Our aim of this model is to capture the economics of different green diesel plants: specifically, converting waste oils into renewable diesel via hydro-processing; and converting biologically derived oils into bio-diesel via trans-esterification.

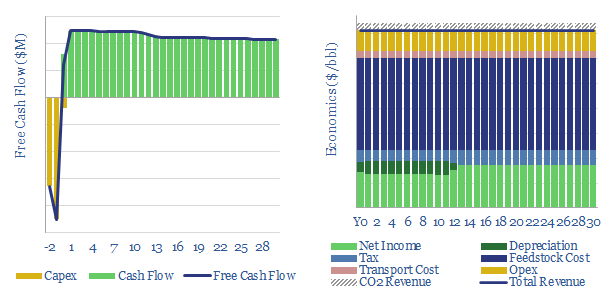

Our base case is that a US renewable diesel facility must achieve $4.6/gallon sales revenues (which is c$200/bbl) as it commercializes a product with up to 75% lower embedded emissions than conventional diesel.

Similarly, a US bio-diesel facility must achieve $3.6/gallon sales revenue (which is c$150/bbl) as it commercializes a product with around 60% lower embedded emissions than conventional diesel. A detailed breakdown of biodiesel CO2 intensity is also included in the model.

The models are most sensitive to input feedstock prices, then conversion efficiencies, and only secondarily to other cost lines. Detailed cost data are broken out from companies, projects and technical papers.

Our notes from technical papers are also captured in the data-file. Economics can be disaggregated as a function of feedstocks, feedstock:product ratios, heat inputs, gas prices, electricity consumption per gallon, electricity prices, utilization rates, capex costs, other opex costs, tax rates and other reagents (e.g., hydrogen, methanol, sodium hydroxide, hydrochloric acid, etc)..

Capex costs are estimated on both a top-down and a bottom-up basis. The average greenfield is costing around $30M/kbpd (details in the data-file), while have also disaggregated typical costs over 25 different input lines.

To read more about our conclusions on renewable diesel economics versus carbon credits, please see our article here. For our outlook on meeting renewable diesel expansion targets see here.