Our new energies research explores economic opportunities to drive the energy transition. Our definition of new energies is that they are not derived from the combustion of extracted resources. Solar radiation is directly converted to electricity in a photovoltaic cell. Wind and hydro power harness moving masses of fluids to drive turbines. Nuclear energy derives heat from fissioning heavy atoms; possibly in the future, from fusing light atoms. Generally these new energies yield electricity directly (i.e., no heat engines are involved). Electricity can be the highest-grade form of energy. But electricity also requires resilient power grids, sophisticated power electronics and possibly also energy storage via batteries. Achieving an energy transition requires moving ‘Heaven and Earth’, to de-bottleneck bottlenecks in power transmission (heaven) and mined metals and materials (earth). We also consider hydrogen and biofuels among new energies.

Solar Research

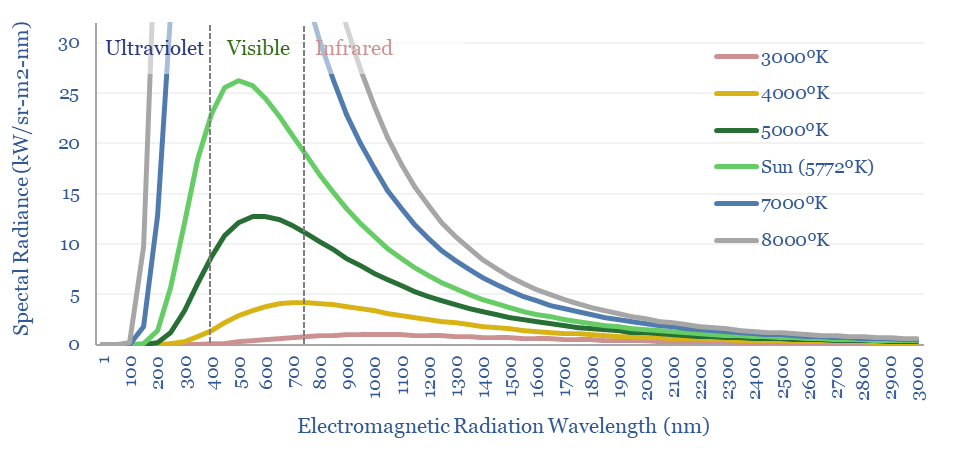

Electromagentic radiation is a form of energy, exemplified by light, infrared, ultraviolet, microwaves and radiowaves. What is the energy content of light? How much of it can be captured in a solar module? And what implications? We answer these questions by explaining the Planck Equation and Shockley-Queisser limit from first principles.

Download

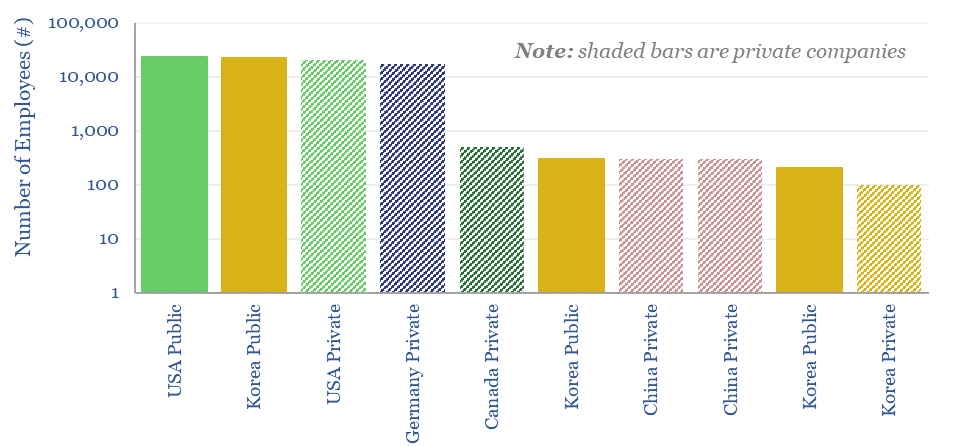

This data-file is a screen of leading companies in vapor deposition, manufacturing the key equipment for making PV silicon, solar, AI chips and LED lighting solutions. The market for vapor deposition equipment is worth $50bn pa and growing at 8% per year. Who stands out?

Download

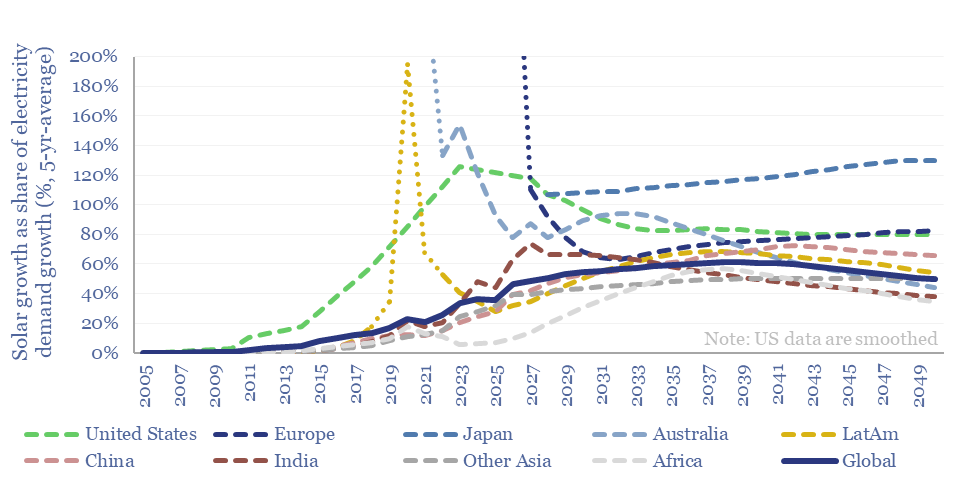

How much new solar can the world absorb in a given year? And are core markets such as the US now maturing? This 15-page note refines our solar forecasts using a new methodology. Annual solar adds will likely plateau at 50-100% of total electricity demand growth in most regions. What implications and adaptation strategies?

Download

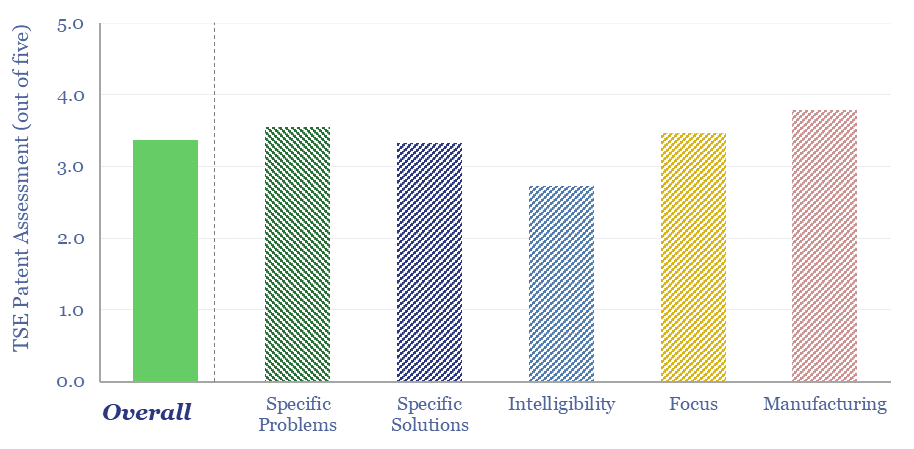

50 companies make conductive silver pastes to form the electrical contacts in solar modules. This data-file tabulates the compositions of silver pastes based on patents, averaging 85% silver, 4% glass frit and 11% organic chemicals. Ten companies stood out, including a Korean small-cap specialist.

Download

This data-file is our LONGi technology review, based on recent patent filings. The work helps us to de-risk increasingly efficient solar modules, a growing focus on perovskite-tandem cells, and low-cost solar modules, with simple manufacturing techniques that may ultimately displace bottlenecked silver from electrical contacts. Key conclusions in the data-file.

Download

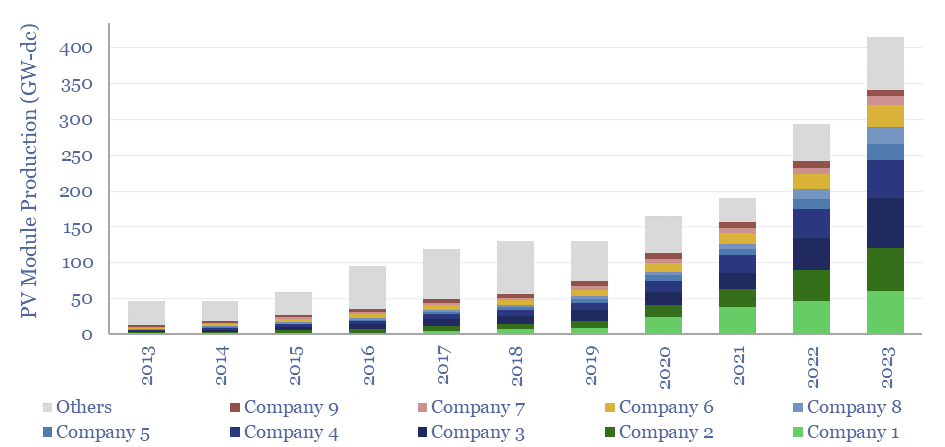

The world produced over 400GW of solar modules in 2023, which is up 10x from a decade ago. This data-file breaks down solar module production by company and over time, comparing the companies by solar module selling prices ($/kW), margins (%), efficiency (%), transparency, and technology development.

Download

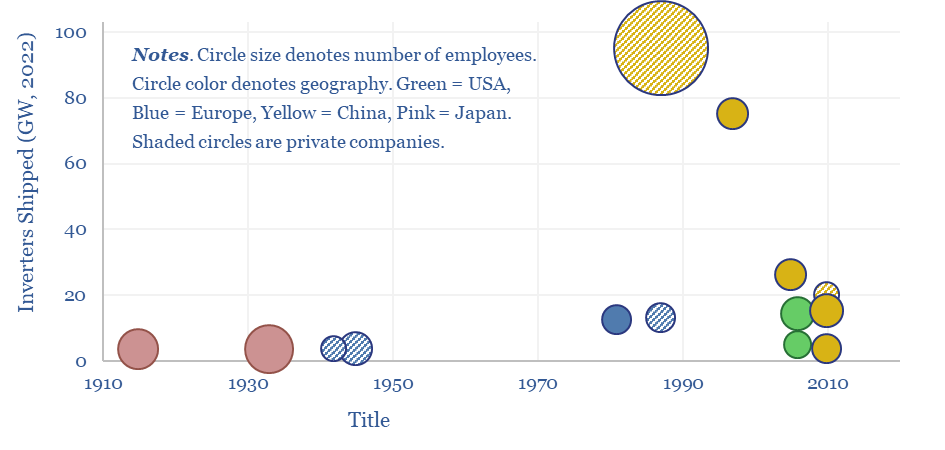

This data-file tracks some of the leading solar inverter companies and inverter costs, efficiency and power electronic properties. As China now supplies 85% of all global inverters, at 30-50% lower $/W pricing than Western companies, a key question explored in the data-file is around price versus quality.

Download

Semiconductors underpin solar panels, electric vehicles and electronics. Hence this 20-page note aims to explain semiconductor physics from first principles: their conductivity and resistance, their use in devices, plus implications for materials value chains and the energy transition itself?

Download

This datafile calculates the conductivity and resistivity of semiconductors from first principles, based on their bandgap, doping, electron and hole mobility, temperature, the Fermi-Dirac distribution and the Effective Density of States. Put in any inputs you like to compute the resistance of silicon, germanium or GaAs.

Download

Solar encapsulants are 300-500μm thick films, protecting solar cells from moisture, dirt and degradation; electrically insulating them at 4 x 10^15 Ωcm resistivity; and yet allowing 90% light transmittance. The industry is moving away from commoditized EVA towards specialized blends of co-polymers and additives. Is there a growing moat around Mitsui Chemicals' solar encapsulants?

Download

Polysilicon is a highly pure, crystalline silicon material, used predominantly for photovoltaic solar, and also for 'chips' in the electronics industry. Global polysilicon capacity is estimated to reach 1.65MTpa in 2023, and global polysilicon production surpasses 1MTpa in 2023. China now dominates the industry, approaching 90% of all global capacity.

Download

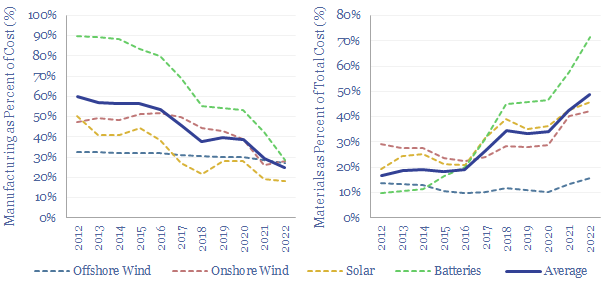

Over the past decade, costs have deflated by 85% for lithium ion batteries, 75% for solar and 25% for onshore wind. Now new energies are entering a new era. Future costs are mainly determined by materials. Bottlenecks matter. Deflation is slower. Even higher-grade materials are needed to raise efficiency. This 14-page note explores the new … Continue reading "New energies: the age of materials?"

Download

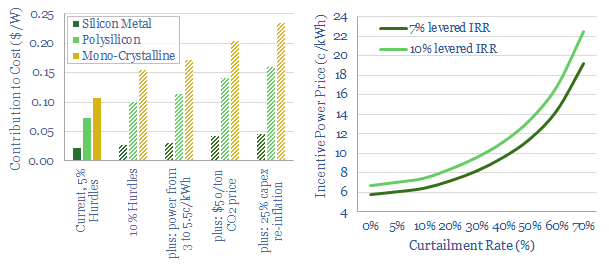

Utility-scale solar costs have deflated by 75% in the past decade to around $1,000/kW. 60% has been the scale-up to mass manufacturing, and 40% has been rising efficiency of solar modules. Materials costs now look likely to dominate future costs and their trajectory. And advanced materials can help double efficiency again from here? Who benefits?

Download

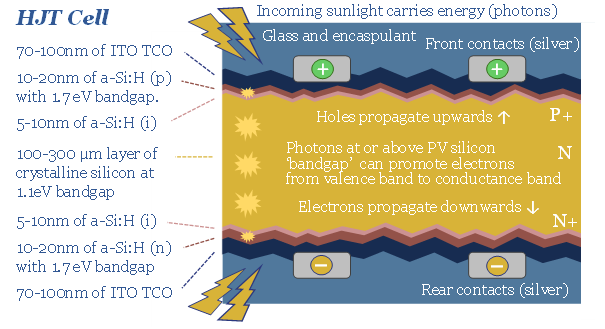

HJT solar modules are accelerating, as they are highly efficient, and easier to manufacture. But HJT could also be a kingmaker for Indium metal, which is used in transparent and conductive thin films (ITO). Our forecasts see primary Indium use rising 4x by 2050. Indium is 100x rarer than Rare Earth metals. It could be a bottleneck. What implications?

Download

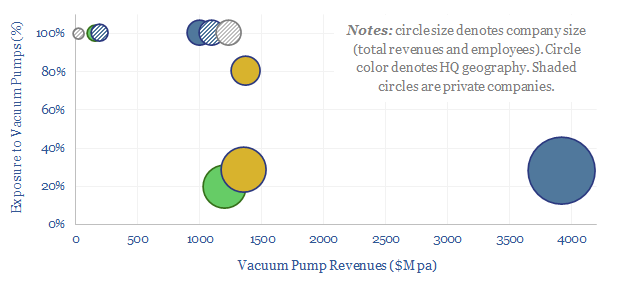

The global market for vacuum pumps is worth $15bn per year, with growing importance for making semiconductors, solar panels and AI chips. This data-file reviews ten leading companies in vacuum pumps, including one European-listed capital goods leader, a European pure-play and a Japanese-listed pure-play.

Download

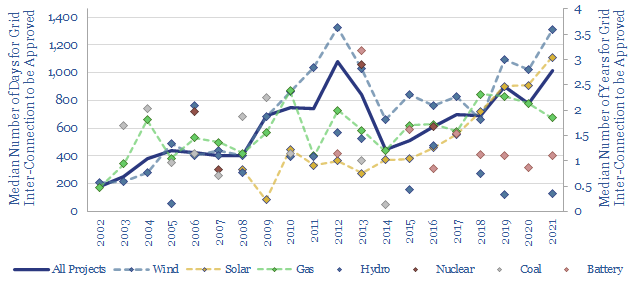

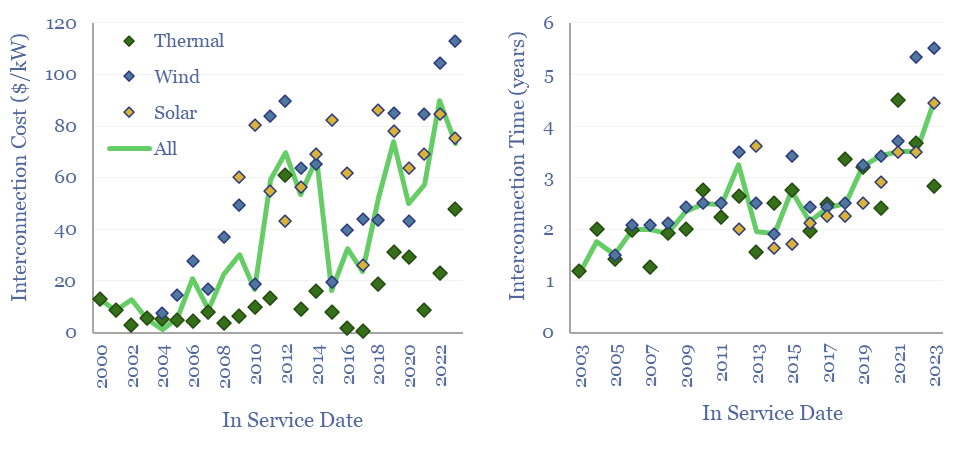

Is the power grid becoming a bottleneck for the continued acceleration of renewables? The median approval time to tie a new US power project into the grid has climbed by 30-days/year since 2001, and doubled since 2015, to over 1,000 days (almost 3-years) in 2021. Wind and solar projects are now taking longest. This data-file looks for de-bottlenecking opportunities, and wonders about changing terms of trade in power markets.

Download

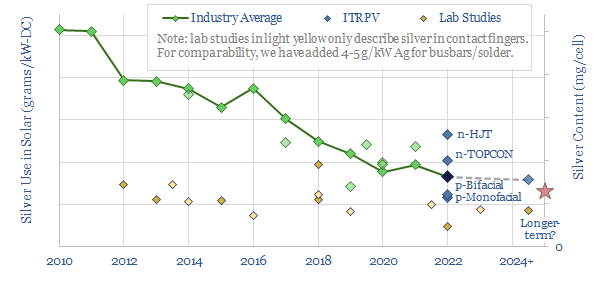

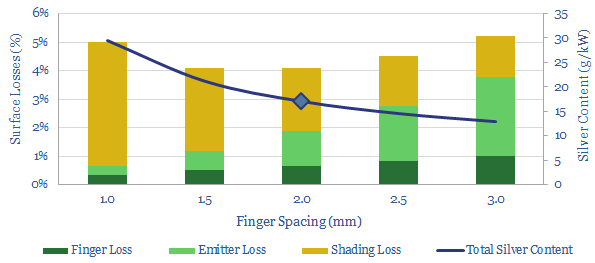

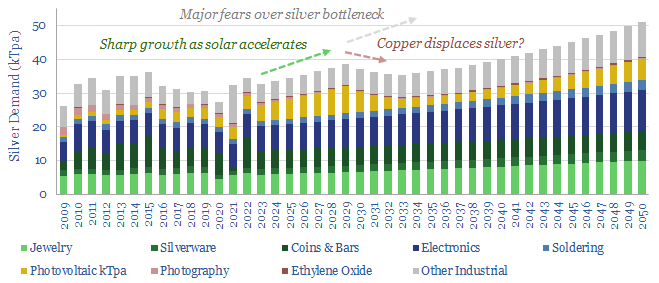

Ramping new energies is creating bottlenecks in materials. But how much can material use be thrifted away? This is a case study of silver intensity in the solar industry, which halved in the past decade, and could halve again. Conclusions matter for solar companies, silver markets, other bottlenecks.

Download

This data-file calculates the losses in a solar cell from first principles. Losses on the surface of the cell are typically c4%, due to contact resistance, emitter resistance and shading. Sensitivity analysis suggests there may be future potential to halve silver content in a solar cell from 20g/kW to 10g/kW without materially increasing the losses beyond 4%.

Download

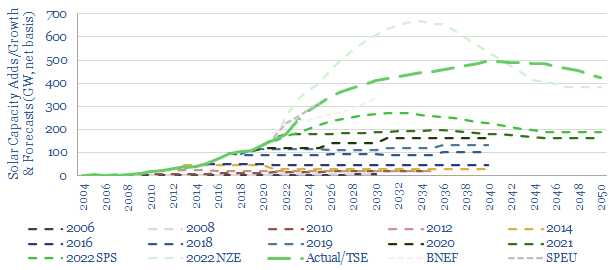

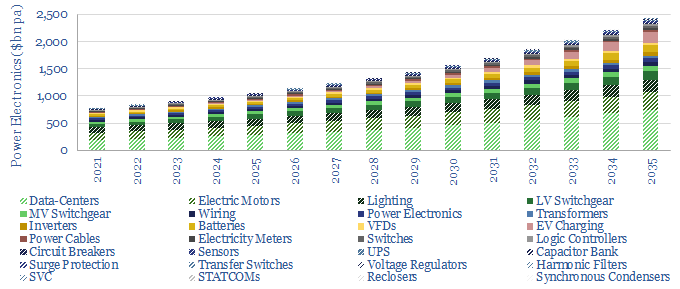

Forecasts for future solar growth have an unsatisfyingly uncertain range, varying by 3x. Hence this 15-page note discusses the future of solar. Solar capacity additions likely accelerate 3.5x by 2030 and 5x by 2040. But this creates bottlenecks, including for seven materials; and requires >$1trn pa of additional power grid capex plus $1trn pa of power electronics capex.

Download

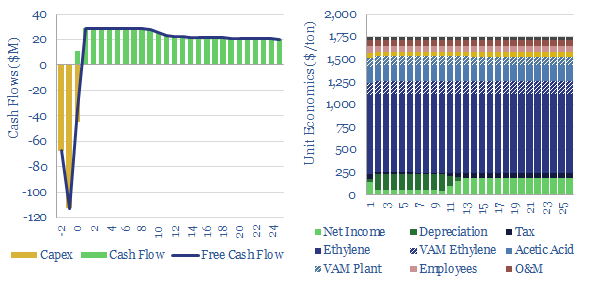

Ethylene vinyl acetate is produced by reacting ethylene with vinyl acetate monomer. This data-file estimates production costs, with a marginal cost between $1,500-2,000/ton, and a total embedded CO2 intensity of 3.0 tons/ton. EVA comprises 5% of the mass of a solar panel and could be an important solar bottleneck.

Download

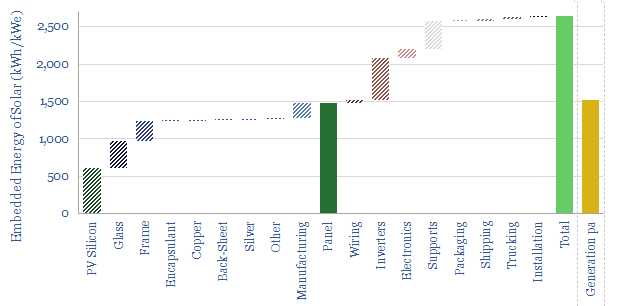

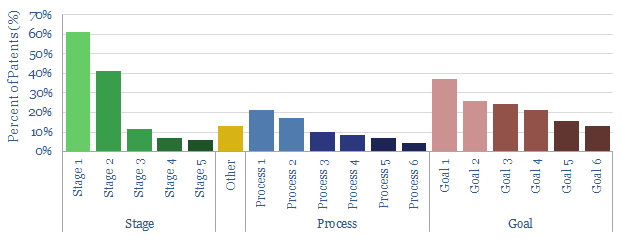

What is the energy payback and embedded energy of solar? We have aggregated the consumption of 10 different materials (in kg/kW) and around 10 other energy-consuming line-items (in kWh/kW). Our base case estimate is 2.5 MWH/kWe of solar and an energy payback of 1.5-years. Numbers and sensitivities can be stress-tested in the data-file.

Download

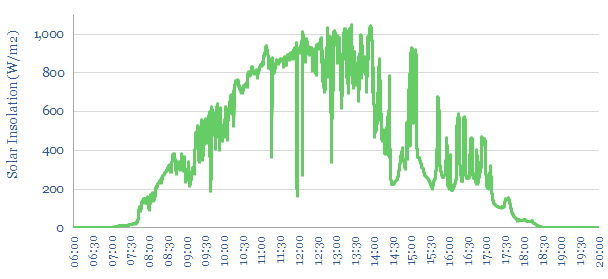

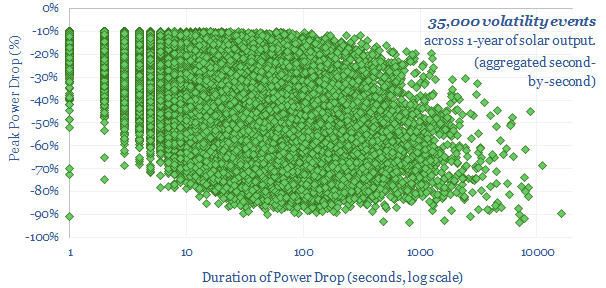

This 20-page note quantifies the statistical distribution of short-term volatility at solar power plants. Solar output typically flickers downwards by over 10%, around 100 times per day. Can industrial processes truly be ‘powered by solar’? What opportunities will arise to buffer the volatility?

Download

We have aggregated the volatility and power drops across an entire year of second-by-second solar data. Each day typically sees 100 volatility events where output drops by over 10%, and 10 events where output drops by over 70 events. Volatility also varies day by day.

Download

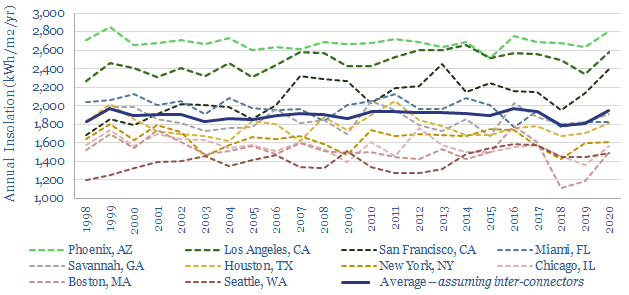

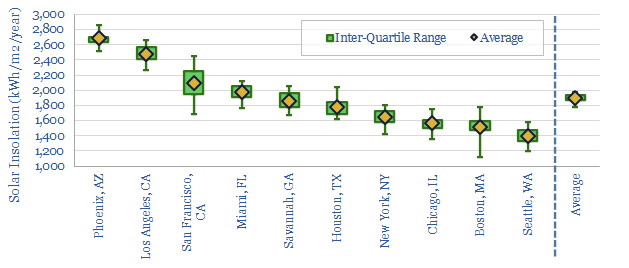

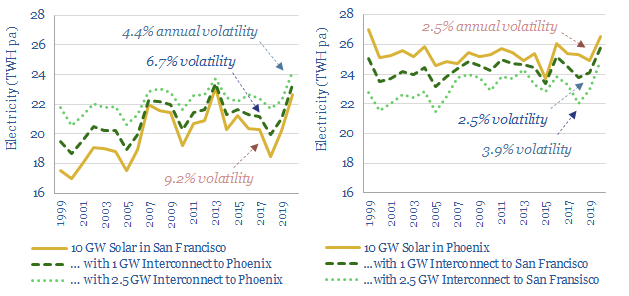

The solar energy reaching a given point on Earth’s surface varies by +/- 6% each year. These annual fluctuations are 96% correlated over tens of miles. And no battery can economically smooth them. Solar heavy grids may thus become prone to unbearable volatility. Our 17-page note outlines this important challenge, and finds that the best solutions are to construct high-voltage interconnectors and keep power grids diversified.

Download

This data-file aggregates the average annual volatility of solar (and wind) resources across ten locations, mainly cities, in the United States. Annual volatility of incoming solar energy reaching ground level tends to vary by +/- 6% per year, is 96% correlated across different locations within that city, and 50-70% correlated with other cities in the same region.

