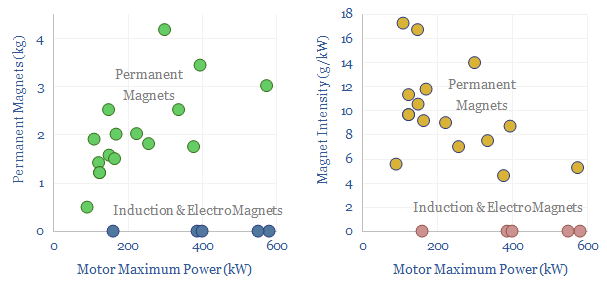

This data-file assesses electric vehicle magnets, the use of permanent magnets and the use of Rare Earth materials such as neodymium (NdFeB). 80-90% of recent EVs have used Rare Earth permanent magnets, averaging 1.5 kg per vehicle, or 7.5g/kW of drive-train power, across the data-file. But the numbers vary vastly. From 0-4 kg per vehicle. 20 vehicles from different OEMs are tabulated in the data-file.

Electric vehicle motors produce torque as magnets in their rotors try to align with rotating magnetic fields that are created in their stator windings by traction inverters. For more details and underlying theory, please see our overview of magnets.

What magnets are used in electric vehicles? 80-90% of electric vehicles sold in the past half decade have used permanent magnets in their rotors, according to different sources.

This data-file tabulates the magnets used by different manufacturers, in kg/vehicle, kg/kW of power, and over time. The average EV in our screen used 1.5kg of Rare Earth Magnets per vehicle, which equates to 7.5 g/kW of power.

The scatter is broad. Some vehicles will use 4 kg of Rare Earth magnets, or as much as 15 g/kW. Almost all of the Rare Earth Magnets are NdFeB, although there are differing blends of other Rare Earths, including dysprosium and praseodymium.

Rare Earth magnets are preferred, because they are more efficient and more reliable. For example, one alternative is to use an electro-magnet in the rotor, but then this magnet needs a power supply (impacting efficiency by 1-3pp) and there is a risk of degradation on the rotating electrical connection (brushes) that feed this power supply in. Another alternative is to use induction, to magnetize the rotor core, but core losses and iron losses also leak power (impacting efficiency by 2-7pp) and generate heat via hysteresis.

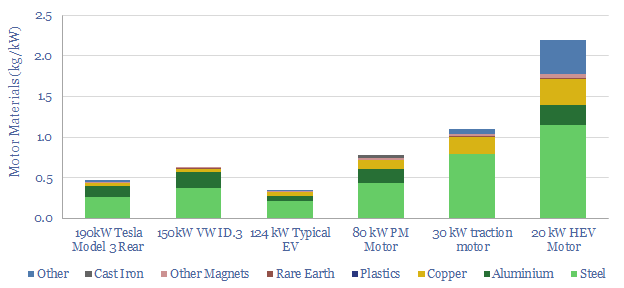

Thrifting Rare Earths from EVs. One strategy we have seen from EV makers is to use less magnetic material. For example, this can be achieved by using a permanent magnet motor for the rear wheels, and induction machines on the front wheels. The induction motors are often idled for efficiency reasons, and only used when extra front-wheel power is required. Another approach to thrifting out Rare Earths optimizes the shapes or “slots” of the rotor, or winding configurations in the stator. The materials make-up of different EVs is charted below.

Supply chains. Another strategy we have seen is for EV makers to sign agreements that help guarantee security of supply. For example, in 2022 Hyundai-Kia signed an 1,000-1,5000 Tpa offtake agreement for NdPr oxides from Arafura Resources at the Nolans mine, 135km North of Alice Springs (reported here). Likewise, General Motors will source Rare Earths from MP Materials’ Mountain Pass mine project (reported here).

A final strategy is to use electro-magnets or induction motors in lieu of permanent magnets. Famously, this strategy was used by Tesla in the Model S and Model X, while Tesla said in early-2023 that it would also move away from Rare Earth magnets in future versions of the Model Y. Some European auto-makers are also adopting this strategy (details in the data-file).

There is some guesswork in the data-file. For some companies, clear data are available. For others, more painfully, googling the vehicle’s name and the keyword “magnets” was more likely to return hundreds of hits for promotional fridge magnets depicting the vehicle’s sleek design features, rather than reveal information about the use of Neodymium in its drivetrain.

Will Rare Earths be a bottleneck for electric vehicles? We think that the ramp-up of wind turbines and electric vehicles will require very large expansions in Rare Earth metals production, while in times of shortage, OEMs will sacrifice efficiency by thrifting out bottlenecked materials and relying on induction or electromagnetic machines. For more details, please see our broader research into Rare Earths.