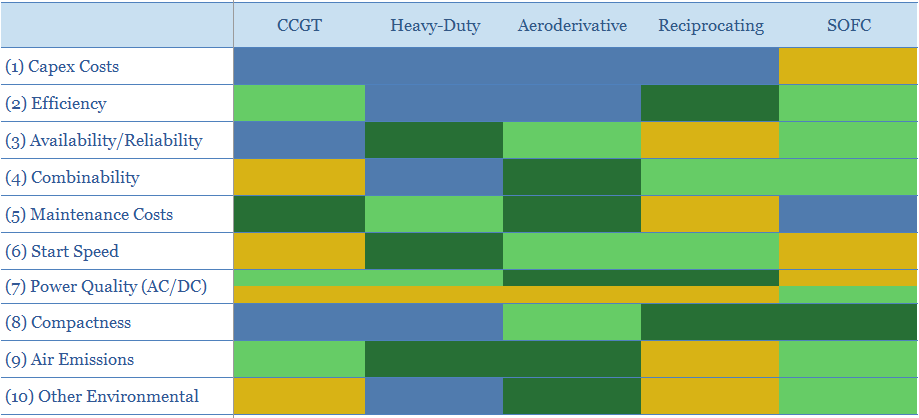

Gas turbines: what outlook in energy transition?

Download

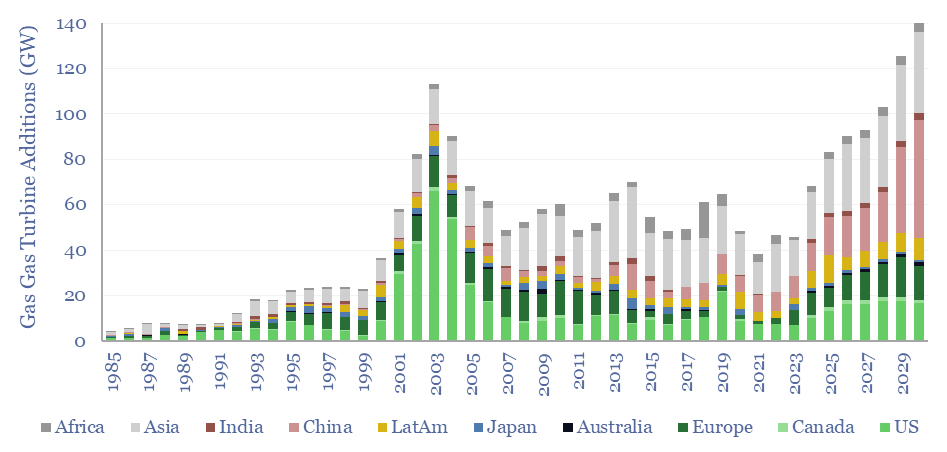

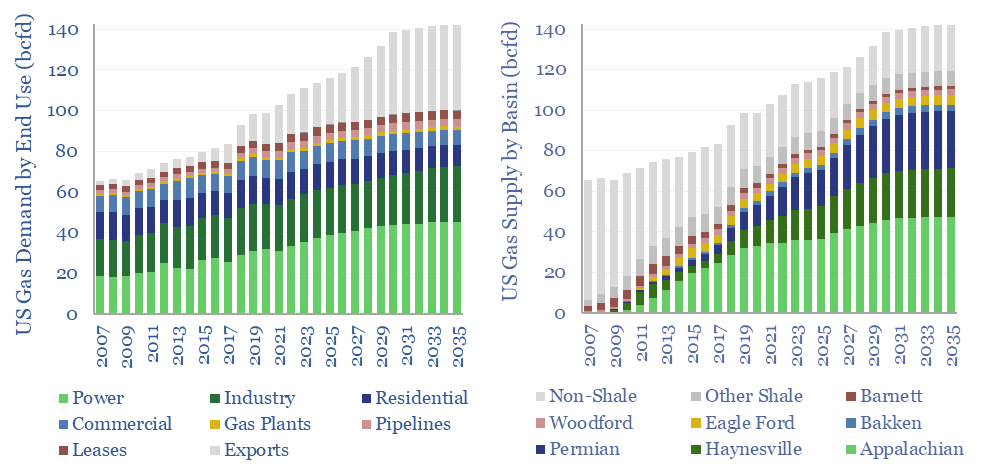

Global gas turbines by region and over time?

Download

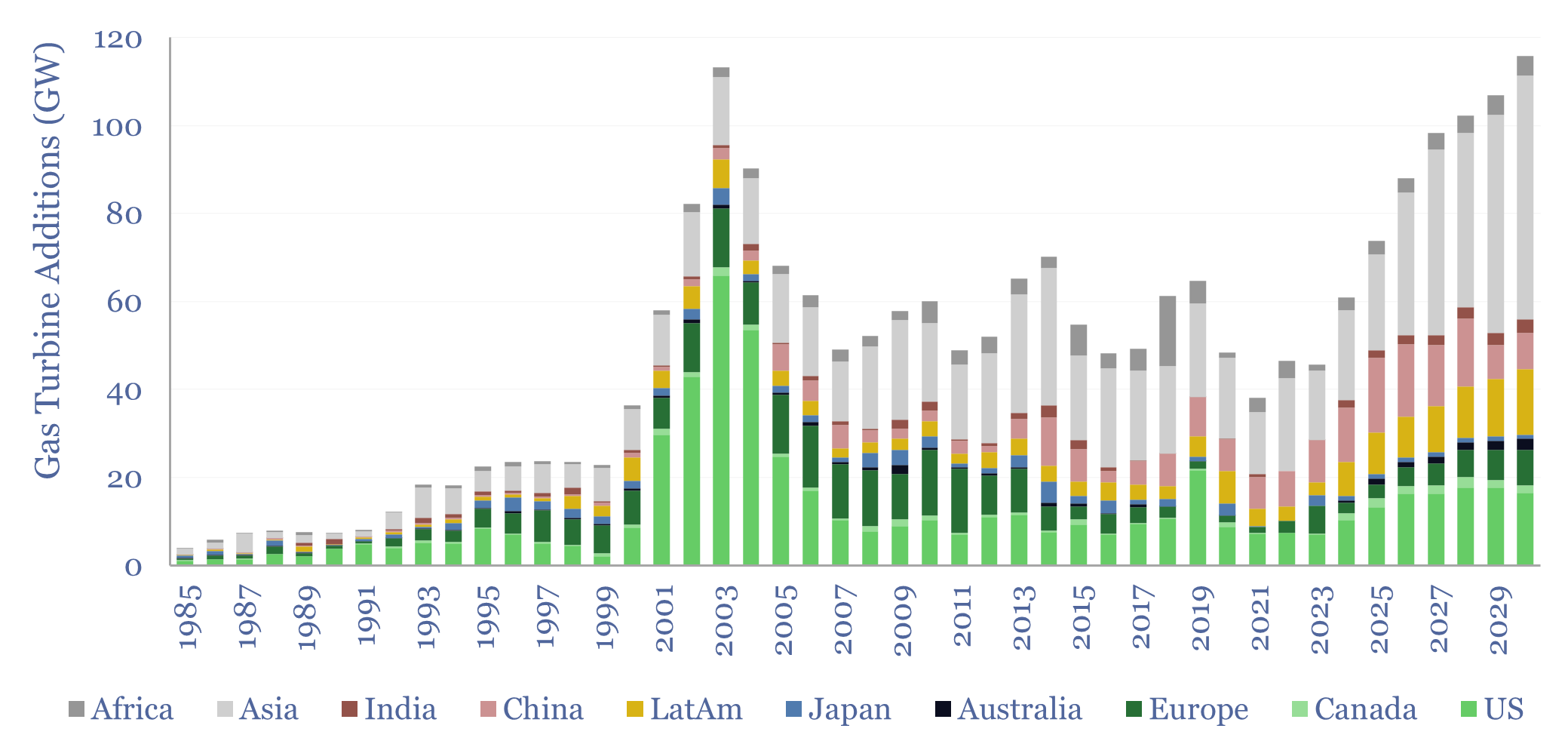

US natural gas: the stuff of dreams?

Download

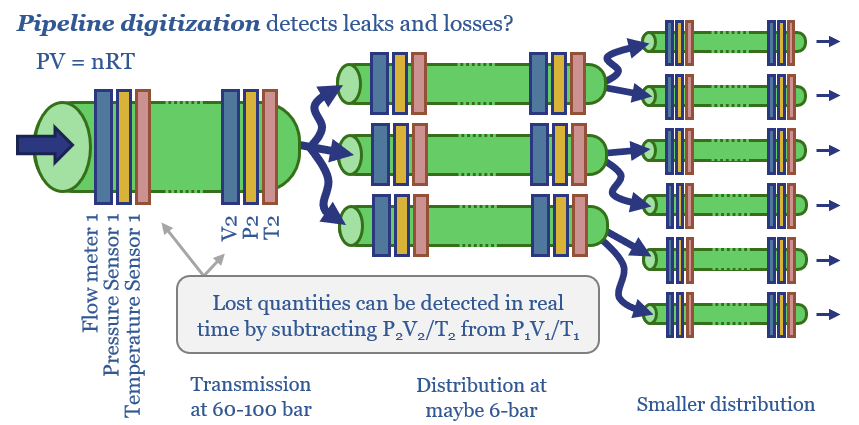

Seeing sense: digitize the downstream gas network?

Download

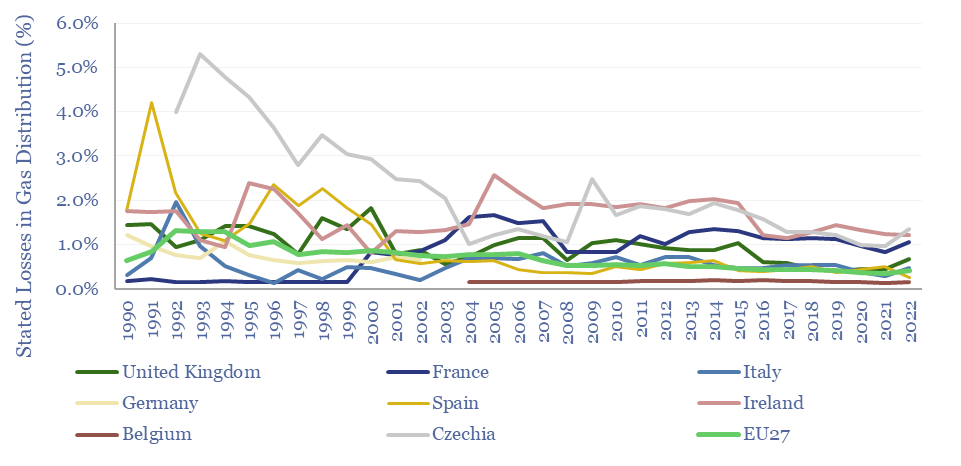

Gas distribution: loss rates, leakage, unaccounted gas?

Download

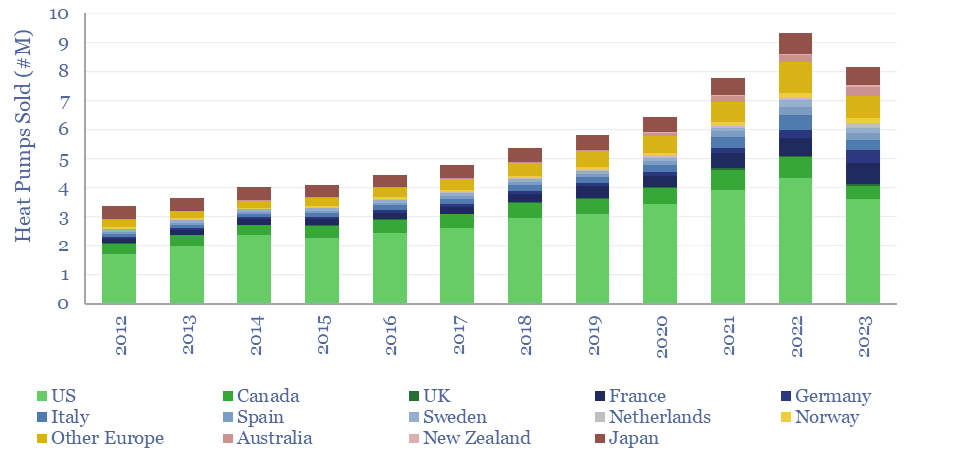

Global heat pump sales by country?

Download

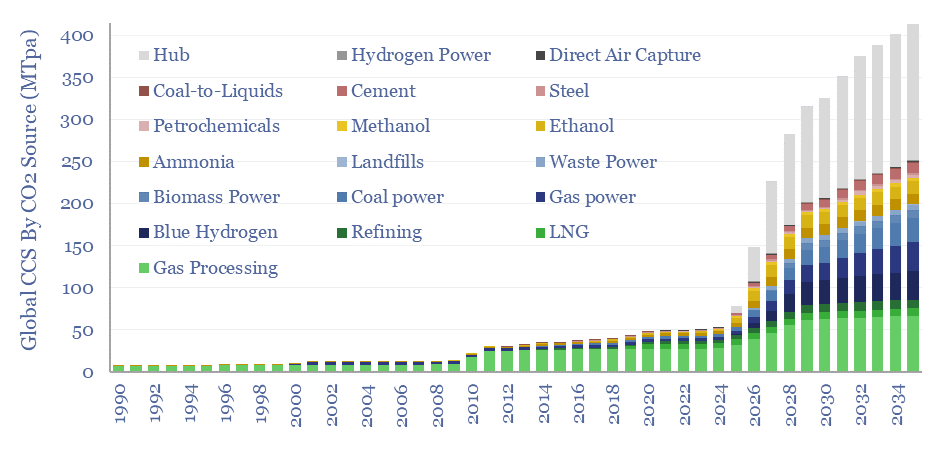

Global CCS Projects Database

Download

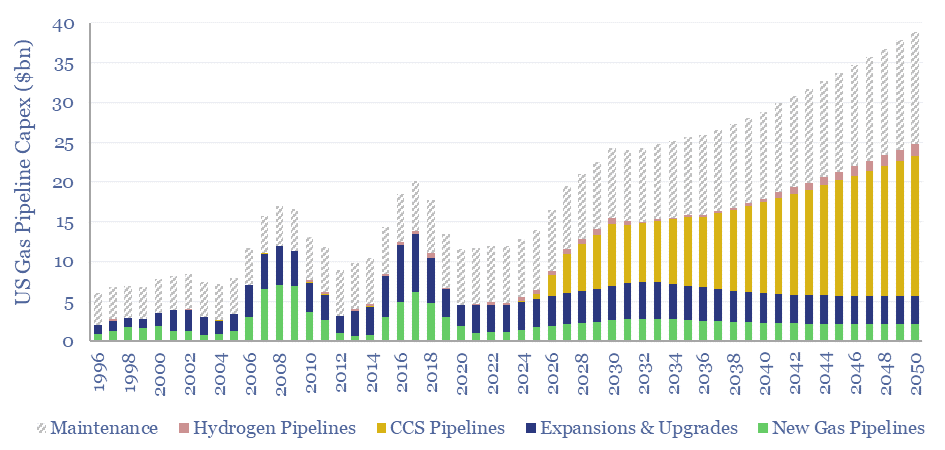

US gas pipeline capex over time?

Download

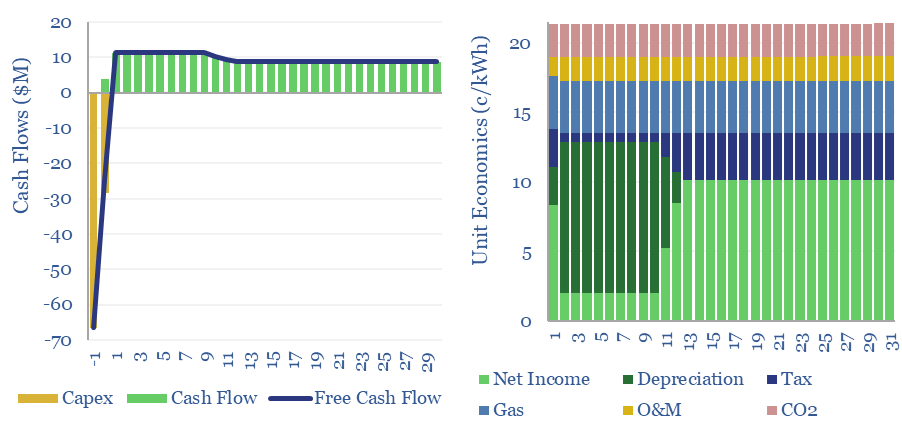

Gas peaker plants: the economics?

Download

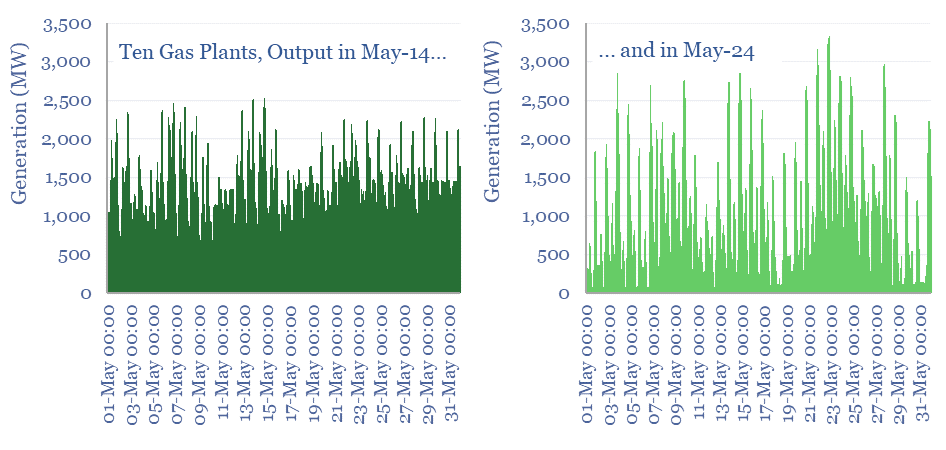

Back up: does ramping renewables displace gas?

Download

Mainspring Energy: linear generator breakthrough?

Download

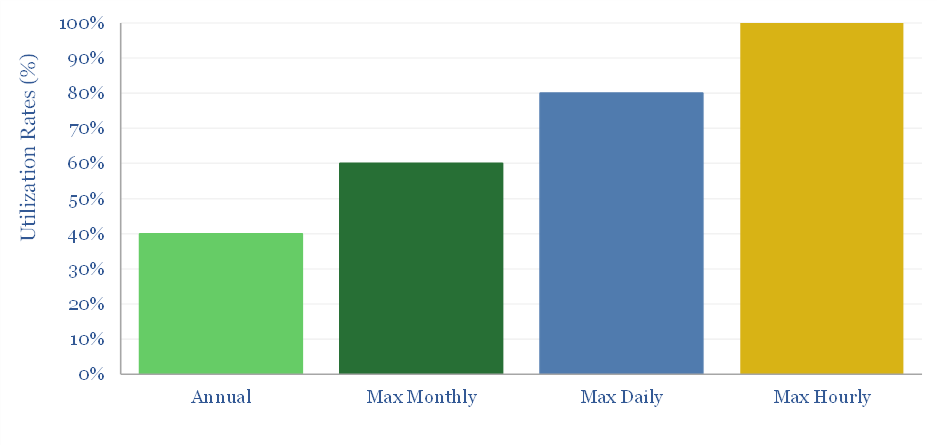

Gas power: does low utilization entail spare capacity?

Download

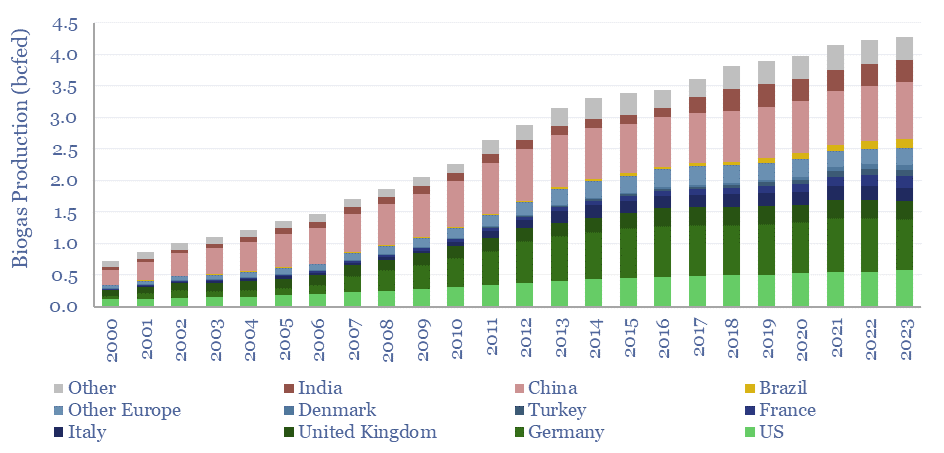

Global biogas production by country?

Download

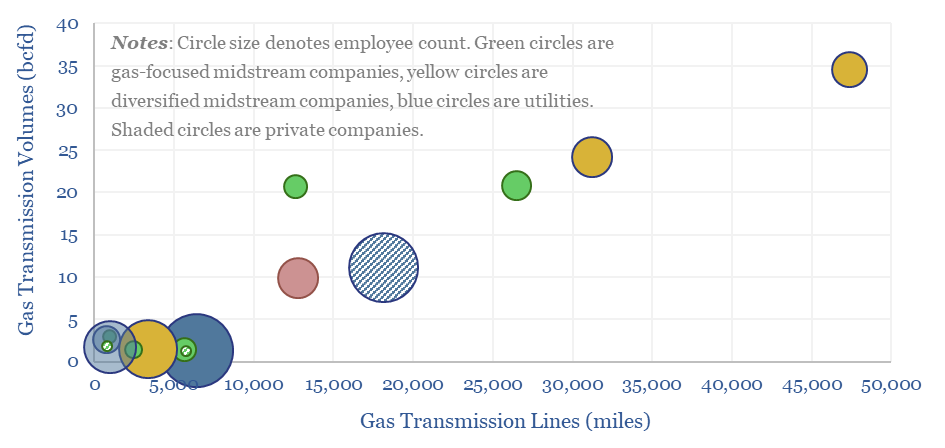

US gas transmission: by company and by pipeline?

Download

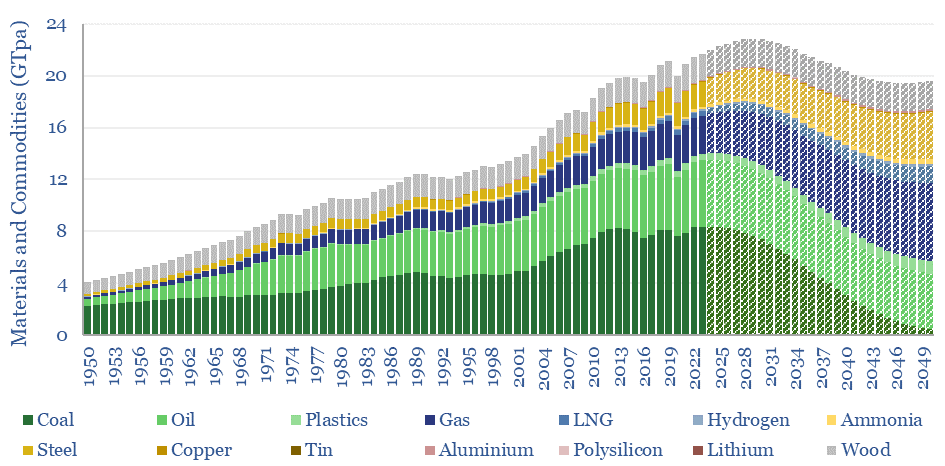

Peak commodities: everything, everywhere, all at once?

Download

Renewable-heavy grids: dividing the pie?

Download

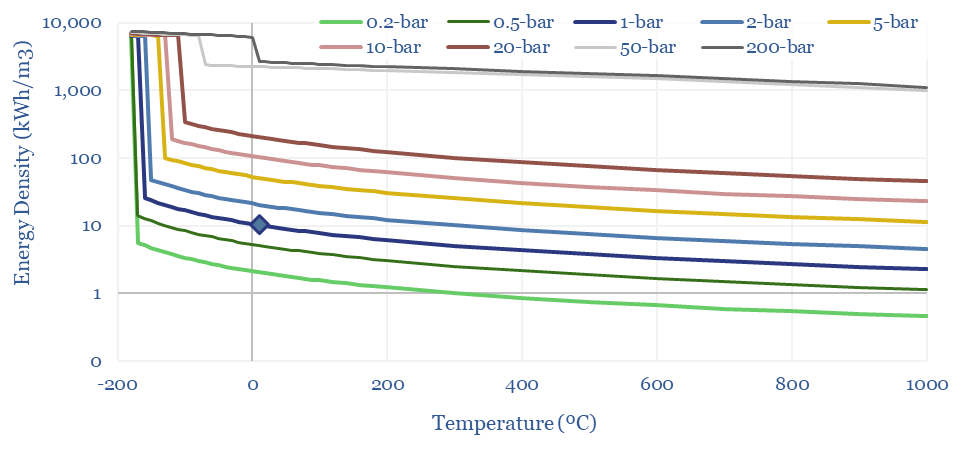

Density of gases: by pressure and temperature?

Download

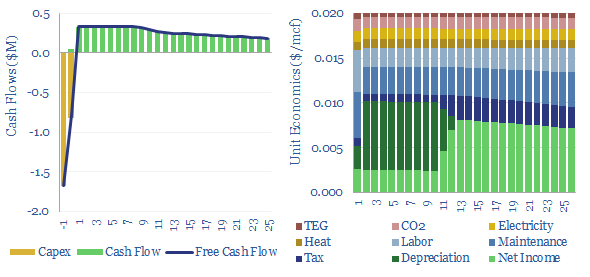

Gas dehydration: costs and economics?

