Silicon carbide power electronics will jolt the energy transition forwards, displacing silicon, and improving the efficiency of most new energies by 1-10 pp. Hence we wonder if this disruptor will surprise to the upside, quintupling by 2027. This 12-page note reviews the technology, advantages, challenges, and who benefits?

Transistors, such as IGBTs and MOSFETs, are the building blocks for solar inverters, wind converters, battery chargers and EV drive trains. We argue that their crucial role in new energies is analogous to the $100bn pa valve sector in conventional energy (pages 2-4).

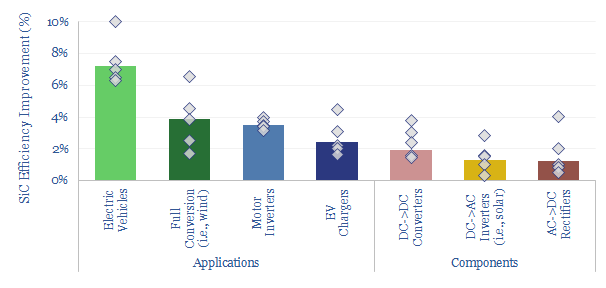

The incumbent semiconductor used in 99.9% of electronics and 95% of power electronics is silicon. However, a new entrant is gaining ground. Silicon carbide (SiC) is a fundamentally better semiconductor for power-electronic applications, yielding 1-10% efficiency improvements (page 5).

Why is SiC “better”? The answer stems from material properties, including 100x lower on-resistance, 10x lower switching losses and 3x better thermal performance. An explanation of these variables, and why they matter, is covered on pages 6-7.

Challenges for SiC power electronics? There are three challenges for SiC, around cost, reliability and scaling. These stem from the production process and can be quantified. Interestingly, we think this set of challenges shapes who is likely to dominate this fast-growing market (pages 8-9).

How large is the silicon carbide power electronics market in $bn? We think the SiC market may surprise to the upside. Different commentators’ SiC market sizing assessments and forecasts are summarized on page 10.

Companies producing SiC power electronics and materials? Our screen of SiC companies, covers 10 public and 2 private companies. There is one stand-out pure-play. Other names with exposure to the theme are mid-large cap companies listed in the US, Europe and Japan (pages 11-12).