Download

Can large-scale power transmission smooth renewables' volatility? To answer this question, this horrible 18MB data-file aggregates 20-years of hour-by-hour solar insolation arriving at four cities in the US. The volatility in year-by-year can be halved by a single inter-connector.

Download

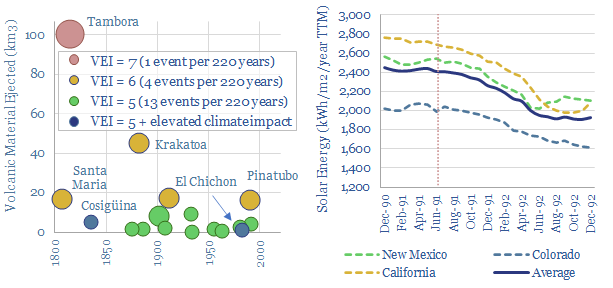

Every 30-years on average, a giant volcano erupts, ejecting >10km3 of debris, including aerosols that dim the sun and temporarily cool the planet by 0.5-1C. After Mount Pinatubo erupted in 1991, US solar insolation fell by 20% in 1992. What implications for global energy security and energy transition?

Download

The front contacts in today’s solar cells are made of screen-printed silver, absorbing 11% of 2021’s silver market. Silver can be substituted with copper, but manufacturing is c5x more costly. So we expect a silver spike, then a switch. This 16-page note explains our outlook, and who benefits?

Download

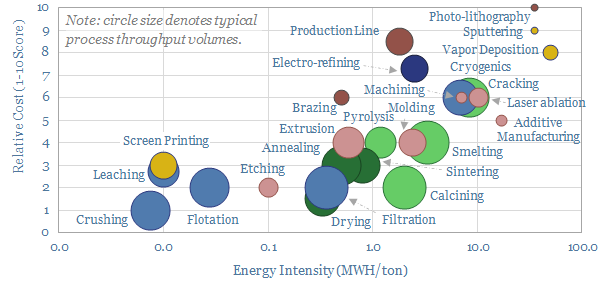

An of overview of manufacturing methods is given in this data-file. Costs are 70% correlated with energy intensity, ranging from well below 0.3 MWH/ton to well above 7MWH/ton. The lowest cost techniques take place at huge throughput in the mining industry, while the most intricate are used in semiconductor.

Download

Trackers re-position solar panels to face the sun, as it arcs across the sky, day-by-day, season-by-season, due to the Earth's 23.5-degree tilt. Solar tracker efficiency improvements typically range from 20-40%. Capex cost increases are c20%. Thus 40-90% of utility solar now uses trackers.

Download

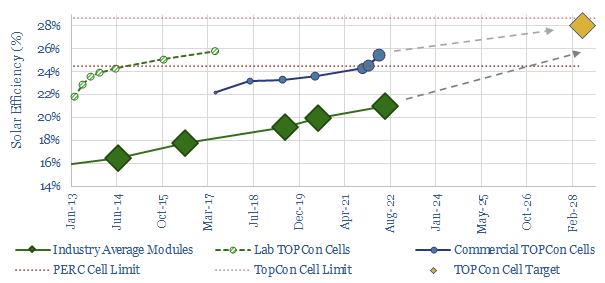

A new solar cell is vying to re-shape the PV industry, with 2-5% efficiency gains and c25-35% lower silicon use. This 13-page note reviews TOPCon cells, which will take some sting out of solar re-inflation, tighten silver bottlenecks and may further entrench China’s solar giants.

Download

Nexwafe is growing standalone silicon wafers on mono-crystalline seed wafers, with no need to slice ingots. It should improve solar efficiency, materials intensity and CO2 intensity. Our technology review found 60 patent filings and can partly de-risk growth ambitions.

Download

First Solar is a solar manufacturer with capacity to produce 8GW of solar panels per year, using CdTe thin film technology. It has production in the US and uses 60% less energy than photovoltaic silicon. Efficiency is interesting. It is usually lower for CdTe than c-Si, but 70% of First Solar's patents target improvements.

Download

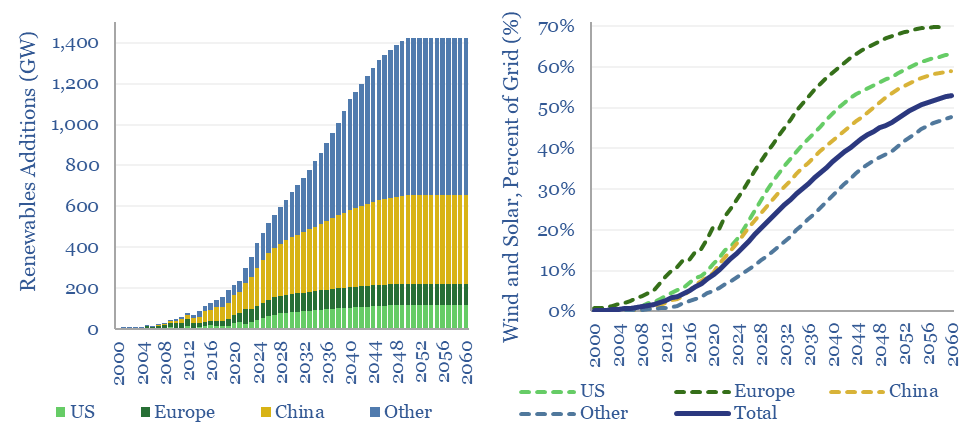

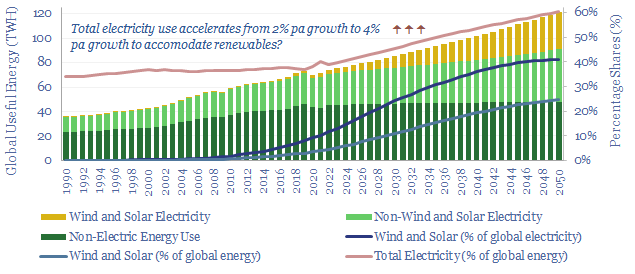

This model aims to calculate global wind and solar capacity additions. How many GW of new capacity would be needed for renewables to reach c25% of the global energy mix by 2050, up from 4% in 2021? In total energy terms, this means a 10x scale up, to 30,000 TWH of useful wind+solar energy in 2050. Gross global wind and solar capacity additions will surpass +1,000 GW by 2040.

Download

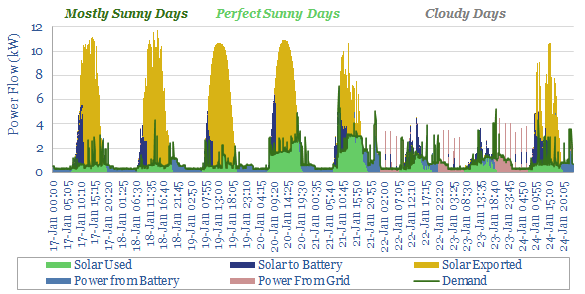

This data-file contains actual power flows, kindly shared by a client of Thunder Said Energy, who is based in sunny Australia, with 13.5kW of residential solar panels and the 13.5kWh Tesla Powerwall system as a back-up. The system meets an impressive 92% of year-round power needs.

Download

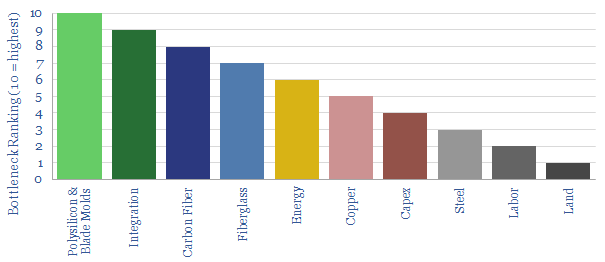

How fast can wind and solar accelerate, especially if energy shortages persist? This 11-page note reviews the top ten bottlenecks. Seven value chains will tighten enormously in the coming years. Paradoxically, however, ramping renewables could exacerbate near-term energy shortages.

Download

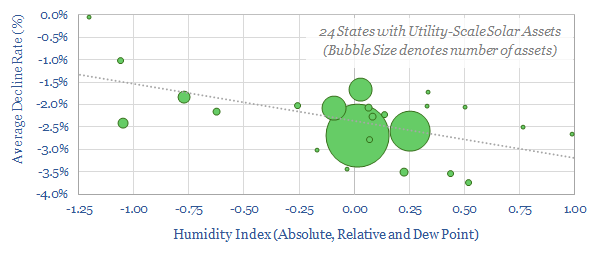

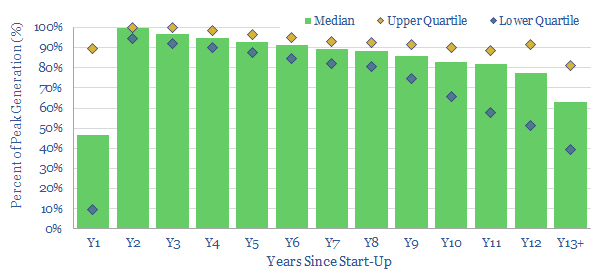

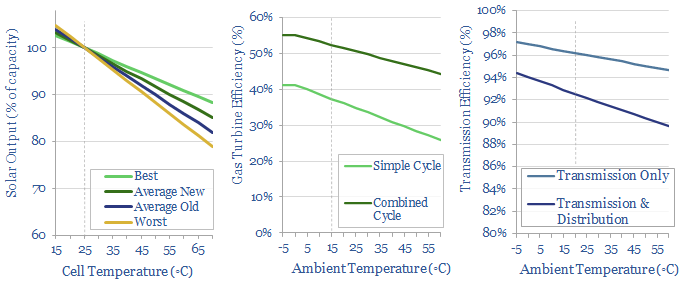

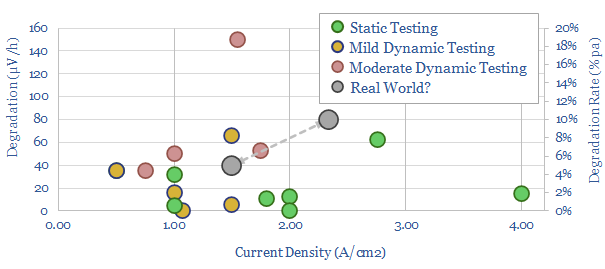

The average solar asset declines at 2.5% per year. This 14-page note reviews the causes. We find humid climates moderate Potential Induced Degradation, adding a relative headwind in coastal geographies and floating solar. But an exciting way to mitigate declines is emerging via smaller inverters.

Download

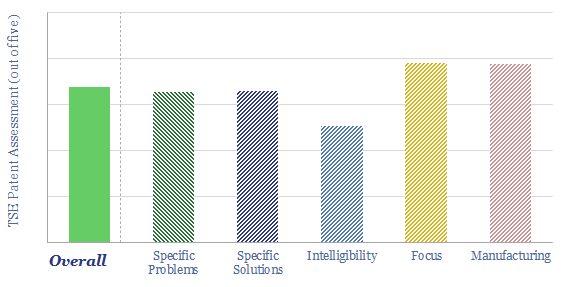

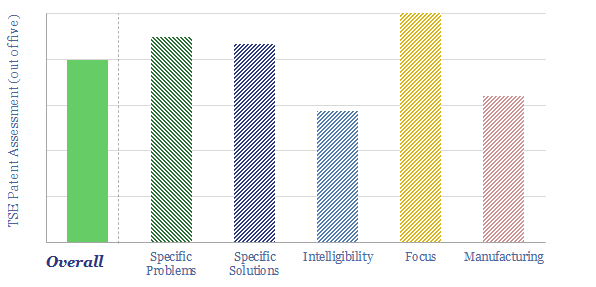

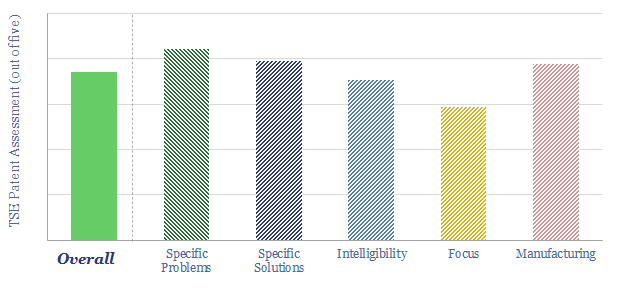

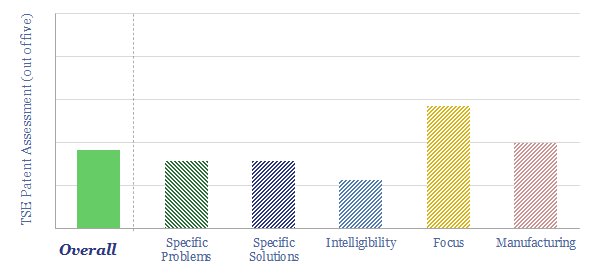

SolarEdge specializes in the power-electronics needed to use solar energy in practical power systems. Our patent review finds a good, but broad array of incremental improvements. They suggest a vast future market in solar-battery energy systems.

Download

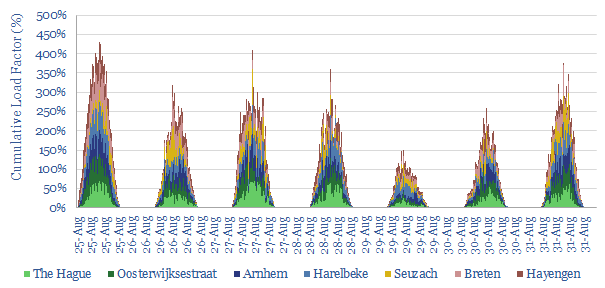

This data-file aggregates granular data from seven solar assets around Western Europe over a sample week. Absolute volatility is around 2-4% of nominal capacity every 15-minutes, while inter-correlations range from 60-90% depending on the distance between the different assets.

Download

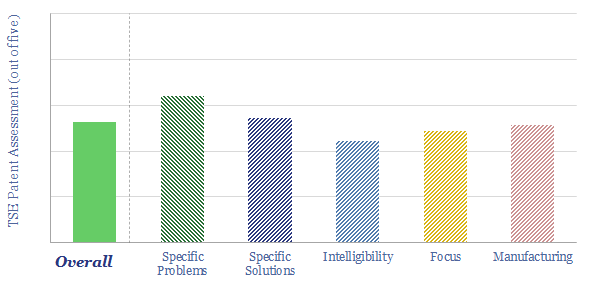

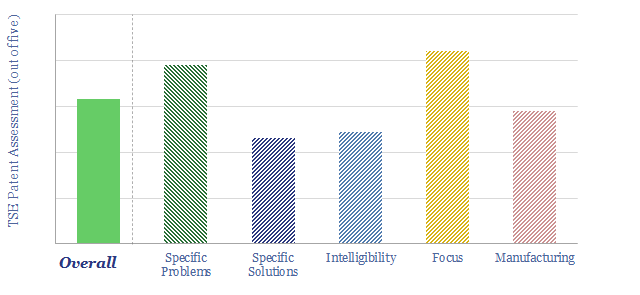

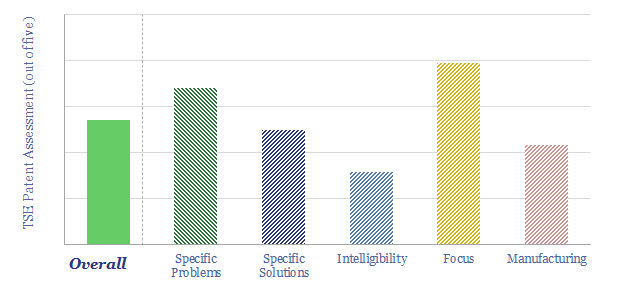

Shoals Technologies Group manufactures electrical balance of system solutions for solar energy projects, focused on promoting reliability, safety and ease of installation. Electrical installation costs can be lowered 40%. Our patent review finds a technology moat on 35% EBITDA margins.

Download

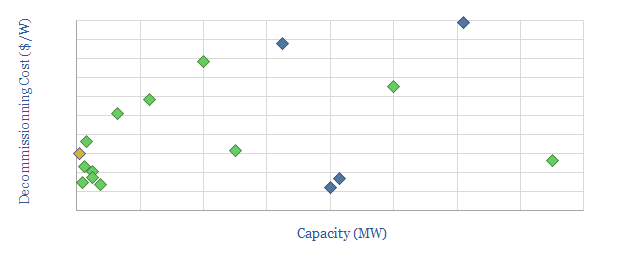

This data-file aims to break down the costs of decommissioning solar projects. Gross costs are estimated within a range of $0.03-0.20/W, which is around 3-20% of the initial installation costs. What might help is the ability to re-use old panels, which could possibly even allow a small profit at end-of-life.

Download

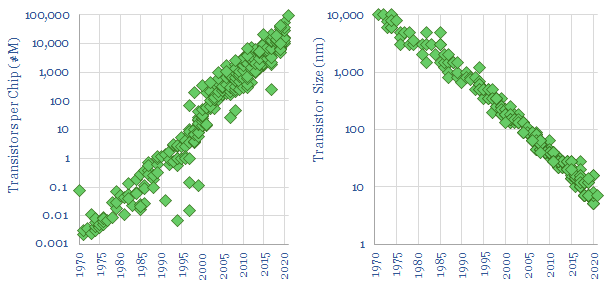

Moore’s law entails that computing performance doubles every 18-months. Which has held true since 1965. This exponential progress has been driven by three positive feedback loops. Can these same feedback loops unlock a similar trajectory for new energies costs? We find mixed evidence.

Download

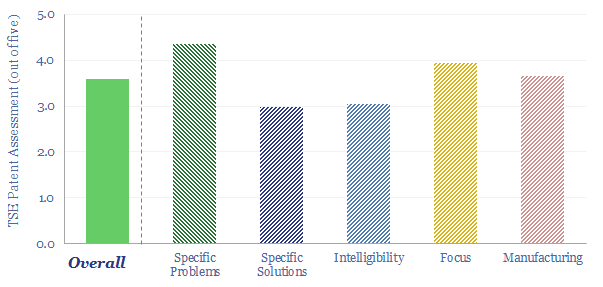

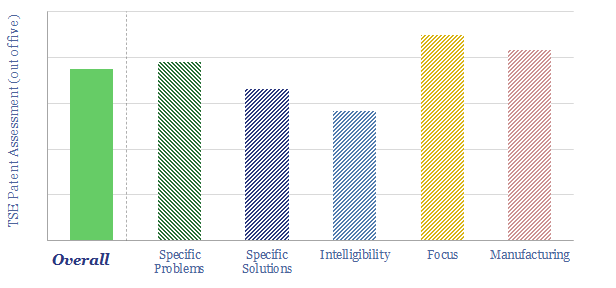

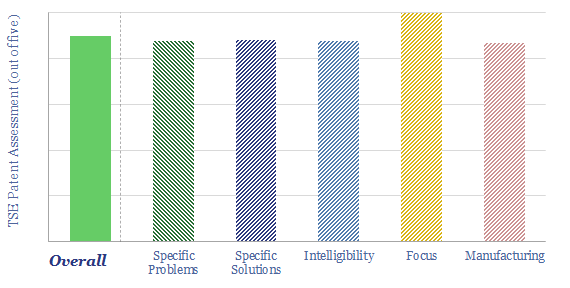

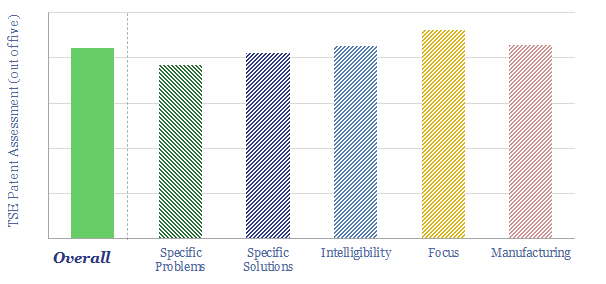

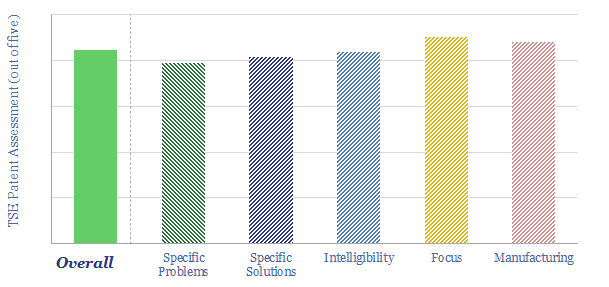

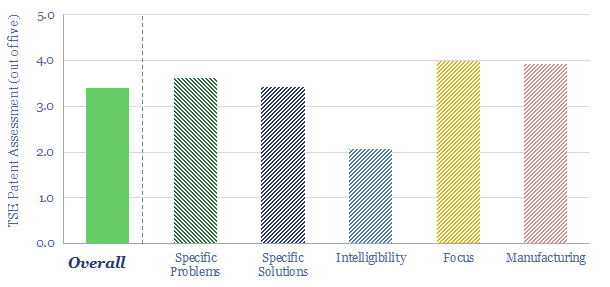

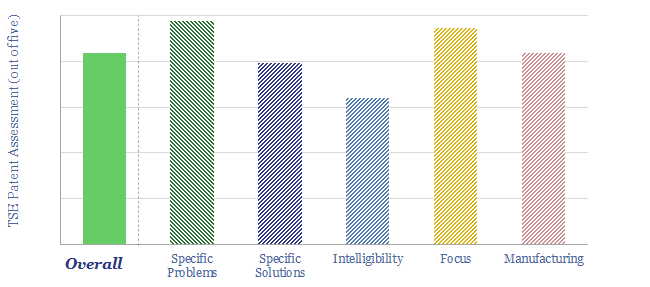

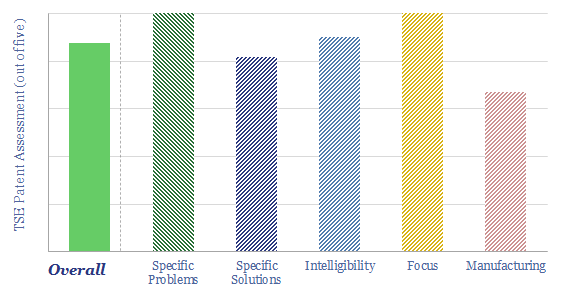

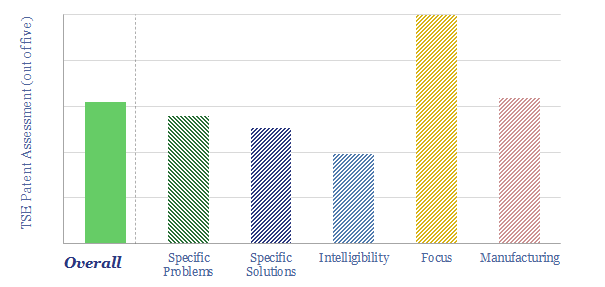

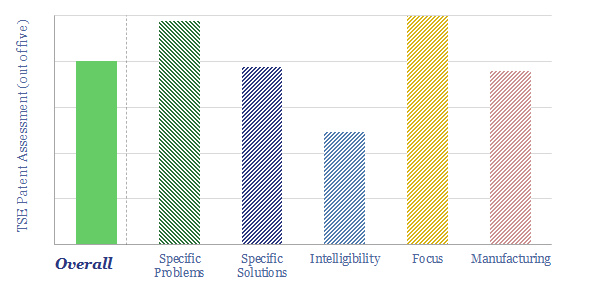

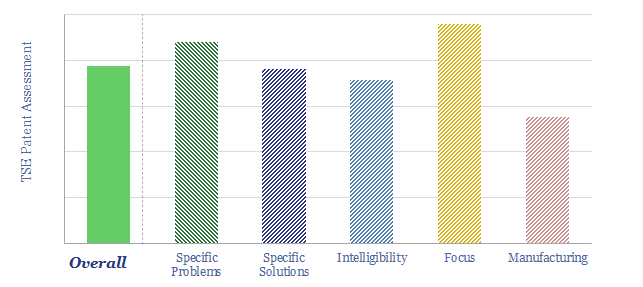

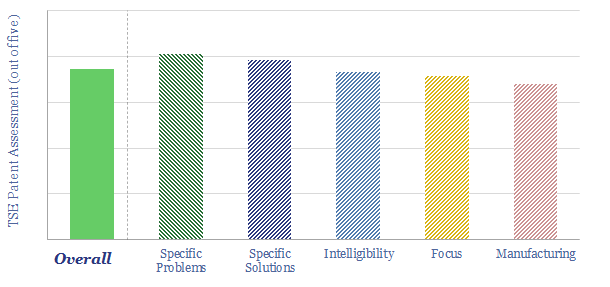

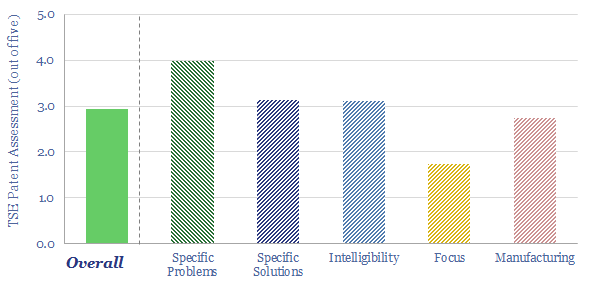

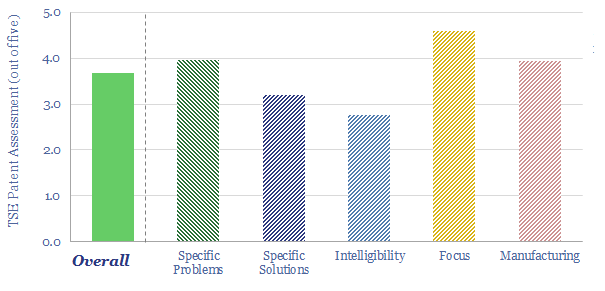

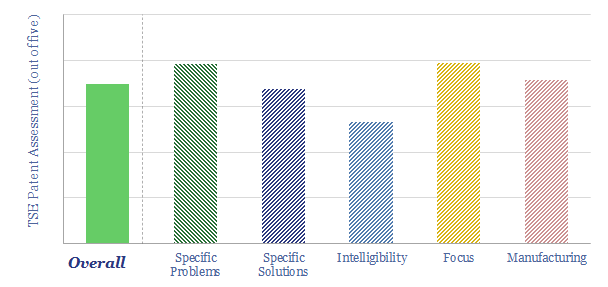

Array Technologies IPO-ed in October-2020. It manufactures solar tracking systems, supporting 25% of US solar modules installed to date. Its systems can uplift solar generation by 5-25%. we found clear, specific, intelligible patents, back-stopping six out of seven key strengths that have been cited by the company.

Download

Solar costs have deflated by an incredible 90% in the past decade to 4-7c/kWh. Some commentators now hope for 2c/kWh by 2050. Further innovations are doubtless. But there are four challenges, which could stifle future deflation or even re-inflate solar. Most debilitating would be a re-doubling of CO2-intensive PV-silicon?

Download

This model breaks down the costs of photovoltaic silicon, which explains $0.1/W of a $0.3/W solar panel. There is no way silicon producers are making economic returns below $12.5/kg mono-crystalline polysilicon prices. The average kg of PV silicon in a solar panel is also most likely associated with 140kg of direct CO2.

Download

This data-file quantifies the energy costs of manufacturing solar panels, based on 10 studies and prior projects. We see the average solar project requiring 5MWH/kW, with a 2.3-year energy payback, a c10x energy-return on energy-invested and CO2-intensity of 90kg/boe (for contrast, average oil is c440kg/boe and average gas is c350kg/boe).

Download

This data-file reviews 70 patents filed by leading solar manufacturers in 2020. We expect double-digit deflation to continue, while solar panels will also gain greater efficiency and longevity. The cutting edge is now in current collectors. Examples and improvements areas are described for each company.

Download

This data-file tabulates the 'decline rates' of 3,200 US solar power plants going back to 2001. The median YoY decline is found to run at 2.5%. However, the data are volatile and variable. Hence this data-file gives full granularity, asset by asset. Decline rates could detract c4pp from the IRRs of future solar projects and stall the ascent of solar power in the 2040s.

