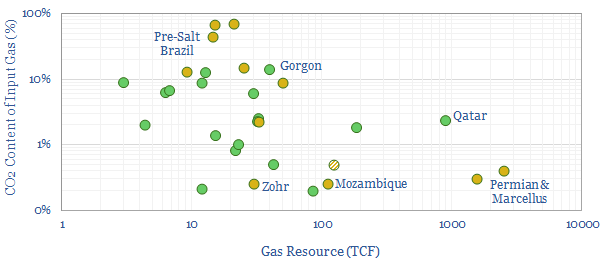

The CO2 content of gas fields is going to matter increasingly, for future gas development decisions: CO2 must be lowered to 50ppm before gas can be liquefied, adding cost. Moreover, it is no longer acceptable to vent the separated CO2 into the atmosphere. Carbon capture and storage costs range from $80-130/ton while we estimate the overall CO2 intensity of natural gas value chains to be around 56 kg/mcf.

Large, low-CO2 resources like the Permian, Marcellus and Mozambique are well-positioned to dominate future LNG growth. LNG markets are set to treble in our energy transition roadmap, rising from 400MTpa today to 1,100MTpa by 2050, for a c4% CAGR. The main reason is to displace coal, which is 2x more CO2 intensive.

What is the cost of switching from coal to gas? In the US, the price of delivered coal averaged $43/ton over the 2010-2019 timeframe, according to data from the EIA, which translates into a ridiculously cheap 0.7 c/kWh of thermal energy (kWh-th). Over the same timeframe, the average price of natural gas was $3.3/mcf, which translates into 1.1 c/kWh-th. Thus the excess cost of natural gas was around 0.4 c/kWh-th. Directly substituting coal fuel for gas fuel therefore incurred a cost of $20/ton of CO2 that was ‘avoided’. In Europe the premium for natural gas was around 1.5c/kWh-th incurring a cost of $80/ton of CO2 avoided. This is low on our CO2 abatement cost curve.

The present data-file tabulates 30 major gas resources around the world, their volumes, the CO2 content of those gas fields and how the CO2 is handled.