Download

Gas fractionation: NGL economics?

Download

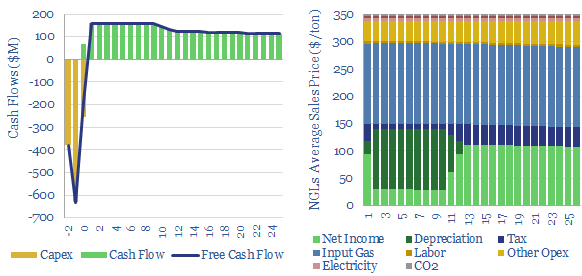

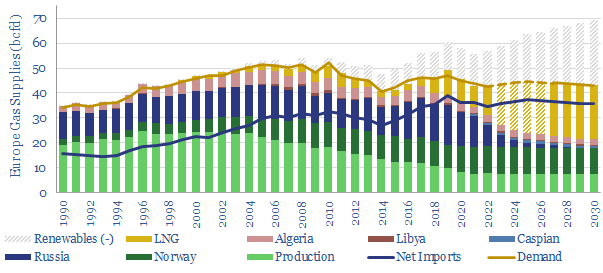

European gas and power model: natural gas supply-demand?

Download

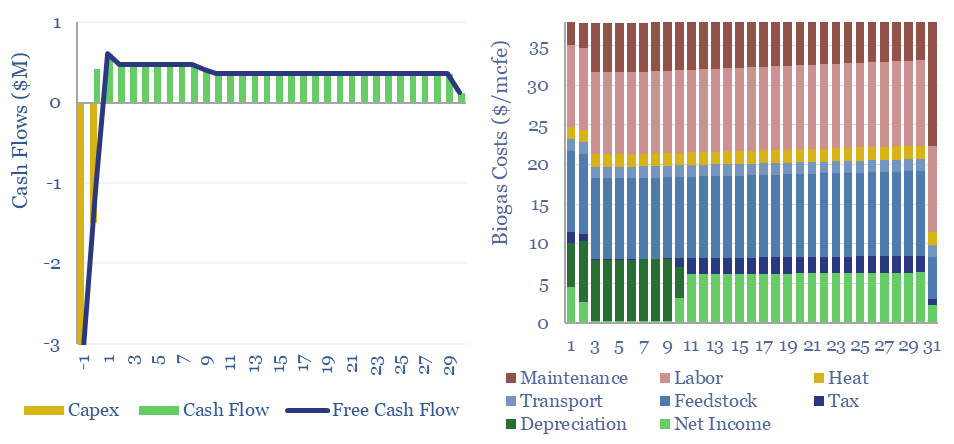

Biogas: the economics?

Download

Development capex: long-term spending from Oil Majors?

Download

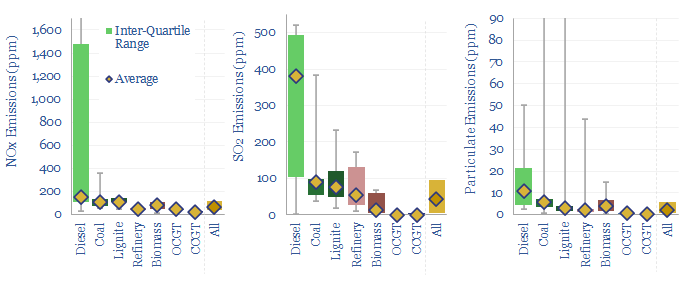

Air quality: sulphur, NOx and particulate emissions?

Download

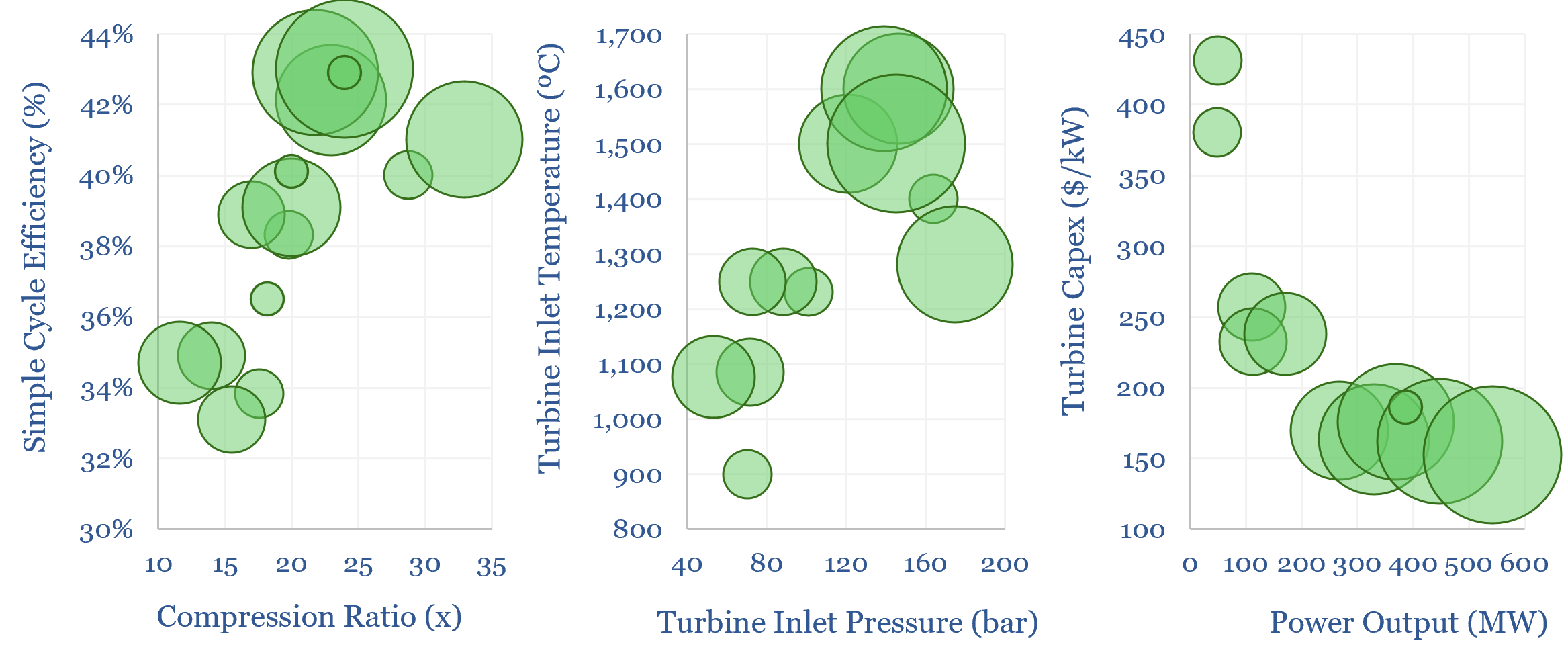

Gas turbines: operating parameters?

Download

NET Power: gas-fired power with inherent CO2 capture?

Download

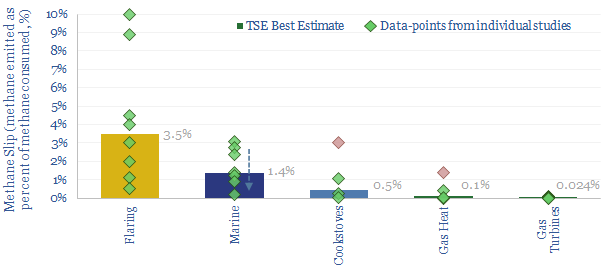

Methane slip: how much gas evades combustion?

Download

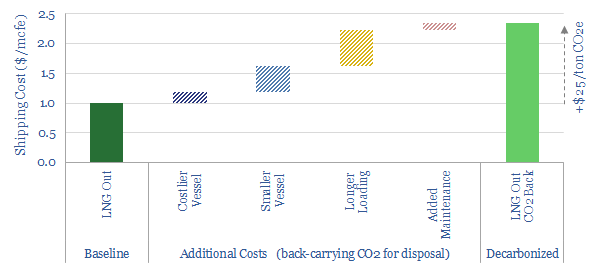

Decarbonized gas: ship LNG out, take CO2 back?

Download

Exploration capex: long-term spending from Oil Majors?

Download

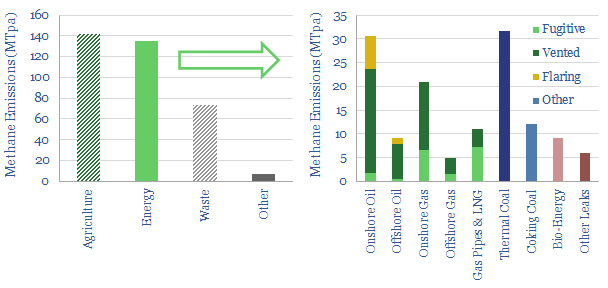

CH4 context: the largest methane leaks of all time?

Download

Global gas: five predictions through 2030?

Download

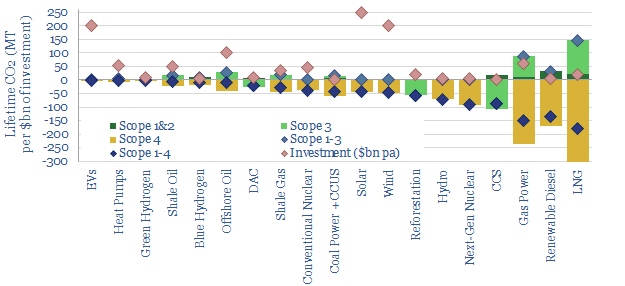

Scope 4 emissions: avoided CO2 has value?

Download

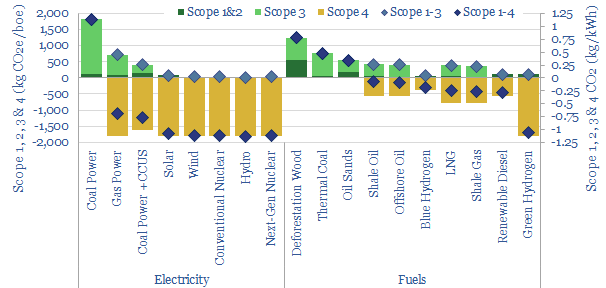

CO2 intensity: Scope 1, 2 & 3 and Scope 4 emissions?

Download

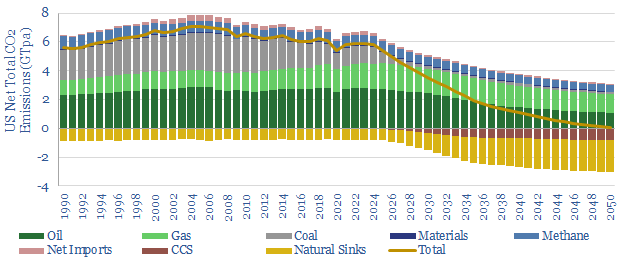

US decarbonization: energy and CO2 emissions?

Download

Gas diffusion: how will record prices resolve?

Download

LNG Research

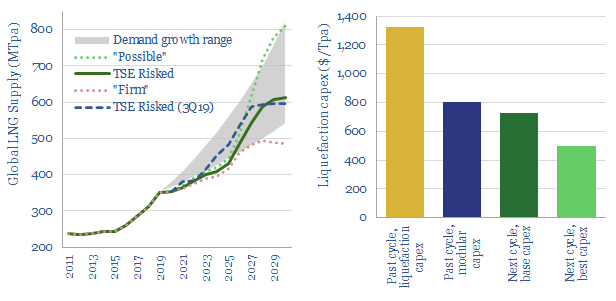

LNG: top conclusions in the energy transition?

Download

Global gas supply-demand in energy transition?

Download

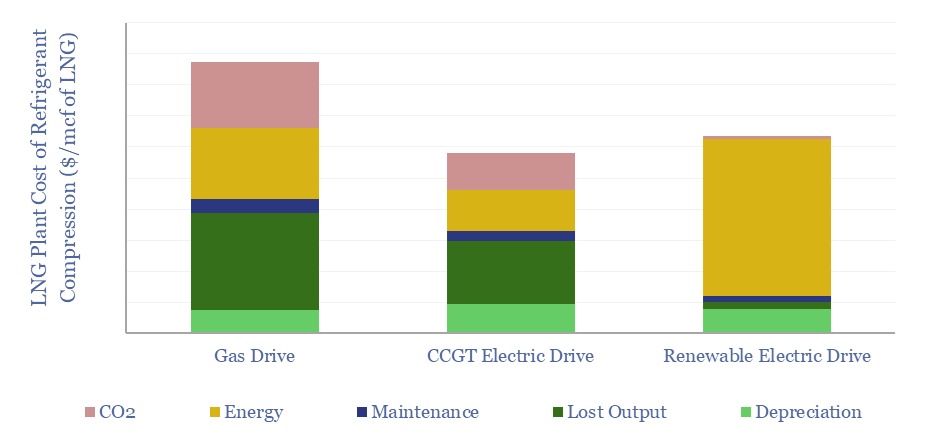

LNG plant compressors: chilling goes electric?

Download

LNG plant compression: gas drives vs electric motors?

Download

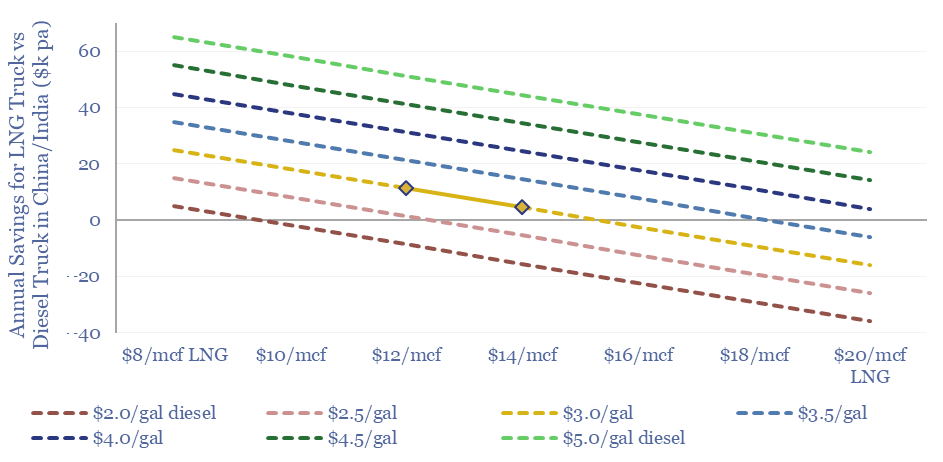

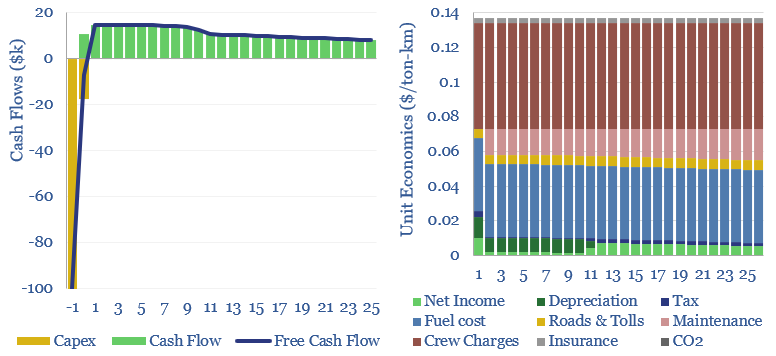

LNG trucks: Asian equation?

Download

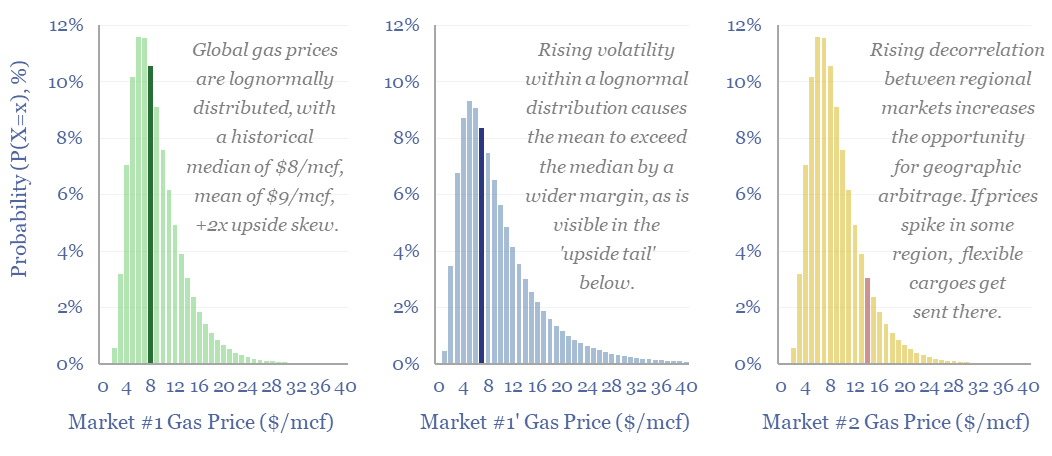

Energy trading: value in volatility?

Download

European gas and power model: natural gas supply-demand?

Download

Liquefied CO2 carriers: CO2 shipping costs?

Download

Decarbonized gas: ship LNG out, take CO2 back?

Download

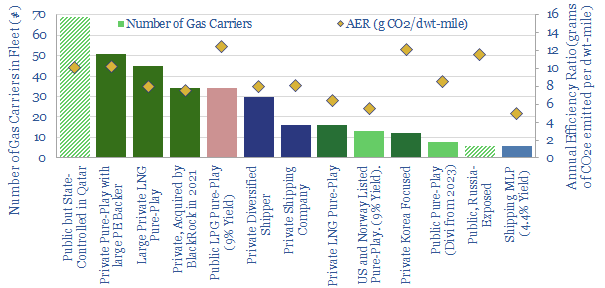

LNG shipping: company screen?

Download

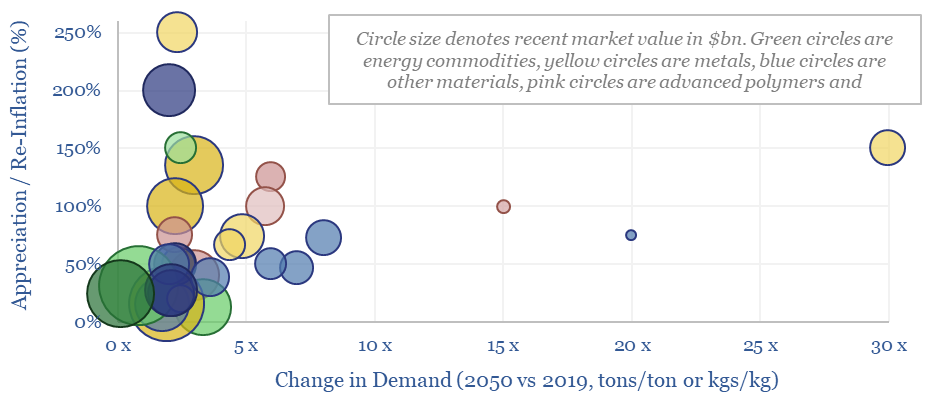

Energy transition: top commodities?

Download

Global gas: five predictions through 2030?

Download

Gas diffusion: how will record prices resolve?

Download

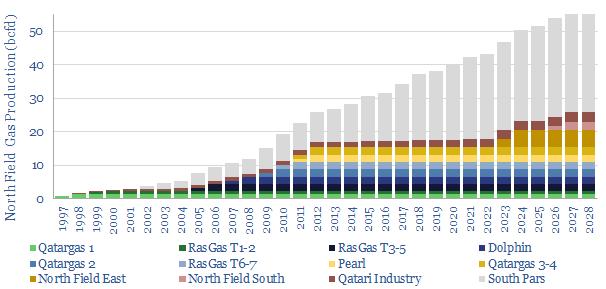

North Field: sharing the weight of the world?

Download

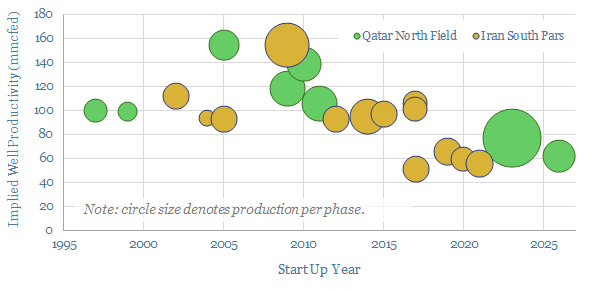

Qatar’s North Field: production and productivity?

Download

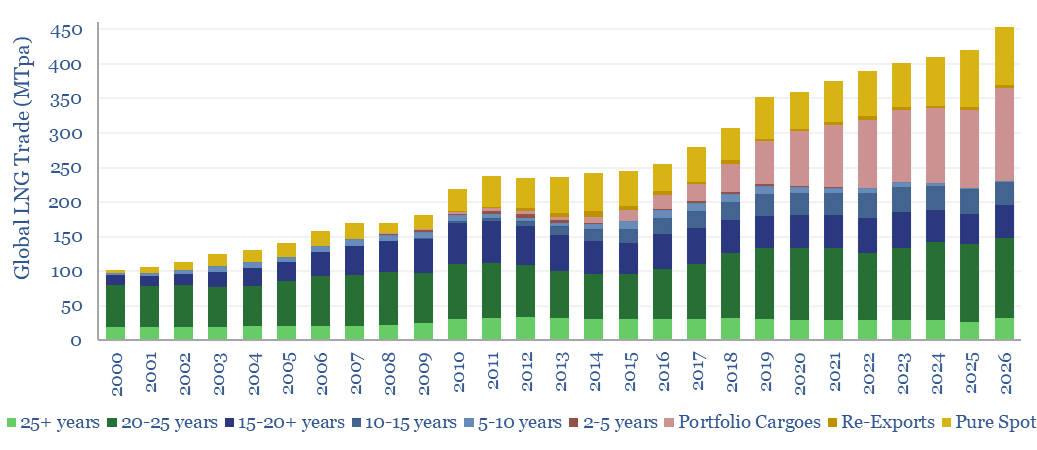

Energy security: the return of long-term contracts?

Download

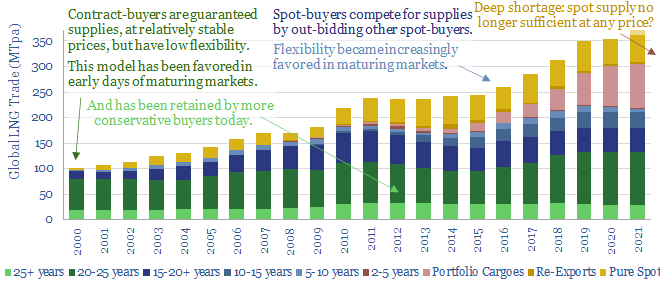

Global LNG: offtake contracts and spot market development?

Download

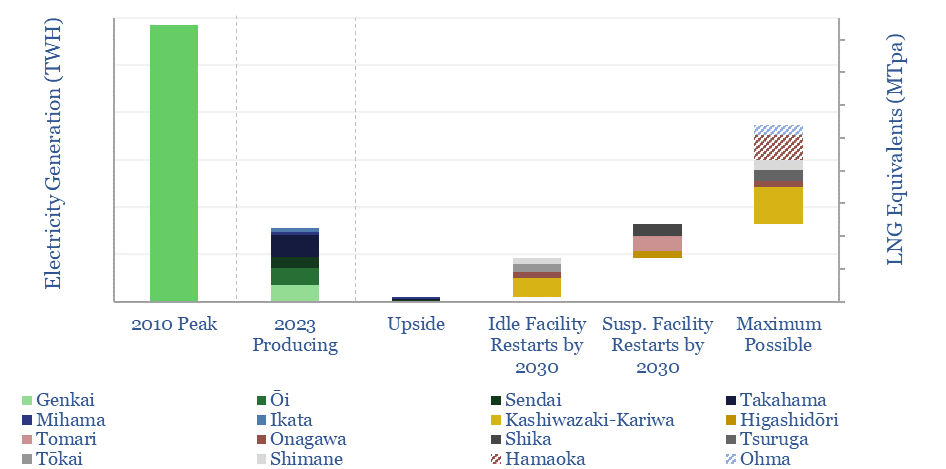

Japan: nuclear restart tracker?

Download

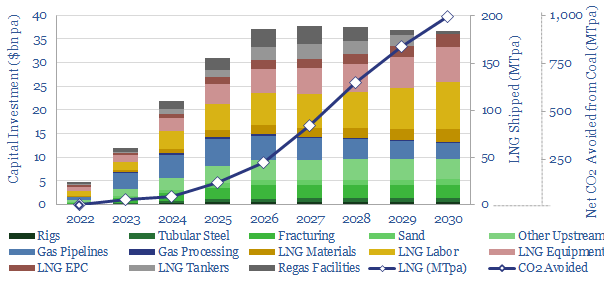

US LNG: new perceptions?

Download

LNG regasification: the economics?

Download

Global LNG supply model: by project and by country?

