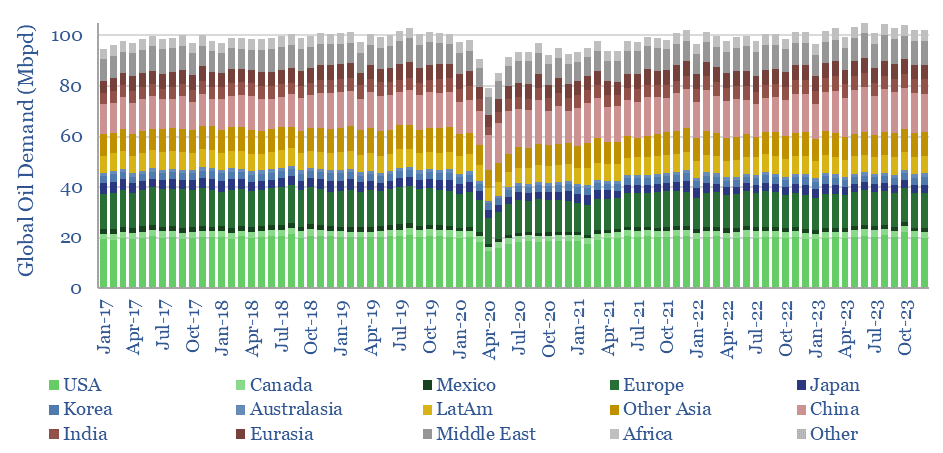

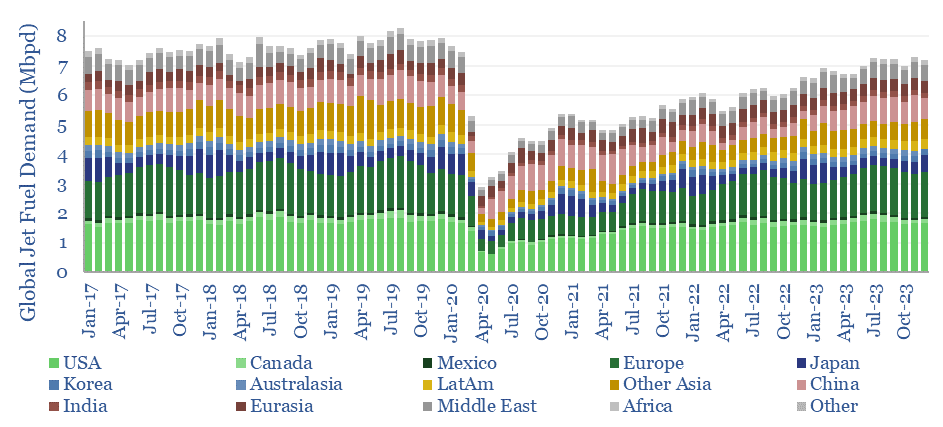

This data-file breaks down global oil demand, country-by-country, product-by-product, month-by-month, across 2017-2023. Global oil demand again hit new highs in 2023, driven by emerging world growth, especially across gasoline, jet fuel and naphtha. Although jet fuel use in 2023 was still 1Mbpd below pre-COVID levels.

This data-file is a breakdown of oil demand, month-by-month, across 120 countries/regions, and 12 oil products, from 2017 to 2023. We have compiled and cleaned the data as a reference for TSE clients.

Overall, global oil demand fell by -22Mbpd at trough in April-2020; and by -9Mbpd YoY in 2020 overall. In 2021, two thirds of the lost demand recovered, but global oil demand was still -3Mbpd below 2019 levels.

However, in 2022 and 2023, global oil demand hit new all-time highs. Global oil demand grew by +2.5Mbpd in 2023 to surpass 102Mbpd, a new all time peak, 1.5Mbpd higher than 2019 levels, prior to the COVID crisis.

