This data-file is a screen of leading companies in polyurethane production, capturing 80% of the world’s 25MTpa market, across 20 listed companies and 3 private companies. We see growing demand for polyurethanes — especially for insulation, electric vehicles and consumer products — while there is also an exciting prospect that EVs displace reformates from the gasoline pool, helping to deflate feedstock costs. So who benefits?

This screen of polyurethane producers captures about 80% of all global polyurethane production, across 23 chemicals companies, across different parts of the value chain.

Global production of polyurethane stands at around 25MTpa as of 2022, with major uses in insulation materials, elastic fibers (e.g., spandex/lycra), foamed furniture materials such as mattresses, consumer products like shoes, vehicles, electrical products and adhesives/resins. The World Cup Football famously incorporated polyurethanes from Covestro. Global plastics production, by polymer, is quantified here.

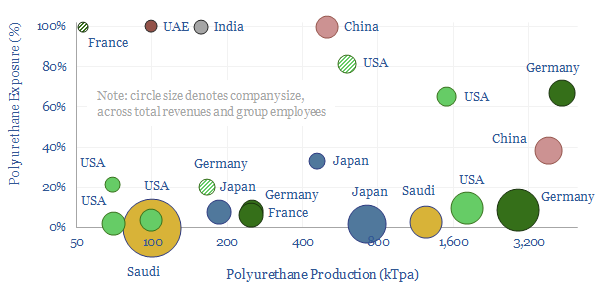

Five companies dominate the polyurethane industry and produce over half of all global polyurethanes, of which two are listed in Germany, two are listed in the US and one is listed in China. 5-7 lines of key details on each company are summarized the data-file, including product exposures, geographic exposures and CO2 intensity.

Are polyurethane producers concentrated or diversified? Concentration varies widely by company. The median company in the screen is diversified, and derives just 10% of its business from polyurethanes. Although seven companies derive over half of their revenues from polyurethanes and five are over 80% concentrated.

Are polyurethane producers integrated? Some companies in our screen simply purchase polyols and dio-isocyanate intermediates as commodity chemicals, and specialize in their polymerization, foaming, and forming into products (e.g., one company in the screen has a 30-40% market share for mattresses in geographies such as India and Australia). Others are vertically integrated all the way back to naphtha, benzene, toluene or propylene inputs.

Inorganic activity has also been prevalent in the polyurethanes business, as some companies have suffered from weak 3-7% margins and ROICs, especially in challenging geographies. Dow and DuPont famously merged and then unmerged. Thailand’s PTT has been buying up niche polyurethanes businesses. And Aramco bought Novomer’s CO2-absorbing polyols technology for up to $100M back in 2016.

The polyurethane industry is opaque and complex, hence this data-file is not going to be perfect. We have used our best guesses from public disclosures, and triangulation of reported reports, to make informed estimates, breaking down volumes for the leading companies in polyurethane. All of our plastics and polymers research is summarized here. For further details please see our outlook for polyurethane in the energy transition.