Download

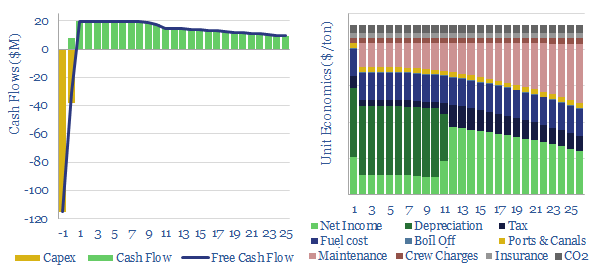

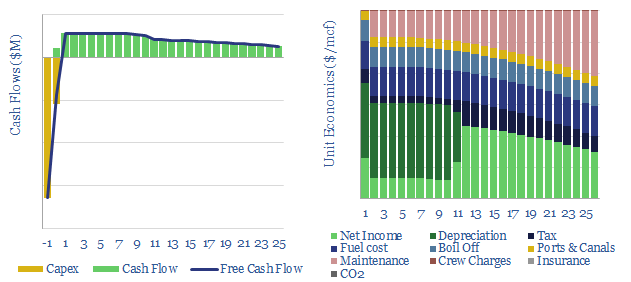

LNG transport: shipping economics?

Download

LNG in the energy transition: rewriting history?

Download

LNG liquefaction: what challenges and opportunities?

Download

LNG liquefaction: the economics?

Download

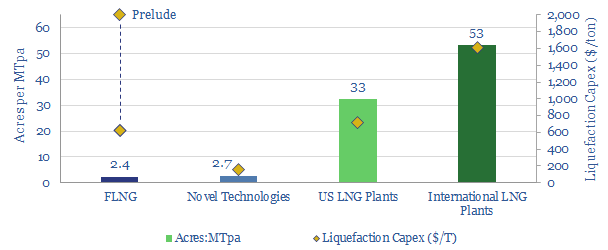

LNG plant footprints: compaction costs?

Download

Heavy truck costs: diesel, gas, electric or hydrogen?

Download

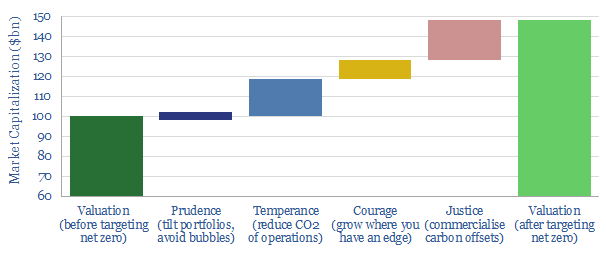

Net zero Oil Majors: four cardinal virtues?

Download

LNG: deep disruptions?

Download

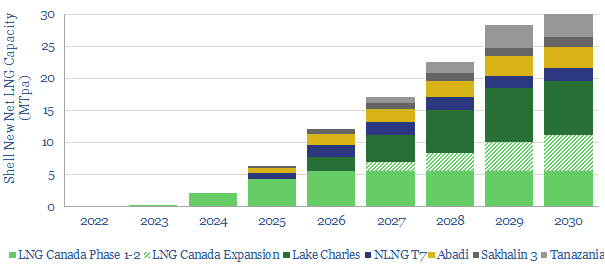

Shell: the future of LNG plants?

Download

Global Flaring Intensity by Country

Download

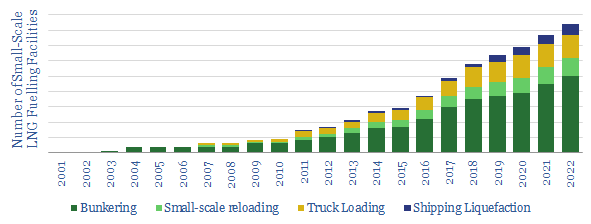

The Ascent of Small Scale LNG?

Download

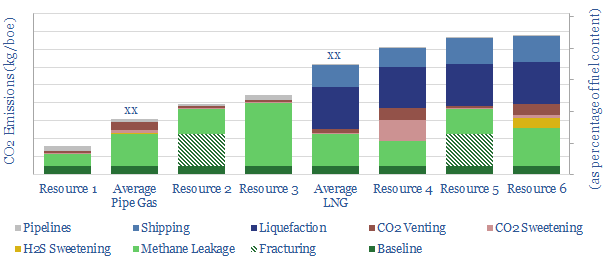

CO2 intensity of natural gas value chains?

Download

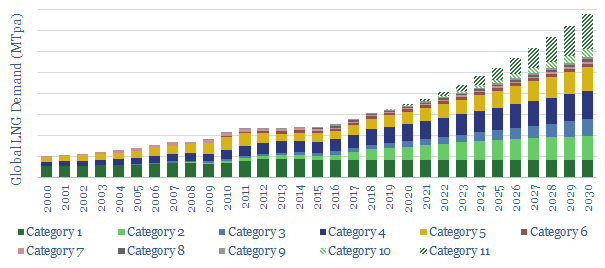

Long-Term LNG Demand: technology-led?

Download

US Shale Gas to Liquids?

Download

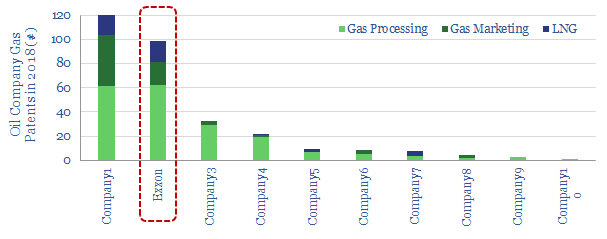

Greenfield LNG: Does Exxon have an edge?

Download

China’s Shale Challenge?

Download

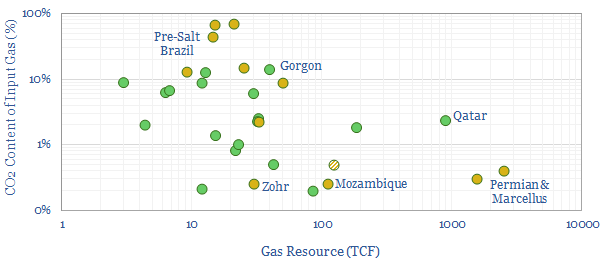

The World’s Great Gas Fields and Their CO2

Download

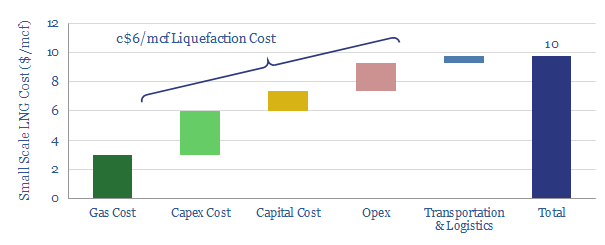

Small-Scale LNG liquefaction Costs: New Opportunities?

Download

LNG in transport: scaling up by scaling down?

Download

Downstream Research

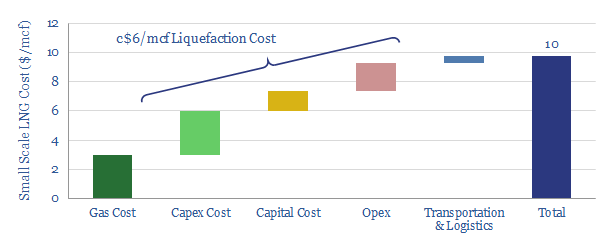

Storage tank costs: storing oil, energy, water and chemicals?

Download

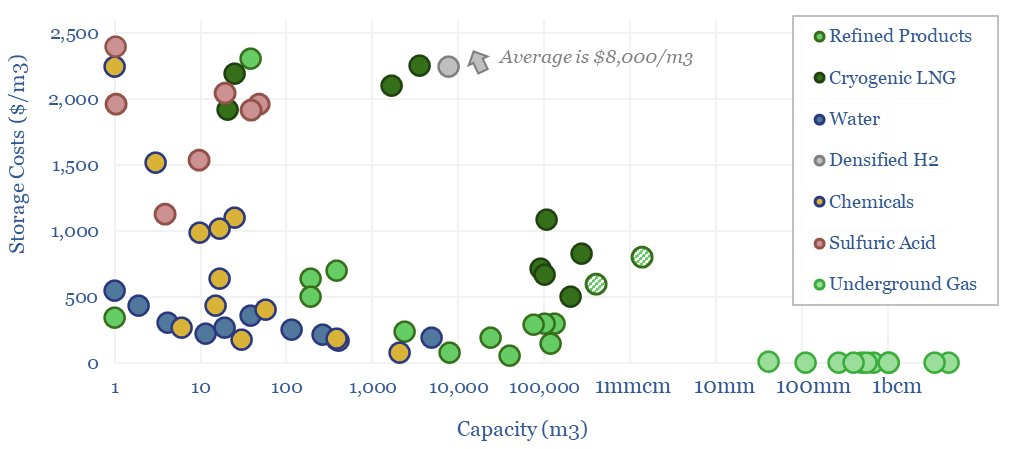

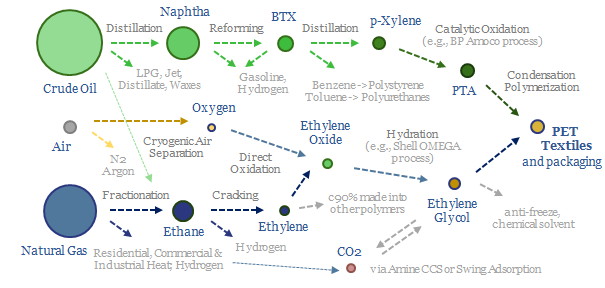

Crude to chemicals: there will be naphtha?

Download

Global oil demand forecasts: by end use, by product, by region?

Download

US Refinery Database: CO2 intensity by facility?

Download

Scope 4 emissions: avoided CO2 has value?

Download

Electric vehicles: chargers of the light brigade?

Download

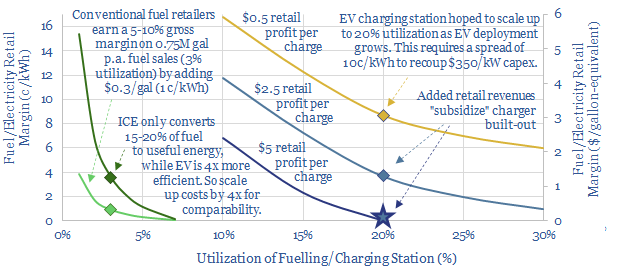

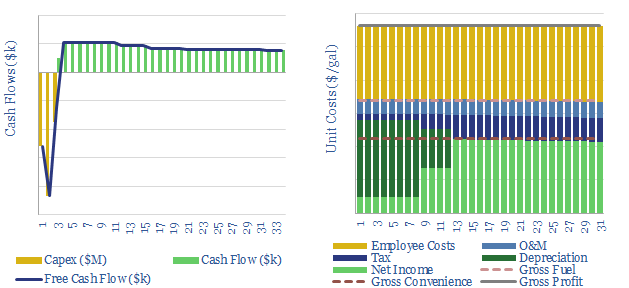

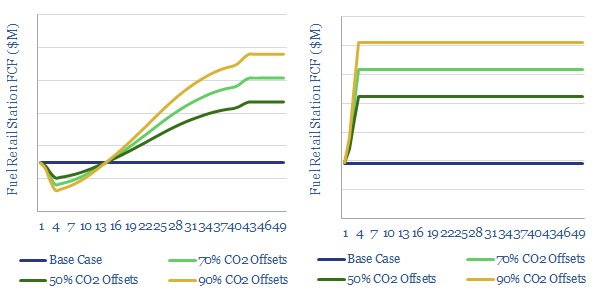

Fuel retail: economics of a petrol station?

Download

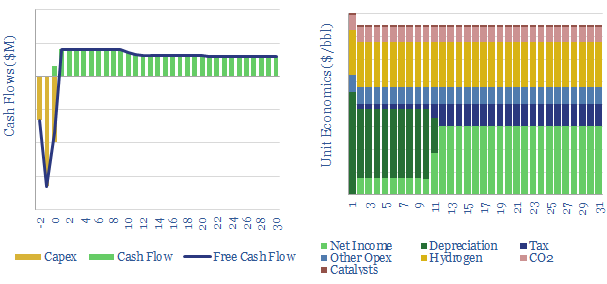

Hydroprocessing: the economics?

Download

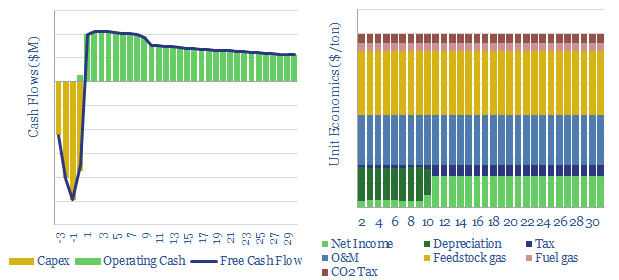

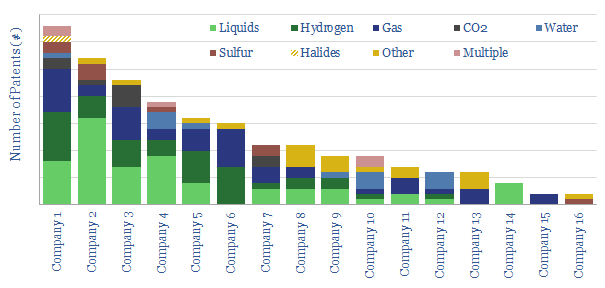

Methanol production: the economics?

Download

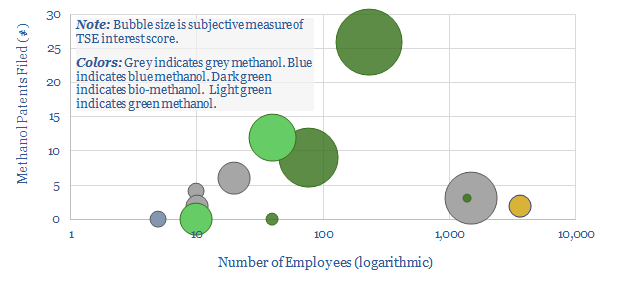

Methanol: leading companies?

Download

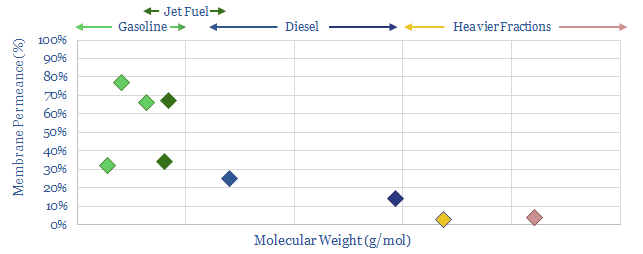

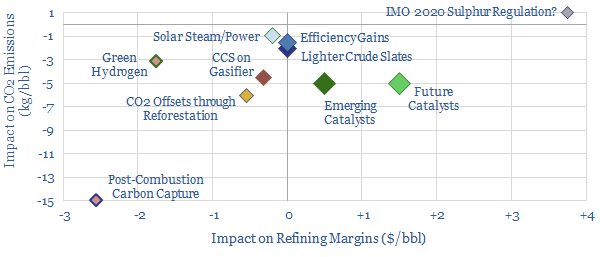

Low-carbon refining: insane in the membrane?

Download

Refinery membranes: where’s the IP?

Download

Pipeline costs: moving oil, products or other liquids?

Download

Waste heat recovery: heat exchanger costs?

Download

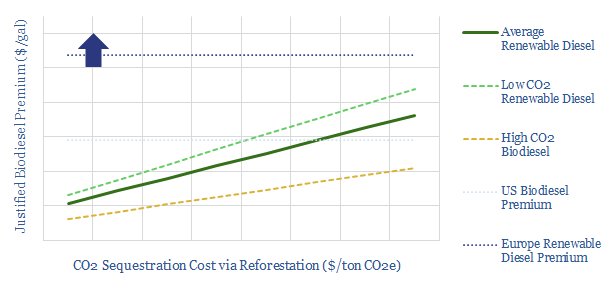

Renewable diesel: the economics?

Download

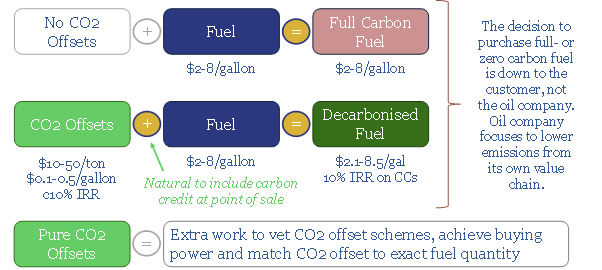

Can carbon-neutral fuels re-shape the oil industry?

Download

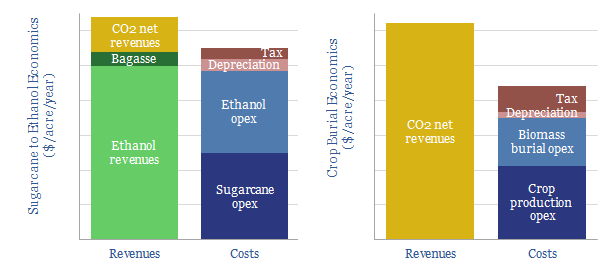

Biomass to biofuel, or biomass for burial?

Download

Should fuel retail stations sell carbon credits: the economics?

Download

Carbon Offsets vs Renewable Diesel?

Download

Decarbonise Downstream?

Download

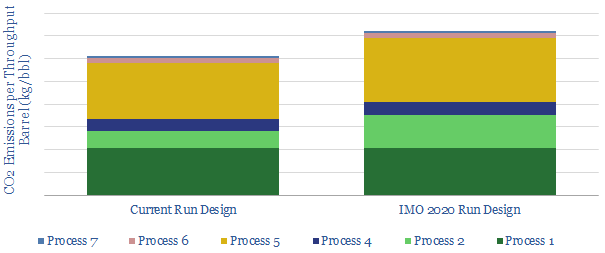

Carbon Costs of IMO 2020?

Download

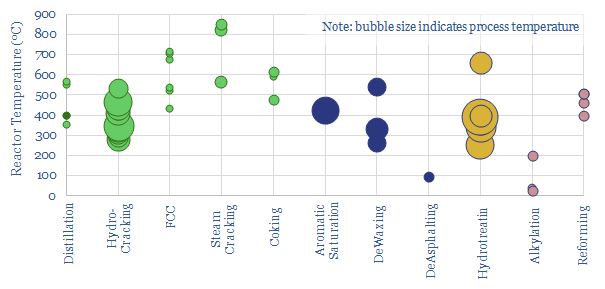

Upgrading Catalysts: lower refinery temperatures and pressures?

Download

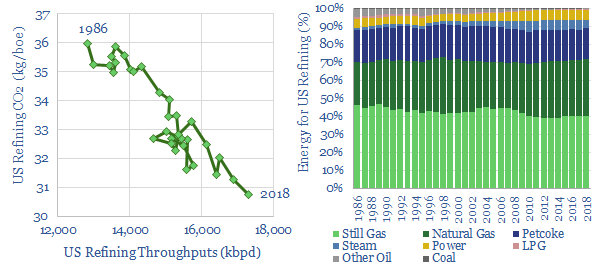

US Refining: energy and CO2 intensity

Download

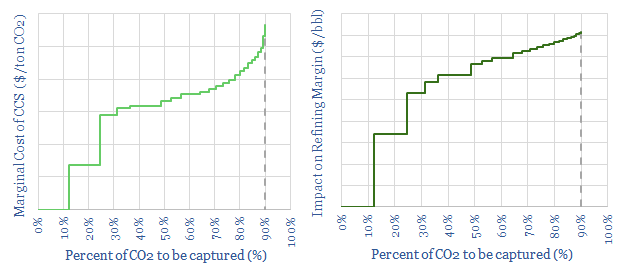

Carbon Capture Costs at Refineries?

Download

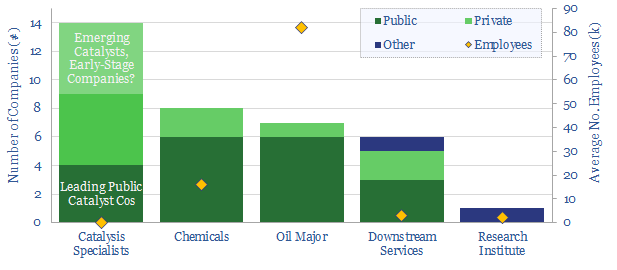

Overview of Downstream Catalyst Companies

Download

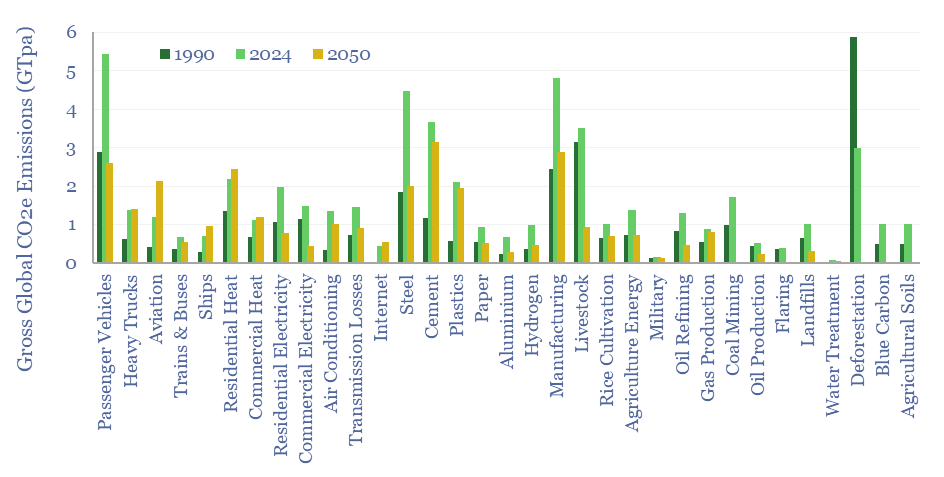

Global CO2 emissions breakdown?

Download

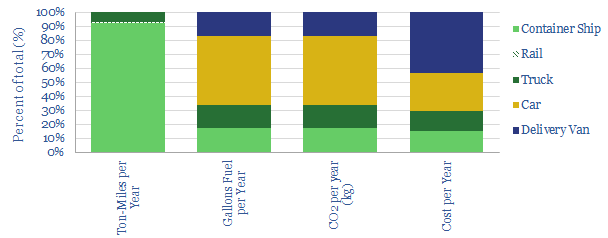

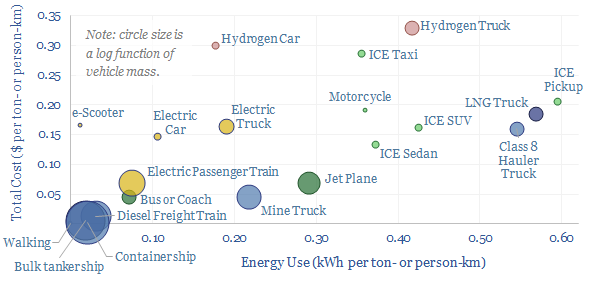

Distribution Costs: Ships, Trucks, Trains and Delivery Vans?

Download

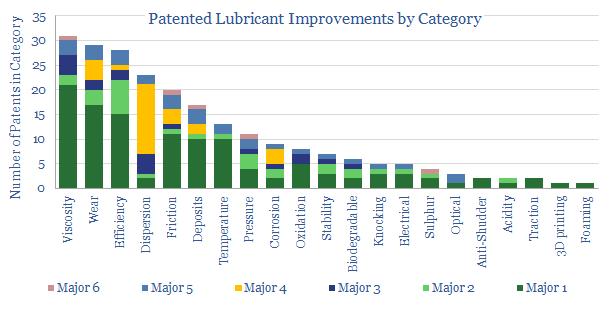

Lubricant Leaders: our top five conclusions

Download

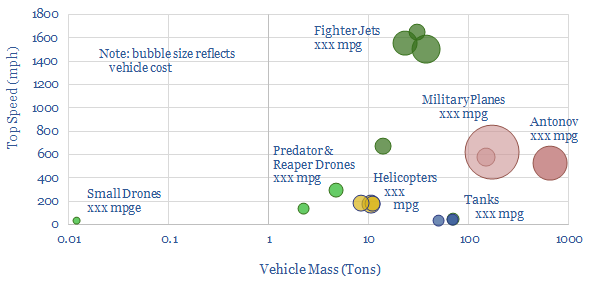

Drones attack military fuel economy?

