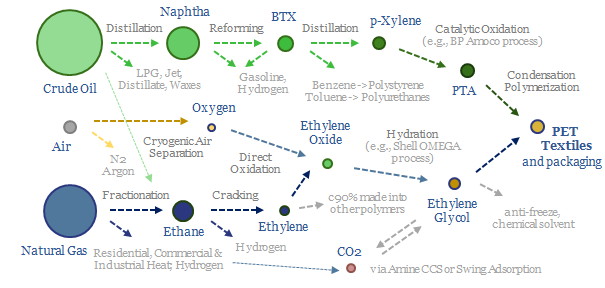

Polyester is the most produced textile fiber on Earth. Of the world’s 8GTpa of oil and gas production, 80MTpa, or 1%, ends up as PET, via eleven chemical processing stages that span naphtha-reforming, BTX separation into paraxylene, oxidation to PTA, plus ethane cracking, ethylene oxide and ethylene glycol. This data file covers the polyester production process, step by step, including yields and reaction conditions.

Global textile production stood at around 110MTpa in 2021, of which 60MTpa is polyester (and c50MTpa is PET), 25MTpa is cotton, 10MTpa is other polymers, 6MTpa is cellulosics (e.g., linens from flax, hemp, jute), 1-2 MTpa is wool, c1-2MTpa is leather.

Uses of polyester? Statistically, there is a c50% chance that the shirt on your back is made of hydrocarbons derived from the chemical processes described in this data-file and spun into PET fibers. But note that the uses of fibers are also broader than just clothing. Solar panels often use PET as an underlying layer of their backsheet.

Uses of PET? Global production of PET stands at 80MTpa. 50MTpa is used as textile fiber. And another 30MTpa is used as a plastic packaging material, e.g., for water bottles and clam-shell food containers. Note that our database of global plastic production only counts the 30MTpa of PET used as packaging material, while PET used in textiles are counted separately. Some classifications do not even count them as “plastics”. Because, well, they don’t look like other plastics or feel like other plastics.

The polyester production process? This data-file gives an overview of polyester production, specifically PET fiber production process, building up from first principles, covering inputs, outputs, mass balances, yields and reaction conditions.

There are eleven separate chemical processes in the value chain for producing PET, the hottest of which reaches 800ºC (ethane cracking), the coldest of which reaches -200ºC (cryogenic air separation), but the average process takes place at 200ºC.

PET is produced from the condensation polymerization of PTA and ethylene glycol at 220-260ºC and 3-6 bar pressure. The PTA is produced from the catalytic oxidation of paraxylene (e.g., using BP’s Amoco process), which in turn is derived from catalytic reforming of naphtha. The ethylene glycol is produced from hydration of ethylene oxide (e.g., using Shell’s OMEGA process), which in turn is derived from cracking ethane, which is the most common NGL during the fractionation of natural gas.

There are three sources of upside for PET in the energy transition. Most interestingly, the electrification of vehicles will lower demand for motor gasoline, tempting refiners to flow less reformate into the gasoline pool, and more reformate into BTX for chemicals, with the overall effect of lowering the input costs for PTA? Effectively, there is a pathway where the electrification of vehicles improves the margins of polyester producers?

Similarly, if gas is ramped up to displace 2-2.5x more CO2 intensive coal, this will yield more ethane as a by-product, which may flow through to lower input costs for ethane crackers, and ultimately lower the input costs of ethylene glycol.

Third, PET is one of the few polymers that is already fully recyclable, which is also an advantage for sustainability. In our broader research, we have looked at next-gen PET recyclers, such as Carbios.

Land use of global textile production? Producing 25MTpa of cotton ties up 85M acres of land globally. This matters as deforestation has driven 25-30% of all anthropogenic emissions historically (data here and here). In principle, if 85M acres of land could be reforested, it would absorb c500MTpa of CO2, or 1% of today’s global CO2 emissions.

Leading companies in polyester value chains? The world’s largest PET producers include Indorama (Indonesia), Alpek (Mexico), Yasheng, Sanfame, CRC, FENC (China) and Reliance (India). Across the input value chain, leading PTA producers also include BP, Sinopec, Reliance, SABIC, Lotte; and leading ethylene glycol producers include Shell, Dow, SABIC, BASF, Sinopec, Formosa, Reliance, et al.