Download

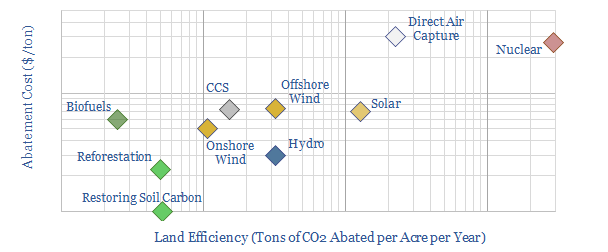

This data-file compares the land required by different energy transition technologies, in tons of CO2-equivalents abated per acre per year. Including renewables, nature based solutions, efficiency gains and CCS, we find that decarbonizing a typical developed world country may use up 20-50% of its land.

Download

Under our base case estimates, a $130/ton CO2 price is required to achieve passable economics and incentivize rooftop solar heaters. Once installed, solar heaters save around 1T of CO2 per household per year and lower water heating bills by 50-80%. This data-file models the economics.

Download

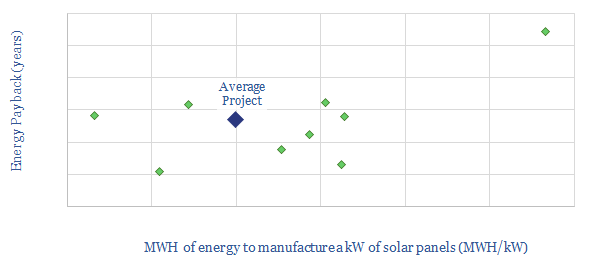

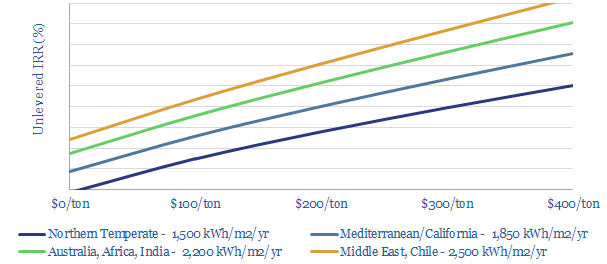

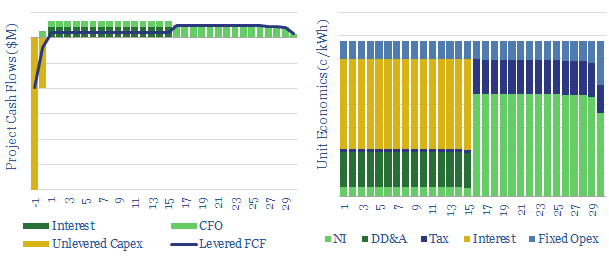

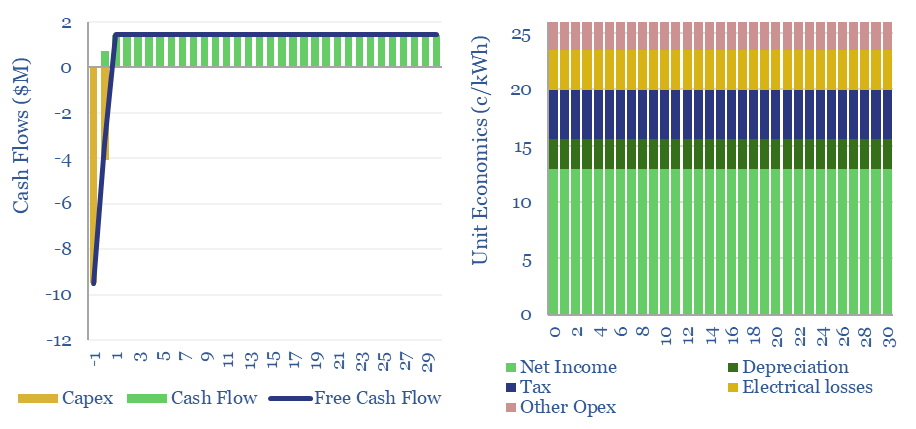

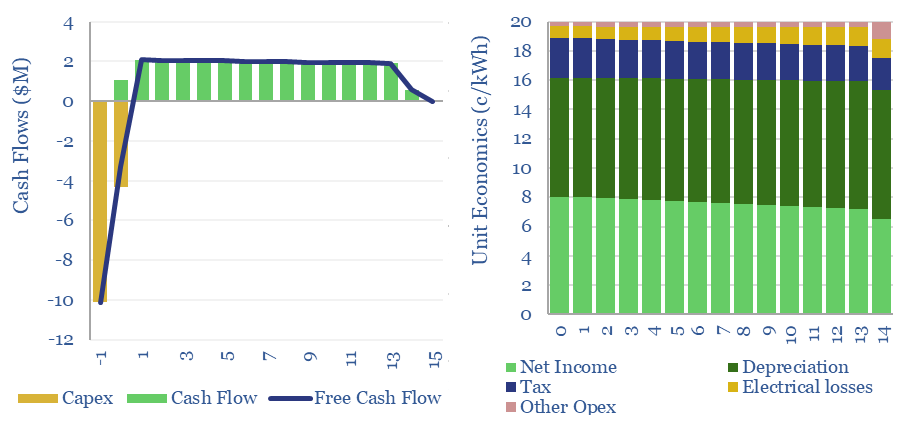

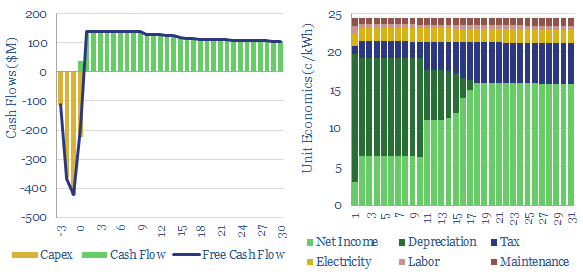

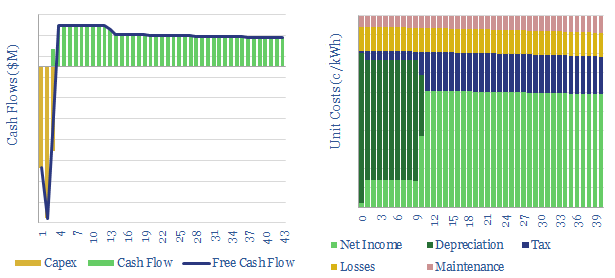

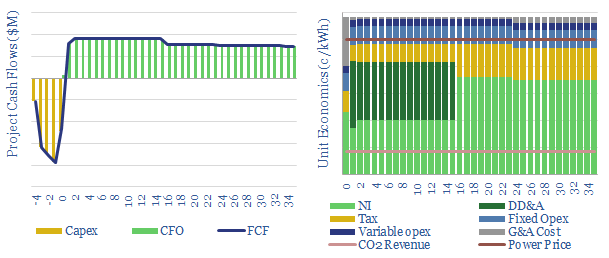

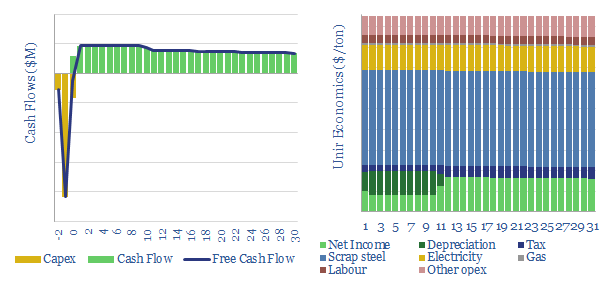

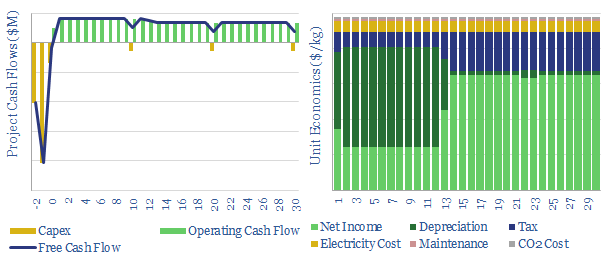

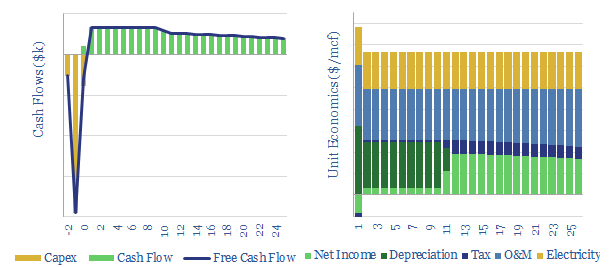

This model indicates the economics of a typical utility-scale solar project, as a function of a dozen input assumptions. Our base case shows utility scale can be extremely economic. But incentive prices rise c3c/kWh if solar penetration is already high, and 5-7c/kWh in less sunny locations.

Download

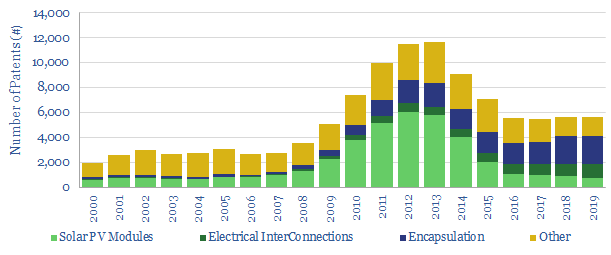

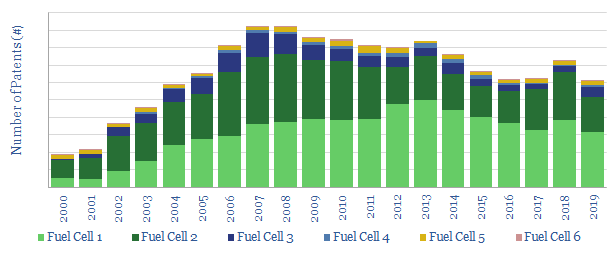

We have tabulated 110,000 solar patents. Research peaked in 2012-13, at 11,500 patents/year. It since slowed to c6,000/year. Yet Chinese companies have ramped up to 50% of all the filings, and now comprise 14 out of 2019's top 25 solar patent filers. Majors' patents comprise c0.5% of the total, with one SuperMajor clearly leading.

Download

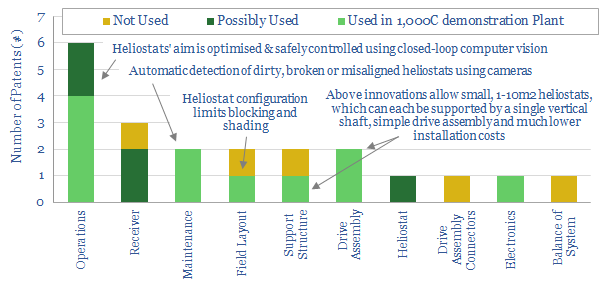

Heliogen has set a new record for concentrated solar power in 2019, generating >1,000C temperatures from an array of c370 hexagonal mirrors, which are precisely controlled using computer vision. This is almost 2x traditional CSP plants. Hence this data-file reviews 21 of Heliogen's patents, finding impressive innovations and ultimate costs.

Download

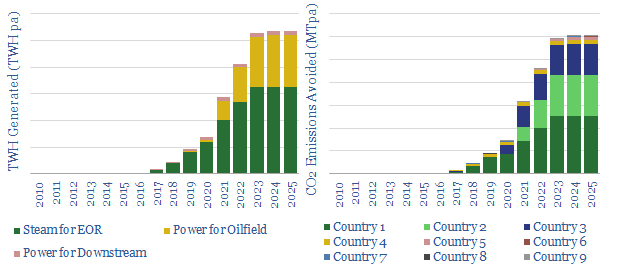

20 solar projects are being undertaken across the oil industry, to reduce CO2 emissions. But today's project pipeline will obviate less than 1% of oil industry CO2 by 2025. So momentum must build behind these leading examples, which are: steam-EOR in Oman and California, Solar PV in the Permian, and specific companies such as Occidental, Shell, Eni and other Majors.

Download

Wind Research

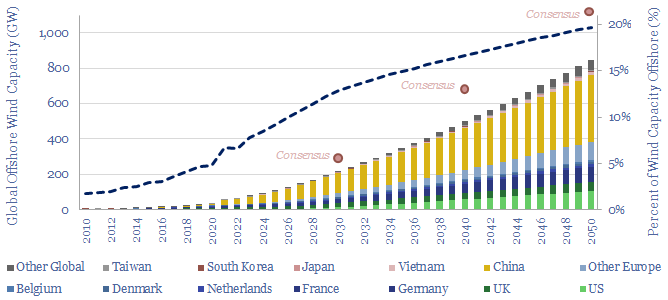

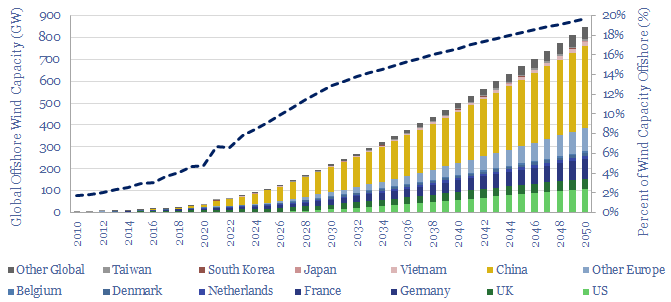

This 14-page report re-visits our wind industry outlook. Our long-term forecasts are reluctantly being revised downwards by 25%, especially for offshore wind, where levelized costs have reinflated by 30% to 13c/kWh. Material costs are widely blamed. But rising rates are the greater evil. Upscaling is also stalling. What options to right this ship?

Download

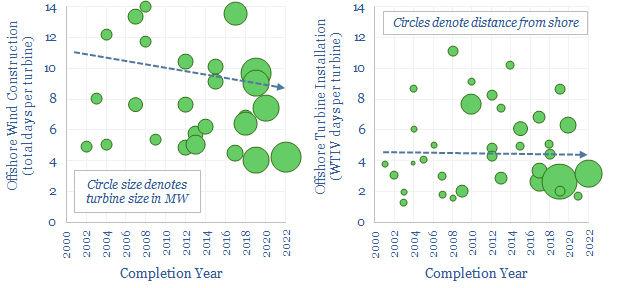

Global offshore wind capacity stood at 60GW at the end of 2022, rising at 8GW pa in the past half decade, comprising 7% of all global wind capacity, and led by China, the UK and Germany. Our forecasts see 220GW of global offshore wind capacity by 2030 and 850GW by 2050, which in turn requires a 15x expansion of this market.

Download

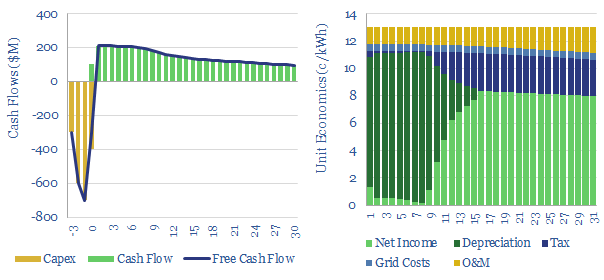

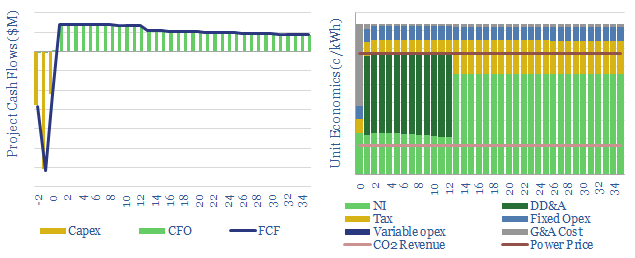

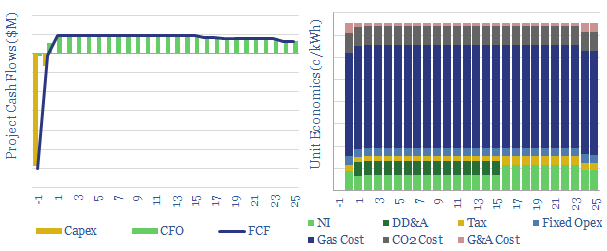

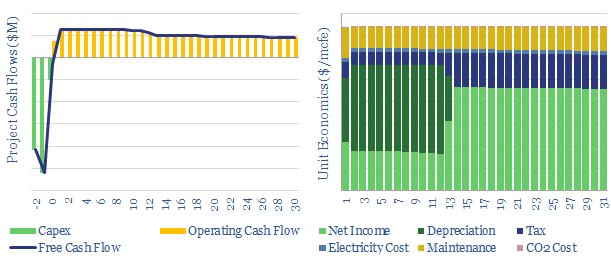

This model estimates the levelized cost of offshore wind at 13c/kWh, to generate a 7% IRR off of capex costs of $4,000/kW and a utilization factor of 40-45%. Each $400/kW on capex adds 1c/kWh and each 1% on WACC adds 1.3 c/kWh to offshore wind levelized costs.

Download

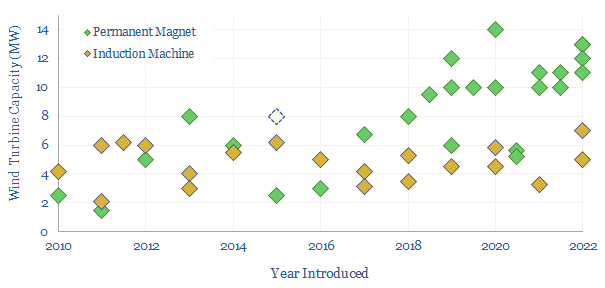

Wind turbines can use doubly fed induction generators (DFIGs) or permanent magnet synchronous generators (PMSGs) based around Rare Earth metals. This data-file captures the trends in DFIGs vs PMSGs over time by tabulating 40 examples, as turbines have grown larger, and different wind turbine manufacturers have adopted different strategies.

Download

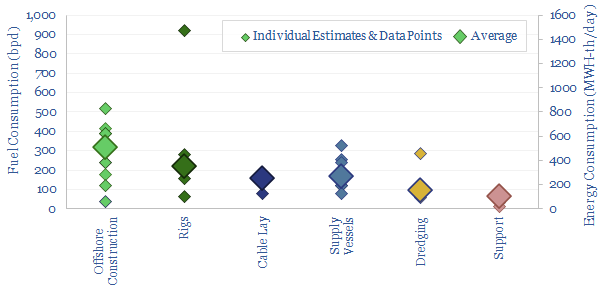

This database tabulates the typical fuel consumption of offshore vessels, in bpd and MWH/day. We think a typical offshore construction vessel will consume 300bpd, a typical rig consumes 200bpd, supply vessels consume 150bpd, cable-lay vessels consume 150bpd, dredging vessels consume 100bpd and medium-sized support vessels consume 50bpd. Examples are given in each category, with typical variations in the range of +/- 50%.

Download

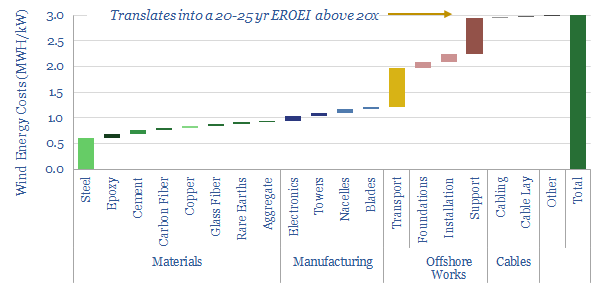

This data-file estimates 3MWH of energy is consumed in manufacturing and installing 1kW of offshore wind turbines, the energy payback time is usually around 1-year, and total energy return on energy invested (EROEI) will be above 20x. These estimates are based on bottom-up modelling and top-down technical papers.

Download

Is the power grid becoming a bottleneck for the continued acceleration of renewables? The median approval time to tie a new US power project into the grid has climbed by 30-days/year since 2001, and doubled since 2015, to over 1,000 days (almost 3-years) in 2021. Wind and solar projects are now taking longest. This data-file looks for de-bottlenecking opportunities, and wonders about changing terms of trade in power markets.

Download

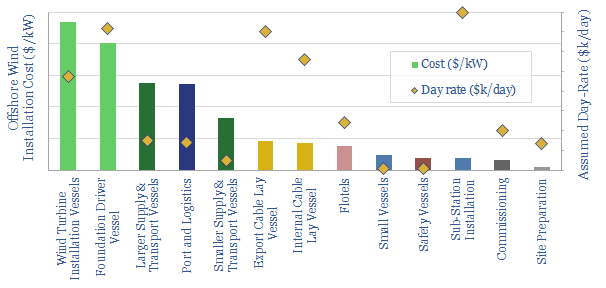

An offshore wind project is likely to cost $2,500/kW, of which c$1,500/kW is turbines and $1,000/kW is offshore installation costs. This data-file aims to estimate the breakdown by vessel type, day-rates and costs per turbine.

Download

Goldwind is one of the largest wind turbine manufacturers in the world, headquartered in Beijing, and shares are publicly listed. The wind industry is increasingly aiming to mimic the inertia and frequency responses of synchronous power generators. Goldwind has published some interesting case studies. Hence we have reviewed its patents to see if we can find an edge?

Download

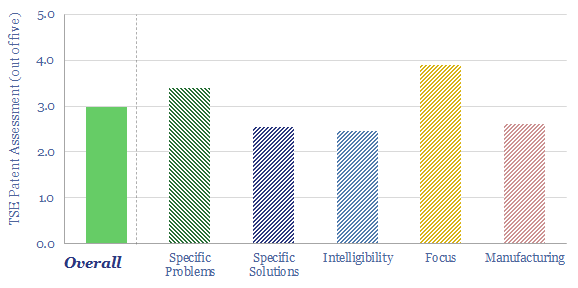

Wind turbine installation vessels are estimated to cost $100-500/kW in the breakdown of a typical offshore wind project's capex. Total offshore construction time is around 10 days per turbine. Wind turbine installation vessel use averages around 5 days per turbine. Data from past projects are tabulated in this data-file.

Download

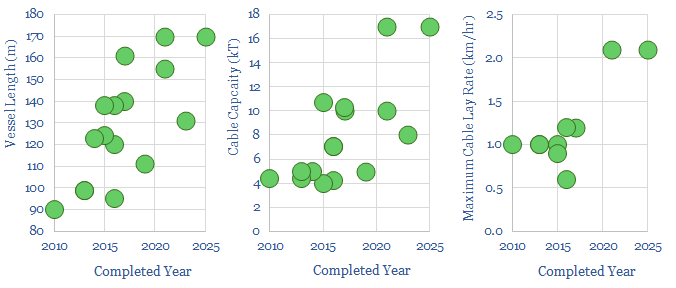

This is a database of cable installation vessels for offshore wind and power transmission; tabulating costs (in $M), contract awards (in $/km), capacity (in tons), installation speeds (in meters per hour), power ratings (in MW), crew sizes and positioning systems. There is a paradox over costs.

Download

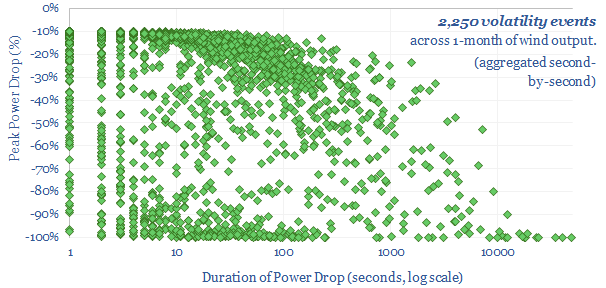

We have evaluated the second-by-second data on the power output of a 25MW onshore wind farm in Germany. A typical day sees 75 volatility events. Compared to solar, wind power drops slightly less frequently, but more extensively (often >90%) and for longer (often several hours or days). Both wind and solar show high short-term volatility.

Download

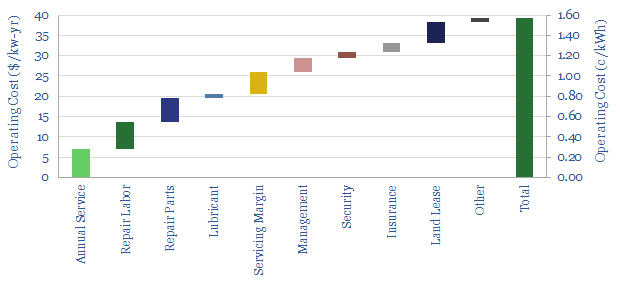

Opex for a wind power project is typically $40/kW-year, or around 1-2c/kWh. Around $25/kW is maintenance, suggesting the wind maintenance market is now worth >$20bn per year. The best route to lower cost is up-scaling turbines and wind assets.

Download

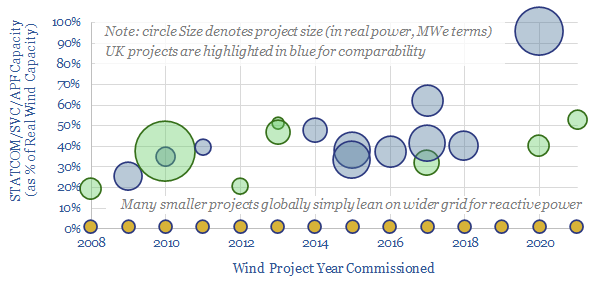

Wind and solar have so far leaned upon conventional power grids. But larger deployments will increasingly need to produce their own reactive power; controllably, dynamically. Demand for STATCOMs & SVCs may thus rise 30x, to over $25-50bn pa. This 20-page note outlines the opportunity and who benefits?

Download

This model aims to calculate global wind and solar capacity additions. How many GW of new capacity would be needed for renewables to reach c25% of the global energy mix by 2050, up from 4% in 2021? In total energy terms, this means a 10x scale up, to 30,000 TWH of useful wind+solar energy in 2050. Gross global wind and solar capacity additions will surpass +1,000 GW by 2040.

Download

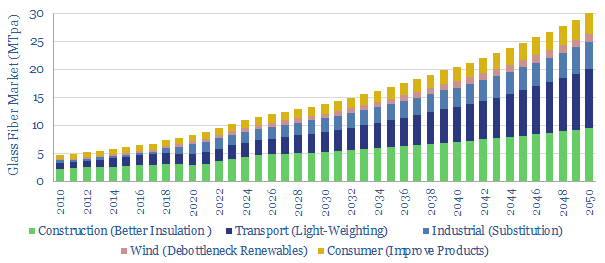

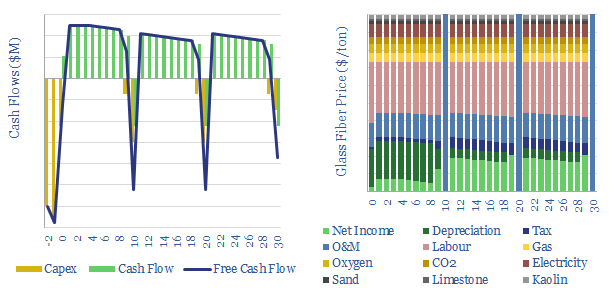

Glass fiber makes up 50% of a wind turbine blade, lightens vehicles and insulates homes for 30-70% energy savings. Hence we see demand rising 3.5x in the energy transition. To appraise the opportunity, this 13-page note assesses the market, costs, CO2 intensity and leading companies.

Download

This data-file models the economics of producing glass fiber, the key component in fiberglass for wind turbines; but also a light-weight insulating material. Marginal cost is likely $2,000/ton, with a CO2 intensity of 1.5 tons/ton. Some Chinese product is 50% cheaper but 2x more CO2 intensive.

Download

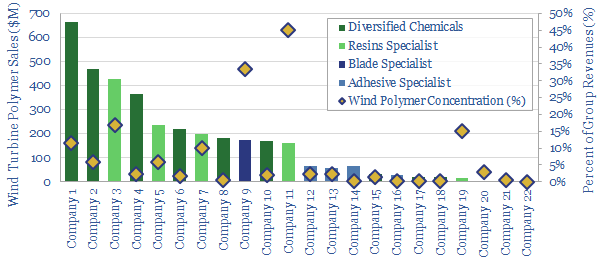

This data-file tabulates details for 20 companies that make epoxy- or polyurethane resins and adhesives, especially those that feed into the construction of wind turbines. We think there are 5 public companies ex-China with 5-35% exposure to this sub-segment of the wind industry.

Download

How fast can wind and solar accelerate, especially if energy shortages persist? This 11-page note reviews the top ten bottlenecks. Seven value chains will tighten enormously in the coming years. Paradoxically, however, ramping renewables could exacerbate near-term energy shortages.