Download

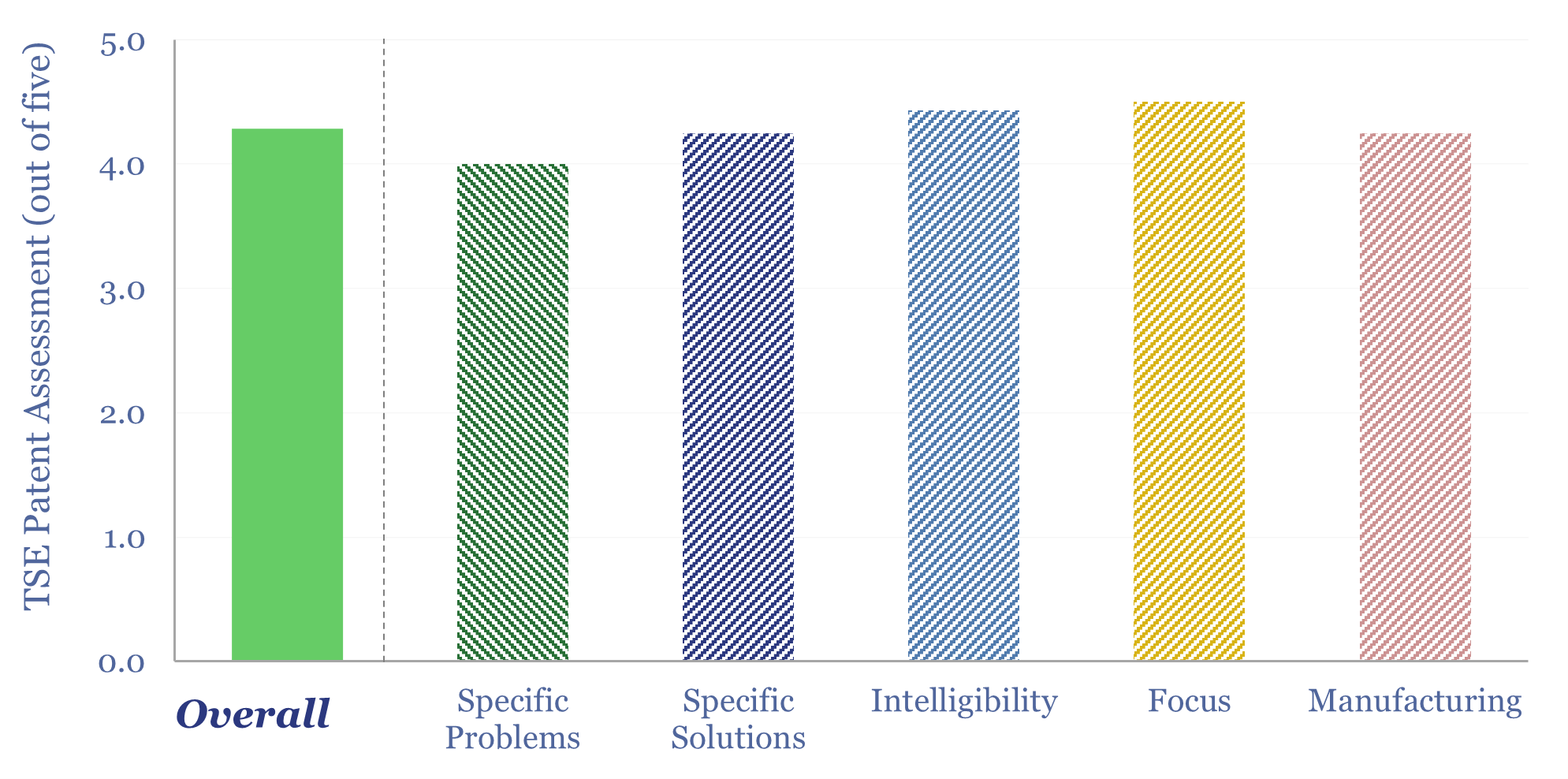

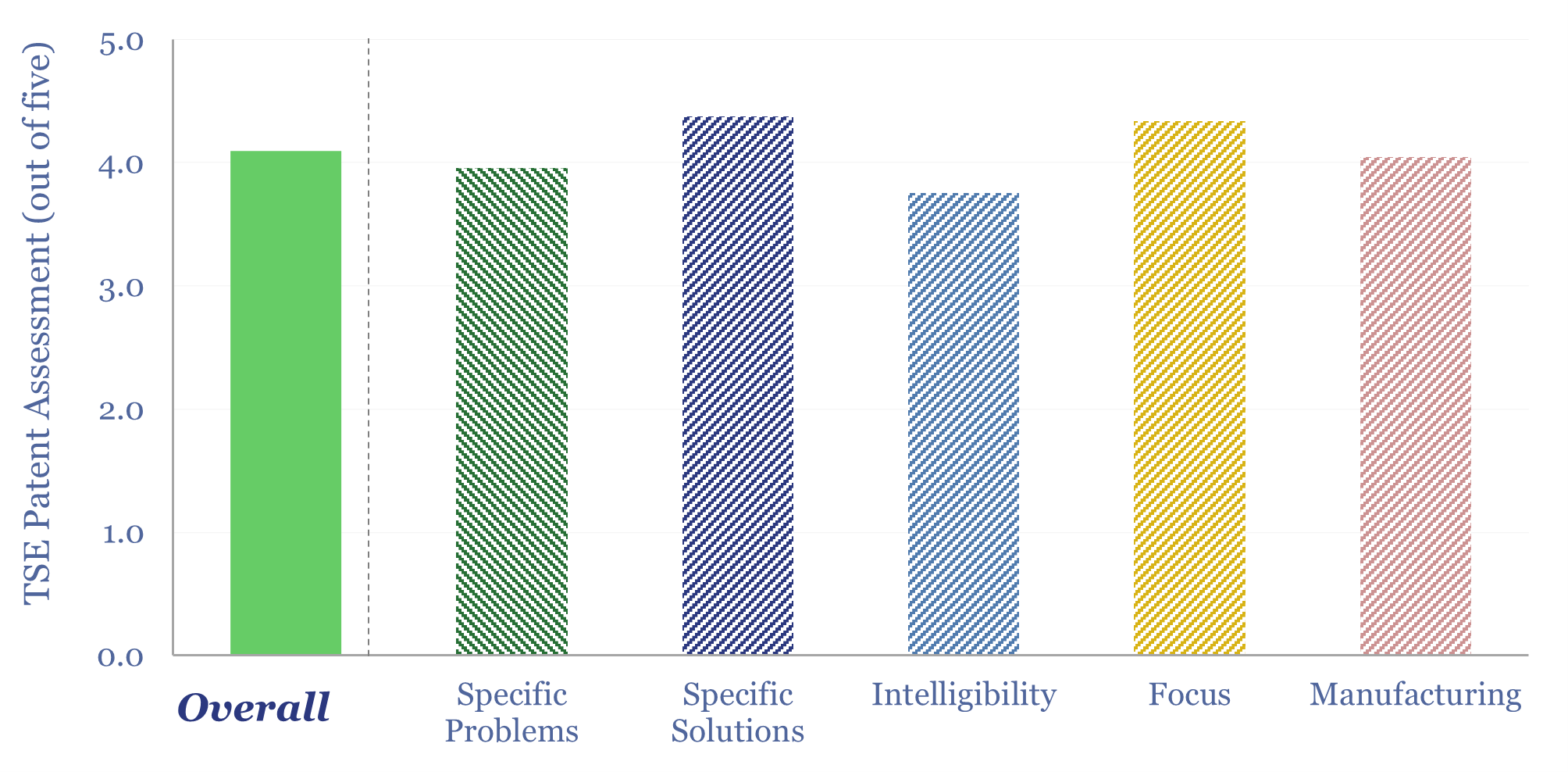

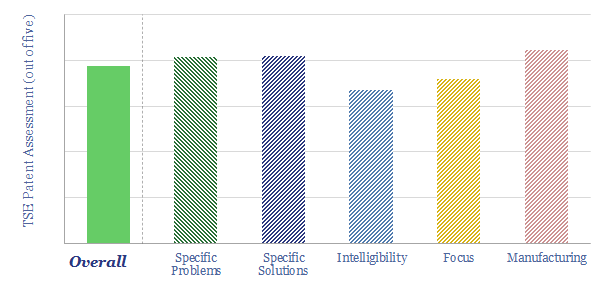

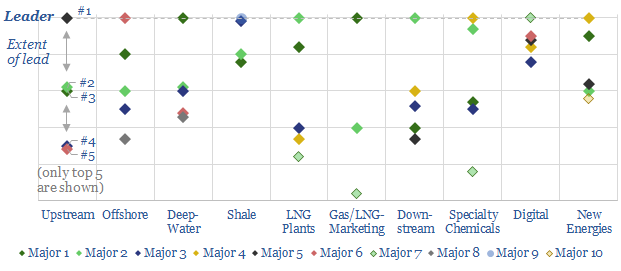

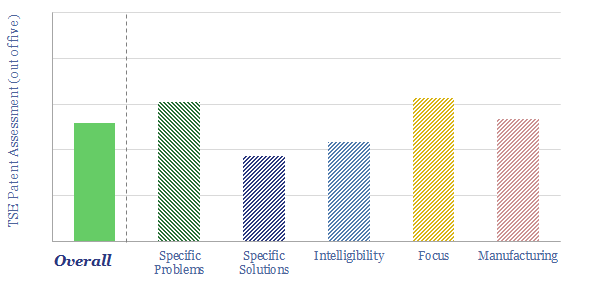

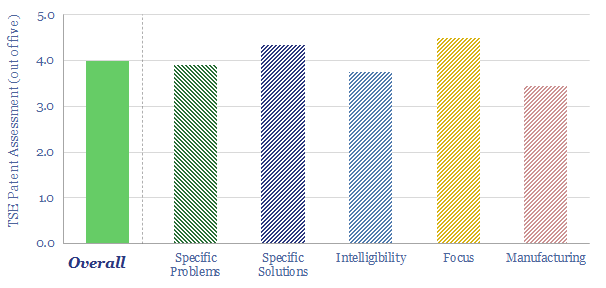

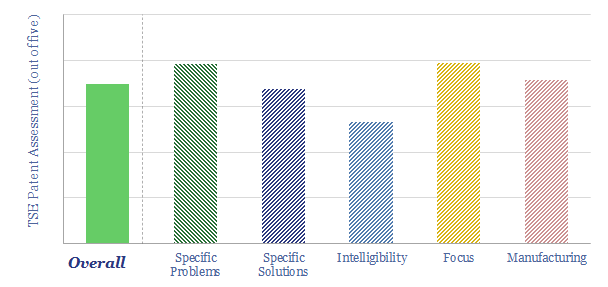

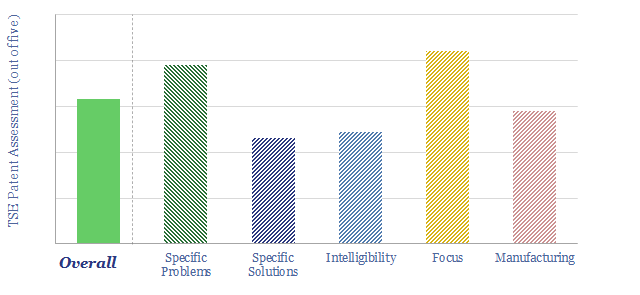

Patent Leaders in Energy

Download

US Shale Gas to Liquids?

Download

Explaining US gasoline?

Download

Electric cars slow the energy transition?

Download

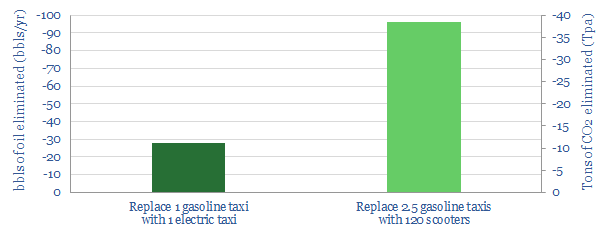

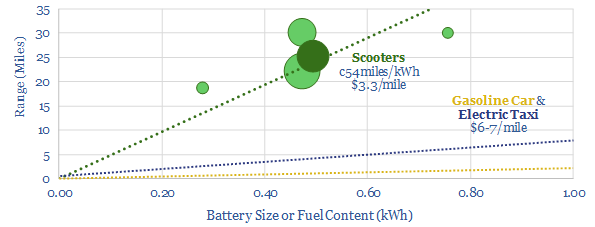

Scooter Wars?

Download

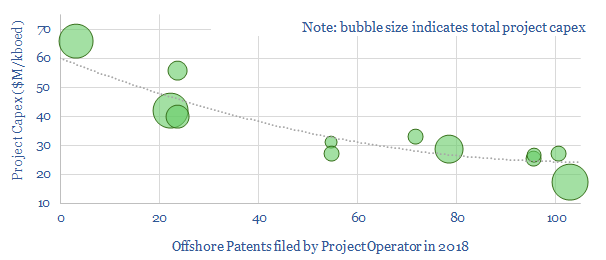

Offshore Capex for Technology Leaders?

Download

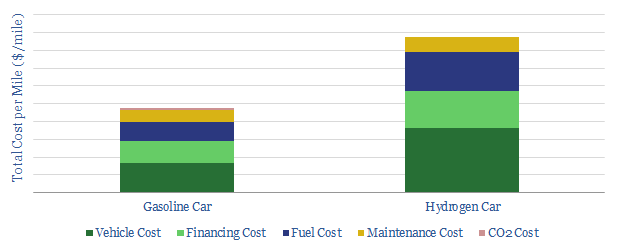

Hydrogen Cars: how economic?

Download

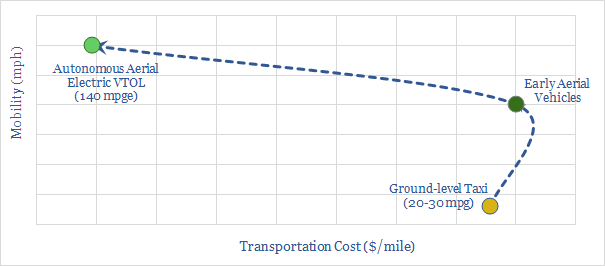

Aerial Vehicles: why flying cars fly

Download

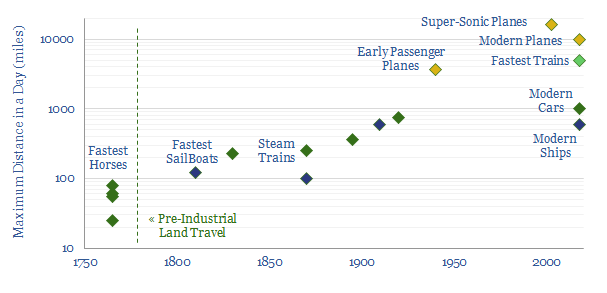

A Short History of Travel Speeds

Download

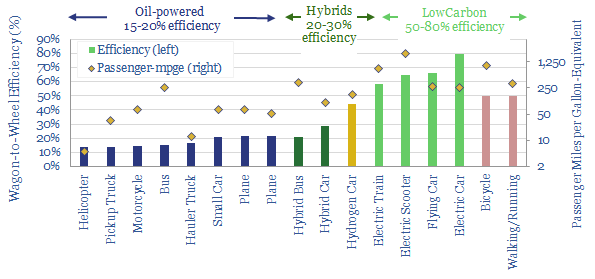

Vehicles: fuel economy and energy efficiency?

Download

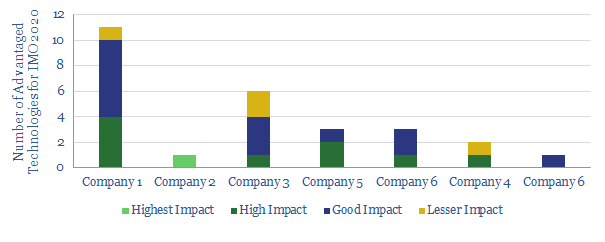

Our Top Technologies for IMO 2020

Download

Plastics and Polymers Research

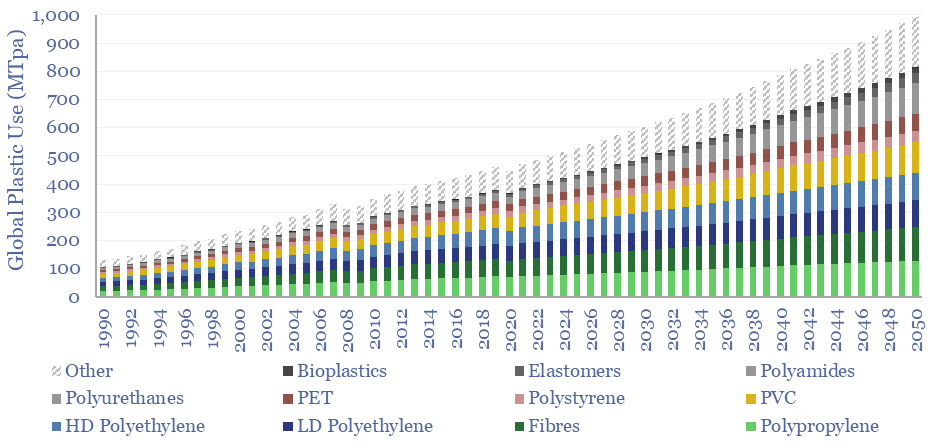

Global plastic demand: breakdown by product, region and use?

Download

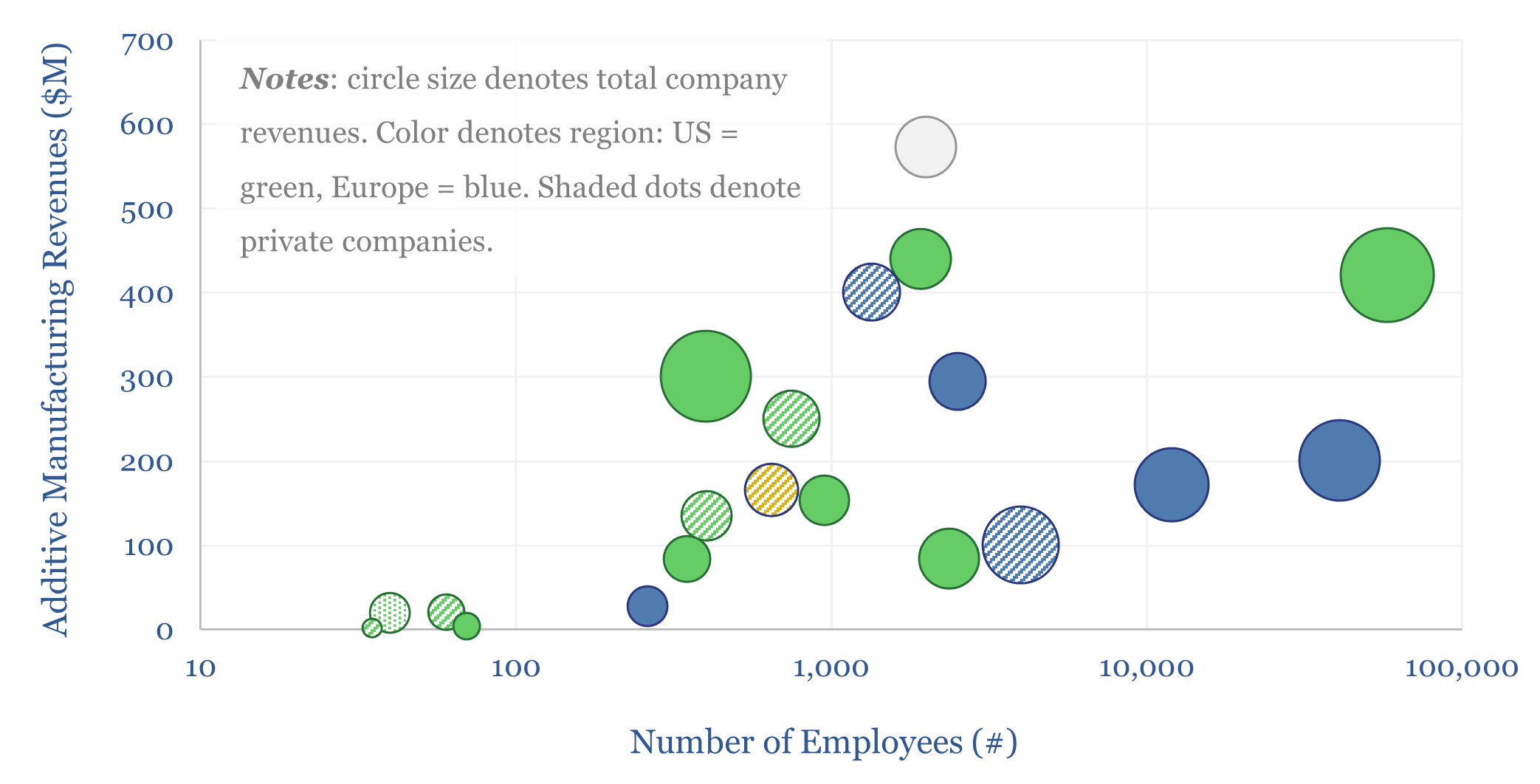

Additive manufacturing: technology leaders?

Download

Poly Vinyl Chloride: the economics?

Download

Eastman: molecular recycling technology?

Download

Plastic recycling: the economics?

Download

Plastic products: energy and CO2 intensity of plastics?

Download

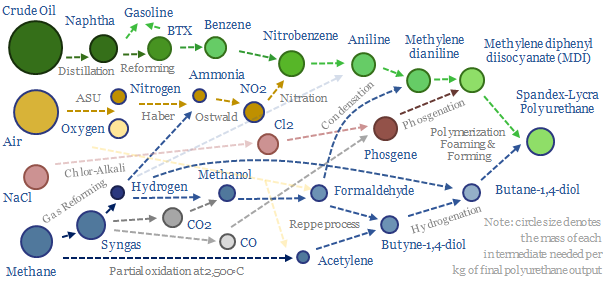

Polyurethanes: what upside in energy transition?

Download

Propylene oxide: production costs?

Download

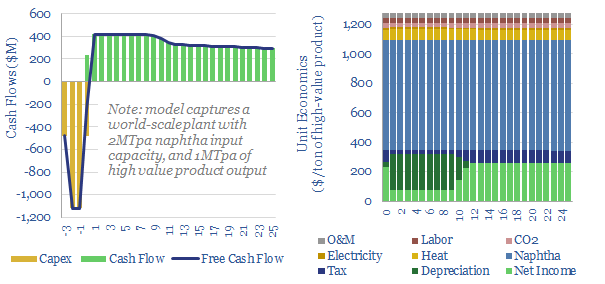

Naphtha cracking: costs of ethylene, propylene and aromatics?

Download

Crude to chemicals: there will be naphtha?

Download

Newlight AirCarbon: bioplastics breakthrough?

Download

Acetylene: production costs?

Download

Purified terephthalic acid: PTA production costs?

Download

Polyester: production process?

Download

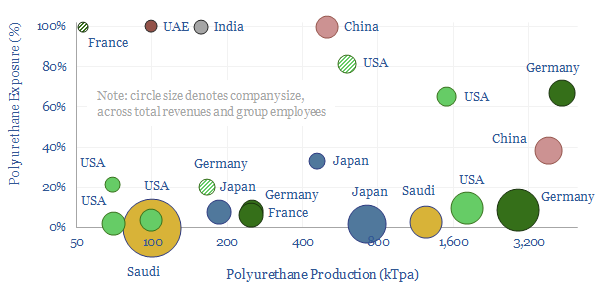

Polyurethane: leading companies?

Download

Alterra Energy: technology review?

Download

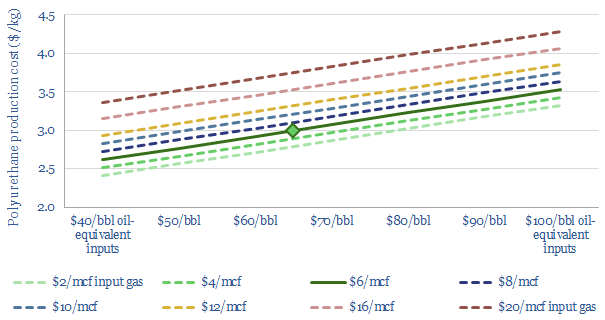

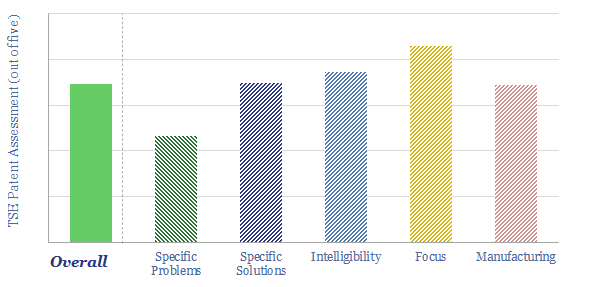

Polyurethane: production costs?

Download

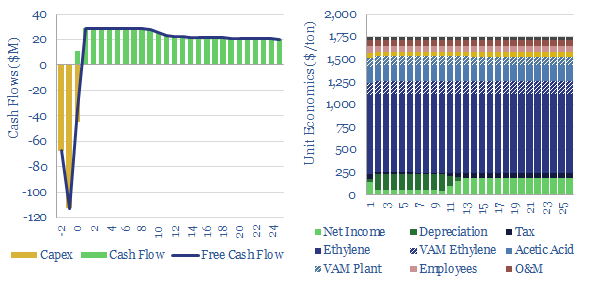

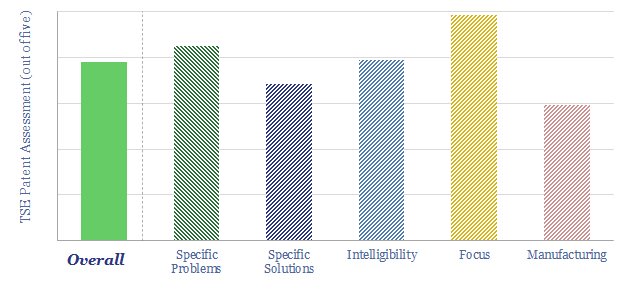

Ethylene vinyl acetate: production costs?

Download

Agilyx: plastic recycling breakthrough?

Download

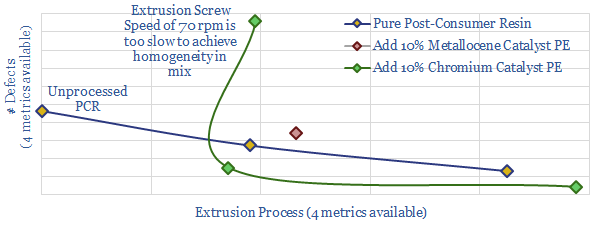

PureCycle: polypropylene recycling breakthrough?