Looking across countries and regions, 2023’s YoY growth in oil demand can be attributed to China (+1.5Mbpd to 16Mbpd), the US (+0.3Mbpd to 20.3Mbpd), India (+0.2Mbpd to 5.4Mbpd), Iraq (+0.1Mbpd to 0.9Mbpd), Saudi Arabia (+0.1Mbpd to 4.0Mbpd), Indonesia (+0.1Mbpd to 1.8Mbpd) and Africa (+0.1Mbpd to 4.3Mbpd). The full numbers are in the data-file. Continued demand from emerging world countries more than offsets declines from developed world countries, which is a source of growing geopolitical tension, per our note here.

Looking across products, jet fuel demand grew most in 2023, rising +1Mbpd to 7.0 Mbpd, yet jet fuel is the only major product category where demand still remains below 2019 levels, which were 8Mbpd.

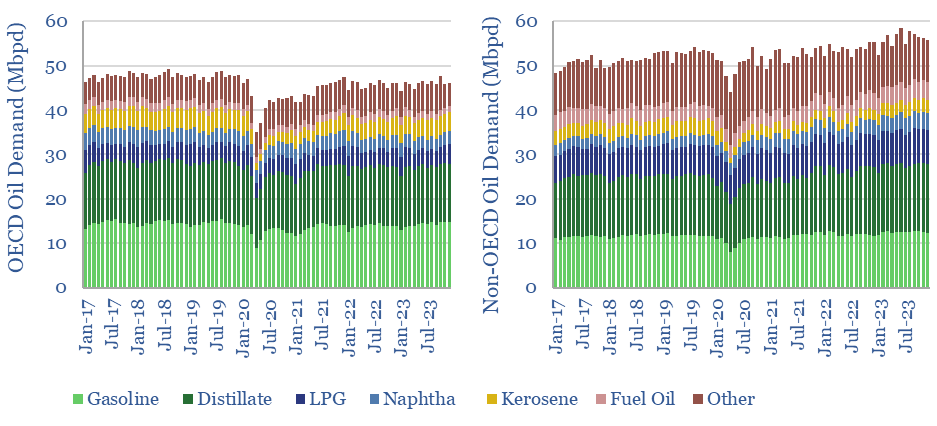

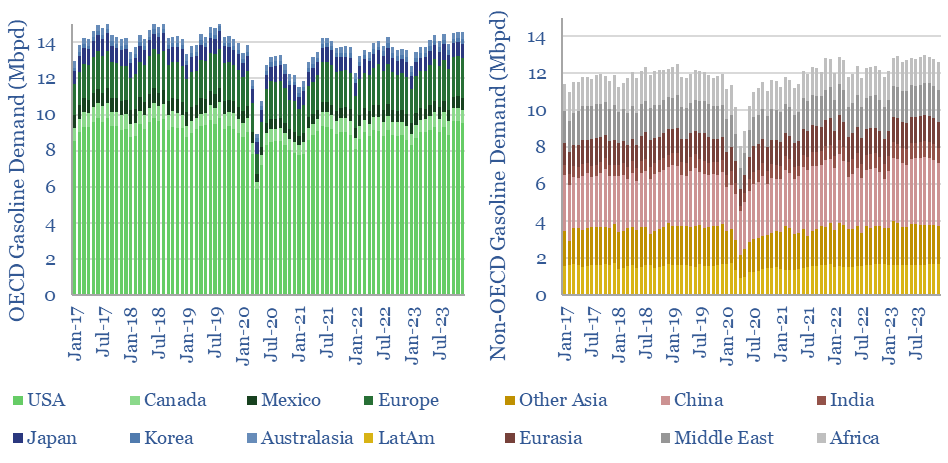

Gasoline demand also grew by a full +1Mbpd YoY in 2023 to an all time high of 27Mbpd. LPG demand for heating grew +0.4Mbpd to a new all time high above 11Mbpd. Naphtha demand for plastics grew +0.4Mbpd to a new all time high above 6.5Mbpd.