Download

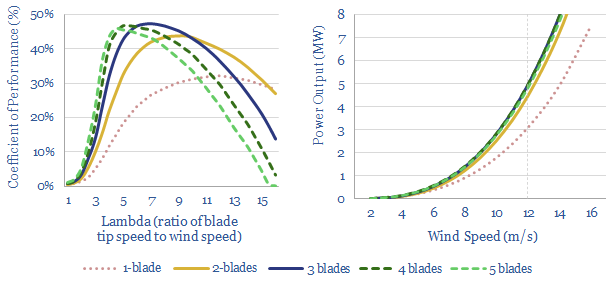

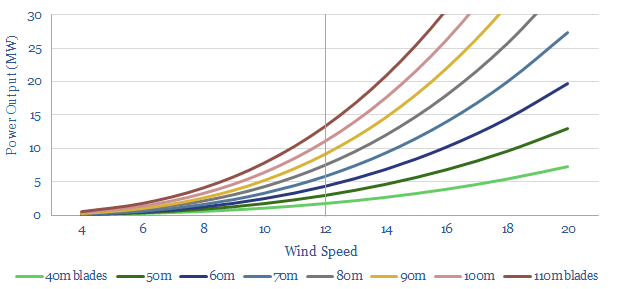

This data-file is an overview of wind power physics. Specifically, how is the power of a wind turbine calculated, in MW, as a function of wind speed, blade length, blade number, rotational speed (in RPM) and other efficiency factors (lambda). A large, modern offshore wind turbine will have 100m blades and surpass 10MW power outputs.

Download

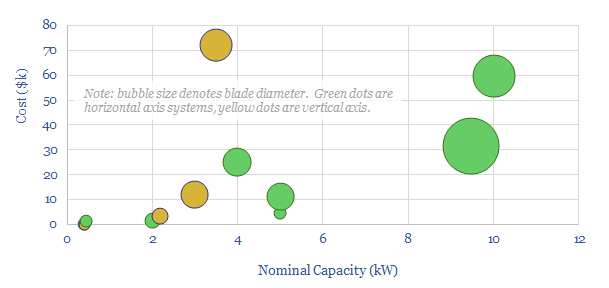

This screen compares the offerings of a dozen small-scale wind turbine providers, with power ratings below 30kW, for residential energy generation. Costs range from $1,000-6,000/kW. The three key challenges are performance, relaibility and cost.

Download

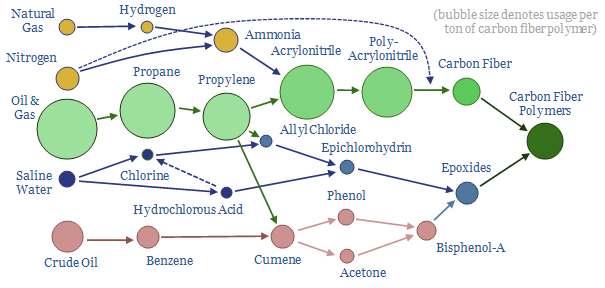

Energy transition will catapult carbon fiber demand upwards from today's 120kTpa baseline, across wind turbine blades, more efficient vehicles and hydrogen tanks. Hence this 16-page note explores opportunities, economics, CO2 intensity and leading companies.

Download

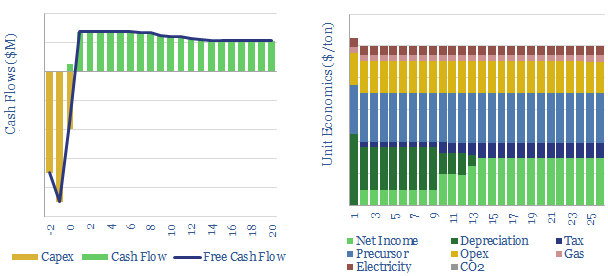

We estimate a marginal cost of $25/kg for a 10% IRR at a new carbon fiber plant. The process will emit 30 tons of CO2 per ton of carbon fiber if powered by gas and electricity. This data-file traces the value chain, the CO2 intensity and the production costs.

Download

Some commentators expect the levelized costs of offshore wind to fall another two-thirds by 2050. The justification is some eolian equivalent of Moore’s Law. Our 16-page report draws five contrasts. Wind costs are most likely to move sideways, even as the industry builds larger turbines. Implications for developers are explored.

Download

Siemens Gamesa is a leader in offshore wind, pushing the boundaries towards a 14MW turbine with an incredible 222m rotor diameter. Our main debate from reviewing its patents is whether the engineering challenges of large turbines is consistent with deflation expectations.

Download

Moore’s law entails that computing performance doubles every 18-months. Which has held true since 1965. This exponential progress has been driven by three positive feedback loops. Can these same feedback loops unlock a similar trajectory for new energies costs? We find mixed evidence.

Download

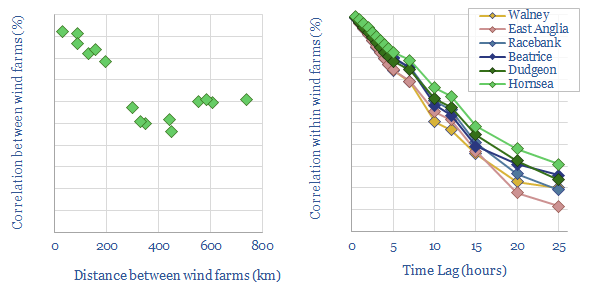

This data-file examines the correlations between different wind farms' generation rates. The output from individual wind farms is 67% correlated on average, at any given point in time, and as high as 90% with a 100km x 100km area. Auto-correlation was also high, as windy/non-windy periods can last 2-10 days.

Download

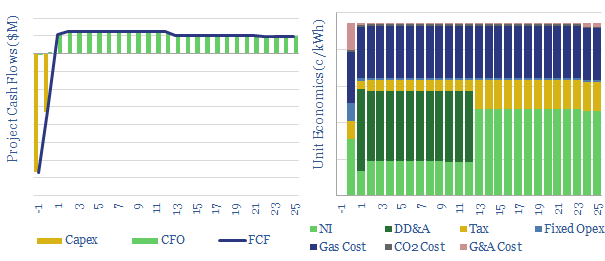

The levelized cost of onshore wind is estimated in this economic model, at 5-7c/kWh to generate 5-10% levered IRRs on new wind project costing $1,000-3,000/kW. The model also contains a granular breakdown of wind capex costs, operating costs, and other economic assumptions for wind projects.

Download

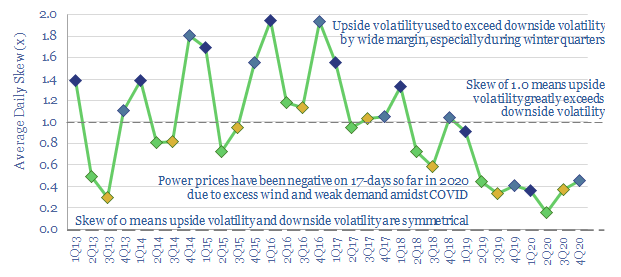

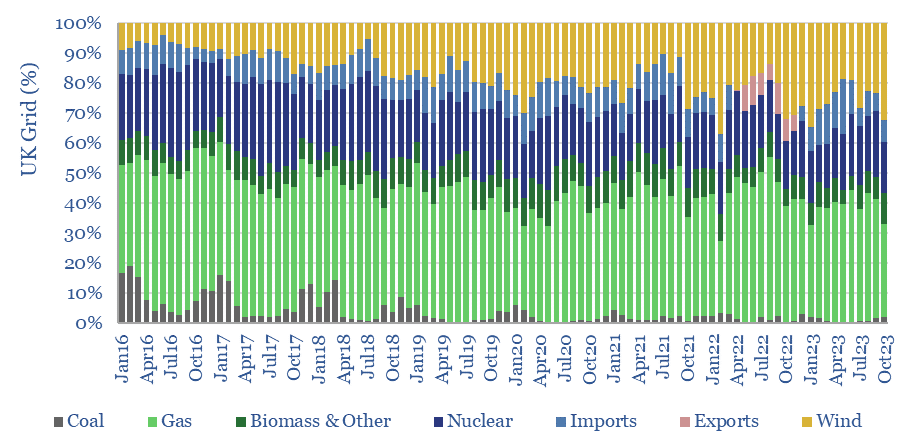

UK wind power has almost trebled since 2016. But its output is volatile, now varying between 0-50% of the total grid. Hence this 14-page note assesses the volatility, using granular, hour-by-hour data from 2020, to outline which backup opportunities are best-placed.

Download

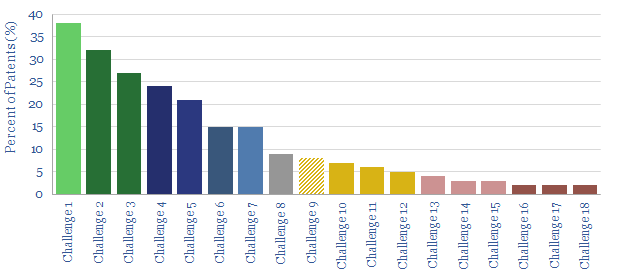

A dozen challenges for floating offshore wind projects are ranked in this 4-page note, by reviewing 50 recent patents across the industry. We model these challenges are likely to double capex and levelized costs, compared with traditional offshore wind. The potential for floating offshore wind is also location dependent.

Download

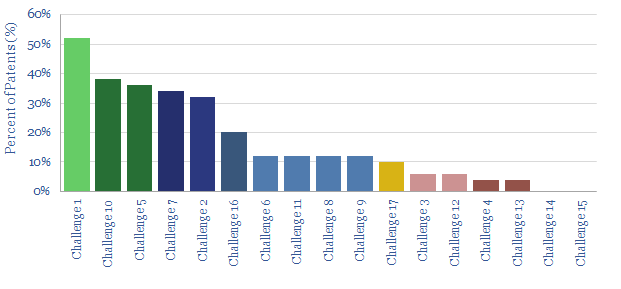

This data-file ranks the greatest challenges for the floating offshore wind industry, by reviewing 50 recent patents, filed by leading companies. The challenges are relatively immutable. They likely double capex and levelized costs, compared with traditional offshore wind.

Download

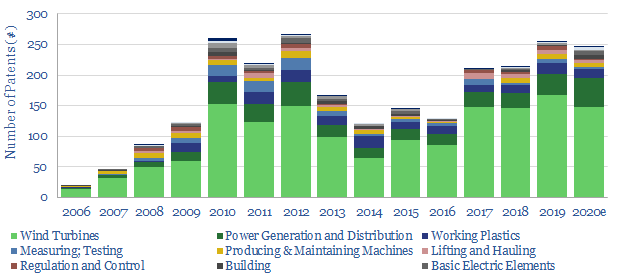

This data-file aggregates 2,000 patents filed by Vestas and compares them with 15,000 patents filed by competitors. Although other companies have made headlines with larger turbines, we find Vestas may have an edge overall, particularly in the category of operations, monitoring, maintenance and ensuring turbines' longevity.

Download

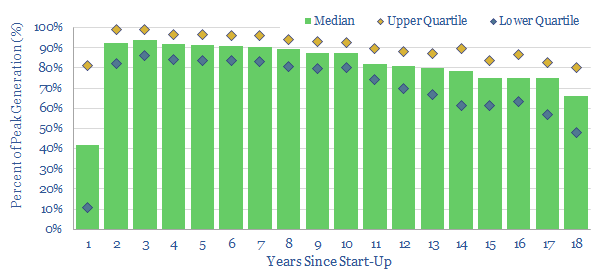

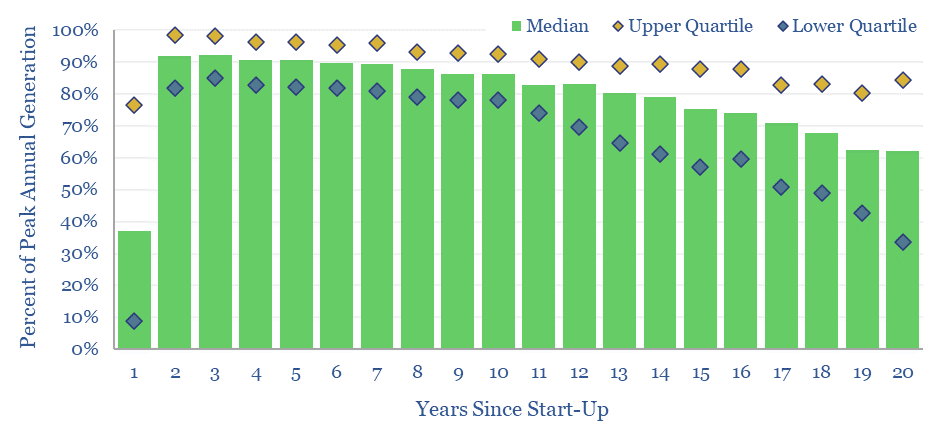

This 4-page PDF presents our conclusions from tabulating the ‘decline rates’ of 1,215 US wind power plants, which have reported data to the US EIA. US wind generation profiles are not dissimilar from well-managed oil and gas fields; some projects may suffer 2% lower IRRs versus forecasts if they have not factored in declines; and … Continue reading "Wind power: decline rate conclusions?"

Download

This data-file aggregates wind generation by facility, across the US, at 1,400 wind farms, going back 20-years. Wind power decline rates average 1% per year, then possibly accelerate to 3-4% per year in years 10-20. However wind generation is also noisy, typically varying +/- 7% YoY. This matters for the economics and ultimate share of wind.

Download

This data-file compares the land required by different energy transition technologies, in tons of CO2-equivalents abated per acre per year. Including renewables, nature based solutions, efficiency gains and CCS, we find that decarbonizing a typical developed world country may use up 20-50% of its land.

Download

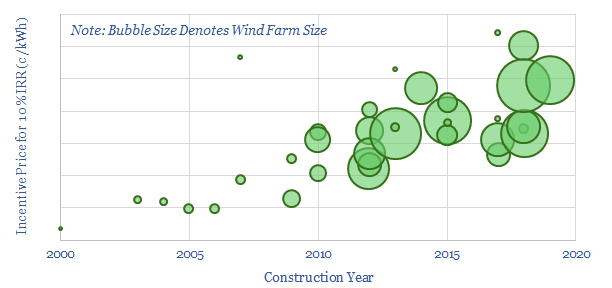

This data-file tabulates the capex costs of 35 offshore wind projects in the UK, with 8.5GW of capacity, which have been installed since the year 2000. There is little evidence for deflation. Rather, breakeven power prices appear to have risen at a 2.5% CAGR over the past decade. Our modelling is show in the data-file.

Download

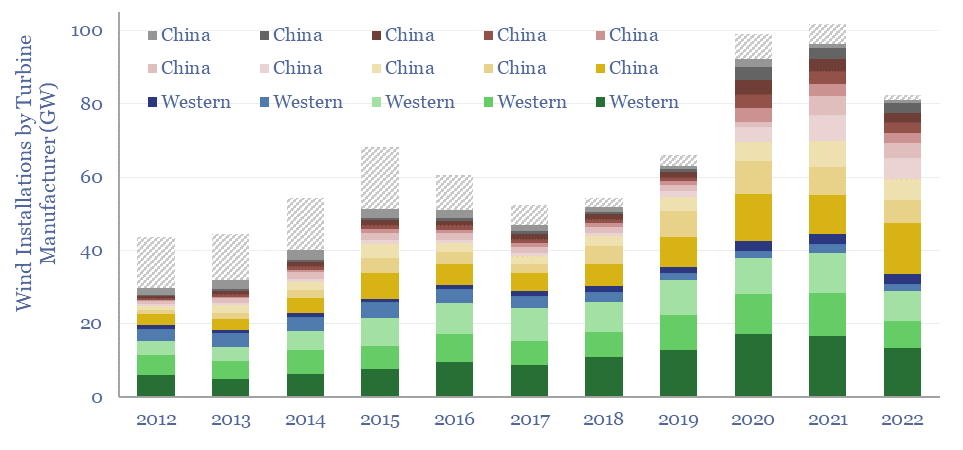

This data-file tracks wind turbine manufacturers, their market shares and their margins. By 2022, fifteen companies account for 98% of global wind turbine installations. This includes large Western incumbents, and a growing share for Chinese entrants, which now comprise over half of the total market, limiting sector-wide operating margins to c3%.

Download

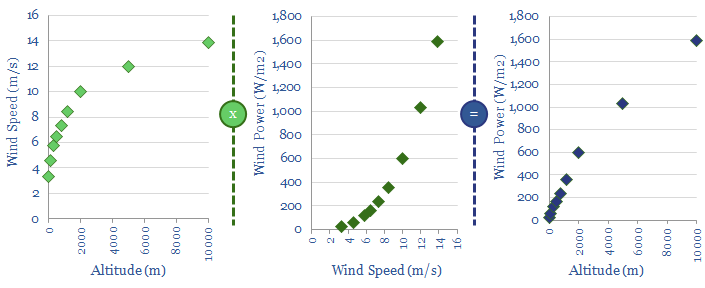

This data-file contains a simple model for how wind speeds and wind power co-vary with altitude. 2x greater power could likely be harnessed by a kite at 300m than a similar-sized turbine at 80m.

Download

Nuclear Research

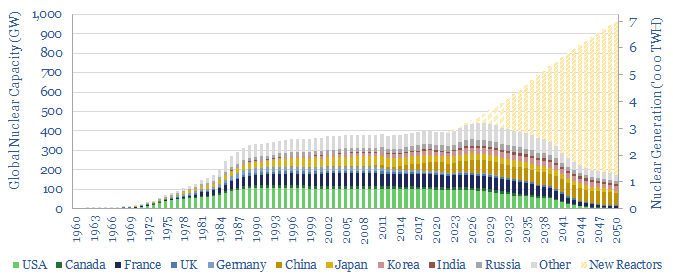

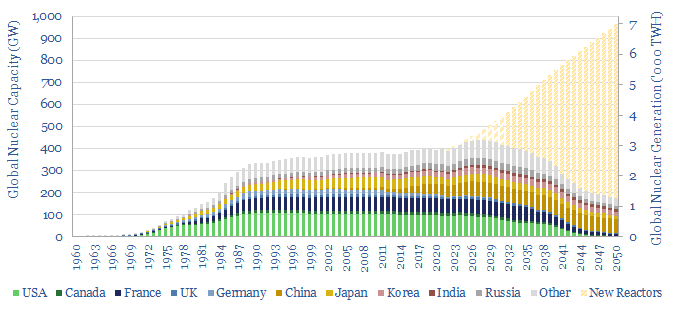

400 GW of nuclear reactors produce 2,800TWH of zero carbon electricity globally each year. But the numbers have been stagnant for two decades. This is now changing. This 14-page note explains why. We expect a >3% CAGR through 2030, and hope for a 2.5x ramp through 2050. A ‘nuclear renaissance’ helps the energy transition.

Download

How much nuclear capacity would need to be constructed in our roadmap to net zero? This breakdown of global nuclear capacity forecasts that 30 GW of new reactors must be brought online each year through 2050, if the nuclear industry was to ramp up to 7,000 TWH of generation by 2050, which would be 6% of total global energy. There is a precedent. Delaying shutdowns helps too.

Download

X-Energy is a next-generation nuclear company, progressing a demonstration project in Washington State, due to start up in 2027. The key innovation is using TRISO fuels, whose manufacturing is locked up with a concentrated patent library. Long-term costs are suggested at 6c/kWh.

Download

TerraPower is one of the most active next-generation nuclear companies, with funding from Bill Gates, and 600 engineers working towards the first, 345MWe Natrium reactor before 2030. We could not entirely de-risk a "breakthrough" due to the breadth and novelty of its patents.

Download

Terrestrial Energy is a next-generation nuclear fission company, aiming to build a small modular reactor: specifically a 2 x 195MWe Integral Molten Salt Reactor with ultimate costs below $3,000/kWe, yielding levelized costs of 5-7c/kWh. 80 patents lock up 8 core innovations in a high-quality library that helps de-risk the potential.

Download

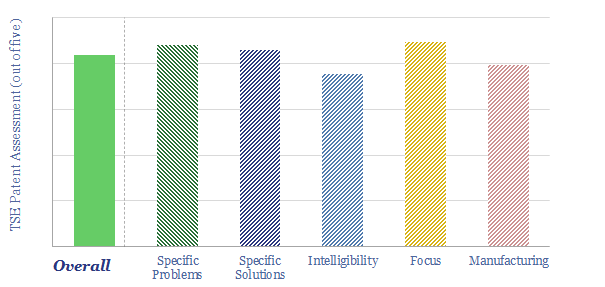

General Fusion is developing a magnetized target fusion reactor, compressing plasma via high-pressure pistons. It hopes to commercialize 100-200MWe fusion reactors with 5-6.5c/kWh levelized costs of electricity in the late 2020s. Our patent de-risks several innovations. Although complexity is high and we note four residual risks for the technology.

Download

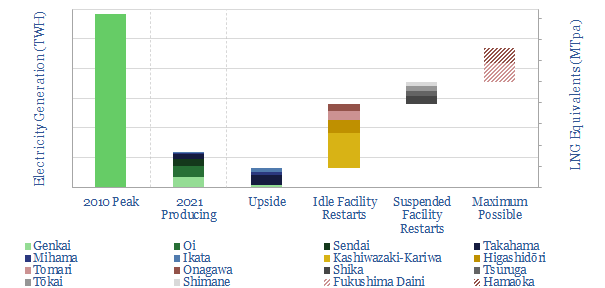

This data-file looks through 17 major nuclear plants in Japan with 45GW of operable capacity, covering the key parameters and re-start news on each facility. Realistically, there is near-term capacity to generate 130TWH more nuclear power in Japan and free up 20MTpa of LNG.

Download

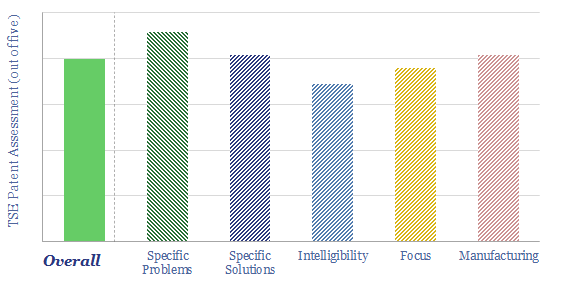

Our patent review found CFS to have a high-quality patent library, of specific, intelligible, commercially-minded innovations to densify the magnets that would confine plasma in a tokamak for nuclear fusion. Specific details, and minor hesitations are in the data-file.

Download

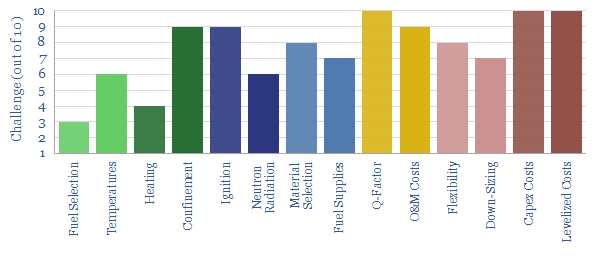

Nuclear fusion could provide a limitless supply of zero-carbon energy from the 2030s onwards. The goal of this 20-page note is simply to understand the challenges for fusion reactors, especially deuterium-tritium tokamaks. Innovations need to improve EROI, stability, longevity and costs.

Download

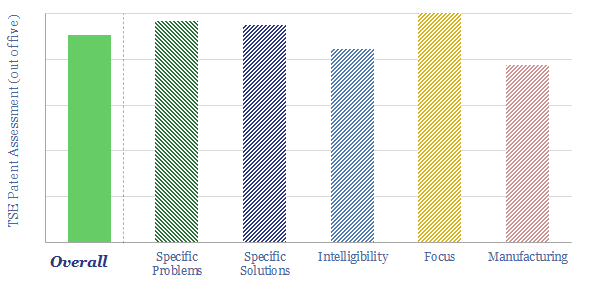

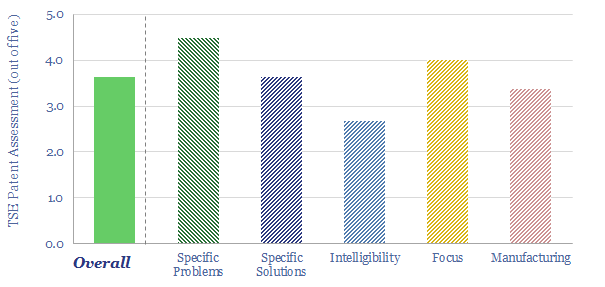

NuScale is developing a small modular nuclear reactor (SMR), producing 77MWe of power. It is the first SMR design to win US regulatory approval and the first plant is being built in Romania for 2028. NuScale's patents scored well on our framework.

Download

Nuclear power can backstop much volatility in renewables-heavy grids, for costs of 15-25c/kWh. This is at least 70% less costly than large batteries or green hydrogen, but could see less wind and solar developed overall. Our 13-page note reviews the opportunity.

Download

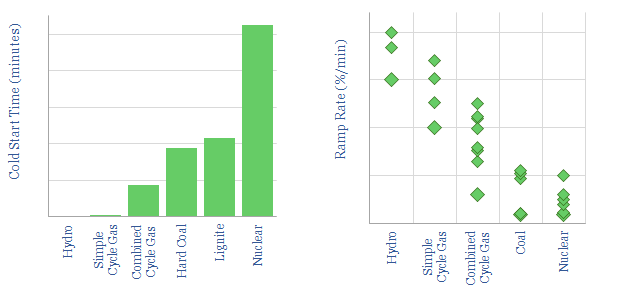

This data-file aggregates the ramp-up rates of power generation sources, as they start up from "cold", and then as they ramp up (in MW per minute). Hydro and simple cycle gas turbines are fastest, followed by CCGTS, coal and nuclear.

Download

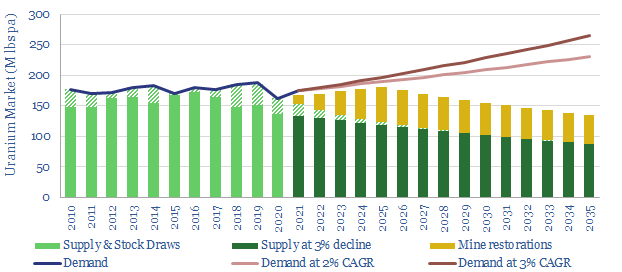

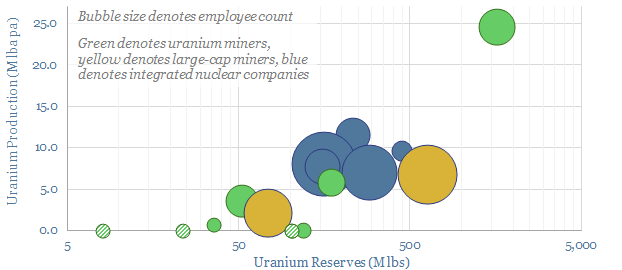

Uranium markets could be 50-75M lbs under-supplied by 2030. This deficit is deeper than other commodities in our roadmap to net zero. Demand is driven by China, constructing reactors for 50-70% less than the West, yielding zero carbon power at 6-8c/kWh. This 18-page note presents the outlook and screens uranium miners.

Download

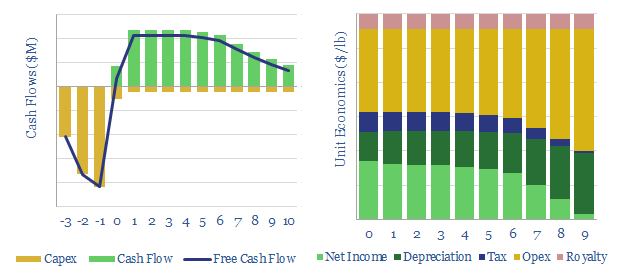

This data-file disaggregates the marginal costs of a new uranium mine, as a simple function of uranium prices, ore grade, capex and opex. Our base case is a marginal cost of $60/lb for a 10% IRR. Cash costs range from $7-40/lb. But lower ore grades can easily require $90/lb uranium to justify investment.

Download

We have screened c20 uranium miners, assessing each company's production, reserves, asset base, size and recent news flow. 10 are publicly listed. Our market outlook is that firm uranium supply may be running 25% short of the level required on our roadmap to net zero.