Download

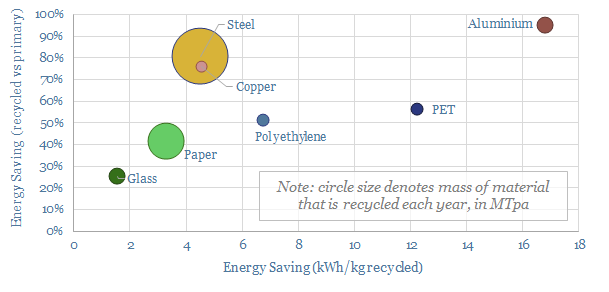

Recycling: a global overview of energy savings?

Download

Stora Enso: next-generation packaging breakthrough?

Download

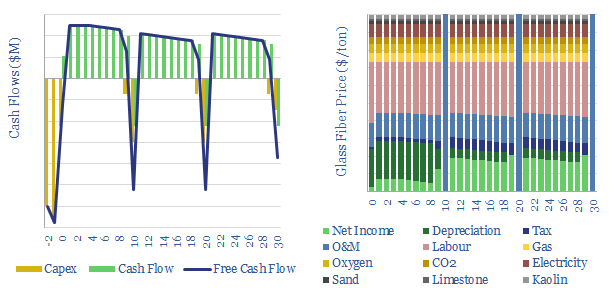

Glass fiber: the economics?

Download

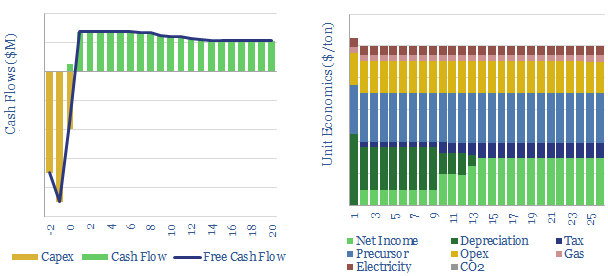

Carbon fiber: energy economics?

Download

Carbios: plastic recycling breakthrough?

Download

Danimer: bio-plastics breakthrough?

Download

Origin Materials: bio-plastics breakthrough?

Download

Polymers and higher olefins: the economics?

Download

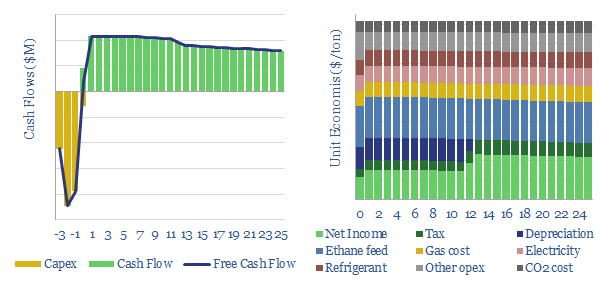

Ethanol-to-ethylene: the economics?

Download

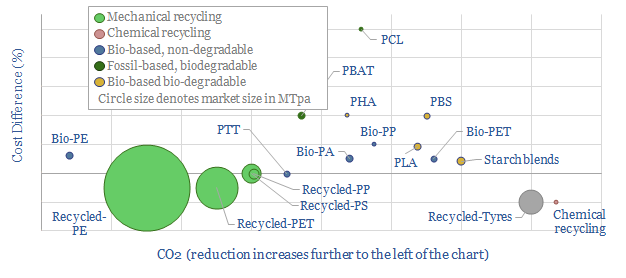

Next-generation plastics: bioplastic, biodegradable, recycled?

Download

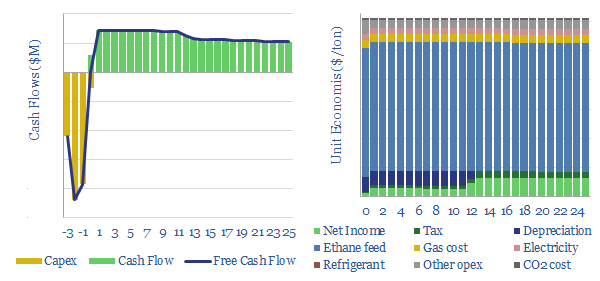

Ethane cracking: the economics?

Download

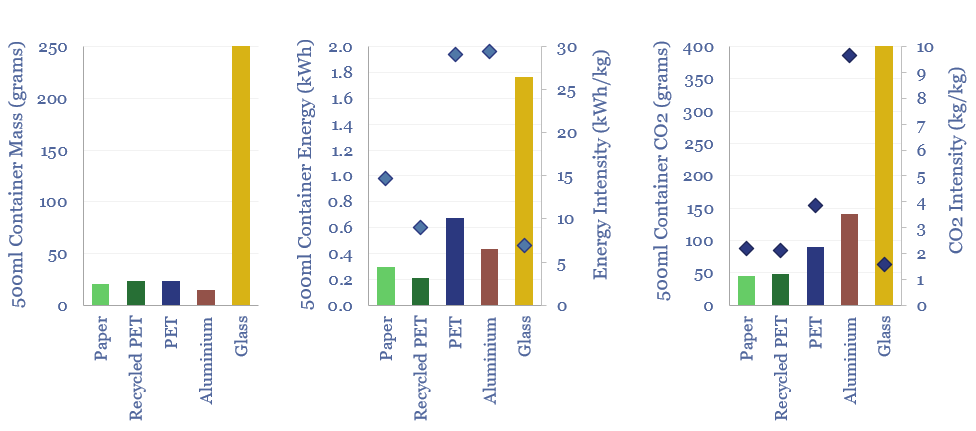

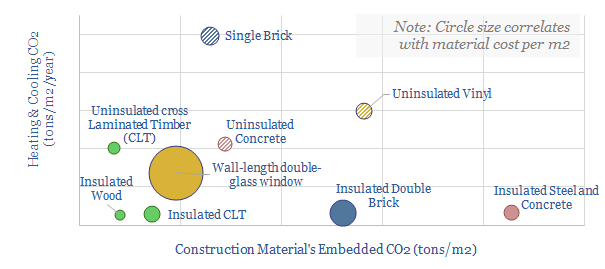

Construction materials: a screen of costs and CO2 intensities?

Download

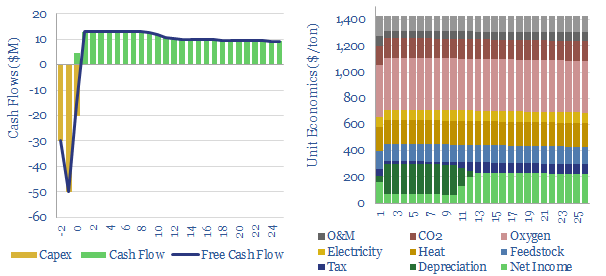

CO2 electrolysis: the economics?

Download

3D printing an energy transition?

Download

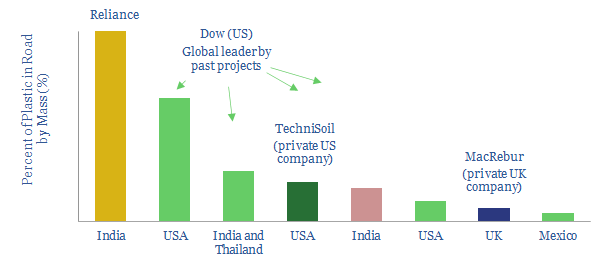

Turn the Plastics into Roads?

Download

Plastic Recycling Companies: pyrolysis and next-generation recycling?

Download

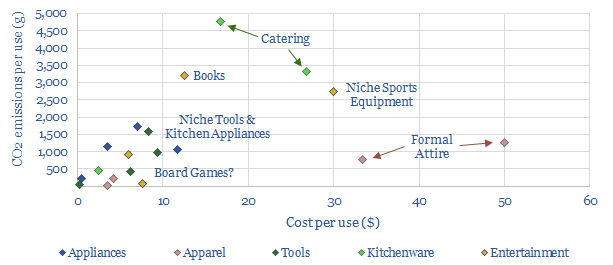

Value in Use: CO2 intensities of household items?

Download

Make CO2 into valuable products?

Download

TOTAL’s Plastic-Recycling Progress?

Download

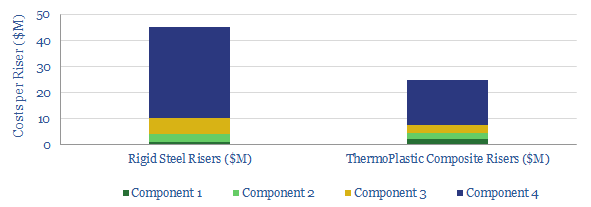

Thermo-Plastic Composite: The Future of Risers?

Download

Coal Research

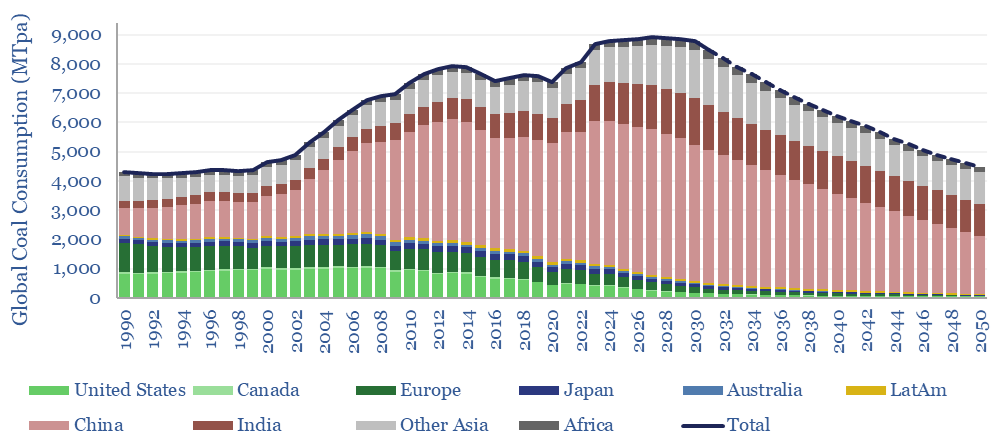

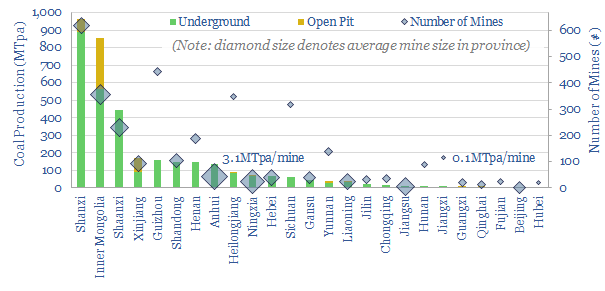

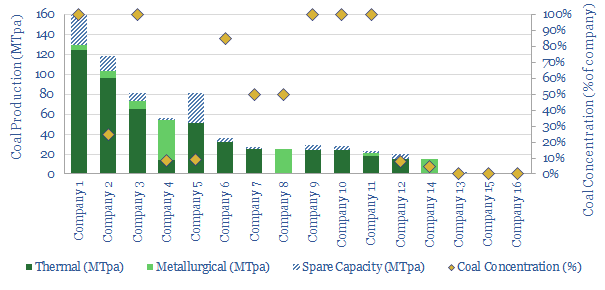

Global coal supply-demand: outlook in energy transition?

Download

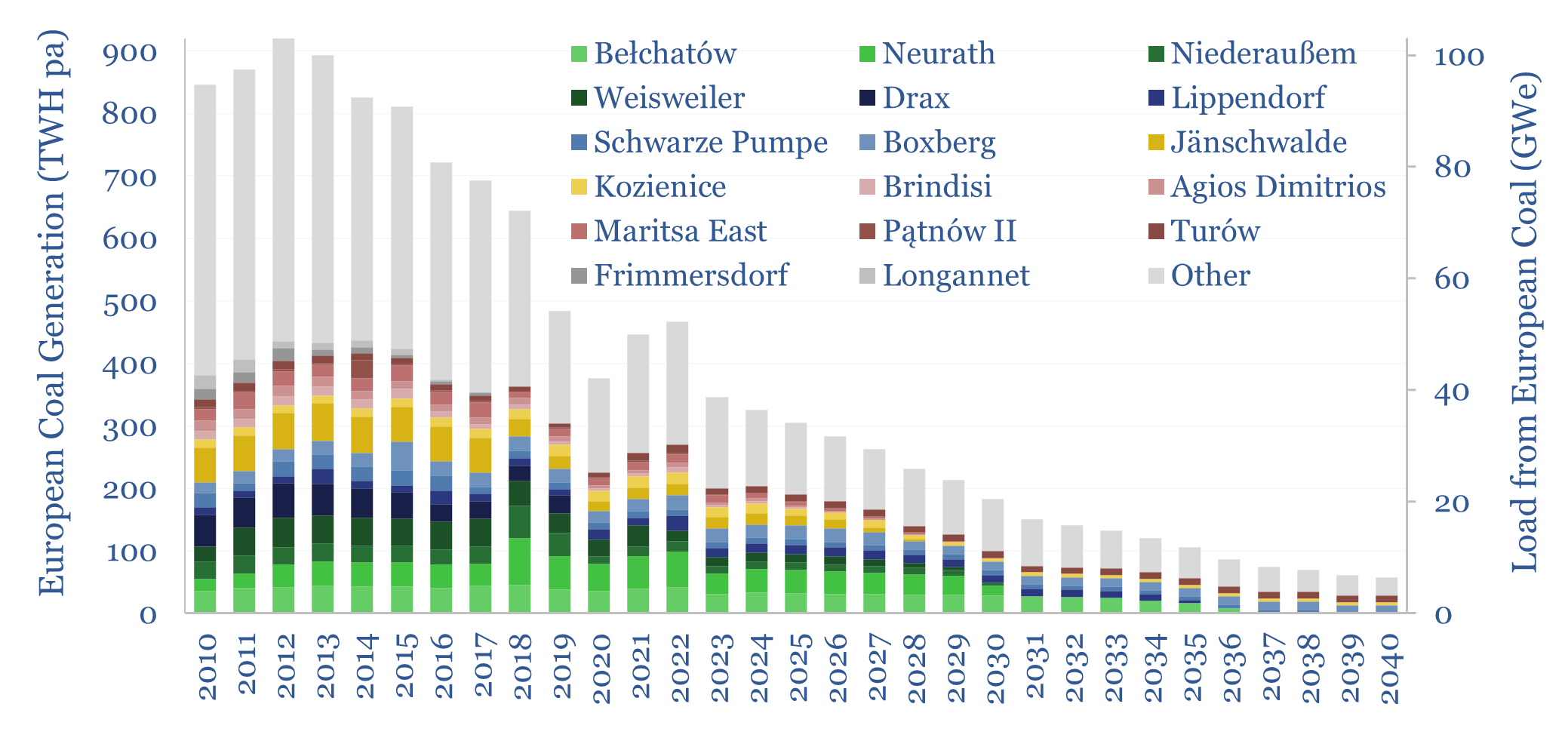

European coal generation by facility and coal plant closures?

Download

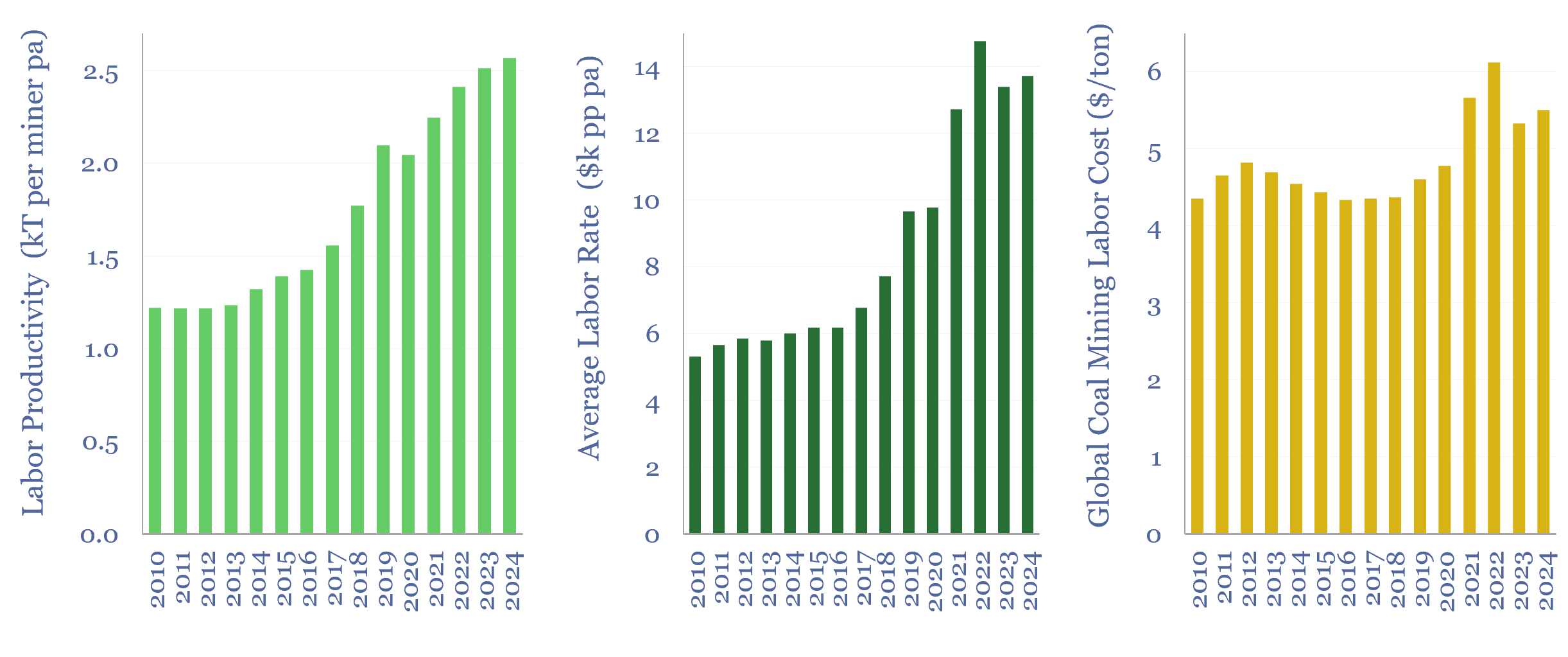

Labor costs of coal production: labor productivity and salaries?

Download

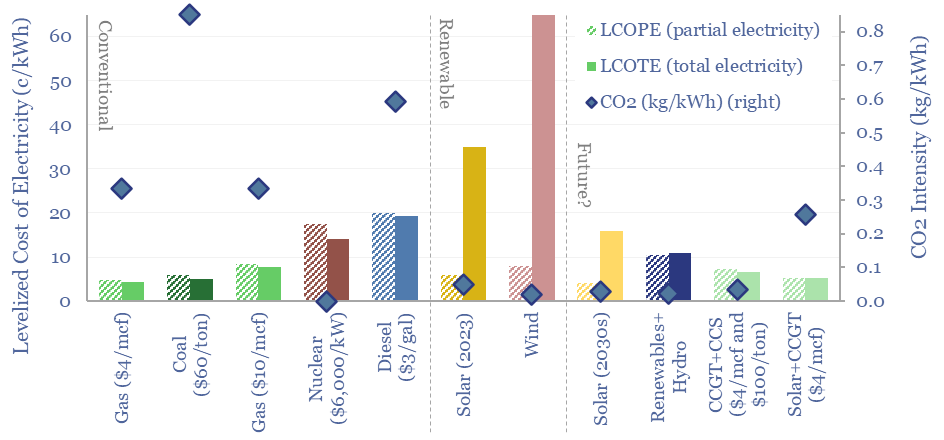

Energy transition: solar and gas -vs- coal hard reality?

Download

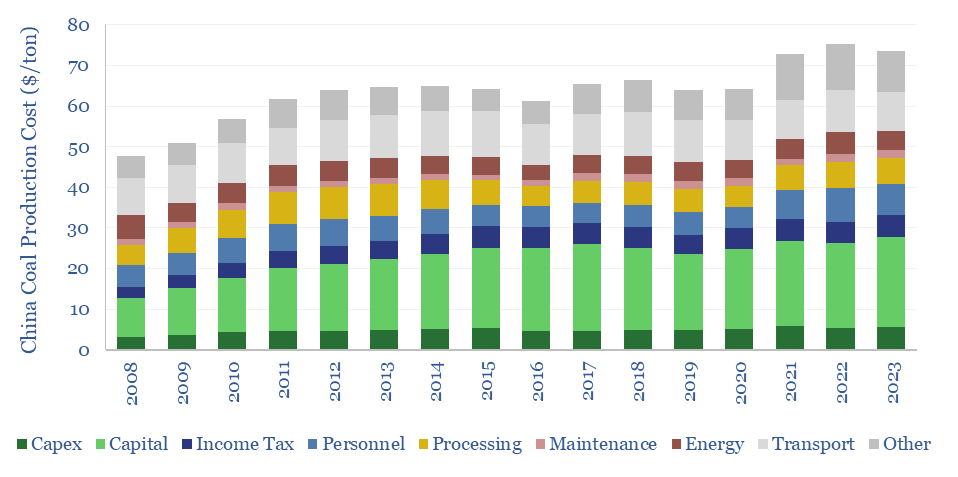

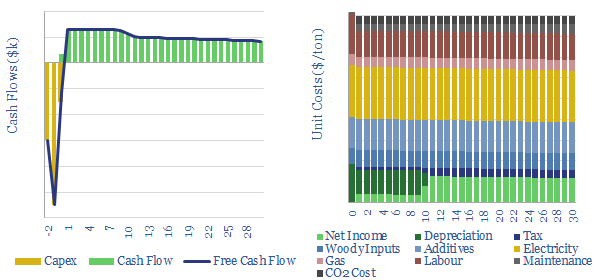

China coal production costs?

Download

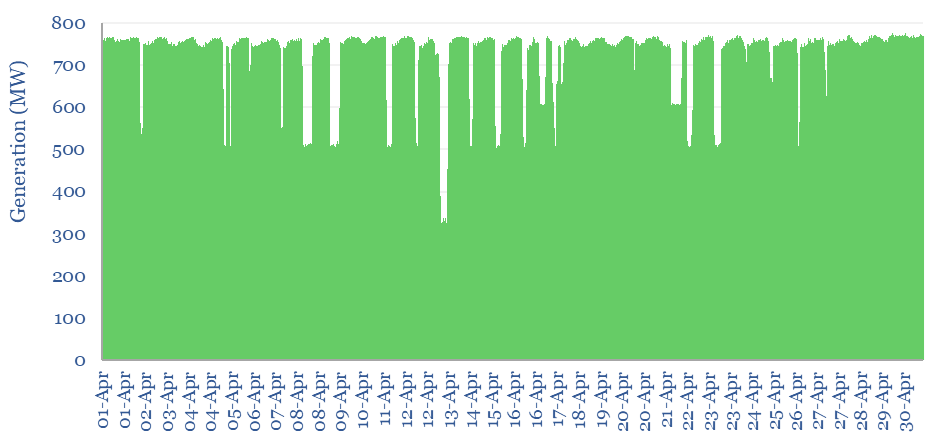

Coal power generation: minute-by-minute flexibility?

Download

European gas and power model: natural gas supply-demand?

Download

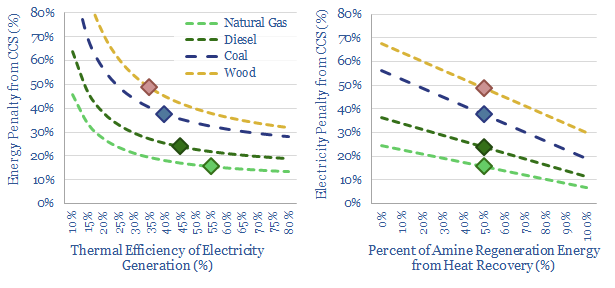

Post-combustion CCS: what energy penalties?

Download

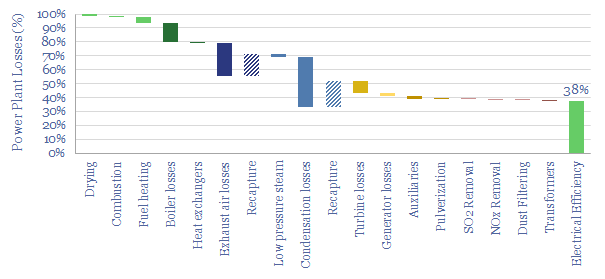

Thermal power plant: loss attribution?

Download

Electrostatic precipitator: costs of particulate removal?

Download

Selective catalytic reduction: costs of NOx removal?

Download

Air quality: sulphur, NOx and particulate emissions?

Download

Flue gas desulfurization: costs of SO2 scrubbers?

Download

Costs of hydrogen from coal gasification?

Download

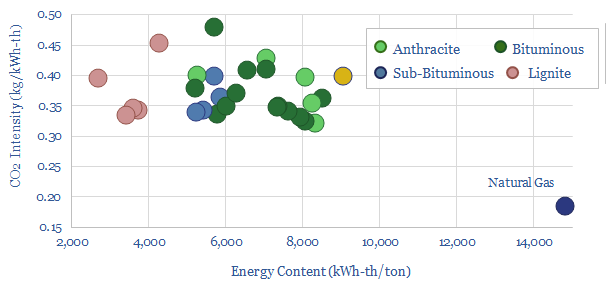

Coal grades: what CO2 intensity?

Download

Bio-coke: energy economics?

Download

All the coal in China: our top ten charts?

Download

Coal miners: a screen of Western companies?