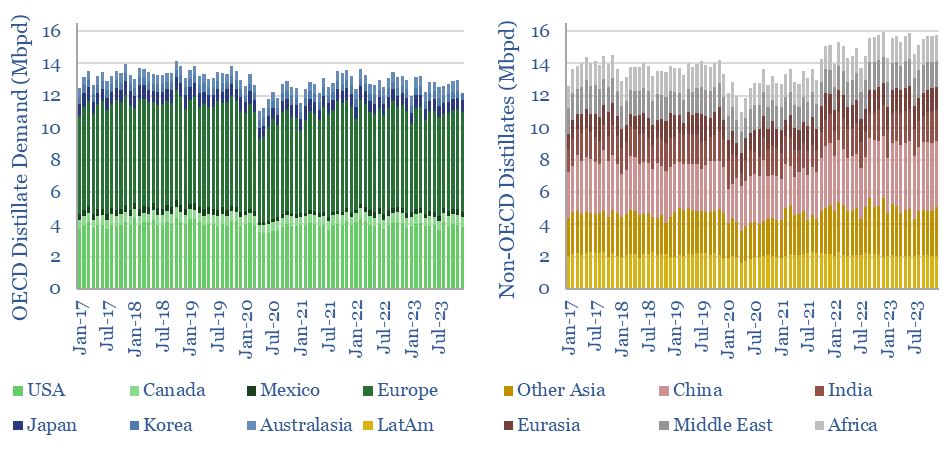

Distillate demand for diesel and industrial use grew +0.2Mbpd to a new all-time high above 28Mbpd. Fuel oil demand for shipping grew +0.2Mbpd to a new all time high above 5.4Mbpd.

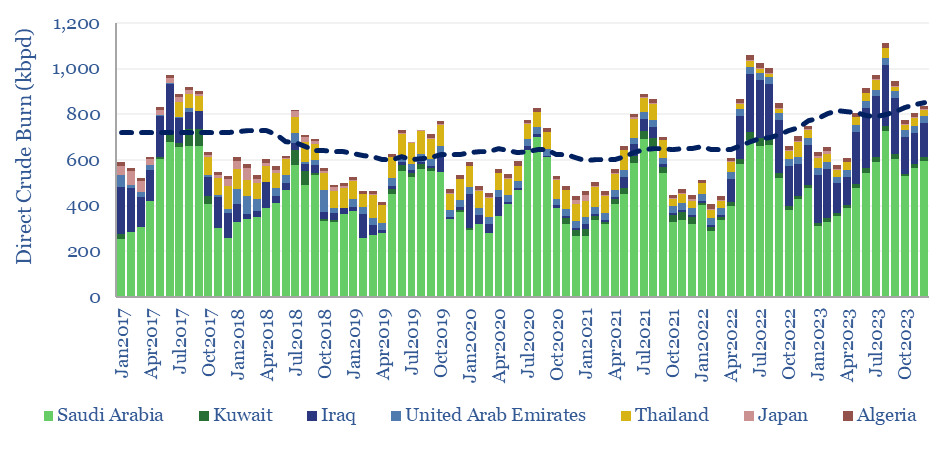

Even direct crude burning for power generation grew by +0.1Mbpd and averaged 0.85Mbpd (chart below).

Overall this data-set confirms our fears that renewables, EVs and other new energies would all need to ramp about 2-4x faster than their likely run-rate in the 2020s to stop oil demand (and even coal demand) from continuing to rise (note here).

This matters because in 2020, many commentators were stating that 2019 would have been the all-time peak for fossil fuels, that demand would never recover to pre-COVID levels, and that the world should therefore “stop investing” in hydrocarbons. Even today, we worry that some commentators are still materially over-estimating the pace of disruption in commodities (note here). A lack of pragmatism worries us (note here). Our LT oil demand model is here.

However, there is some uncertainty in this data-set, as the original data-source (JODI) only covers 80% of the oil market. We estimate the remaining countries by taking a proxy from “analogous countries” (the methodology is described in our original report here). There is always some guesswork involved, including for the ever-elusive “other products” category, which can be particularly erratic, especially in countries such as China. Full details are in the data-file.