Download

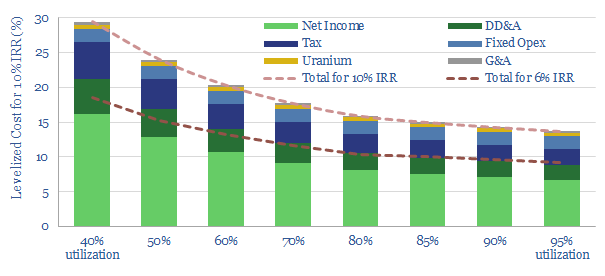

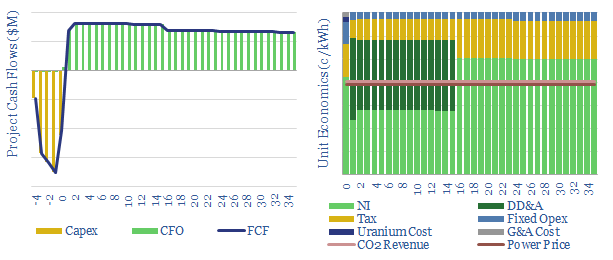

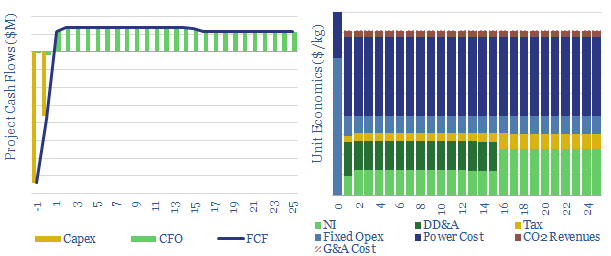

This data-file models the costs of nuclear power project, based on technical papers and past projects around the industry. An up-front capex cost of $6,000/kW might yield a levelized cost of 15c/kWh. But 6-10c/kWh is achievable via a renaissnace in next-generation nuclear.

Download

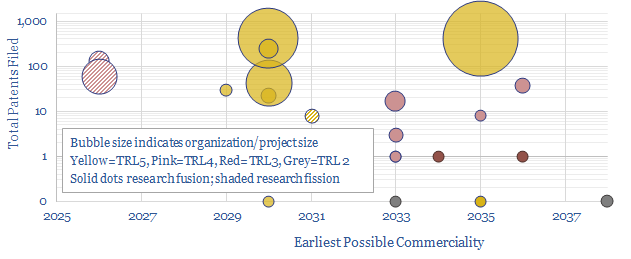

Can next-generation nuclear technologies realistically be factored into long-run forecasts of energy markets or energy-transition? The impacts of nuclear fusion would be vast, and several companies are making exciting progress, but no facility in our sample has yet surpassed TRL6, achieved an "energy gain" or system stability beyond c10 mS - 2mins.

Download

Batteries Research

Thunder Said Energy is a research firm focused on economic opportunities that can drive the energy transition. Our top ten conclusions into batteries and energy storage are summarized below, looking across all of our research.

Download

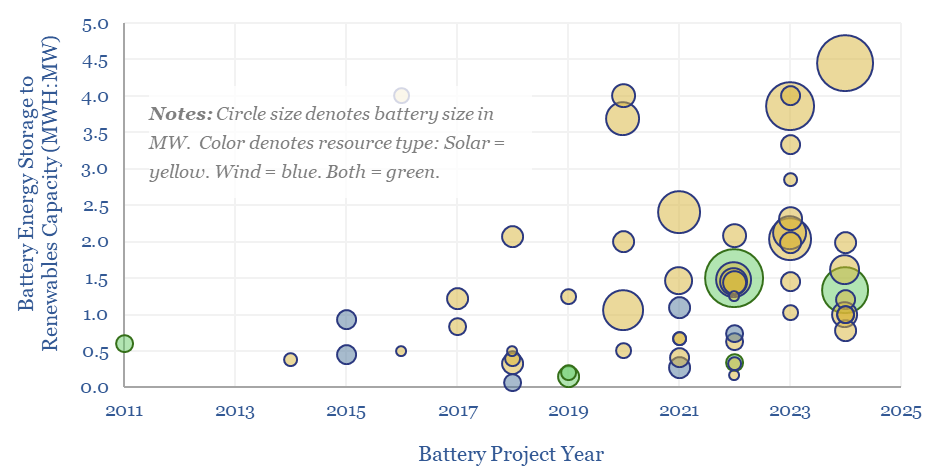

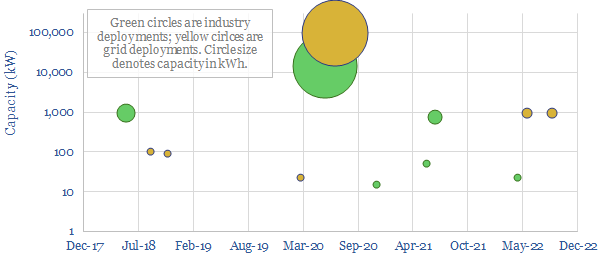

More and more renewables plus batteries projects are being developed as grids face bottlenecks? On average, projects in 2022-24 supplemented each MW of renewables capacity with 0.5MW of battery capacity, which in turn offered 3.5 hours of energy storage per MW of battery capacity, for 1.7 MWH of energy storage per MW of renewables.

Download

Our base case estimates for Compressed Air Energy Storage costs require a 26c/kWh storage spread to generate a 10% IRR at a $1,350/kW CAES facility, with 63% round-trip efficiency, charging and discharging 365 days per year. Our numbers are based on top-down project data and bottom up calculations, both for CAES capex (in $/kW) and CAES efficiency (in %) and can be stress-tested in the model. What opportunities?

Download

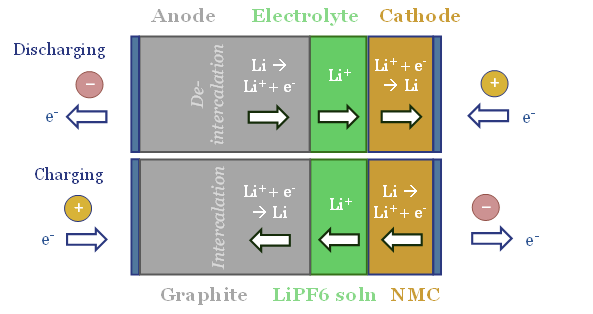

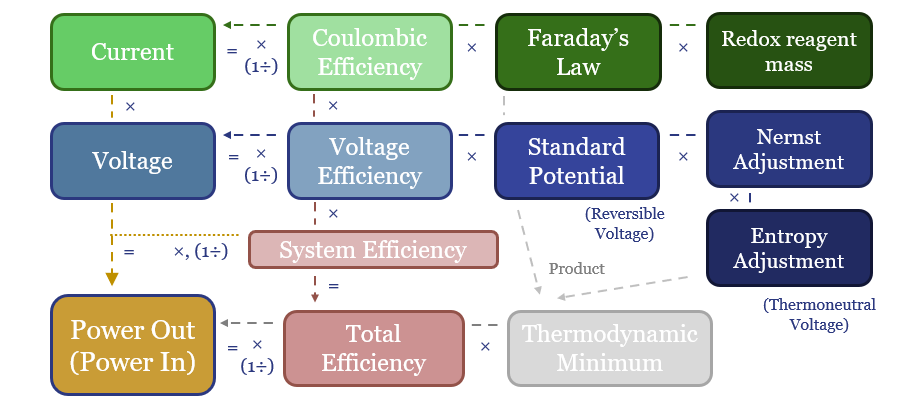

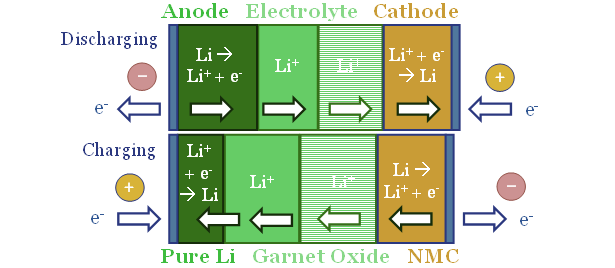

Batteries, electrolysers and cleaner metals/materials value chains all hinge on electrochemistry. Hence this 19-page note explains the energy economics from first principles. The physics are constructive for lithium and next-gen electrowinning, but perhaps challenge green hydrogen aspirations?

Download

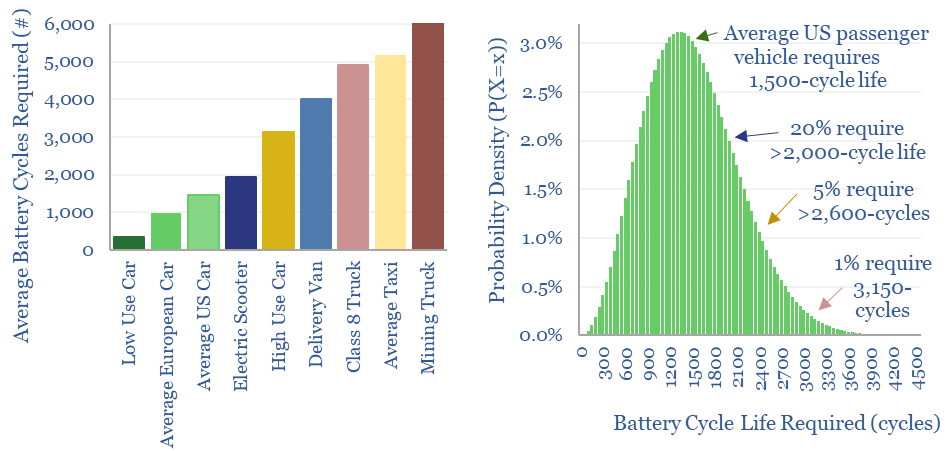

Electric vehicle battery life will realistically need to reach 1,500 cycles for the average passenger vehicle, 2,000-3,000 cycles after reflecting a margin of safety for real-world statistical distributions, and 3,000-6,000 cycles for higher-use commercial vehicles. This means lithium ion batteries may be harder to displace with novel chemistries?

Download

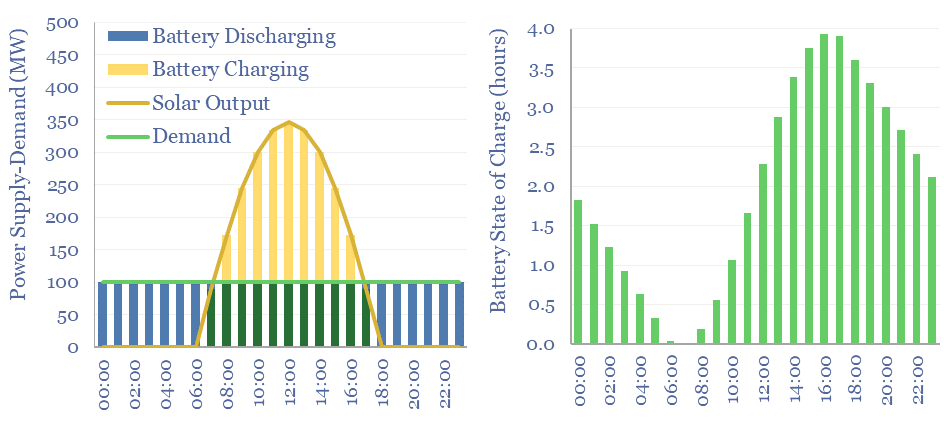

Thermal energy storage will outcompete other batteries and hydrogen for avoiding renewable curtailments and integrating more solar? Overlooked advantages are discussed in this 21-page report, plus a fast-evolving company landscape. What implications for solar, gas and industrial incumbents?

Download

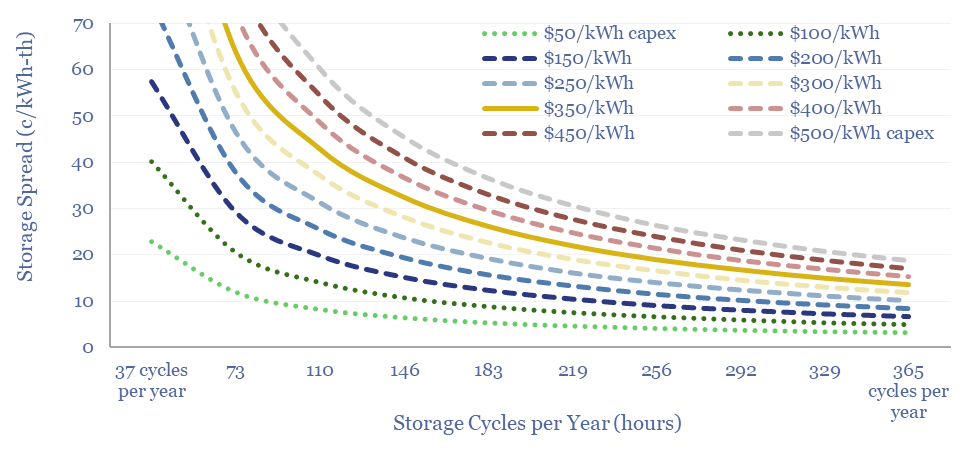

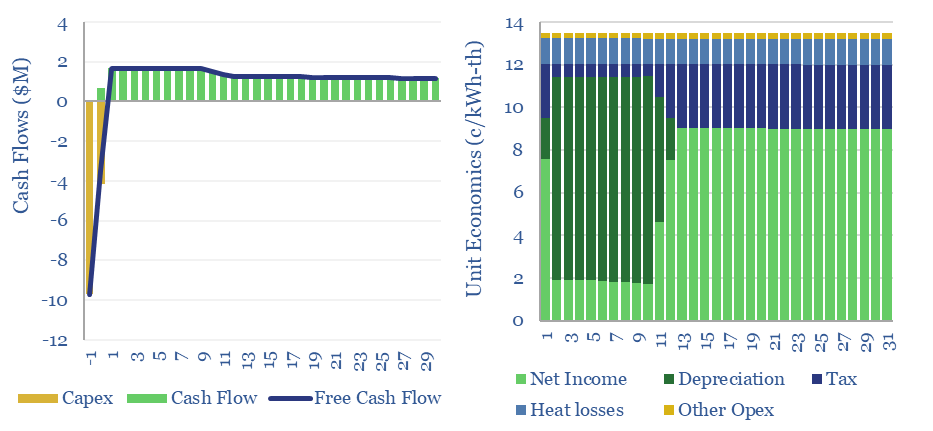

This data-file captures the costs of thermal energy storage, buying renewable electricity, heating up a storage media, then releasing the heat for industrial, commercial or residential use. Our base case requires 13.5 c/kWh-th for a 10% IRR, however 5-10 c/kWh-th heat could be achieved with lower capex costs.

Download

How much wind, solar and/or batteries are required to supply a stable power output, 24-hours per day, 7-days per week, or at even longer durations? This data-file stress-tests different scenarios, with each 1MW of average load requiring at least 3.5MW of solar and 3.5MW of lithium ion batteries, for a total system cost of at least 18c/kWh, and up to 800c/kWh.

Download

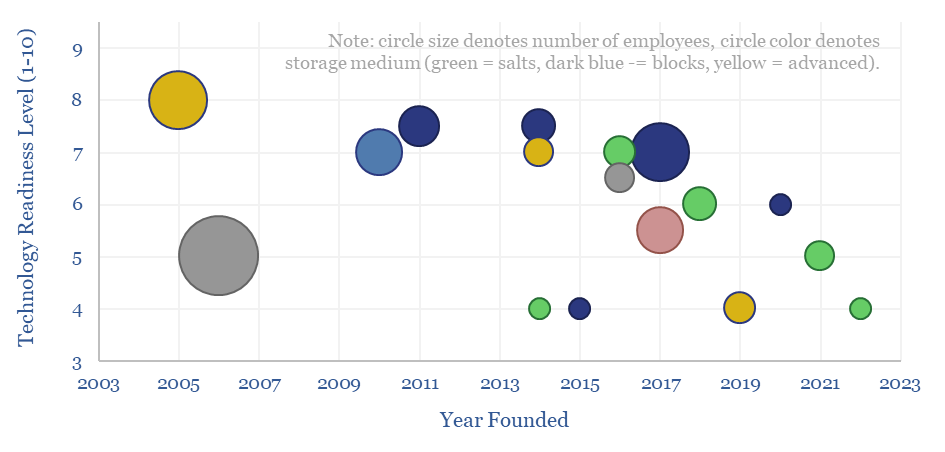

This data-file is a screen of thermal energy storage companies, developing systems that can absorb excess renewable electricity, heat up a storage medium, and then re-release the heat later, for example as high-grade steam or electricity. The space is fast-evolving and competitive, with 17 leading companies progressing different solutions.

Download

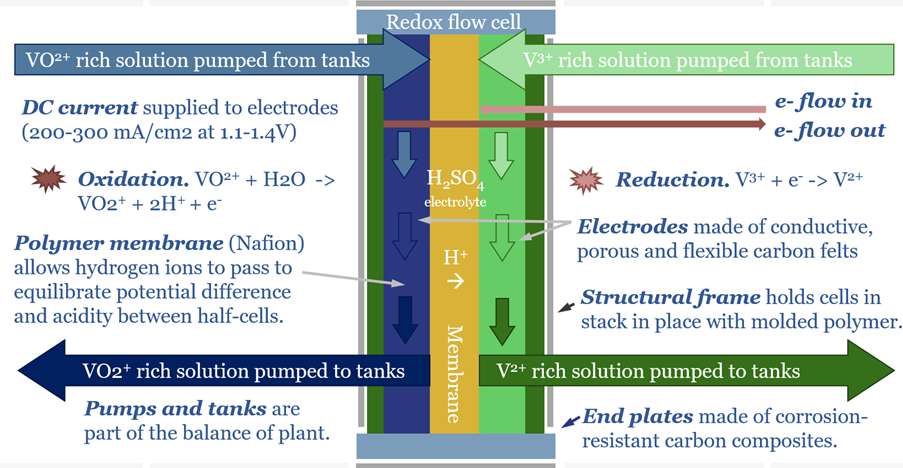

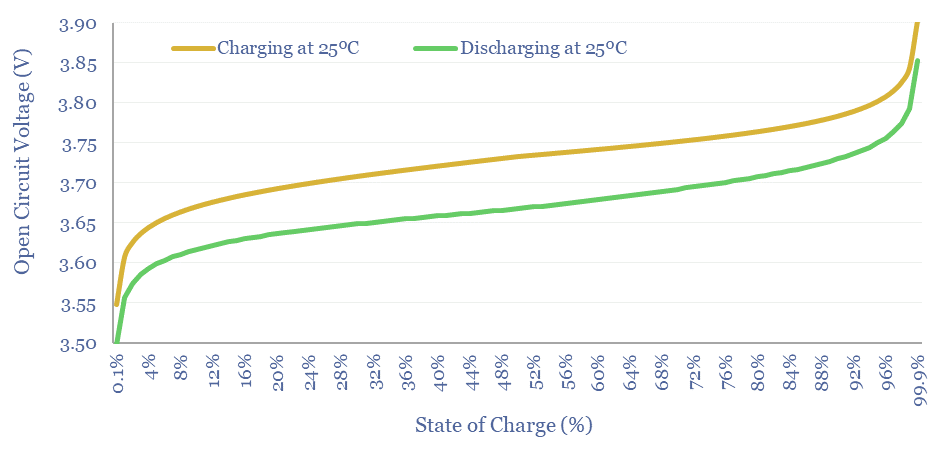

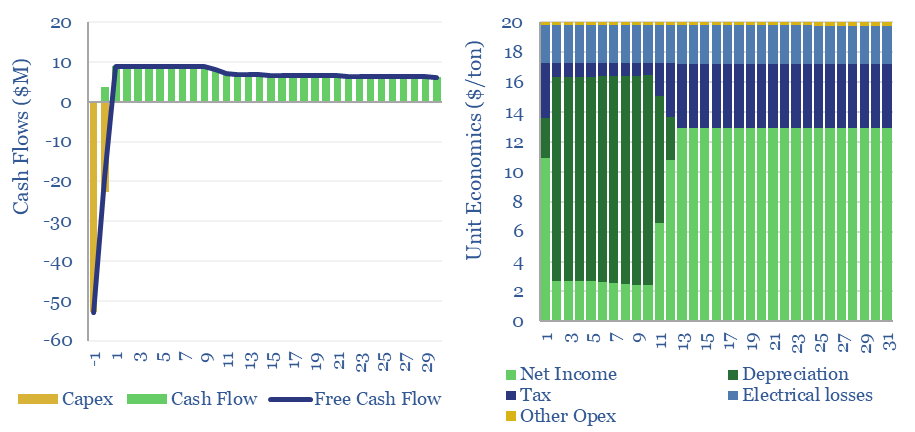

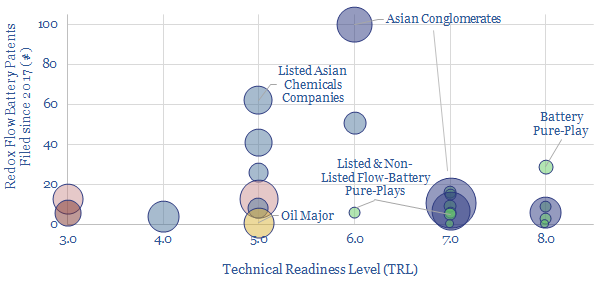

Redox flow batteries have 6-24 hour durations and require 15-20c/kWh storage spreads. They will increasingly compete with lithium ion batteries in grid-scale storage. Does this unlock a step-change for peak renewables penetration? Or create 3-30x upside for total global Vanadium demand? This 15-page note is our outlook for redox flow batteries.

Download

What determines the Voltage of an electrochemical cell, such as a lithium ion battery, redox flow battery, a hydrogen fuel cell, an electrolyser or an electrowinning plant? This note explains electrochemical voltages, from first principles, starting with Standard Potentials and the Nernst Equation.

Download

Redox flow battery costs are built up in this data-file, especially for Vanadium redox flow. In our base case, a 6-hour battery that charges and discharges daily needs a storage spread of 20c/kWh to earn a 10% IRR on $3,000/kW of up-front capex. Longer-duration redox flow batteries start to out-compete lithium ion batteries for grid-scale storage.

Download

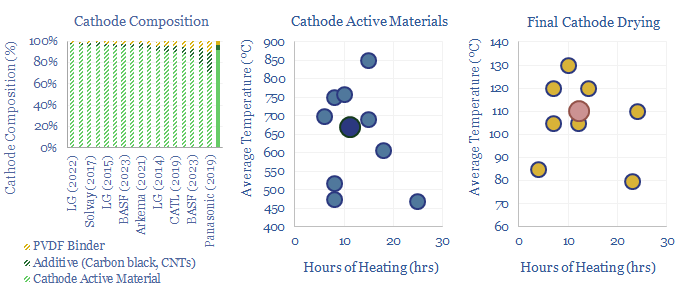

Lithium ion batteries famously have cathodes containing lithium, nickel, manganese, cobalt, aluminium and/or iron phosphate. But how are these cathode active materials manufactured? This data-file gathers specific details from technical papers and patents by leading companies such as BASF, LG, CATL, Panasonic, Solvay and Arkema.

Download

Solvay is a chemicals company with growing exposure to battery materials, especially the PVDF binders that hold together active materials in the electrodes. But also increasingly in electrolyte solvents, salts and additives. Interestingly, our patent review finds optimizations of this overall system can improve the longevity and energy density of batteries, which may also lead to consolidation across the battery supply chain?

Download

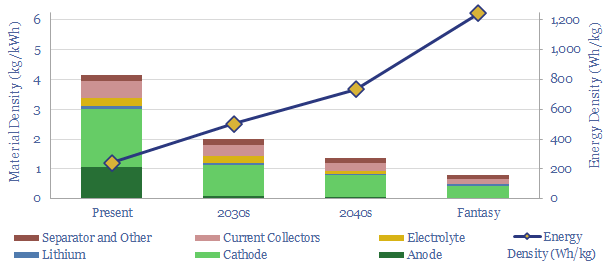

Today's lithium ion batteries have an energy density of 200-300 Wh/kg. I.e., they contain 4kg of material per kWh of energy storage. Technology gains can see lithium ion batteries' energy densities doubling to 500Wh/kg in the 2030s, trebling to 750 Wh/kg by the 2040s, and the best possible energy densities are around 1,250 Wh/kg. This is still 90% below hydrocarbons, at 12,000 Wh/kg.

Download

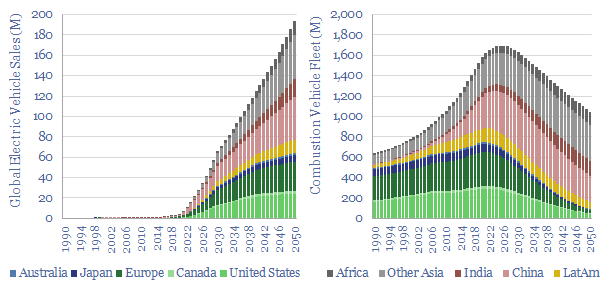

Electric vehicles are a world-changing technology, 2-6x more efficient than ICEs, but how quickly will they ramp up to re-shape global oil demand? This 14-page note finds surprising ‘stickiness’. Even as EV sales explode to 200M units by 2050 (2x all-time peak ICE sales), the global ICE fleet may only fall by 40%. Will LT oil demand surprise to the upside or downside?

Download

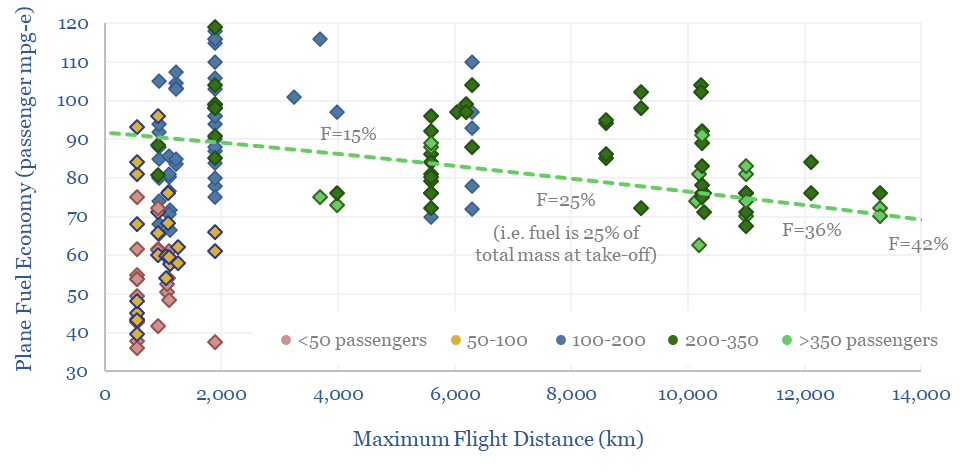

This data-file calculates the fuel economy of planes from first principles, using physics to calculate lift and drag, and comparing with actual data from aircraft manufacturers. The typical fuel economy of a plane is 80 passenger-mpg to carry 400 passengers, 8,000km at 900kmph, using jet fuel with 12,000 Wh/kg energy density. What sensitivities and decarbonization opportunities?

Download

Amprius is commercializing a lithium-ion battery with a near-100% silicon anode, yielding 80% higher energy density. It can achieve 80% charge within 6-minutes. The company is listed on NYSE. We have reviewed Amprius' silicon anode technology. The patent library is excellent, goes back to 2009 and has locked upon a specific design. This allows us to guess at costs, degradation and longevity.

Download

Hillcrest Energy Technologies is developing an ultra-efficient SiC inverter, which has 30-70% lower switching losses, up to 15% lower system cost, weight, size, and thus interesting applications in electric vehicles. How does it work and can we de-risk the technology?

Download

Grid-scale batteries are envisaged to store up excess renewable electricity and re-release it later. Grid-scale battery costs are modeled at 20c/kWh in our base case, which is the 'storage spread' that a LFP lithium ion battery must charge to earn a 10% IRR off $1,200/kW installed capex costs. Other batteries can be compared in the data-file.

Download

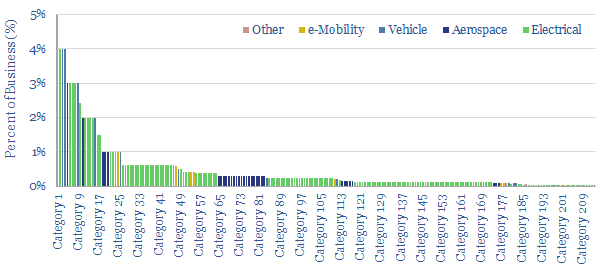

Eaton is a power-electronics super-giant, listed in the US, employing 86,000 people, generating $20bn per year of revenues. We have aimed to guess how $20bn pa of net sales is distributed across 200 different product categories. 75% is exposed to power-electronics, with tailwinds in the energy transition.