Download

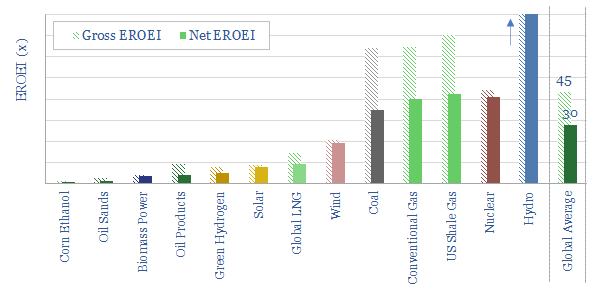

Energy return on energy invested?

Download

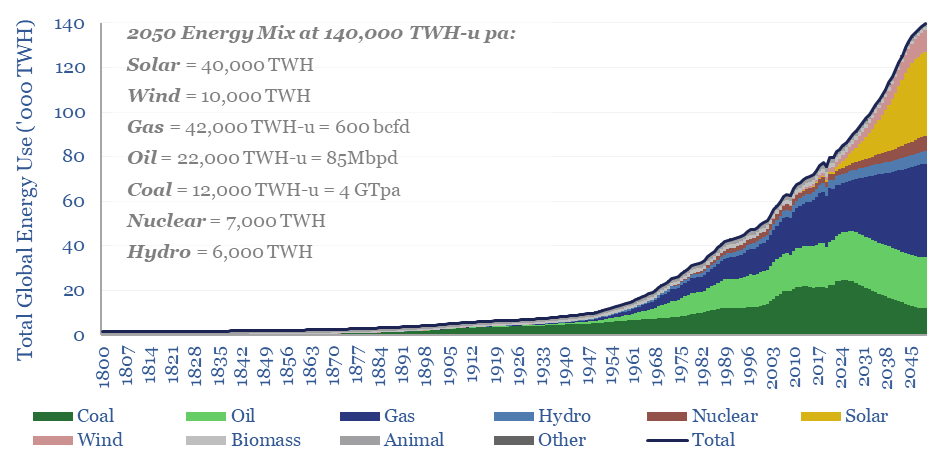

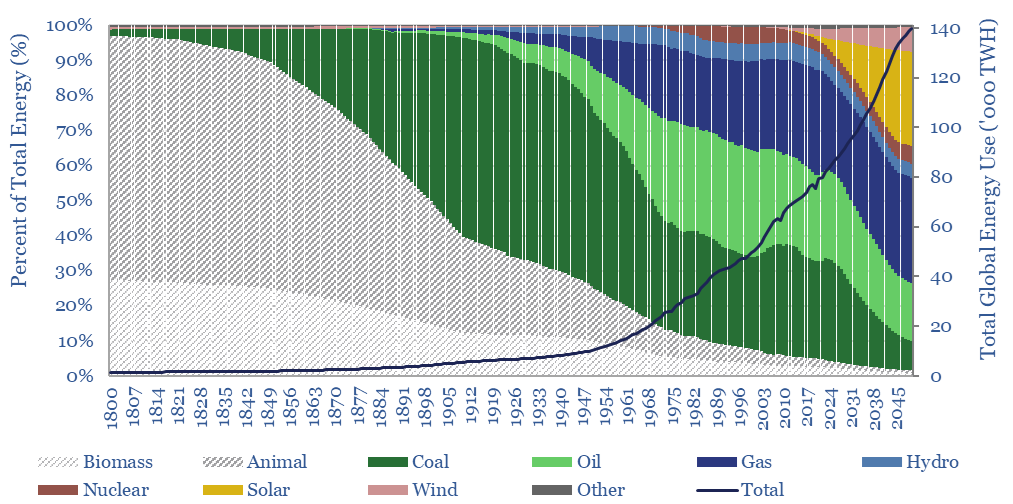

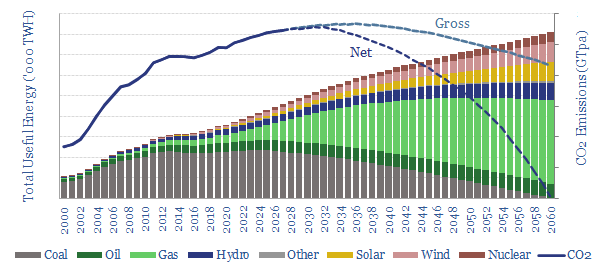

Global energy market model for the energy transition?

Download

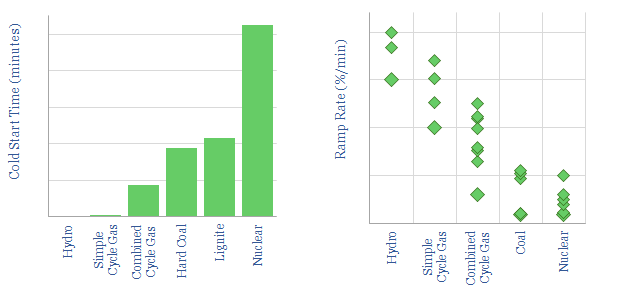

Power plants: cold starts and ramp rates?

Download

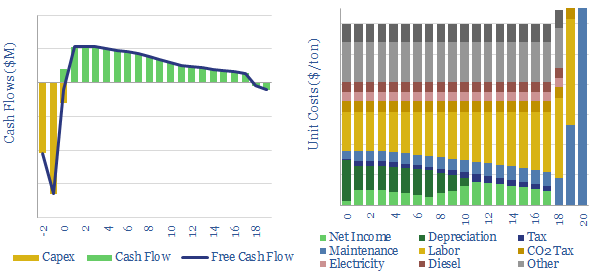

Coal mining: the economics?

Download

US CCS: market sizing?

Download

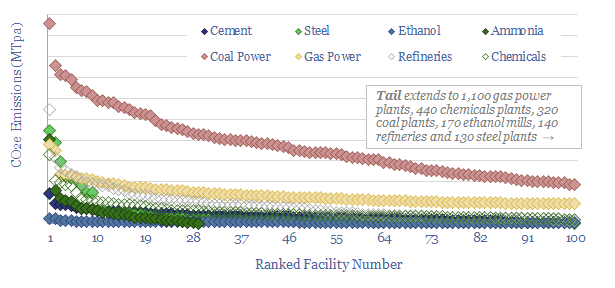

US CO2 emissions by industrial facility size?

Download

China: can the factory of the world decarbonize?

Download

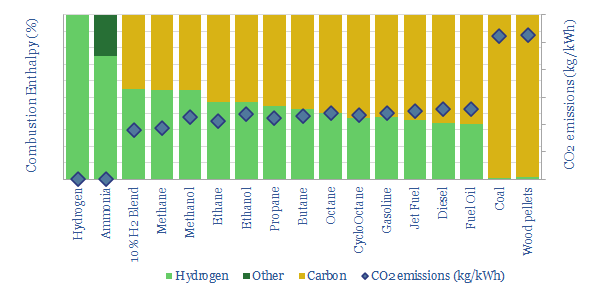

Energy economics: energy content of combustion fuels?

Download

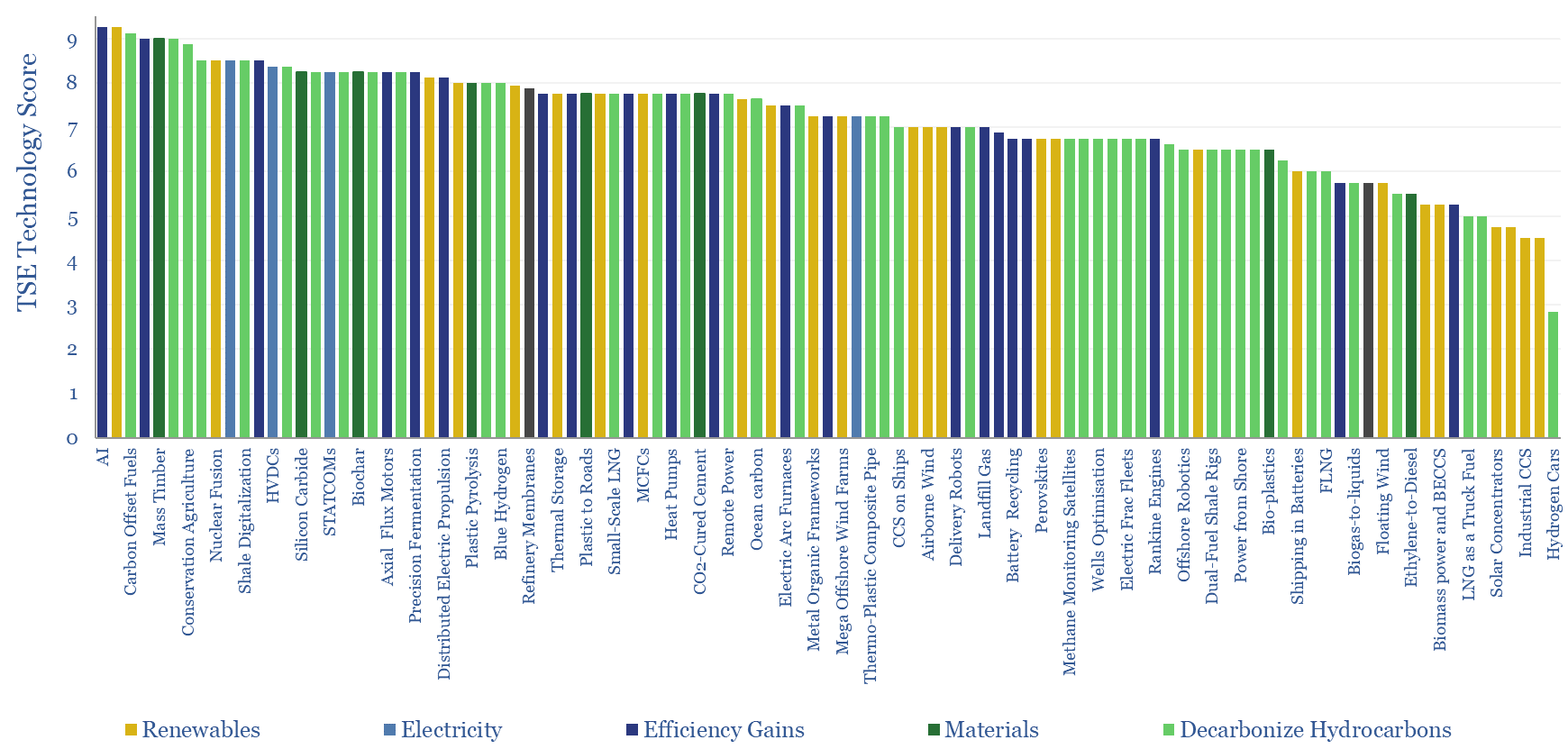

Energy Transition Technologies?

Download

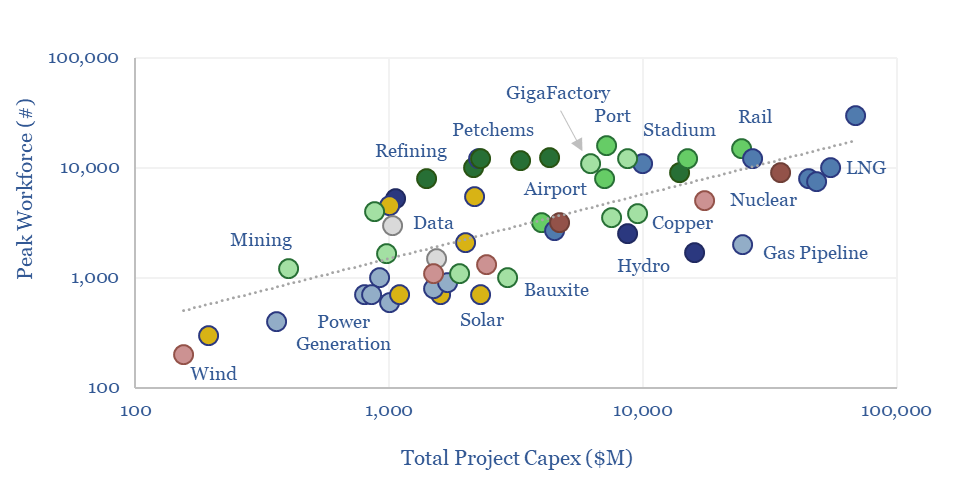

Energy infrastructure: labor intensity?

Download

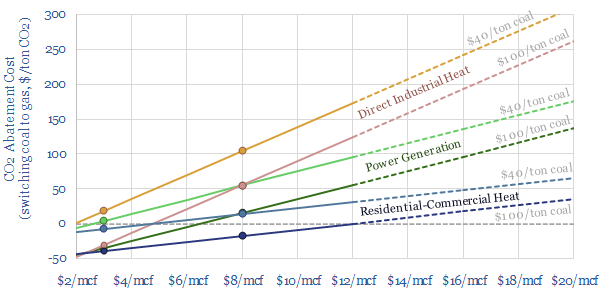

Coal-to-gas switching: what CO2 abatement cost?

Download

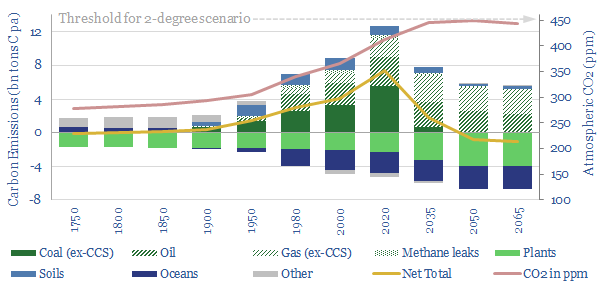

The route to net zero: an energy-climate model for 2-degrees

Download

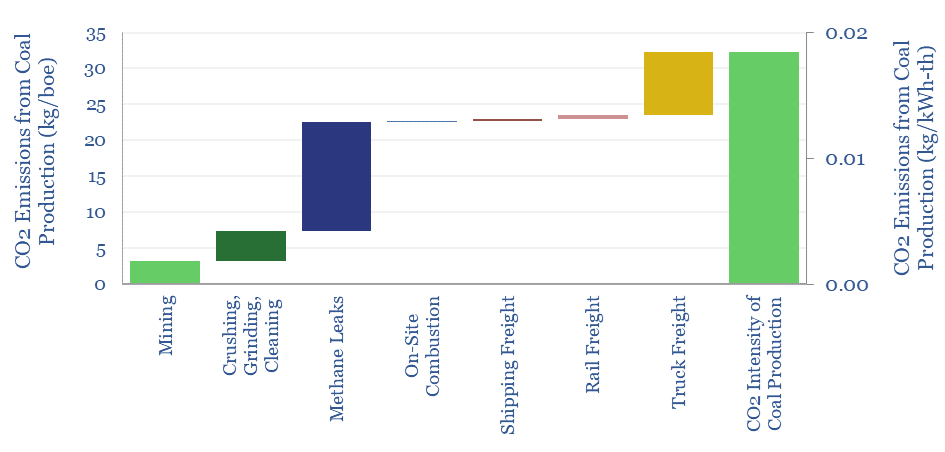

CO2 intensity of coal production?

Download

Molten Carbonate Fuel Cells: CCS plus Power? The Economics?

Download

Coal-to-Power Project Economics

Download

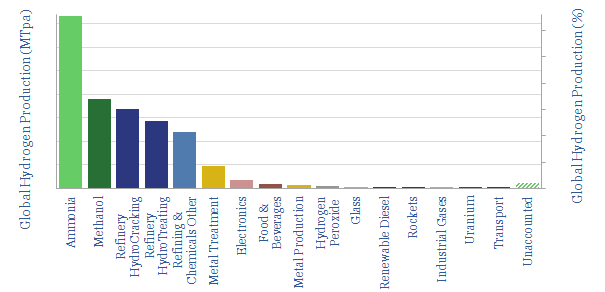

Global hydrogen: market breakdown?

Download

Global CO2 emissions breakdown?

Download

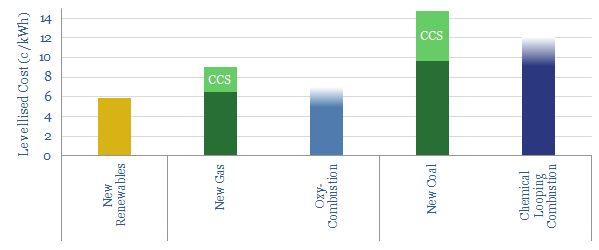

Major technologies to decarbonise power?

Download

De-carbonising carbon?

Download

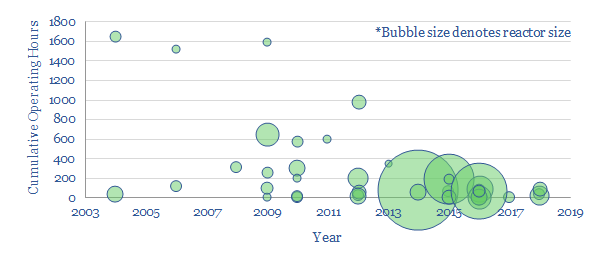

Chemical Looping Progress?

Download

Carbon Capture and Storage (CCS)

Vehicles: energy transition conclusions?

Download

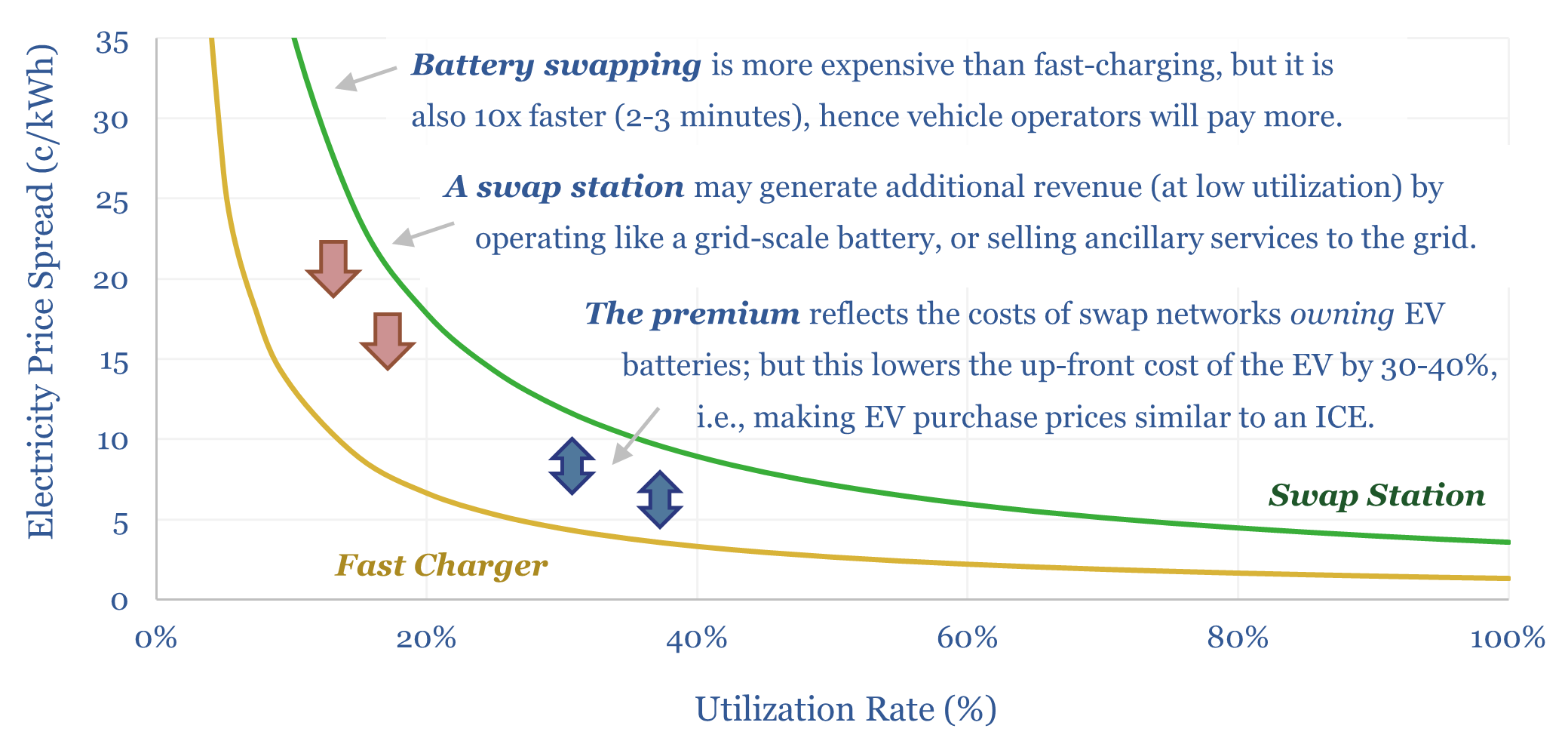

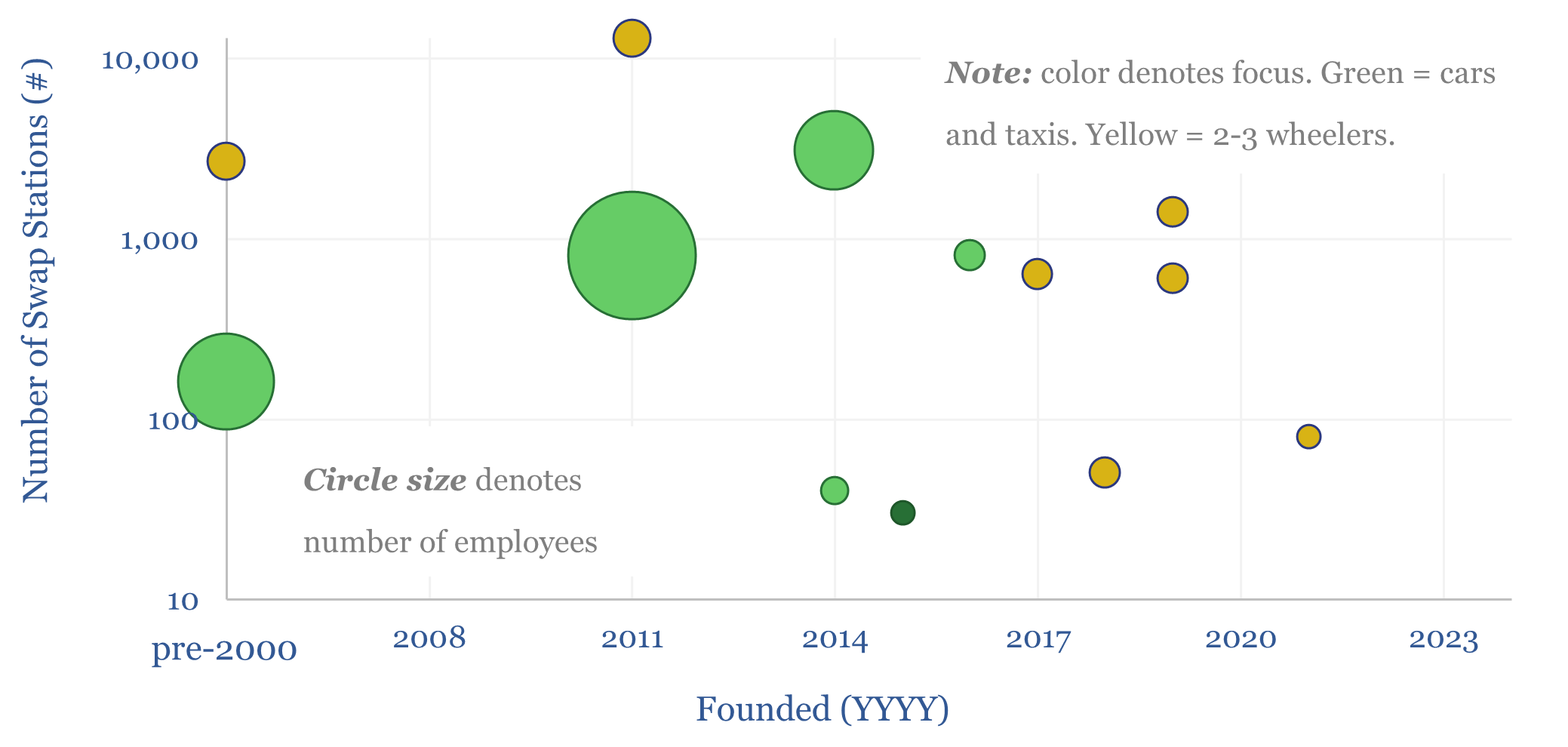

Battery swapping: off to the races?

Download

Battery swapping: leading companies?

Download

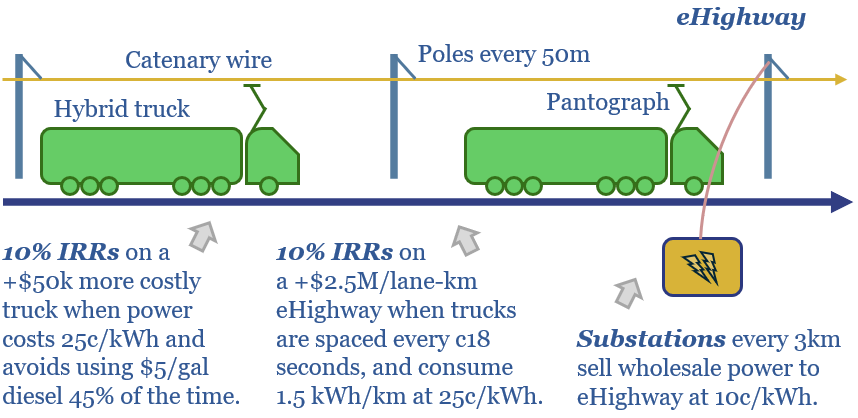

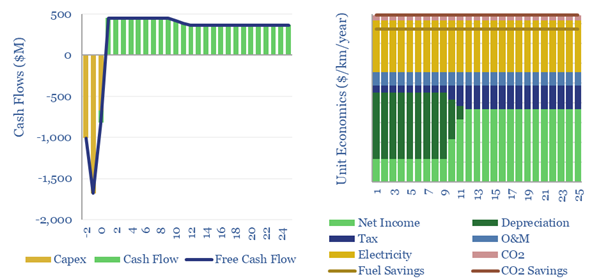

eHighways: trucking by wire?

