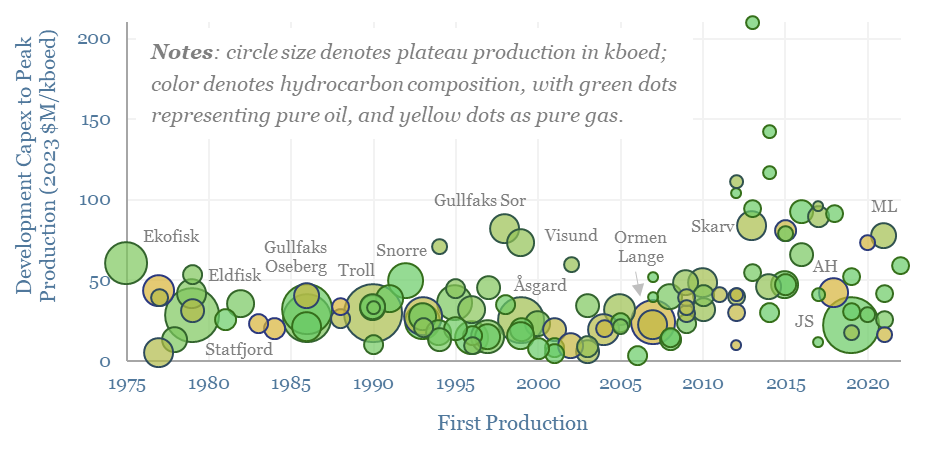

Across 130 offshore oil fields in Norway, going back to 1975, real development capex per flowing barrel of production has averaged $33M/kboed. Average costs have been 2x higher when building during a boom, when one-third of projects blew out to around $100M/kboed or higher. The data support countercyclical investment strategies in energy.

This data-file captures the development capex for 130 oilfields offshore Norway, from 1975-2023, in real 2023 USD per flowing barrel. Specifically, data on each field are publicly available from the Norwegian Offshore Directorate, in NOK, while we have cleaned the data, converted it into USD using historical exchange rates from the Bank of England and then translated the numbers in 2023$ real terms.

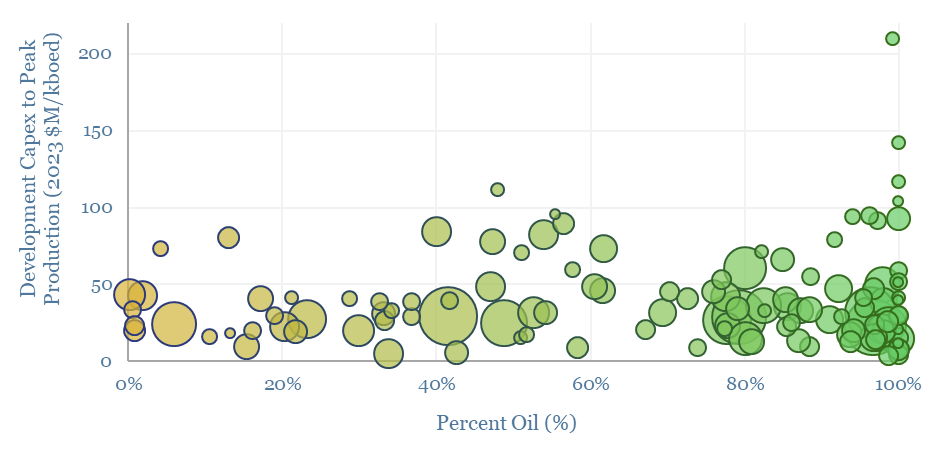

The average Norwegian offshore field cost $33M/kboed to develop, comprising $3.3bn of development capex, peaking at 100kboed of hydrocarbon production, of which two-thirds was liquids and one-third was gas. There was no material difference in the costs of oilfield or gas field developments (chart below).

Development costs can also be indexed over time, running at a relatively constant $30M/kboed in the 1980s, 1990s and early 2000s. Total development capex actually declined from 1970s levels over this time frame, in real terms, due to learning curve effects.

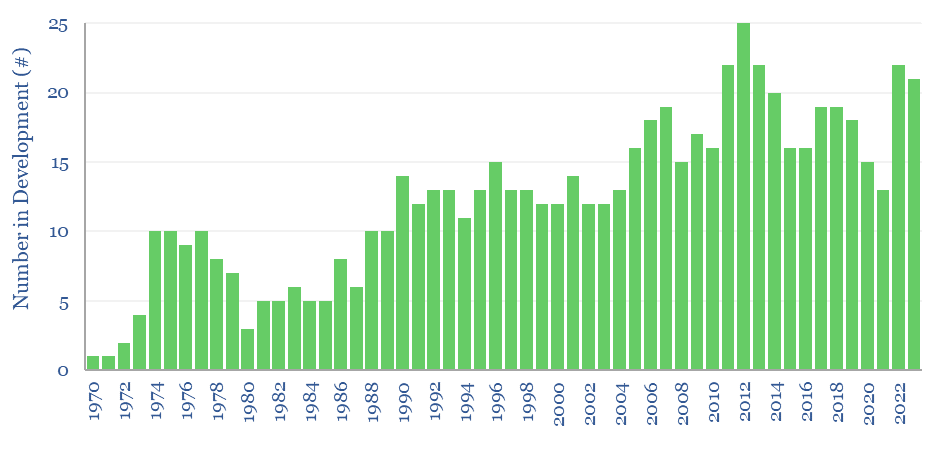

Activity levels have also varied. On average, there have been 12 fields in development across the Norwegian Continental Shelf. However, at peak, there were 20-25 fields under development in 2011-2015.

During this timeframe, the average development cost also doubled to $60-70M/kboed. The distribution of outcomes was also much wider during this timeframe of intense activity levels, with an intensified risk of ‘capex blow-outs’, as one-third of the projects exceeded $100M/kboed.

On the other side of the spectrum, low-cost developments can cost as little as $5-10M/kboed, especially using concepts such as tiebacks and unmanned platforms, and especially when the supply chain had slack capacity. A nice example is Johan Sverdrup. There was also a -16% correlation between field size and offshore development costs.

Our cleaned data-set is available for download below. Across all energy sub-sectors, there are benefits to counter-cyclical investment, whether we are considering oil, gas, LNG, nuclear, wind, solar or power grids.