Download

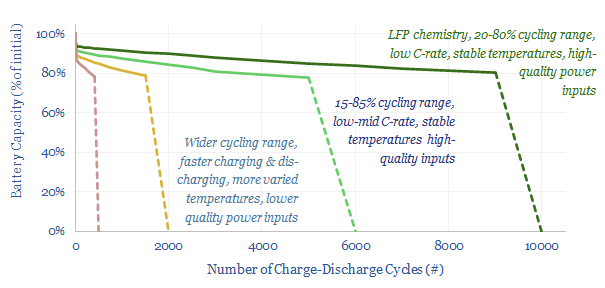

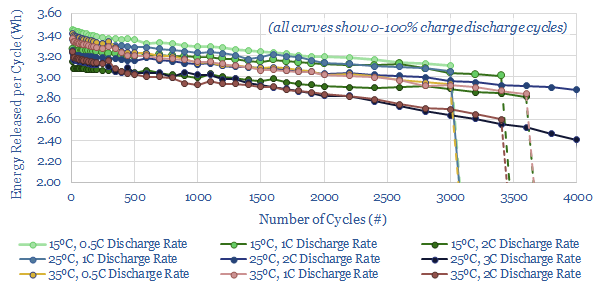

This 14-page note offers five rules of thumb to maximize the longevity of lithium-ion batteries, in grid-scale storage and electric vehicles. The data suggest hidden upside in the demand for batteries, for lithium and high-quality power electronics, especially if batteries are to backstop renewables.

Download

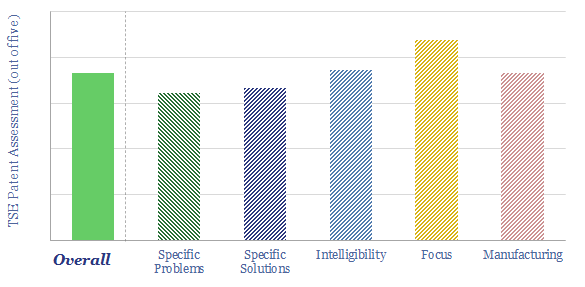

Lithium ion battery degradation rates vary 2-20% per 1,000 cycles. And lithium ion batteries last from 500 - 20,000 cycles. We have aggregated 7M data-points from laboratory tests, in order to quantify what drives battery degradation. LFP chemistry, low C-rates, stable temperatures and limited cycling all help.

Download

Supercapacitors are well suited to smoothing short-term volatility in increasingly renewables-heavy grids. Typical systems are 10kW-10MW, 1M chage-discharge cycles, 5-30 seconds storage and $30/kW costs. Expect the market to surprise to the upside, especially in combination with other power-electronics. Who benefits?

Download

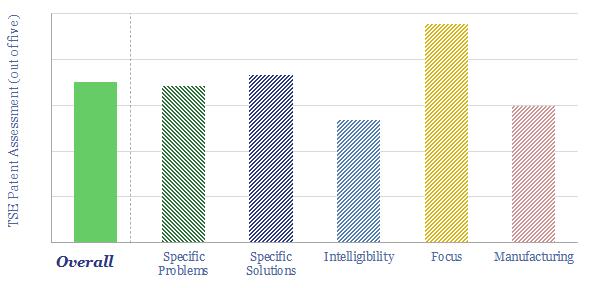

Powin commercializes energy storage hardware and software. Its LFP battery system is 30% more compact than peers, at 200 MWH/acre, and modular, meaning it may be 50% faster to install. Our patent review finds a moat around specific process improvements, to help back up the short-term volatility of solar and wind.

Download

The solar energy reaching a given point on Earth’s surface varies by +/- 6% each year. These annual fluctuations are 96% correlated over tens of miles. And no battery can economically smooth them. Solar heavy grids may thus become prone to unbearable volatility. Our 17-page note outlines this important challenge, and finds that the best solutions are to construct high-voltage interconnectors and keep power grids diversified.

Download

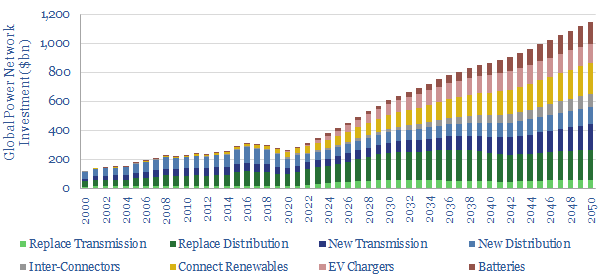

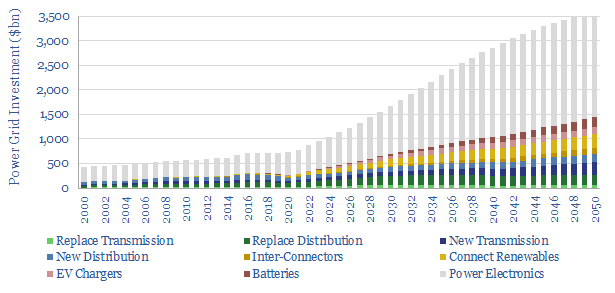

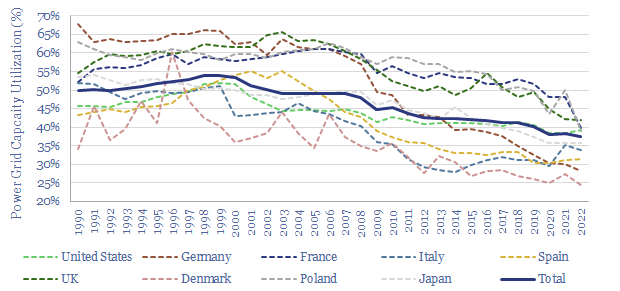

Global investment into power networks averaged $280bn per annum in 2015-20, of which two-thirds was for distribution and one-third was for transmission. Amazingly, these numbers step up to $600bn in 2030, >$1trn in the 2040s and can be as large as all primary energy investment.

Download

Nostromo is commercializing a thermal energy storage system, for commercial buildings in hot climates, where AC can comprise 40-70% of total energy use. It scores highly on our patent framework and can be an interesting alternative to lithium batteries.

Download

Semi-solid electrodes are aimed at "dramatically reducing" costs of lithium ion batteries, with 70-100% higher energy density, plus better safety and reliability, for use in battery storage and electric vehicles. 24M has a moat and is licensing technology to Freyr and Volkswagen.

Download

This data-file assesses pumped hydro costs, to back up wind and solar. A typical project has 0.5GW of capacity, 12-hours storage duration, 80% efficiency, and capex costs of $2,250/kW. Thus it requires a 25c/kWh storage spread, in order to generate a 10% IRR.

Download

CATL produces one-third of the world's lithium ion batteries. Its patents have warned of devastating lithium shortages since at least 2016. Hence in 2021, it announced it would produce commercial sodium-ion batteries by 2023. The technical challenges are captured in its patent library. We cannot fully de-risk its 2023 target.

Download

Direct Lithium Extraction from brines could help lithium scale 30x in the Energy Transition; with costs and CO2 intensities 30-70% below mined lithium; while avoiding the 1-2 year time-lags of evaporative salars. This 15-page note reviews the top ten challenges that decision-makers need to de-risk.

Download

This data-file approximates the costs of battery-grade lithium from brines, via traditional salars the emerging technology of direct lithium extraction. Costs are c40-60% lower than mined lithium in ($/ton of lithium carbonate equivalent). CO2 intensity is 50-80% lower (in kg/kg).

Download

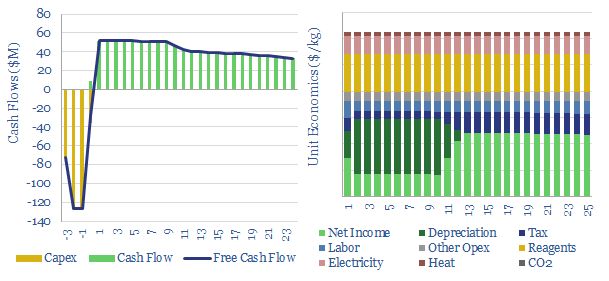

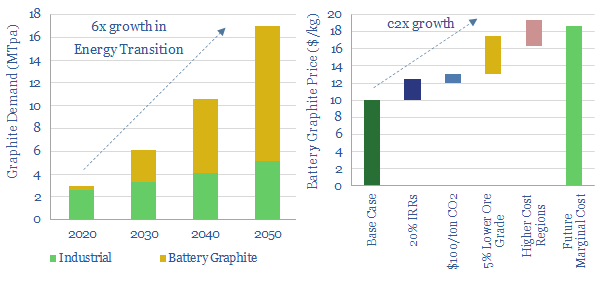

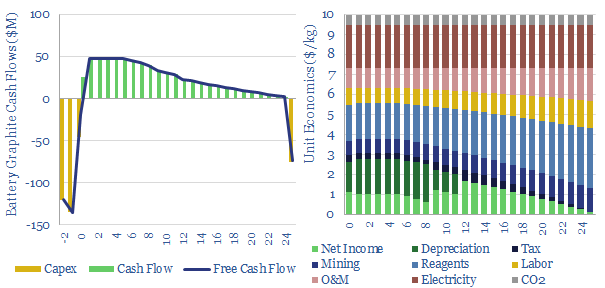

Global graphite volumes grow 6x in the energy transition, mostly driven by electric vehicles. We see the industry moving away from China’s near-exclusive control. The future favors a handful of Western producers, integrated from mine to anode, with CO2 intensity below 10kg/kg. This 10-page note outlines the opportunity.

Download

This data-file captures simplified costs for producing battery-grade graphite (i.e., 99.9% pure, coated, spheronized graphite) in an integrated facility, from mine to packaged output. Our marginal cost is estimated at around $10,000/ton for a 10% IRR. CO2 intensity varies but averages 10kg/kg.

Download

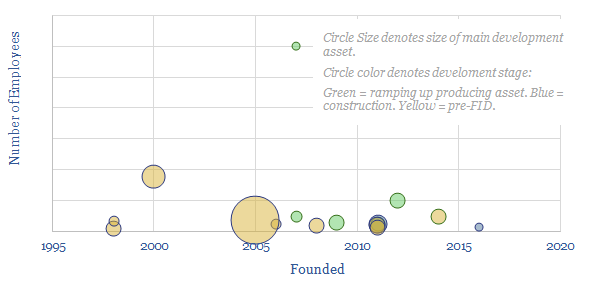

This data-file screens 15 companies that are developing graphite mines, plus downstream refining facilities, to upgrade their output into highly pure spheronized graphite that can be used as an anode material for lithium ion batteries, such as in electric vehicles.

Download

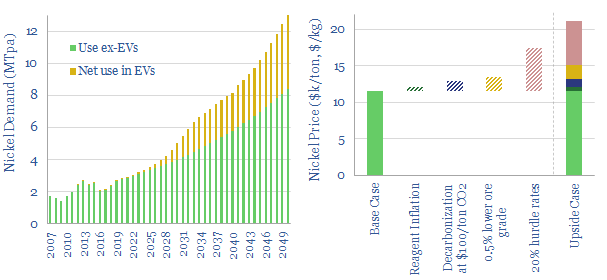

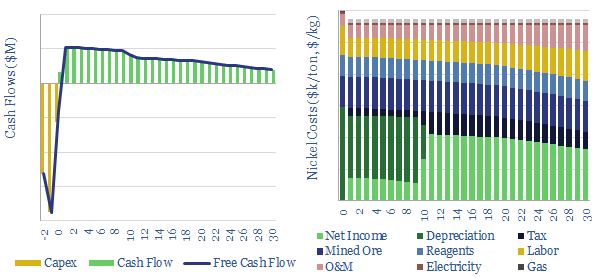

The global nickel market will grow from $30bn pa to $300bn in the energy transition, including a 5x increase in volumes and 2x increase in price. This 15-page note evaluates the nickel supply chain for electric vehicle battery cathodes. Deficits are looming. Hence we end by screening nickel names.

Download

This model captures the economics of producing battery-grade nickel (e.g., Class I, nickel sulphate) at a metallurgical processing facility. Marginal cost is likely around $11,500/ton in order to generate a 10% IRR, in a process emitting 14 tons of CO2 per ton of product. Numbers vary.

Download

This data-file contains actual power flows, kindly shared by a client of Thunder Said Energy, who is based in sunny Australia, with 13.5kW of residential solar panels and the 13.5kWh Tesla Powerwall system as a back-up. The system meets an impressive 92% of year-round power needs.

Download

ESS is emerging as a leader in medium-duration energy storage (4-12 hours), with an iron flow battery costing 2-5c/kWh (assuming >daily cycling) and lasting 20,000 cycles. The patent library is high quality. We note five challenges to consider. The largest is round-trip efficiency.

Download

Sila Nanotechnologies claims to have made "the biggest battery breakthrough in 30-years", integrating silicon with the anodes of lithium ion batteries. Overall, our patent review did support some further de-risking of silicon anode LIBs.

Download

Solid Power is developing solid-state batteries, using sulphide electrolytes. Ambitious goals include >500 miles of EV range (50-100% more than today's lithium ion batteries), 2x higher life-spans and costs as low as $85/kWh. The company is going public via SPAC, valued at $1.2bn, and has an exceptional list of backers.

Download

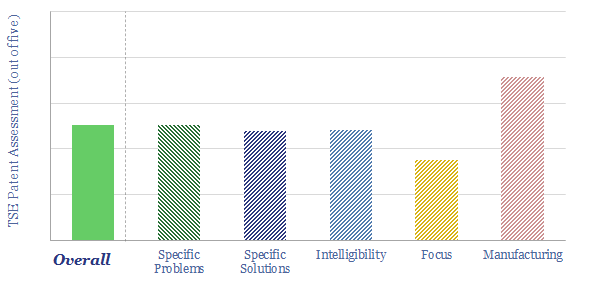

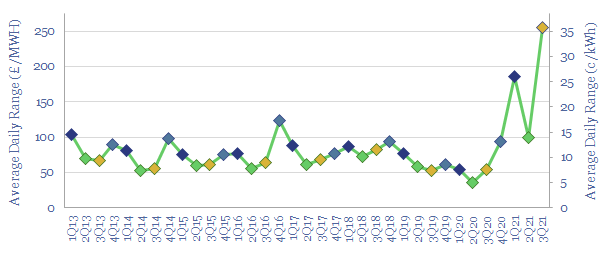

UK power price volatility has exploded in 2021. The average daily range has risen 4x from 2019-20, to 35c/kWh in 3Q21. At this level, grid-scale batteries are strongly ‘in the money’. So will the high volatility persist? This is the question in today's 6-page note.

Download

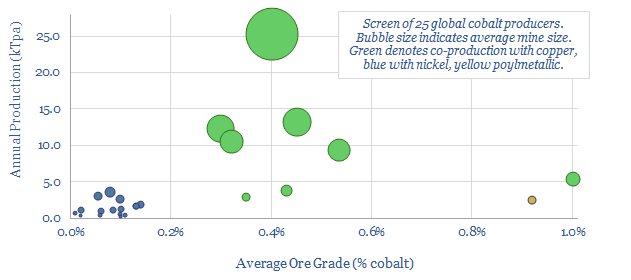

Our global decarbonization models burn through the world's entirely terrestrial cobalt resources. Hence this data-file reviews c25 mines around the world, and the resultant positions of 25 global cobalt producers. All cobalt is produced alongside copper or nickel, but some companies are more cobalt-exposed.

Download

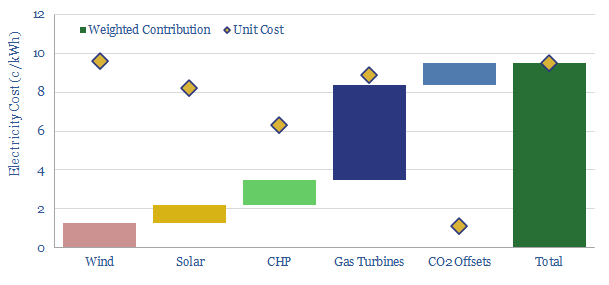

This 14-page note lays out a new model to supply fully carbon-neutral energy to a cluster of commercial and industrial consumers, via an integrated package of renewables, low-carbon gas back-ups and nature based carbon removals. This is remarkable for three reasons: low cost, high stability, and full technical readiness.

Download

Form Energy is aiming to commercialize a metal-air battery, for long-duration energy storage, using only safe and Earth-abundant materials. The first 1MW/150MWH system could be deployed by 2023. Compared to other patent libraries, we have found it harder to de-risk Form's technology.

Download

Lilac Solutions aims to commercialize a lithium ion exchange technology, which can extract lithium from dilute brine solutions, rapidly, economically and scalably. Overall Lilac's patents look promising to us. They contain some excellent, precise and intelligible details on making ion exchange materials.

Download

Lithium demand is likely to rise 30x in the energy transition. So this 15-page note reviews the mined lithium supply chain, finding prices will rise too, by 10-50%. The main reason is lower-grade ores. Second is energy intensity. Low-cost lithium brine producers may benefit from steeper cost curves.

Download

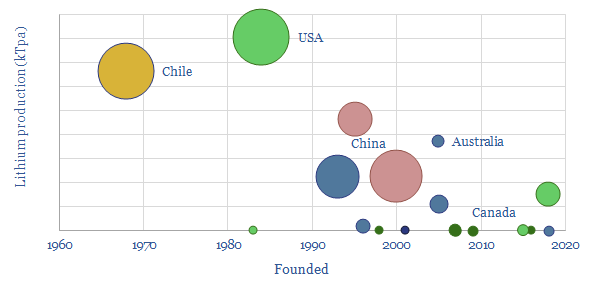

This data-file captures c20 lithium producers, their output (in kTpa), their size and their recent progress. Eight companies effectively control 90% of global supply. 3 out of 12 earlier-stage companies underwent restructurings in 2020, illustrating risks, but also potential future supply shortages.

Download

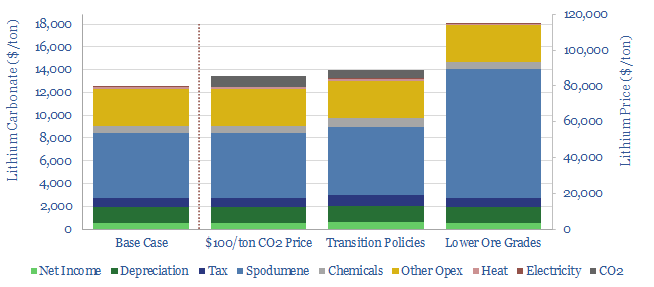

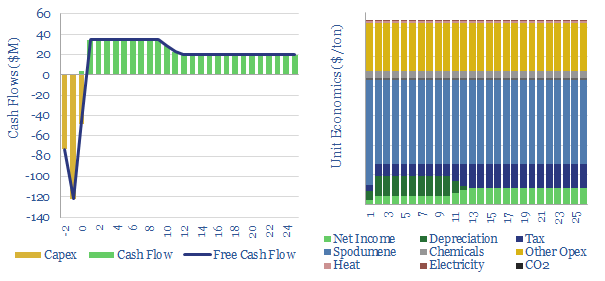

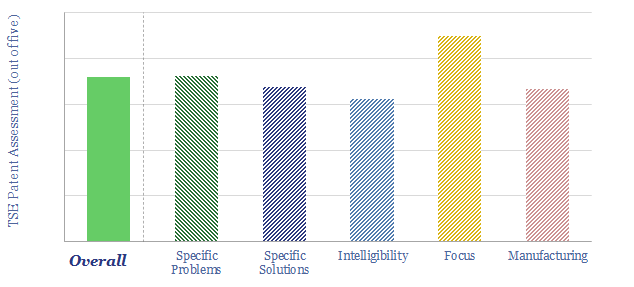

This data-file quantifies the economics of producing lithium carbonate from spodumene in mined pegmatites. We estimate a price of $12,500/ton lithium carbonate price is likely needed for a 10% IRR in today's China-heavy value chain, which emits 50kg of CO2 per kg of lithium.

Download

Stem Inc. went public via SPAC in April-2021, supporting grid-scale batteries with optimization software, which can lower energy bills by 10-30% in the energy transition. Its patents scored reasonably well on our usual framework. Managing short-term renewables volatility was a crucial focus.

Download

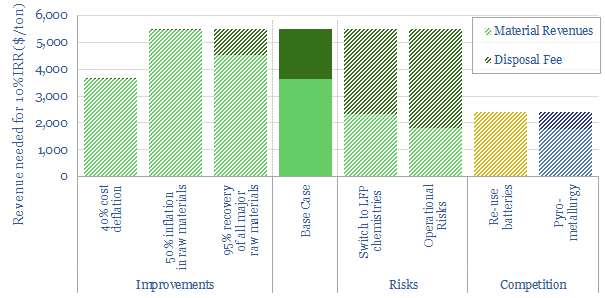

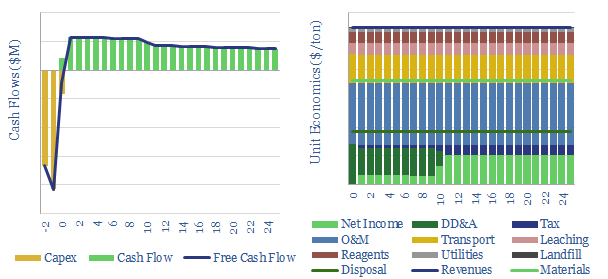

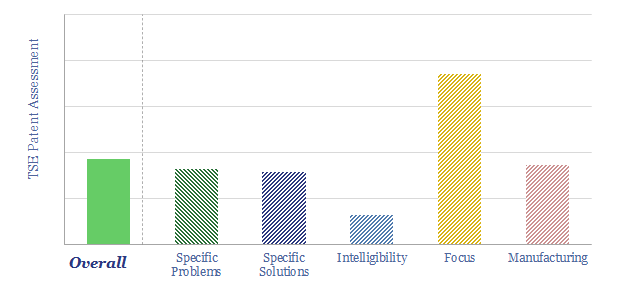

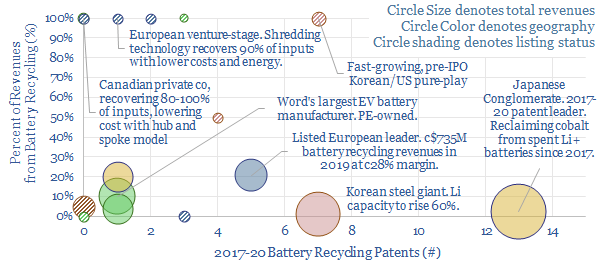

Recycling lithium batteries could be worth $100bn per year by 2040 while supporting electric vehicles’ ascent. Hence new companies are emerging to recapture 95% of spent materials with environmentally sound methods. Our 15-page note explores what it would take for battery-recycling to become both practical and compelling.

Download

This data-file models the economics of recycling spent lithium ion batteries, taking in waste cells, and recovering materials such as cobalt, nickel, manganese, copper, aluminium, lithium and steel. It currently looks challenging to generate acceptable IRRs without charging a disposal fee in the range of $1,700-2,000/ton. This could change through more automated processes.

Download

Enovix has developed a 3D silicon lithium-ion battery, 5-years ahead of the broader industry, with 2x higher energy density. The company went public via SPAC in February-2021, with an implied post-deal valuation of $1.12bn. This data-file assesses its technology breakthroughs.

Download

StoreDot is developing "extreme fast-charging" batteries for electric vehicles, using a proprietary range of nanomaterial additives. It claims prototype cells can charge 5-6x faster than conventional lithium ion. This data-file assesses StoreDot patents from 2019-20, looking to de-mystify its breakthroughs.

Download

Solid state batteries promise 2x higher energy density than traditional lithium ion, with 3x faster charging and lower risk of fires. They could re-shape global energy, especially heavy trucks. But the industry has been marooned by uncontrollable cell degradation. QuantumScape’s disclosures suggest it is light years ahead. But costs may remain high.

Download

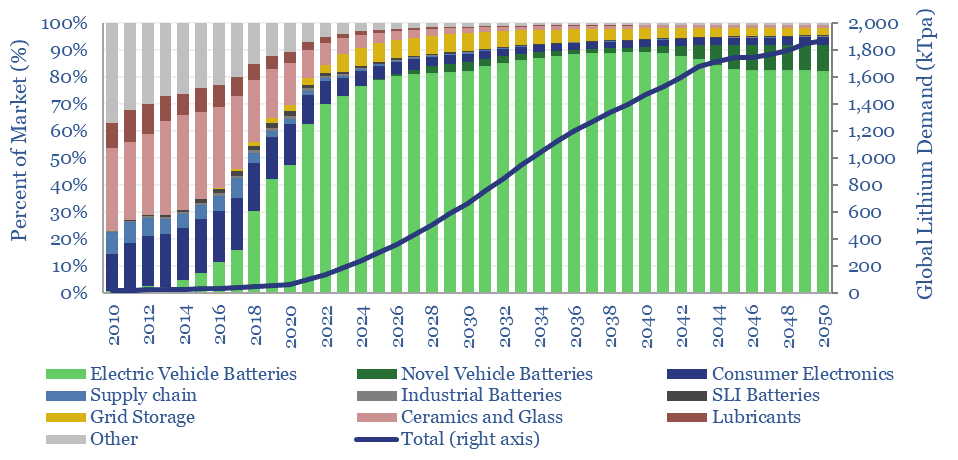

This data-file estimates global demand for lithium as part of the energy transition. The market has already trebled from 23kTpa in 2010 to 65kTpa in 2020, while we see the ascent continuing to 500kTpa in 2030 and almost 2MTpa in 2050. 90% is driven by transport. Global reserves suffice to cover the demand.

Download

This data-file reviews 25 of QuantumScape's 2019-20 patents, in order to substantiate its claims of a solid-state battery than can achieve c50-100% higher energy density than conventional lithium ion batteries, 3x faster charging, while also surviving hundreds of charge-discharge cycles without degradation.

Download

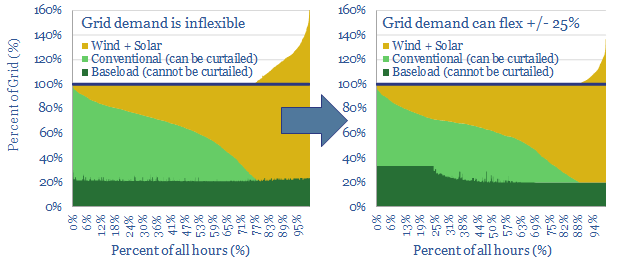

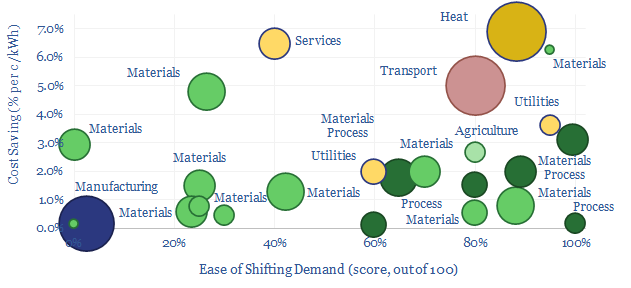

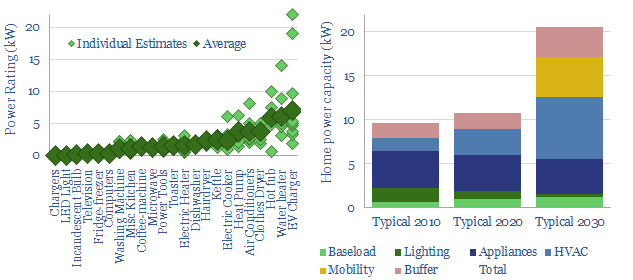

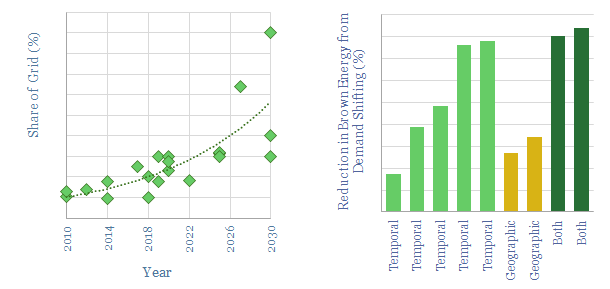

25% of the power grid could realistically become ‘flexible’, shifting its demand across days, even weeks. This is the lowest cost and most thermodynamically efficient route to fit more wind and solar into power grids. We are upgrading our renewables ceilings from 40% to 50%. This 22-page note outlines the opportunity.