Download

eHighway economics: costs of electrifying heavy trucks?

Download

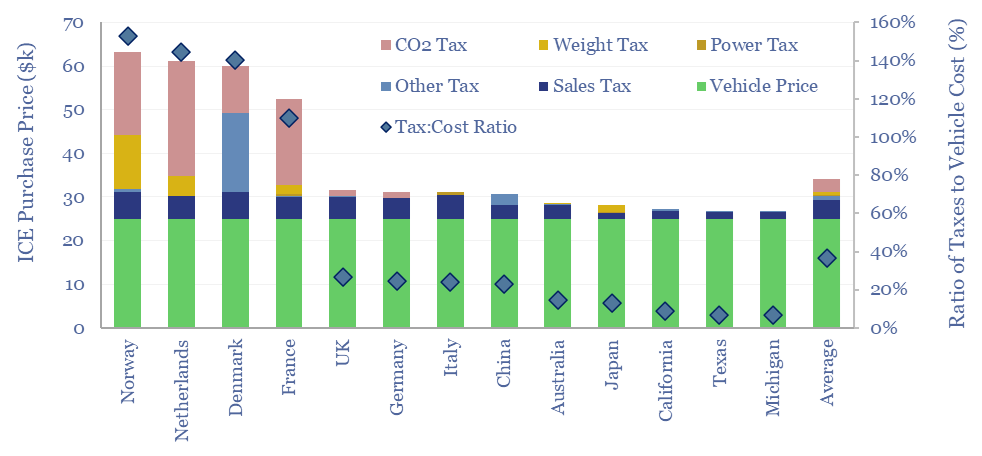

EV incentives: vehicle taxes by country?

Download

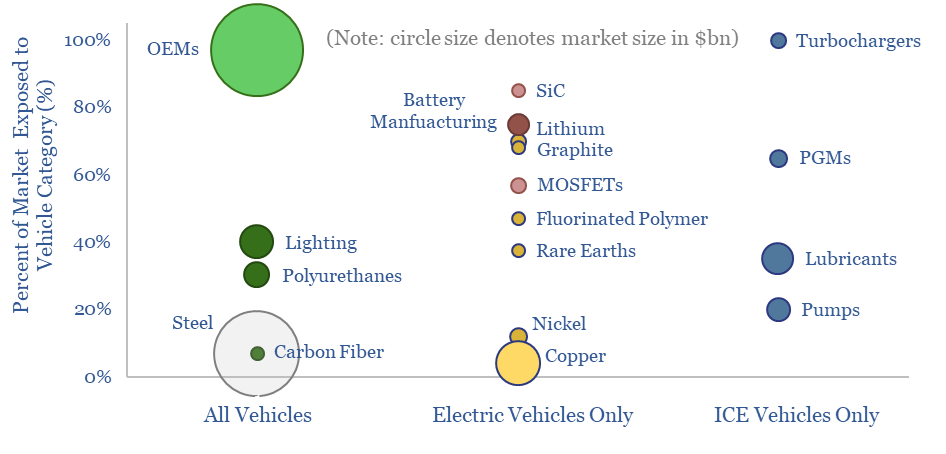

Mapping vehicle value chains?

Download

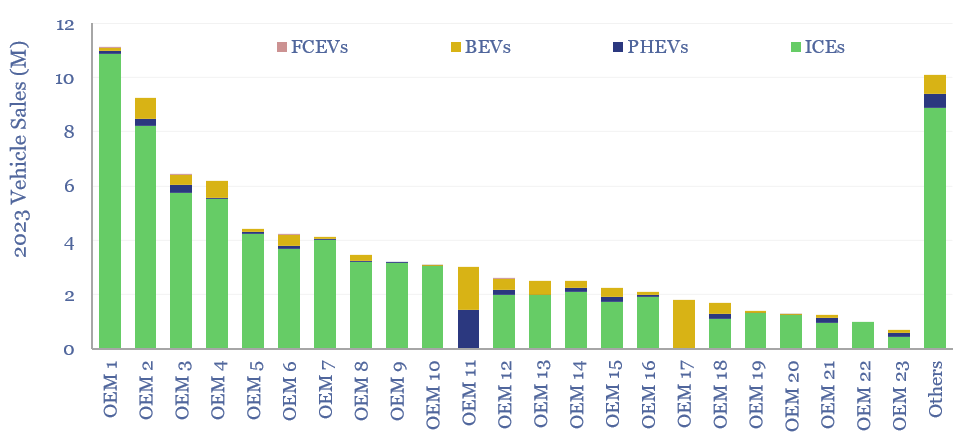

Global vehicle sales by manufacturer?

Download

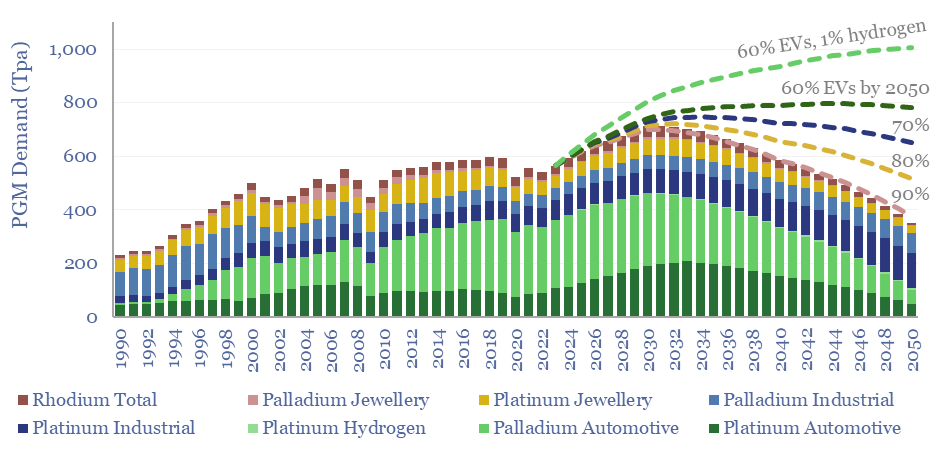

Going platinum: PGMs in energy transition?

Download

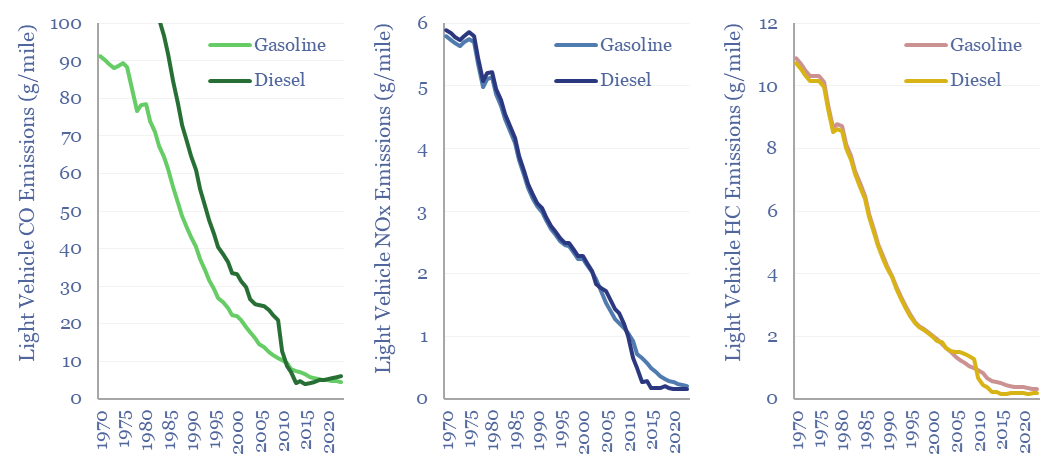

Vehicle emissions of CO, NOx and HCs?

Download

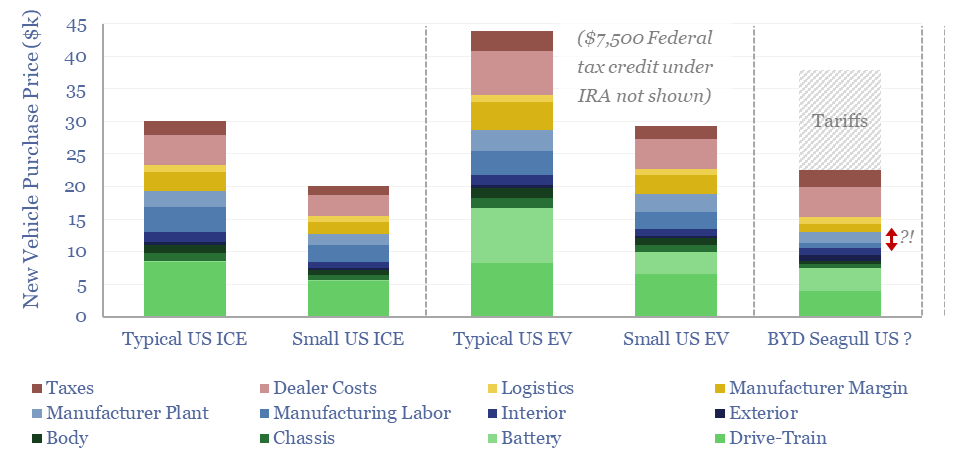

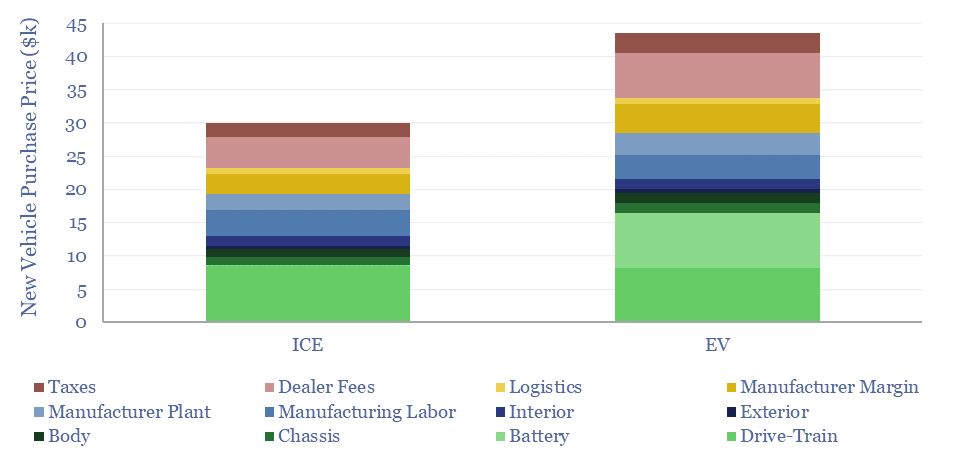

Electric vehicles: the road to cost parity?

Download

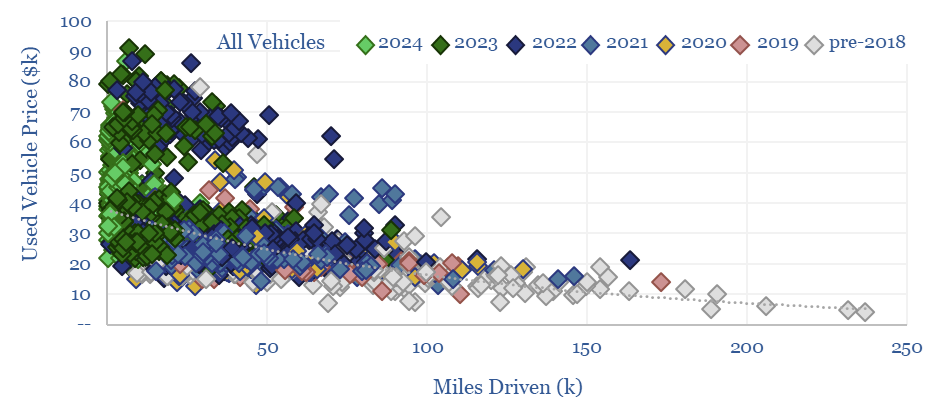

Vehicle depreciation rates: EVs versus ICEs?

Download

Electric vehicle cost breakdown by component?

Download

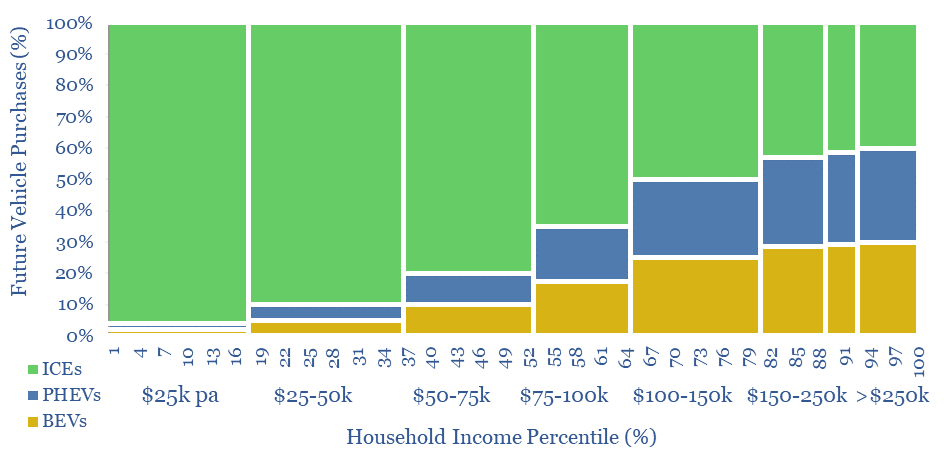

Electric vehicles: saturation point?

Download

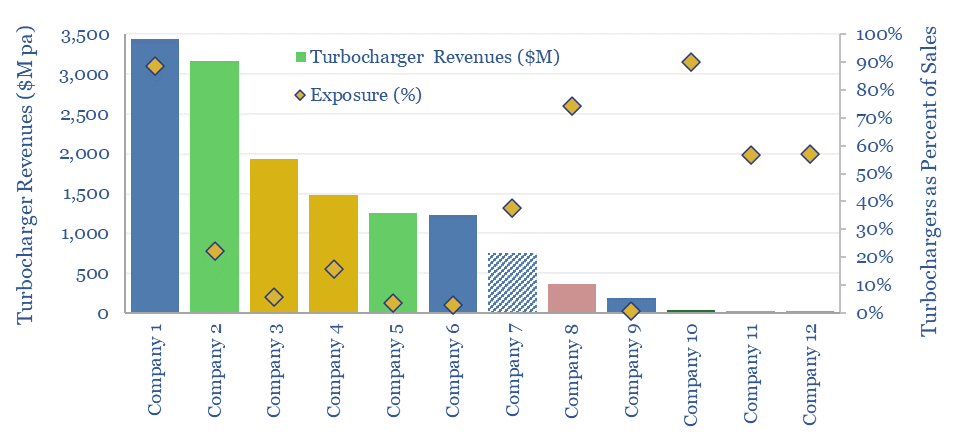

Turbochargers: leading companies?

Download

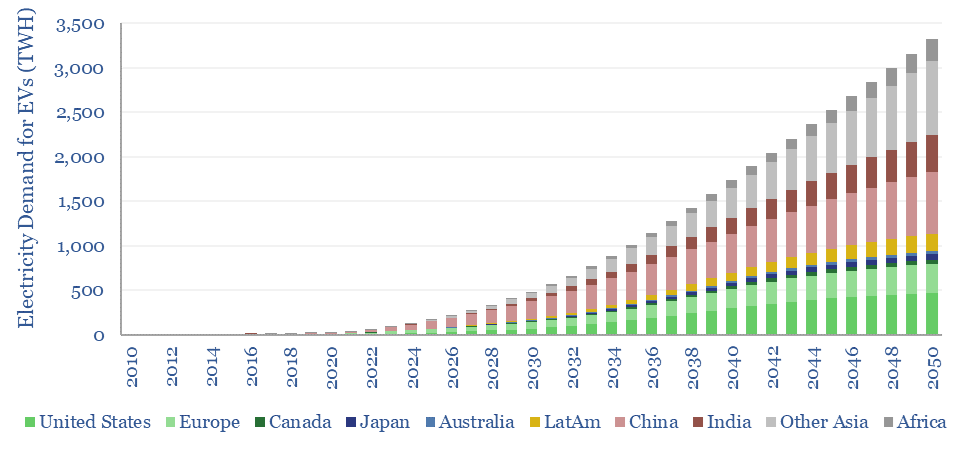

Electricity demand for electric vehicles?

Download

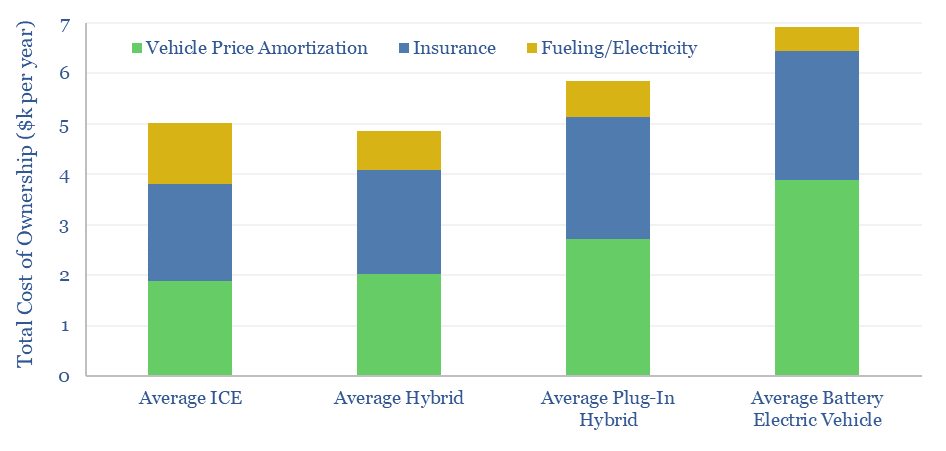

Electric vehicles: total cost of ownership?

Download

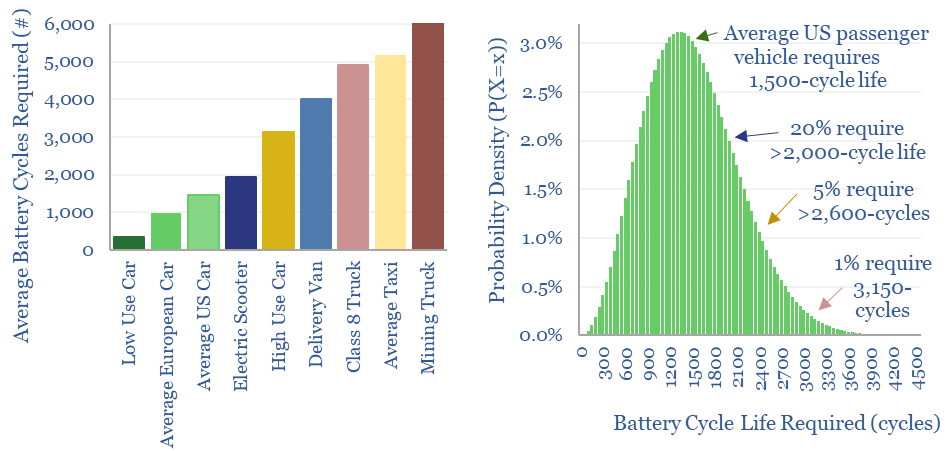

Electric vehicle: battery life?

Download

Electric vehicles: breaking the ICE?

Download

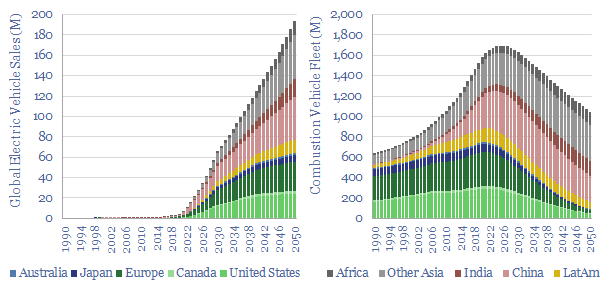

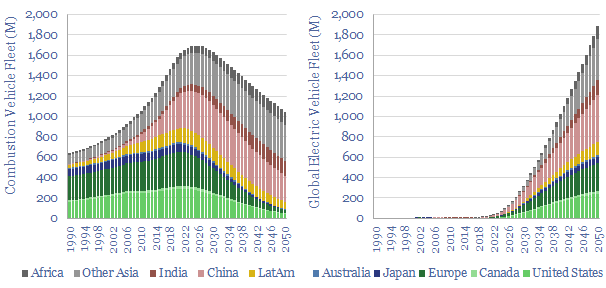

Global vehicle fleet: vehicle sales and electrification by region?

Download

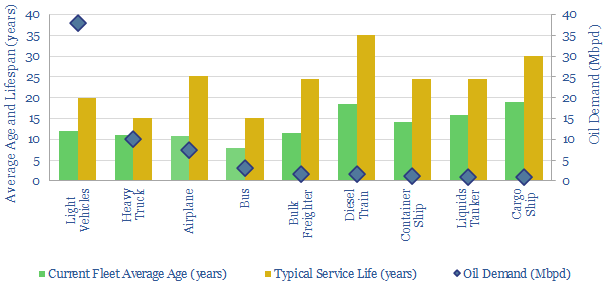

Vehicle fleets: service life and retirement age by vehicle type?

Download

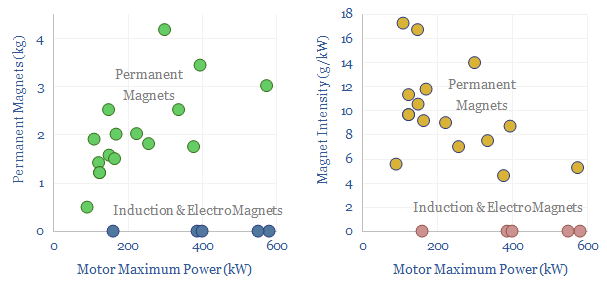

Electric vehicles: motors and magnets?

Download

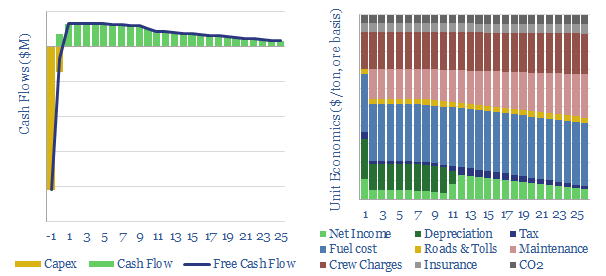

Bulk shipping: cost breakdown?

Download

Commercial aviation: fuel economy of planes?

Download

Offshore vessels: fuel consumption?

Download

Hillcrest: ZVS inverter breakthrough?

Download

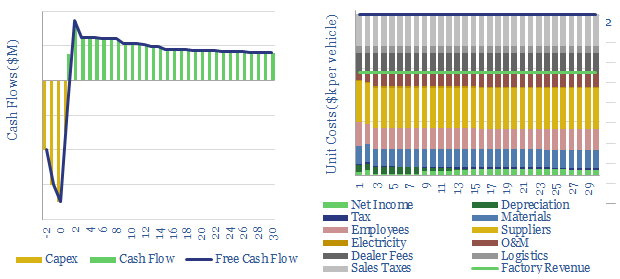

Auto manufacturing: the economics?

Download

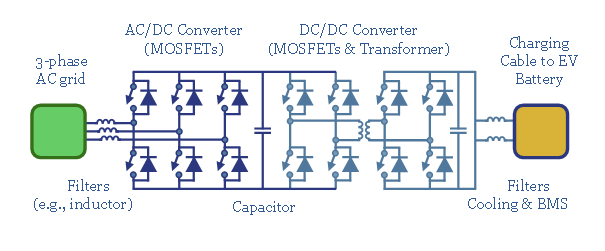

EV fast charging: opening the electric floodgates?

Download

Power-MOSFETs: leading companies?

Download

Electric vehicles: chargers of the light brigade?

Download

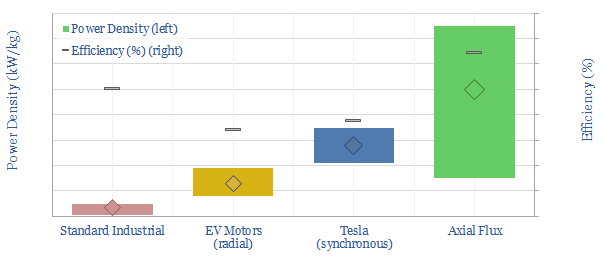

Electric motors: state of flux?

Download

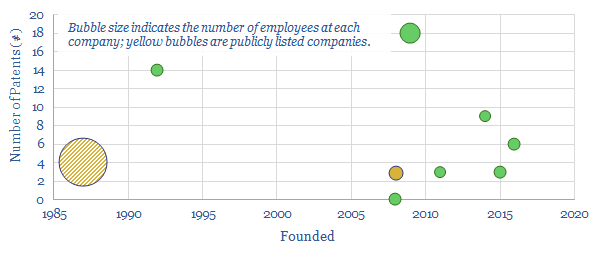

Axial flux motors: leading companies and products?

Download

Mine trucks: transport economics?

Download

LNG transport: shipping economics?

Download

Commercial aviation: air travel economics?

Download

Container freight: shipping economics?

Download

ChargePoint: electric vehicle charging edge?

