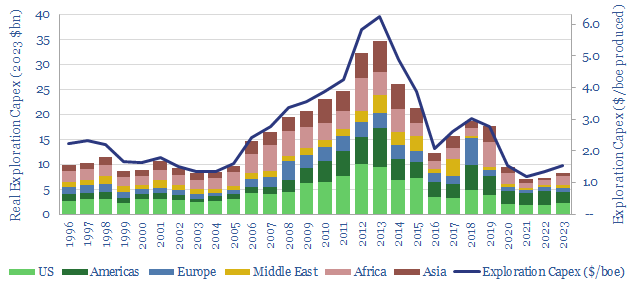

This data-file tabulates the Oil Majors’ exploration capex from the mid-1990s, in headline terms (in billions of dollars) and in per-barrel terms (in $/boe of production). Exploration spending quadrupled from $1/boe in 1995-2005 to $4/boe in 2005-19, and has since collapsed like a warm Easter Egg. One cannot help wondering about another cycle?

The peer group comprises ExxonMobil, Chevron, BP, Shell and TOTAL, which comprise c10% of the world’s oil production and 12% of the world’s gas production. As a good rule of thumb, this group can be thought of as c10% of global production.

This peer group quadrupled its exploration expenditures, from $5bn pa spent on exploration in 1995-2005 to an average of $20bn pa on exploration at the peak of the 30-year oil and gas cycle in 2010-2015. Exploration spend ramped from $1/boe to $4/boe over this timeframe. It has since fallen back to $1/boe, or around $1bn per company pa in 2022.

The US has always been the most favored destination, attracting c25% of all exploration investment, both offshore (e.g., Gulf of Mexico) and increasingly for short-cycle shale. During the last oil and gas cycle, the largest increases in exploration investment occurred in Africa, other Americas, Australasia; and to a lesser extent Europe and the Middle East.

One possible scenario for the future is that this peer group continues to limit its exploration expenditures to the bare minimum, below $1bn per company per year, or below $1/boe of production; under the watchwords of “capital discipline”, “value over volume” and “energy transition”.

However, it is somewhat terrifying to consider that the industry needed to spend an average of $2.5/boe on exploration from 2005-2019 in order to hold its organic production “flattish”.

Under-investment across the entire industry may foreshadow a sustained shortage of energy, especially if 50% lower-carbon gas is intended to replace coal as part of the energy transition, per our roadmap to net zero, or more pressingly as Europe faces sustained gas shortages. Hence one cannot help wondering if industry-wide exploration capex in the 2020s and 2030s is going to resemble the 2000s and 2010s?

This data-files aggregates the Oil Majors’ exploration capex, across ExxonMobil, Chevron, BP, Shell and TOTAL disclosures, apples-to-apples, back to 1995.