Download

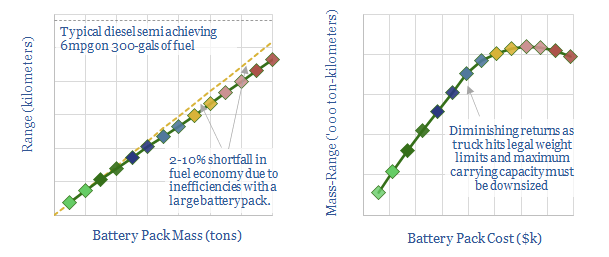

An electric truck would need a 15 ton battery to match the c2,500-mile range of a diesel truck. However, larger batteries above c8-tons detract 10% from fuel economy and may cause trucks to exceed regulatory weight limits, lowering their payload capacities. 4-6 ton batteries with 700-1,000km ranges are optimal.

Download

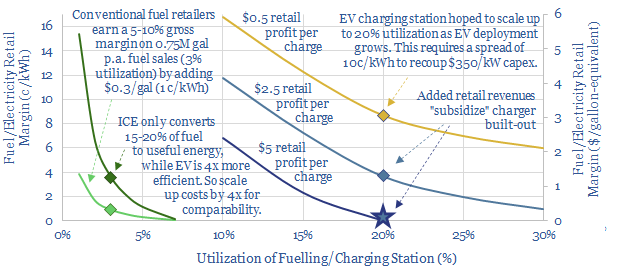

This data-file models the economics of electric vehicle chargers, by disaggregating the costs of different charger types. Economics are most favorable where they lead to incremental retail purchases and for faster chargers. Economics are least favorable around apartments, charging at work and for slower charging speeds.

Download

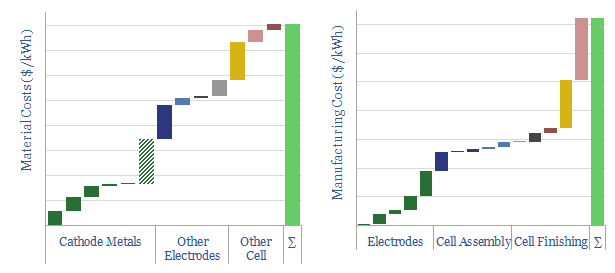

This data-file is a breakdown of lithium ion battery materials and their costs. A typical lithium ion battery has a cell-level energy density around 250 Wh/kg, and weighs 380 grams, of which 40% is cathode metals, 25% is anode materials, 20% is current collectors, 15% is electrolyte and separators. Total cost is around $150/kWh, half materials, half manufacturing.

Download

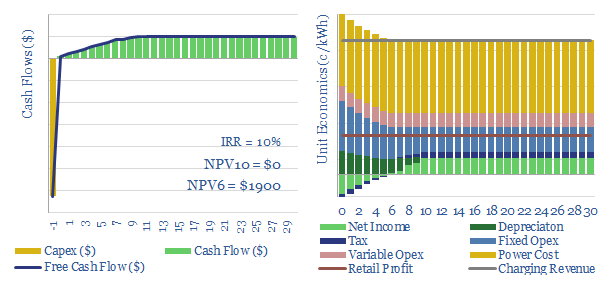

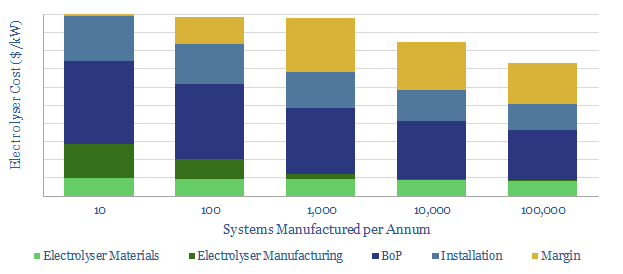

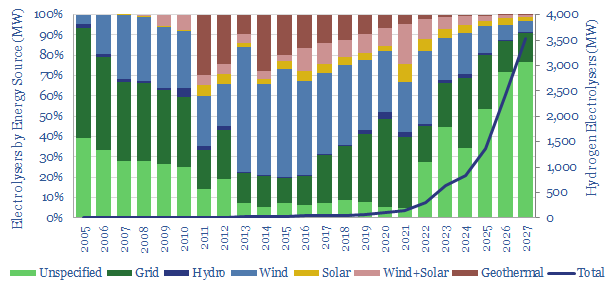

For green hydrogen to become competitive, total electrolyser costs must deflate by over 75% from current levels around $1,000/kW. This 14-page note breaks down the numbers and the challenges, based on patents and technical papers. We argue 15-25% total cost deflation may be more realistic if manufacturers also strive to make a margin.

Download

This data-file tabulates the greatest challenges for lithium ion batteries in electric vehicles, which have been cited in 2020's patent literature. Conclusions are spelled out in detail, covering energy density, "million mile" longevity and electric semi-trucks. Companies profiled include Tesla, CATL, LG, Sumitomo, et al.

Download

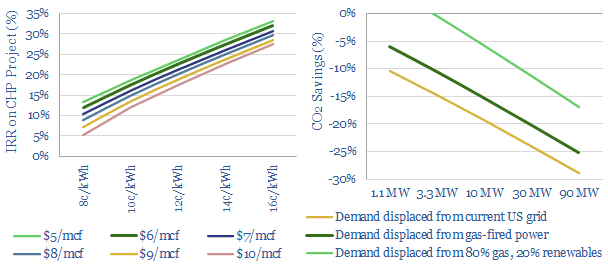

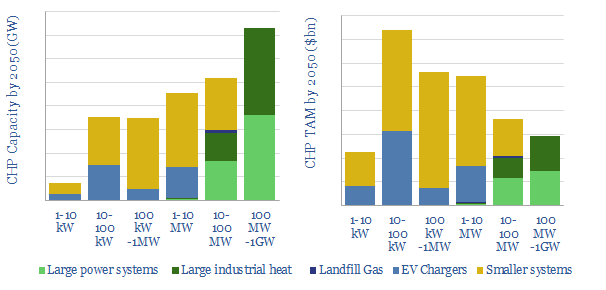

Overbuilding renewables may make power grids more expensive and less reliable. Hence more businesses may choose to generate their own power behind the meter, installing combined heat and power systems fuelled by natural gas. IRRs reach 20-30%. Efficiency is 70-80%. Total CO2 falls by 6-30%. This 17-page note outlines the opportunity.

Download

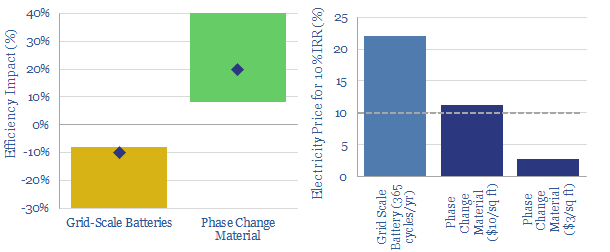

Phase change materials could be a game-changer for energy storage. They can earn double digit IRRs unlocking c20% efficiency gains in freezers and refrigerators, which make up 9% of US electricity. This is superior to batteries which add costs and incur 8-30% efficiency losses. We review 5,800 patents and identify leading companies.

Download

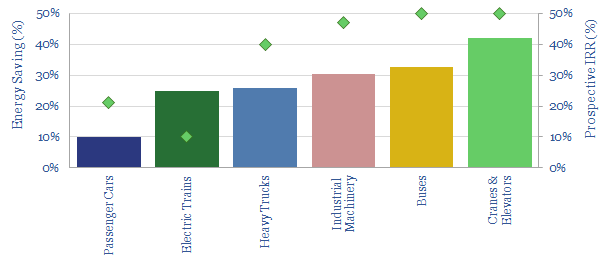

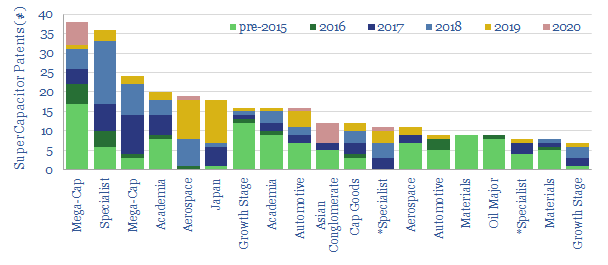

Supercapacitors may eclipse lithium ion batteries in the hybridization of transport and industry. Their energy density is improving. Potential CO2 savings could surpass 1bn tons per year. IRRs of 10-50% can be achieved, even prior to CO2 prices. These are our conclusions after reviewing 2,000 Western patents. We profile the leading companies exposed to the theme.

Download

This data-file screens for the 'top twenty' technology leaders in super-capacitors, by assessing c2,000 Western patents filed since 2013. The screen comprises capital goods conglomerates, materials companies, an Oil Major with exposure and specialist companies improving SC energy density.

Download

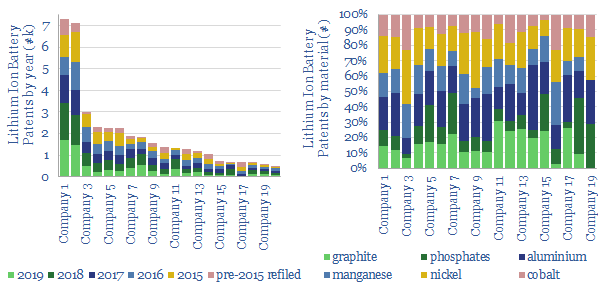

Continued deflation in lithium ion batteries is suggested by a new record of 26,000 patents filed in 2019, hence this data-file identifies the technology leaders. Elsewhere, redox flow batteries patents have doubled since 2014, while interest has been waning in solid state batteries (-57% since 2014) and liquid metal batteries (-67%).

Download

This data-file tracks over 6,000 patents filed into battery recycling technology, escalating at a 15% CAGR since 2000. 18 technology leaders are profiled ex-China, including 6 global, large-cap listed companies and 10 private companies, including some exciting, early-stage concepts to improve material recovery and costs.

Download

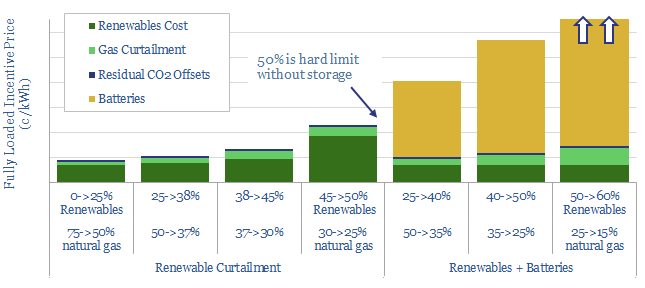

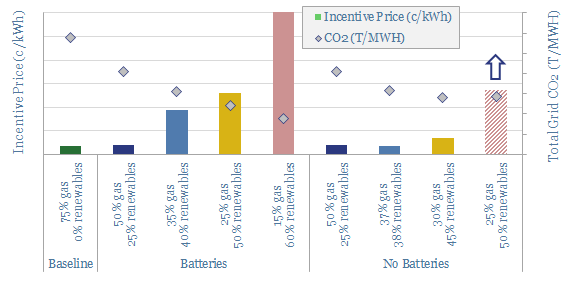

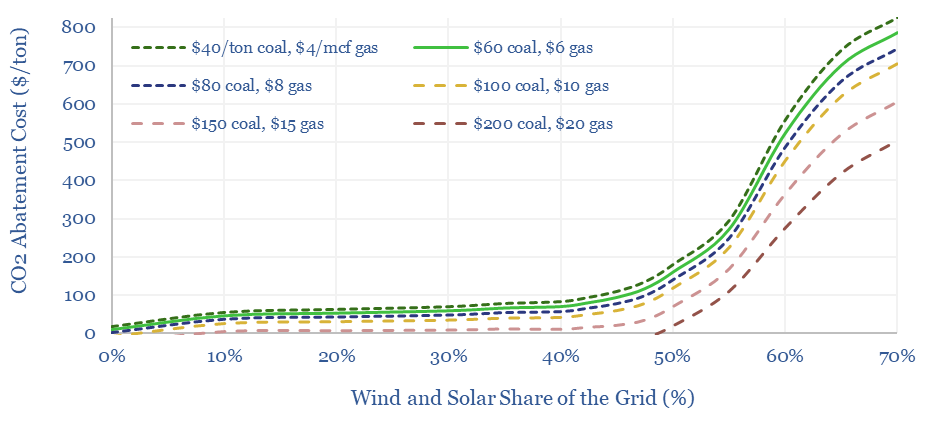

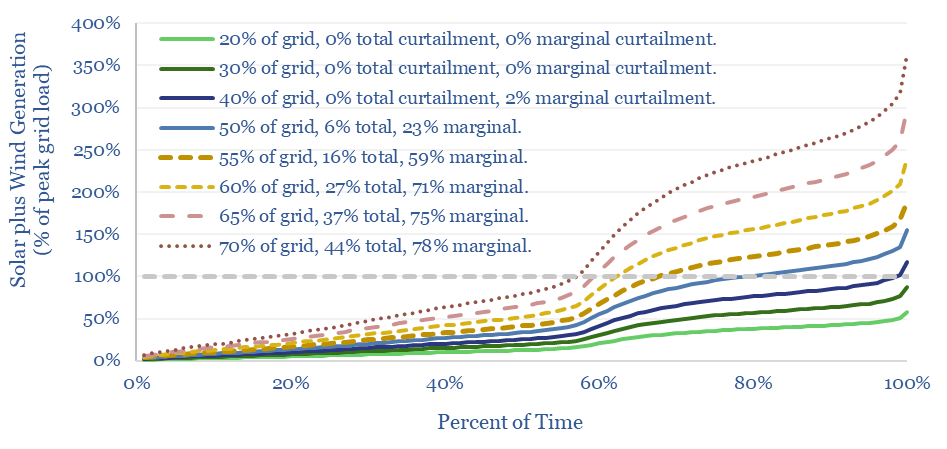

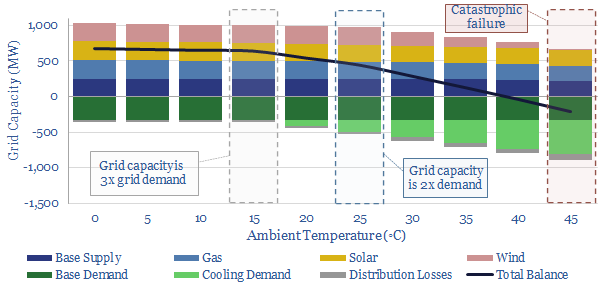

What should future power grids look like? Our answer optimizes costs, stability and CO2. Renewables do not surpass 45-50%. By this point, over 70% of new wind and solar will fail to dispatch, while incentive prices will have trebled. Batteries help little. They raise power prices by a further 2-5x to accommodate just 3-15% more … Continue reading "Decarbonized power: how much wind and solar fit into the optimal grid?"

Download

Renewables would cap out at 40-50% of inflexible electricity grids, based on Monte Carlo analysis of wind, solar and batteries. Beyond 50%, new renewables' curtailment rates surpass 70%, trebling their marginal cost. Batteries also increase incentive prices by 5-25x. Natural gas and demand-shifting are the best backstops.

Download

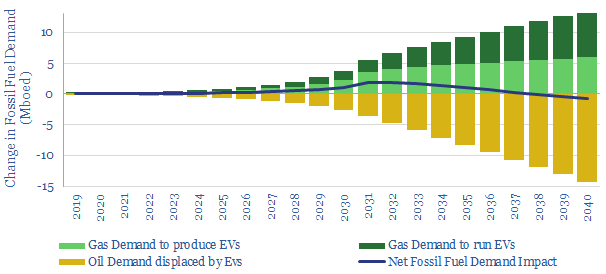

It is widely believed that electric vehicles will destroy fossil fuel demand. We find they will increase it by 0.7Mboed from 2020-35. EVs only start lowering net fossil fuel demand from 2037 onwards. The reason is that 3.7x more energy is consumed to manufacture each EV than the net road fuel it displaces each year; … Continue reading "Electric Vehicles Increase Fossil Fuel Demand?"

Download

We have compiled a database of 25 leading companies in Redox Flow Batteries, by looking across 1,237 patents since 2017. Exciting progress is visible, with technical maturity rapidly progressing, demonstration facilities under construction and a promise of cost-competitive, long-life, energy storage.

Download

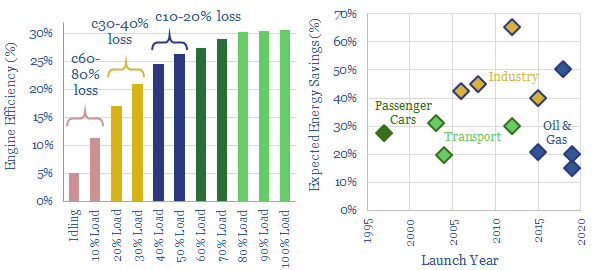

Gas and diesel engines can be 30-80% less efficient when idling, or running at low loads. This is the rationale for hybridizing engines with backup batteries. Industrial applications are increasing, achieving 30-65% efficiency gains, across multiple industries. In 2018-19, the biggest new horizon has been in oil and gas, including hybrid rigs, supply vessels, construction vessels and even LNG plants.

Download

What if it were possible to displace diesel from high-cost, high-carbon island grids, by charging up large batteries with gas- and renewable power, then shipping the batteries? We model the economics to be cost-competitive, while CO2 emissions can be halved. Futher battery cost deflation will also help.

Download

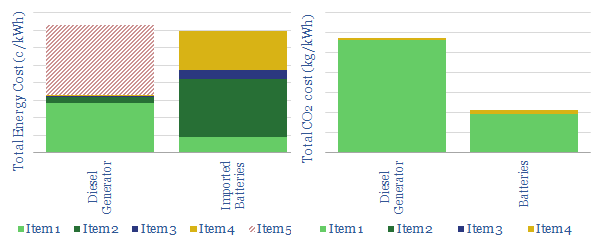

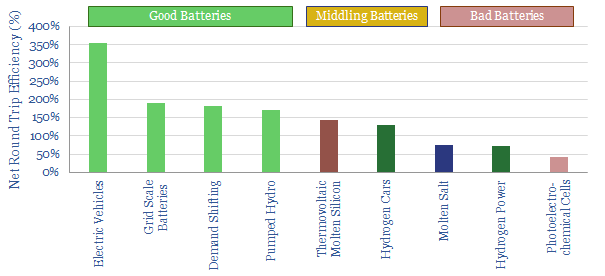

Different batteries have different round trip efficiencies. We see great potential, for example, in electrification of the vehicle fleet, which can achieve c3.5x efficiency gains. We see less potential, for example, backing up the grid with hydrogen, which reduces total system efficiency by c30%.

Download

Power Grids and Power Electronics Research

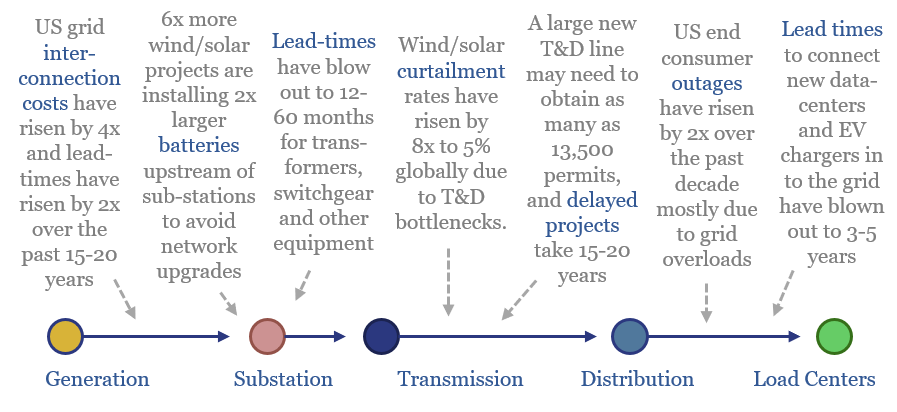

Power grids move electricity from the point of generation to the point of use, while aiming to maximize the power quality, minimize costs and minimize losses. Broadly defined, global power grids and power electronics investment must step up 5x in the energy transition, from a $750bn pa market to over $3.5trn pa. But this theme gets woefully overlooked. This also means it offers up some of the best opportunities in energy transition.

Download

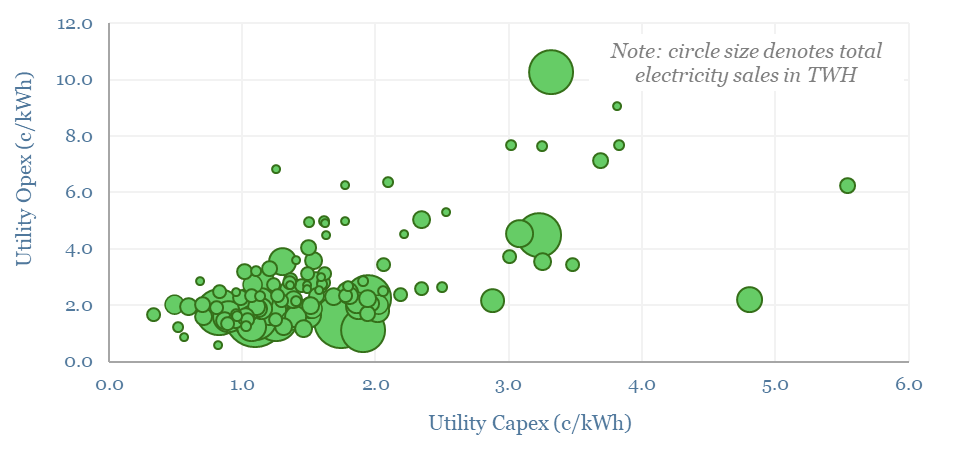

This data-file evaluates transmission and distribution costs, averaging 7c/kWh in 2024, based on granular disclosures for 200 regulated US electric utilities, which sell 65% of the US's total electricity to 110M residential and commercial customers. Costs have doubled since 2005. Which utilities have rising rate bases and efficiently low opex?

Download

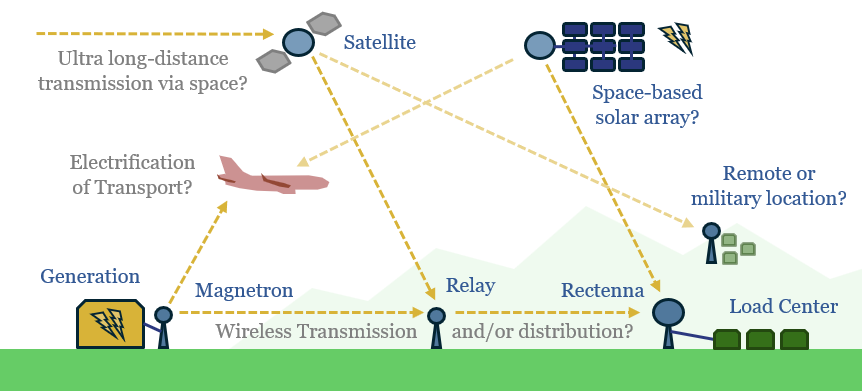

What if large quantities of power could be transmitted via the 2-6 GHz microwave spectrum, rather than across bottlenecked cables and wires? This 12-page note explores the technology, advantages, opportunities, challenges, efficiencies and costs. We still fear power grid bottlenecks.

Download

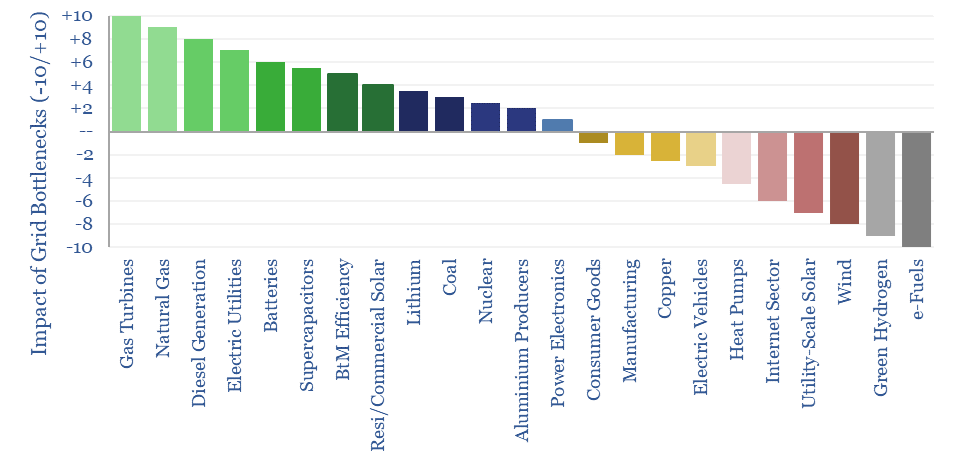

What if the world is entering an era of persistent power grid bottlenecks, with long delays to interconnect new loads? Everything changes. Hence this 16-page report looks across the energy and industrial landscape, to rank the implications across different sectors and companies.

Download

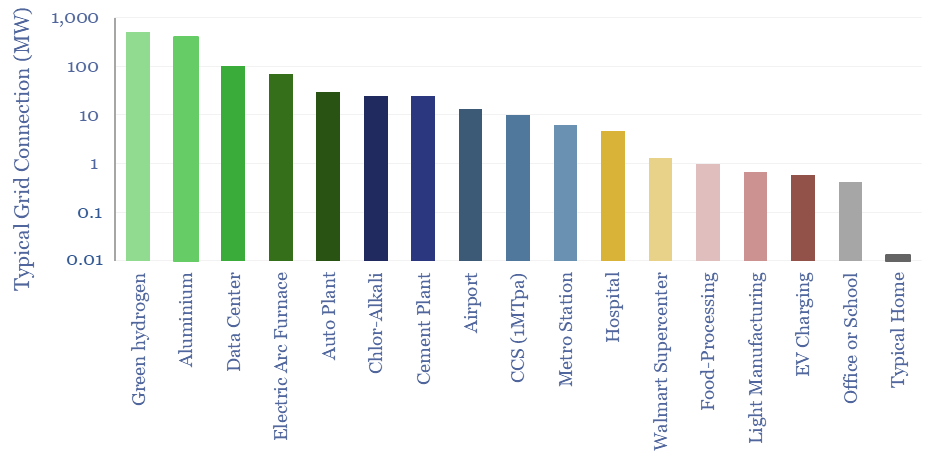

What are the typical sizes of grid connections at different residential, commercial and industrial facilities? This data-file derives aggregates estimates, from the 10kW grid connections of smaller homes to the GW-scale grid connections of large data-centers, proposed green hydrogen projects and aluminium plants.

Download

Power grids will be the biggest bottleneck in the energy transition, according to this 18-page report. Tensions have been building for a decade. They are invisible unless you are looking. And the tightness could last a decade. Further acceleration of renewables may be thwarted. And we are re-thinking grid back-ups.

Download

This data-file tracks some of the leading solar inverter companies and inverter costs, efficiency and power electronic properties. As China now supplies 85% of all global inverters, at 30-50% lower $/W pricing than Western companies, a key question explored in the data-file is around price versus quality.

Download

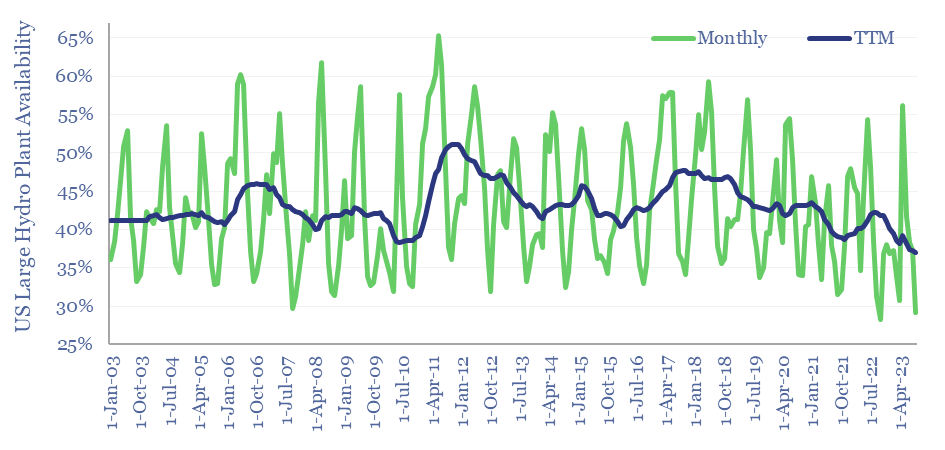

Hydro power generation by facility is tabulated in this data-file for the 20 largest hydro-electric plants in the US. The average facility achieves 43% availability, varying from 39% in hot-dry years to 51% in wet years; and from 33% at the seasonal trough in September-October to 53% at the seasonal peak in May-June. What implications for energy markets and renewables?