Download

Vehicle mass: what opportunities to improve fuel economy?

Download

Battery recycling: long division?

Download

Nio: EV-charging breakthrough?

Download

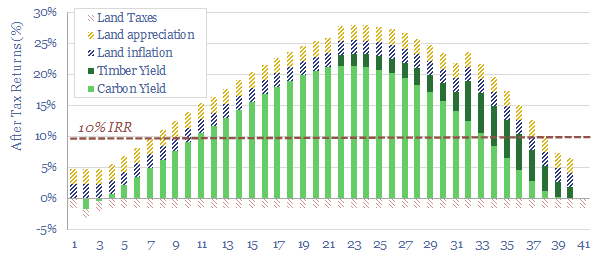

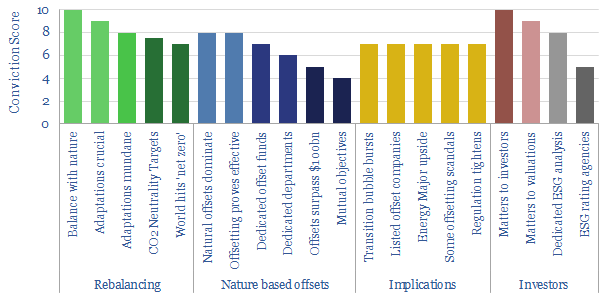

Nature Based Solutions

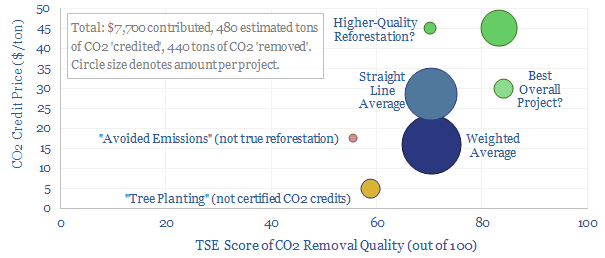

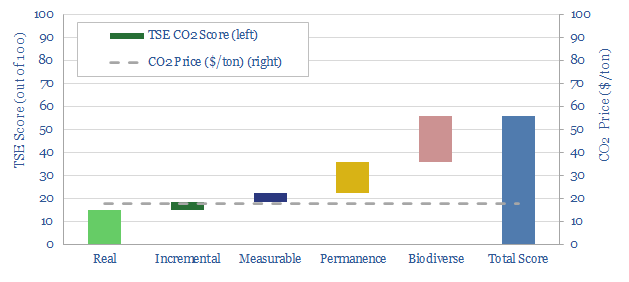

Nature based solutions to climate change?

Download

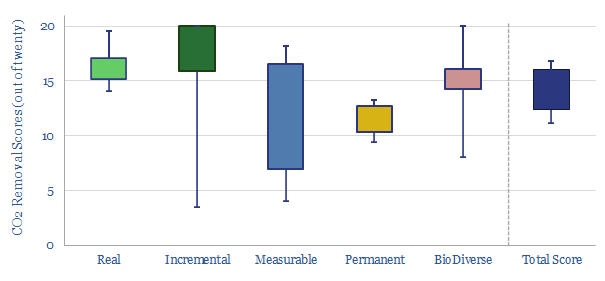

Nature-based CO2 removals: a summary?

Download

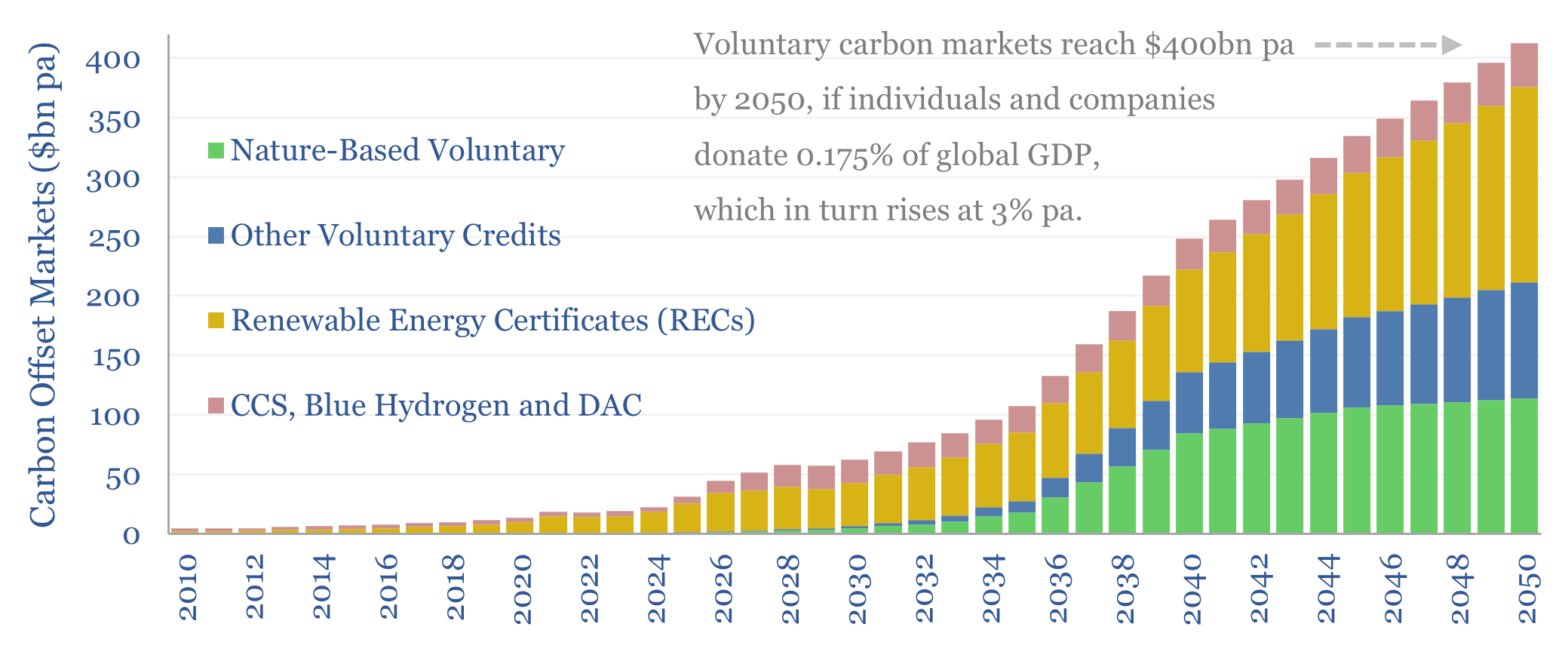

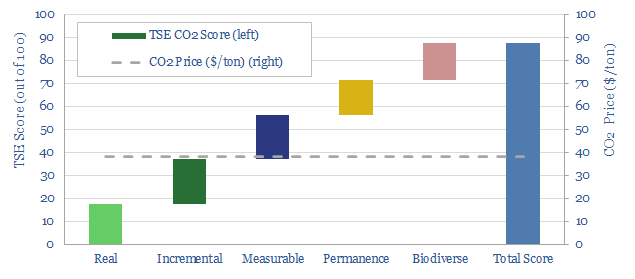

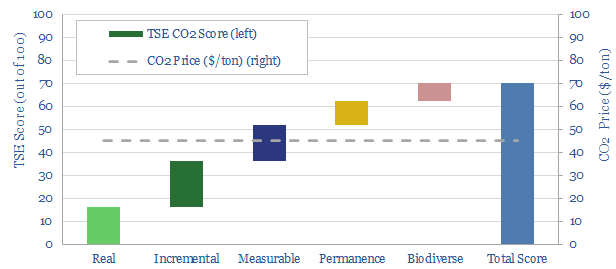

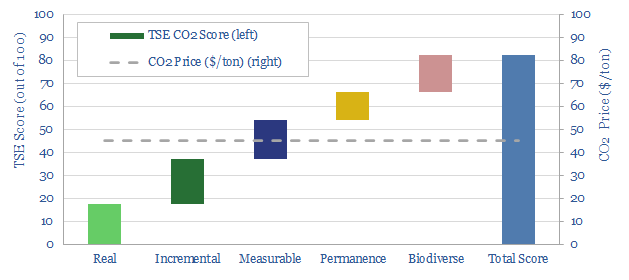

Carbon markets: charity case?

Download

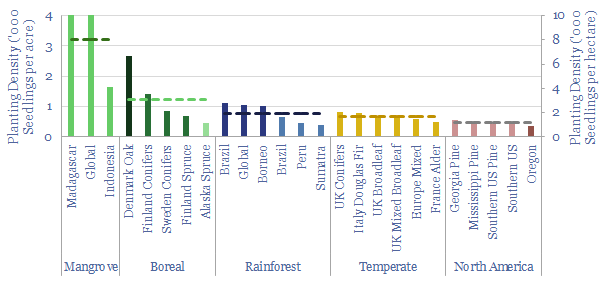

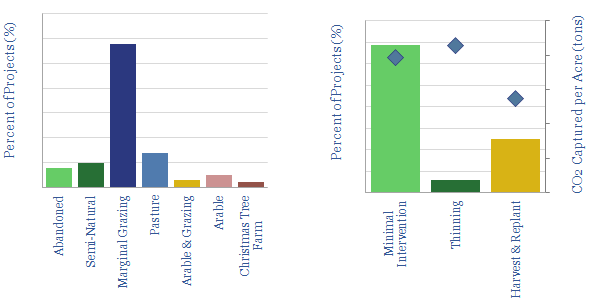

Reforestation: what planting density for seedlings?

Download

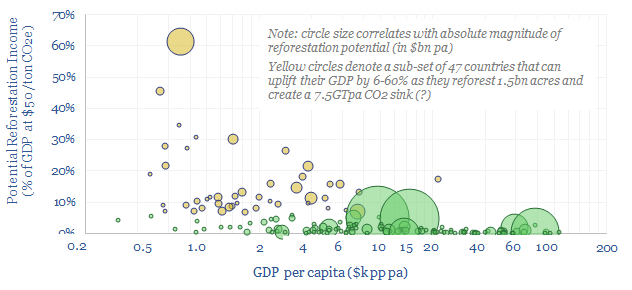

Growing economies: reforest and reinvest?

Download

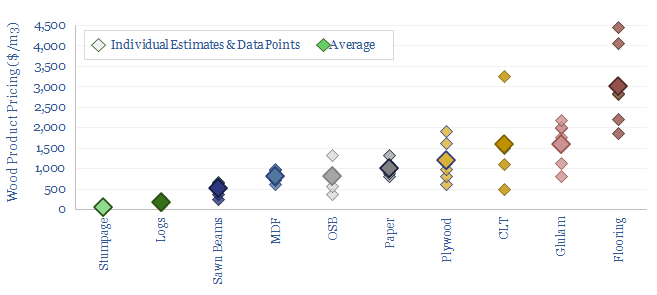

Wood products: typical pricing?

Download

CO2 removals: CO2OL Panama project?

Download

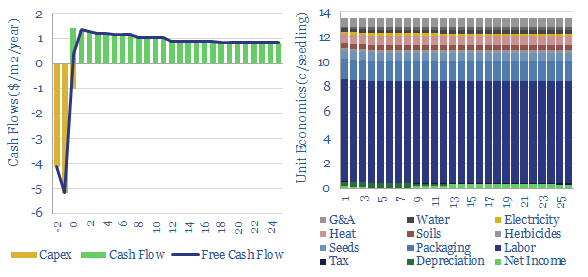

Tree seedlings: costs and economics?

Download

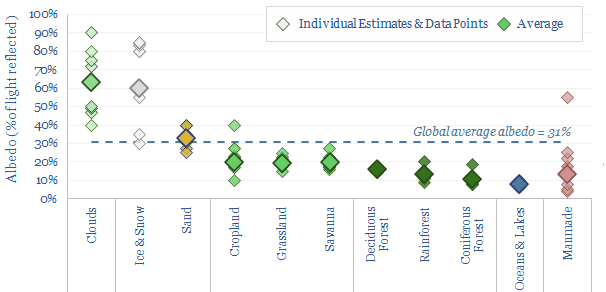

Albedo of different landscapes: a challenge for reforestation?

Download

Nature based solutions: CO2 removals in 2022?

Download

CO2 offsets: Pachama’s AI platform?

Download

Tigercat: forestry and timber innovations?

Download

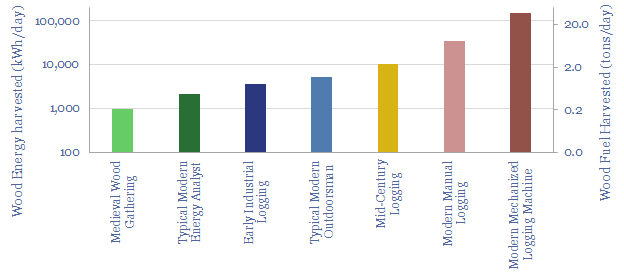

Energy history: how much wood can be cut in a day?

Download

CO2 removals: teak plantations, Nicaragua?

Download

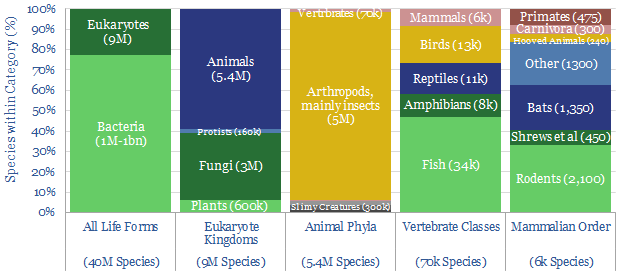

Biodiversity: a breakdown of species and carbon stocks?

Download

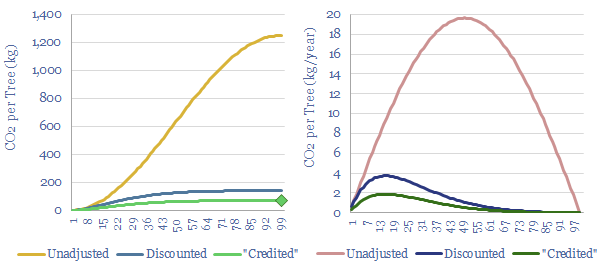

Carbon offsets: cost of CO2 removal per tree planted?

Download

CO2 Removals: BaumInvest Mixed Reforestation, Costa Rica?

Download

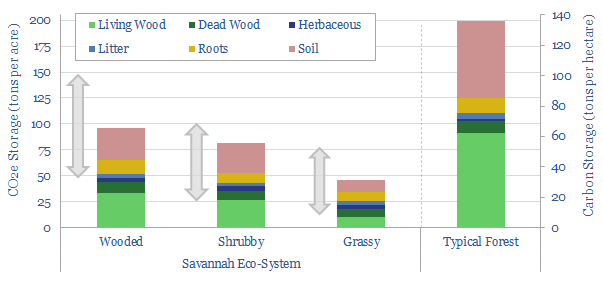

Savanna carbon: great plains?

Download

Palm oil: what CO2 intensity?

Download

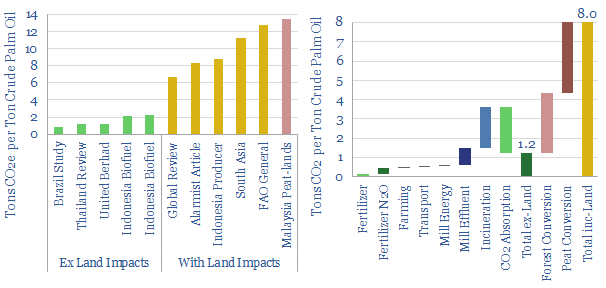

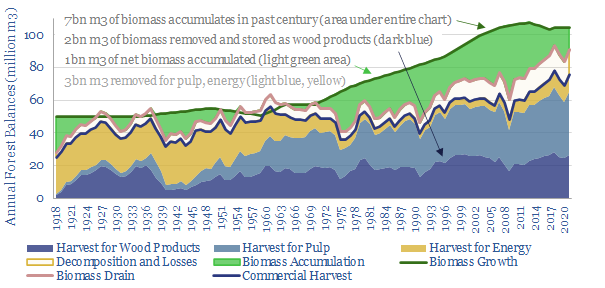

Wood use: what CO2 credentials?

Download

CO2 intensity of wood: context by context?

Download

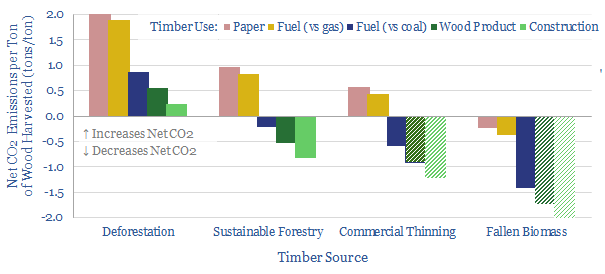

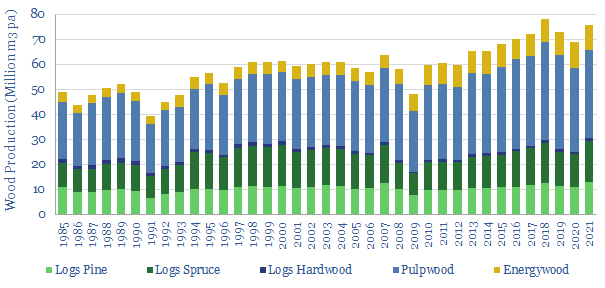

Global wood production: supply by country by year?

Download

Finnish forests: a two billion ton CO2 case-study?

Download

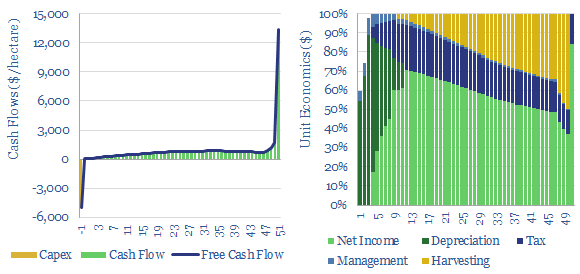

Finnish forests: trees, yields, costs, value?

Download

Reforestation: costs of CO2 removals?

Download

UK reforestation projects: 25 case studies?

Download

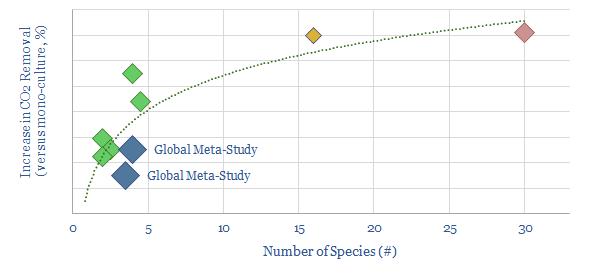

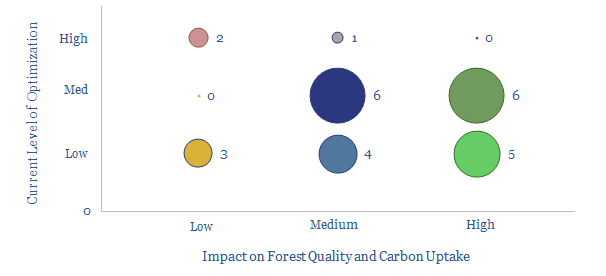

Biodiversity: impacts on forest CO2?

Download

Carbon neutral investing: hedge funds, forest funds?

Download

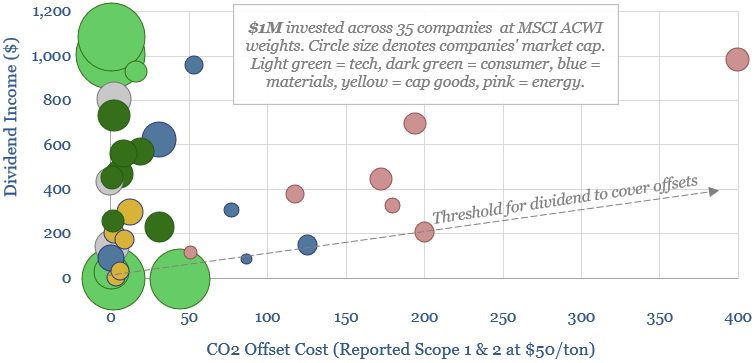

Carbon-offset equities’ Scope 1&2 CO2 emissions?

Download

Nature based CO2 removals: theory of evolution?

Download

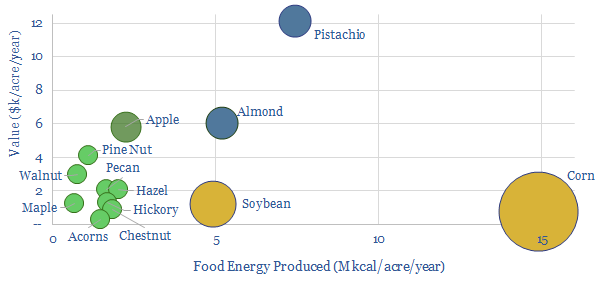

Tree crops: financial and agricultural yields?

Download

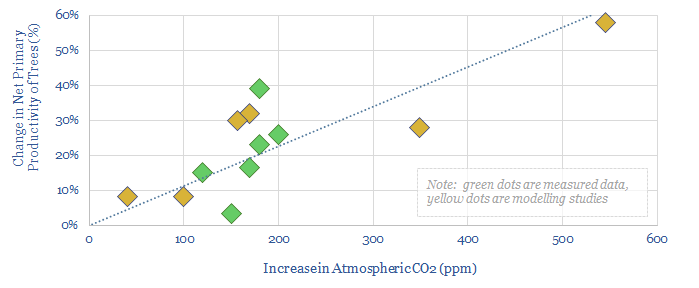

Photo opp: reforestation, CO2 fertilization and global temperatures?

Download

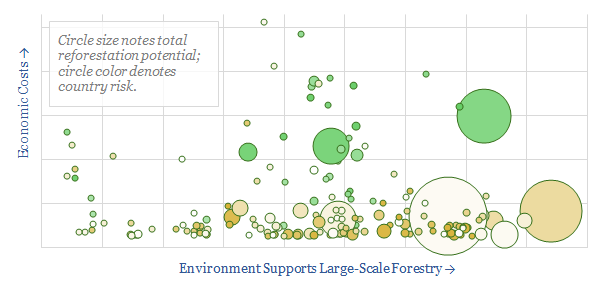

Global reforestation potential by country?

Download

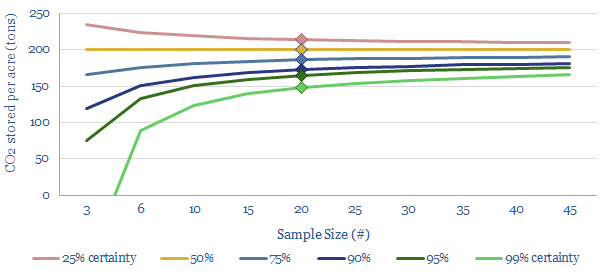

Carbon stocks: measuring the forest from the trees?

Download

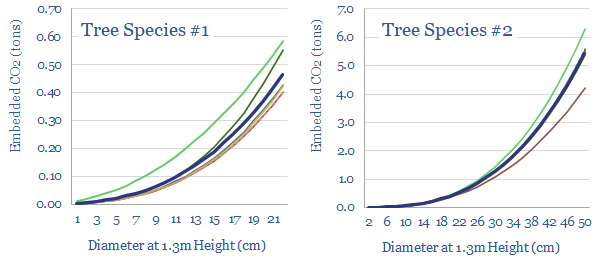

Allometry: how much CO2 in a tree or forest?

Download

Reforestation: a real-life roadmap?

Download

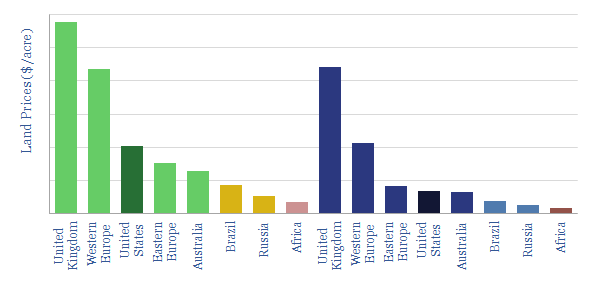

Land prices: an overview for renewables and reforestation?

Download

Carbon offset funds: the future of ESG?

Download

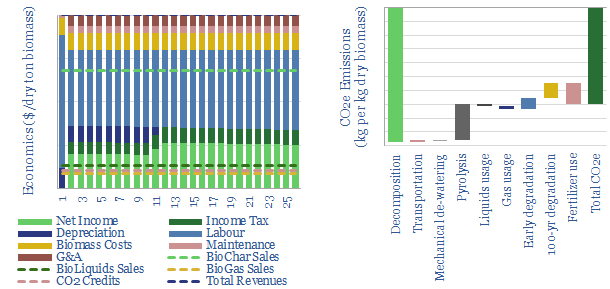

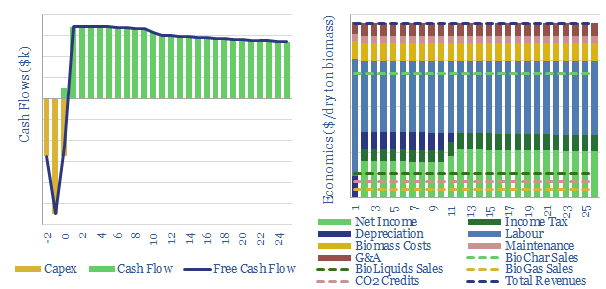

Biochar: burnt offerings?

Download

Biomass to biochar: the economics?

Download