Download

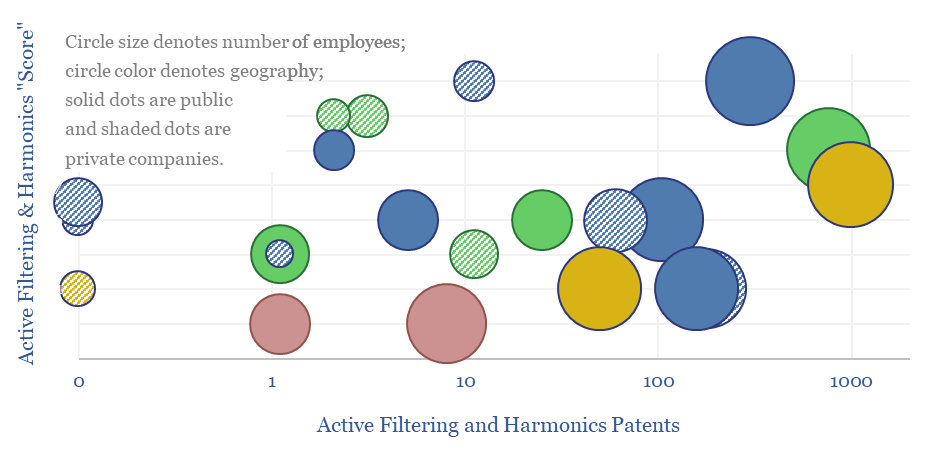

This data-file screens 20 leading companies in harmonic filters, tabulating their size, geography, ownership details, patent filings and a description of their offering. Active harmonic filters reduce total harmonic distortion below 5%, with 97% efficiency, within 5 ms. Half a dozen companies stood out in our screen, including one large, listed Western capital goods company.

Download

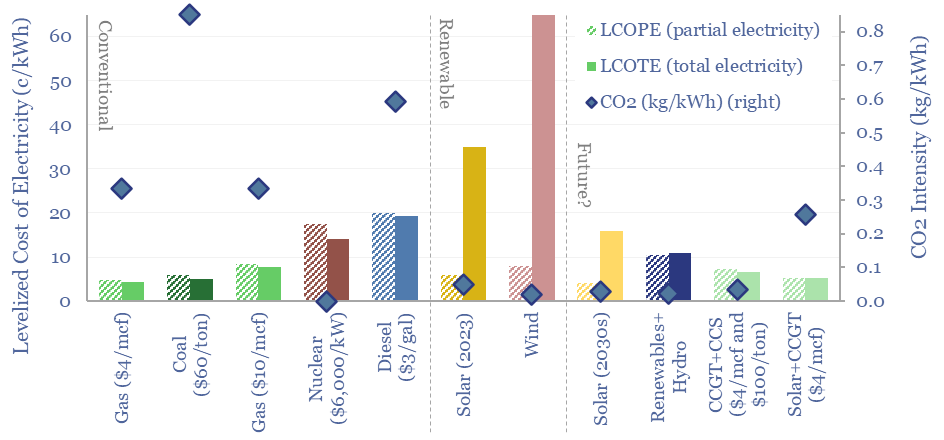

The costs of decarbonizing by ramping up solar and wind are highly dependent on context. But our best estimate is that solar and wind can reach 40% of the global grid for a $60/ton average CO2 abatement cost. This is a relatively low cost. Yet it still raises retail electricity prices from 10c/kWh to 12c/kWh. This 7-page note explores numbers and implications.

Download

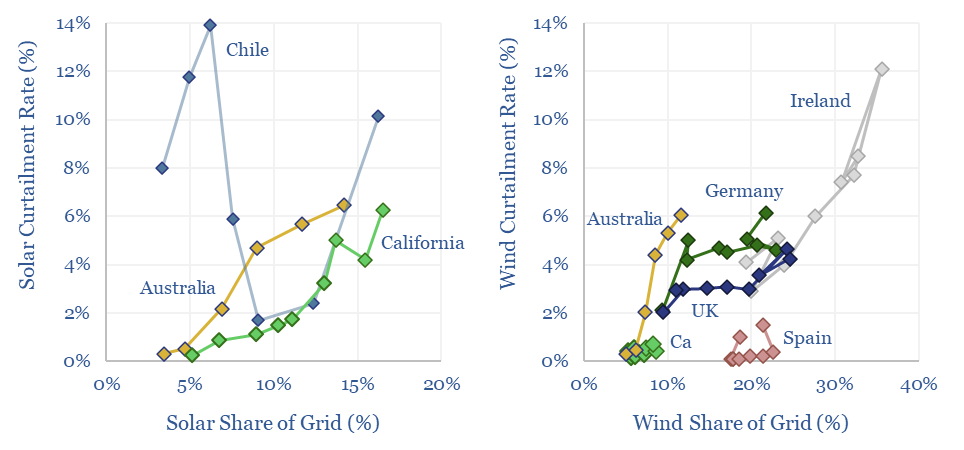

Wind and solar curtailments average around 5% across different grids that we have evaluated in 2022, and have generally been rising over time, especially in the last half-decade. The key reason is grid bottlenecks. Grid expansions are crucial for wind and solar to continue expanding.

Download

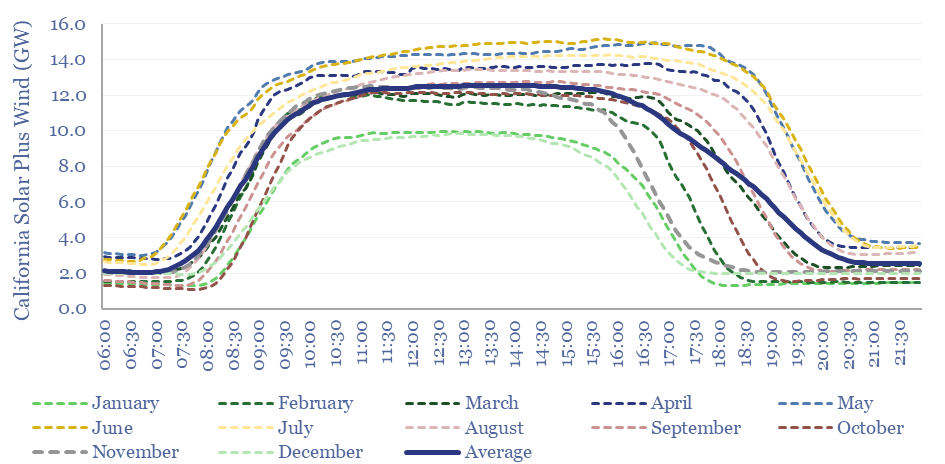

Wind and solar will most likely peak at 50-55% of power grids, without demand-shifting and batteries; more in wind-heavy grids, less in solar heavy grids. This 12-page note draws conclusions from the statistical distribution of renewables’ generation across 100,000 x 5-minute grid intervals.

Download

This data-file aggregates the statistical distribution of total electricity demand, solar generation and wind generation, every 5-minutes, across California, for the entirety of 2022, in order to understand their volatility and curtailment rates. The data suggest that wind and solar will most likely peak at 50-55% of renewables-heavy grids.

Download

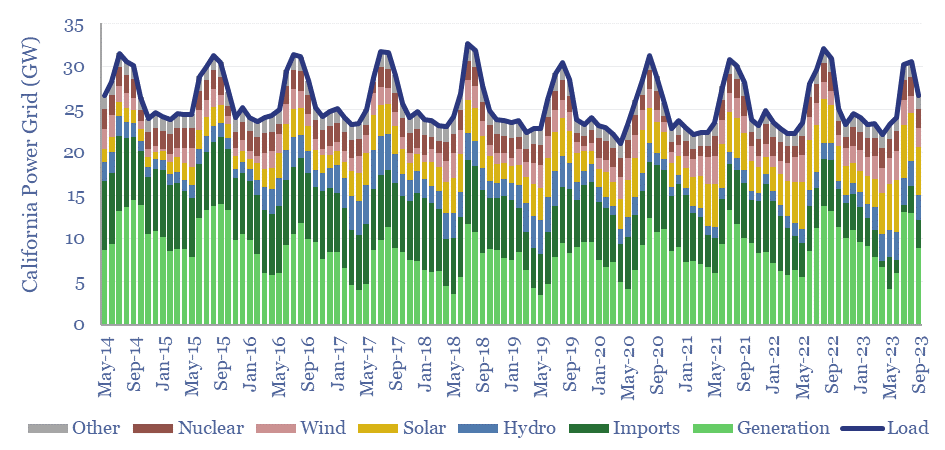

California's power grid ranges from 26-61GW of demand. Utility scale solar has almost quadrupled in the past decade, rising from 5% to almost 20% of the grid. Yet it has not displaced thermal generation, which rose from 28% to 36% of the grid. We even wonder whether wind and solar are entrenching natural gas generators as backstops.

Download

The levelized cost of partial electricity (LCOPE) is very different from the levelized cost of total electricity (LCOTE). This 21-page note explores the distinction. It suggests renewables will peak at 30-60% of power grids? And gas is well-placed as a back-up, set to surprise, by entrenching at 30-50% of renewables-heavy grids?

Download

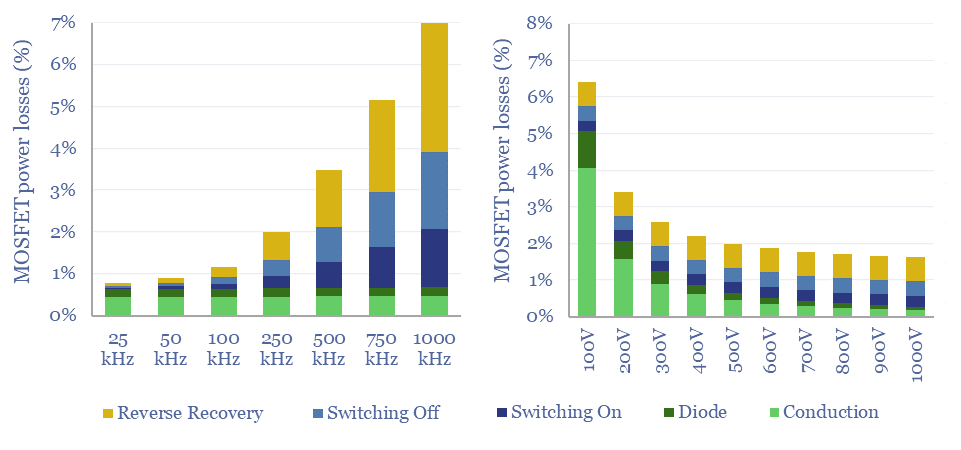

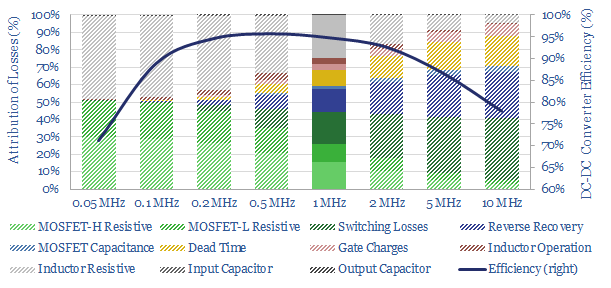

MOSFETs are fast-acting digital switches, used to transform electricity, across new energies and digital devices. MOSFET power losses are built up from first principles in this data-file, averaging 2% per MOSFET, with a range of 1-10% depending on voltage, switching, on resistance, operating temperature and reverse recovery charge.

Download

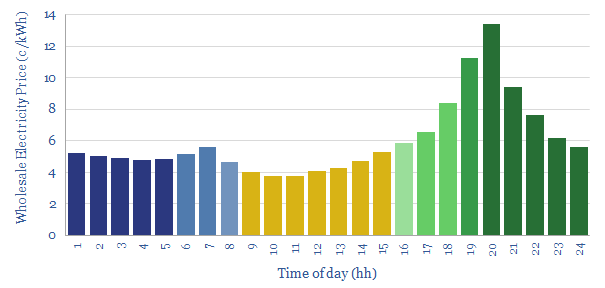

In 2023, power grids with c20-30% solar variation tend to have intra-day spreads of 9c/kWh, between peak wholesale electricity prices at 8pm and trough prices at 10am. Unusually, night-time electricity prices are 40% higher than day-time prices. This data-file quantifies California electricity prices, on a wholesale basis, at a sample of grid nodes, looking hour by hour in August-2023.

Download

There is an economic paradox where shifting towards lower cost supply sources can cause inflation in the total costs of supply. Renewable-heavy grids are subject to this paradox, as they have high fixed costs and falling utilization. As power prices rise, there are growing incentives for self-generation. Energy transition requires a balanced, pragmatic approach.

Download

Some industries can absorb low-cost electricity when renewables are over-generating and avoid high-cost electricity when they are under-generating. The net result can lower electricity costs by 2-3c/kWh and uplift ROCEs by 5-15% in increasingly renewables-heavy grids. This 14-page note ranges over 10,000 demand shifting opportunities, to identify who can benefit most.

Download

Demand shifting flexes electrical loads in a power grid, to smooth volatility and absorb more renewables. This database scores technical potential and economical potential of different electricity-consuming processes to shift demand, across materials, manufacturing, industrial heat, transportation, utilities, residential HVAC and commercial loads.

Download

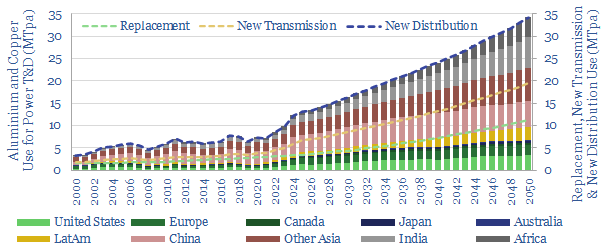

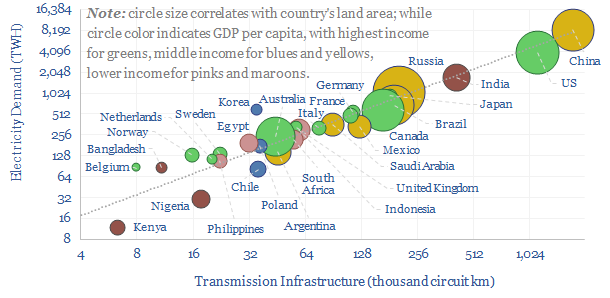

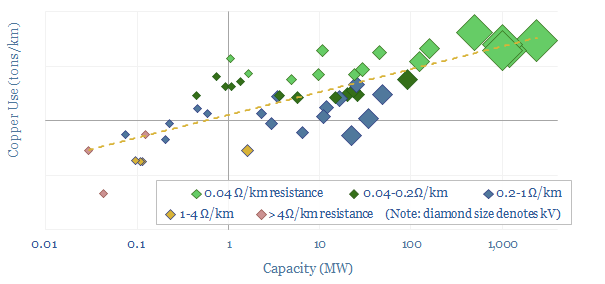

Power grid circuit kilometers need to rise 3-5x in the energy transition. This trend directly tightens global aluminium markets by over c20%, and global copper markets by c15%. Slow recent progress may lead to bottlenecks, then a boom? This 12-page note quantifies the rising demand for circuit kilometers, grid infrastructure, underlying metals and who benefits?

Download

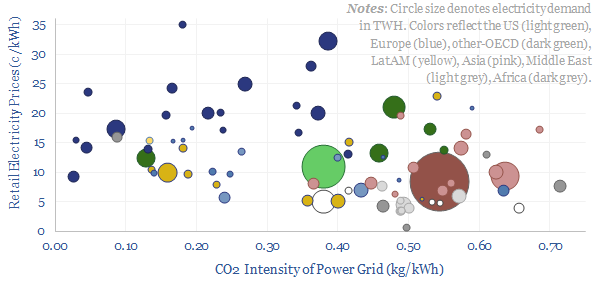

Retail electricity prices average 11c/kWh globally, of which 50-60% is wholesale power generation, 25-35% is transmission and 10-20% covers other administrative costs of utilities. The average CO2 intensity of the global average power grid is 0.45 kg/kWh. Variations are wide. And there is a -35% correlation between electricity prices vs CO2 intensities in different countries globally.

Download

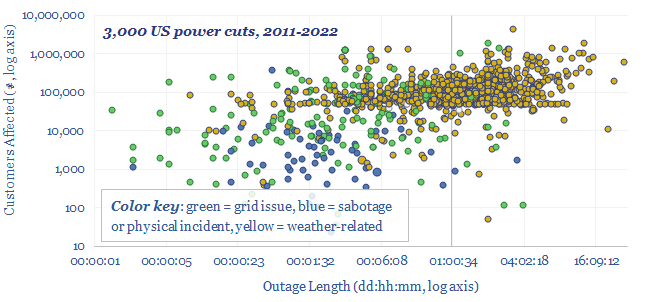

This data-file aggregates significant US power grid disruptions, based on data from the DOE. On average, there are 250 power cuts per year in the United States, lasting for a median average of 5-hours, and affecting a median average of 80,000 customers. 20% of the power cuts last longer than 1-day. 15% affect more than 1M customers. What implications?

Download

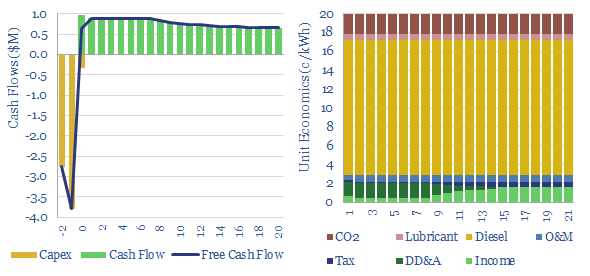

A multi-MW scale diesel generator requires an effective power price of 20c/kWh, in order to earn a 10% IRR, on c$700/kW capex, assuming $70 oil prices and c150km trucking of oil products to the facility. Economics can be stress-tested in the Model-Base tab.

Download

This data-file aggregates power transmission and distribution kilometers by country, across 30 key countries, which comprise 80% of global electricity use. In 2023, the world contains 7M circuit kilometers of power transmission lines and 110M kilometers of power distribution lines. Useful rules of thumb are in the data-file.

Download

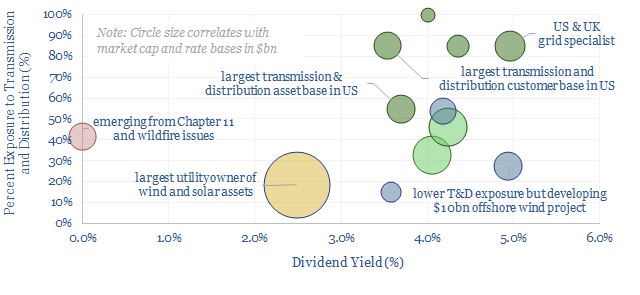

The average US electric utility has 25 GW of generation, 15,000-miles of power transmission, 100,000 miles of distribution, 8M customers, 3.5% dividend yields and 6.5% long-term target growth. We wonder if there is upside on expanding power grids? A dozen companies are in our screen.

Download

DC-DC power converters are used to alter the voltage in DC circuits, such as in wind turbines, solar MPPT, batteries and digital/computing devices. This data-file is a breakdown of DC-DC power converters' electrical efficiency, which will typically be around 95%. Losses are higher at low loads. We think there will be upside for increasingly high-quality and efficient power electronics as part of the energy transition.

Download

Is the power grid becoming a bottleneck for the continued acceleration of renewables? The median approval time to tie a new US power project into the grid has climbed by 30-days/year since 2001, and doubled since 2015, to over 1,000 days (almost 3-years) in 2021. Wind and solar projects are now taking longest. This data-file looks for de-bottlenecking opportunities, and wonders about changing terms of trade in power markets.

Download

Goldwind is one of the largest wind turbine manufacturers in the world, headquartered in Beijing, and shares are publicly listed. The wind industry is increasingly aiming to mimic the inertia and frequency responses of synchronous power generators. Goldwind has published some interesting case studies. Hence we have reviewed its patents to see if we can find an edge?

Download

This is a database of cable installation vessels for offshore wind and power transmission; tabulating costs (in $M), contract awards (in $/km), capacity (in tons), installation speeds (in meters per hour), power ratings (in MW), crew sizes and positioning systems. There is a paradox over costs.

Download

Electrification is the largest, most overlooked, most misunderstood part of the energy transition. Hence this 10-page note aims to explain the upside, simply and clearly. Electricity rises from 40% of total useful energy today to 60% by 2050. Within the next decade, this adds $2trn to the enterprise value of capital goods companies in power grids and power electronics.

Download

Eaton is a power-electronics super-giant, listed in the US, employing 86,000 people, generating $20bn per year of revenues. We have aimed to guess how $20bn pa of net sales is distributed across 200 different product categories. 75% is exposed to power-electronics, with tailwinds in the energy transition.

Download

This data-file is a technology review for Sentient Energy, assessing innovations in smart grids. Its technology can achieve energy savings via a combination of "Conservation Voltage Reduction" and "Volt-VAR optimization at the grid edge". This also helps to integrate more solar and EV charging into power grids. We explain the technology.

Download

This 20-page note quantifies the statistical distribution of short-term volatility at solar power plants. Solar output typically flickers downwards by over 10%, around 100 times per day. Can industrial processes truly be ‘powered by solar’? What opportunities will arise to buffer the volatility?

Download

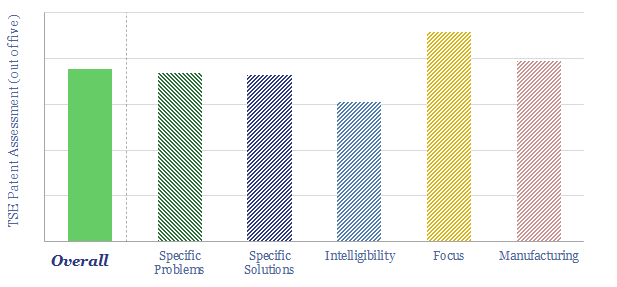

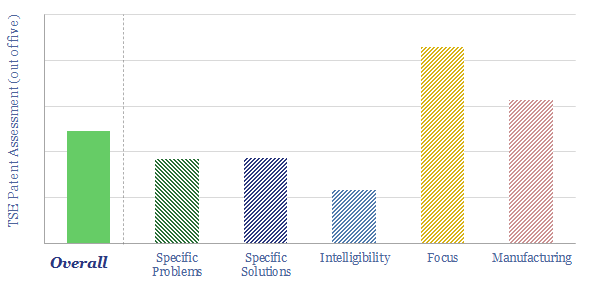

Prysmian scores well on our patent assessment framework. We conclude an array of incremental improvements and industry specializations confer a partial moat and helps to de-risk future installation work.

Download

The solar energy reaching a given point on Earth’s surface varies by +/- 6% each year. These annual fluctuations are 96% correlated over tens of miles. And no battery can economically smooth them. Solar heavy grids may thus become prone to unbearable volatility. Our 17-page note outlines this important challenge, and finds that the best solutions are to construct high-voltage interconnectors and keep power grids diversified.

Download

This data-file aggregates the average annual volatility of solar (and wind) resources across ten locations, mainly cities, in the United States. Annual volatility of incoming solar energy reaching ground level tends to vary by +/- 6% per year, is 96% correlated across different locations within that city, and 50-70% correlated with other cities in the same region.

Download

Can large-scale power transmission smooth renewables' volatility? To answer this question, this horrible 18MB data-file aggregates 20-years of hour-by-hour solar insolation arriving at four cities in the US. The volatility in year-by-year can be halved by a single inter-connector.

Download

Global investment into power networks averaged $280bn per annum in 2015-20, of which two-thirds was for distribution and one-third was for transmission. Amazingly, these numbers step up to $600bn in 2030, >$1trn in the 2040s and can be as large as all primary energy investment.

Download

We describe c15 problems incurred by industrial and commercial power consumers. Many will require additional investment as renewables replace the large rotating generators of traditional power grids. Hence we see the market for commercial and industrial power electronics trebling from $360bn pa in 2021 to $1trn pa by 2035.

Download

Nostromo is commercializing a thermal energy storage system, for commercial buildings in hot climates, where AC can comprise 40-70% of total energy use. It scores highly on our patent framework and can be an interesting alternative to lithium batteries.

Download

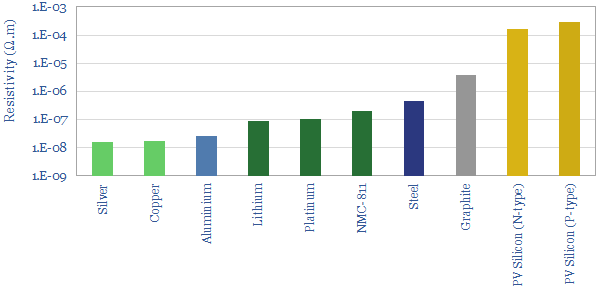

Electrical conductivity of energy transition materials is tabulated in this data-file. 'The action' takes place in the range of 10^-8 to 10^-3 Ohm-meters, including silver in solar cells, copper in renewables and EVs, aluminium transmission lines, batteries, and solar semiconductors.

Download

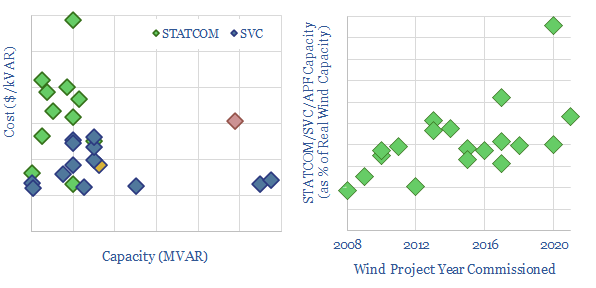

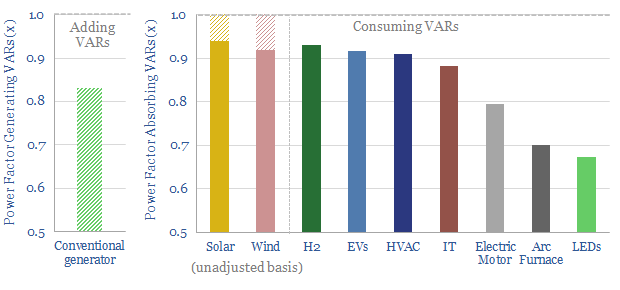

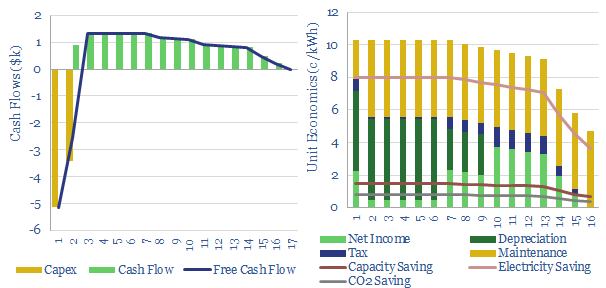

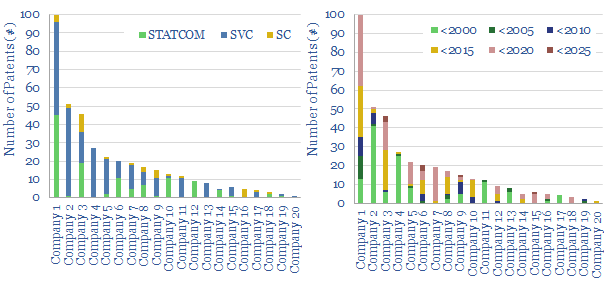

Wind and solar have so far leaned upon conventional power grids. But larger deployments will increasingly need to produce their own reactive power; controllably, dynamically. Demand for STATCOMs & SVCs may thus rise 30x, to over $25-50bn pa. This 20-page note outlines the opportunity and who benefits?

Download

Flexible Alternating Current Transmission System components (FACTS) include Static Synchronous Compensators (STATCOMs) and Static VAR Compensators (SVCs). A typical wind project has 0.5 - 1.0 kVAR of FACTS per 1.0 kW of real power capacity. Each kVAR of SVCs and STATCOMs costs $100/kVAR and $150/kVAR respectively.

Download

Power factor corrections could save 0.5% of global electricity, with $20/ton CO2 abatement costs in normal times, and 30% pure IRRs during energy shortages. They will also be needed to integrate more new energies into power grids. This note outlines the opportunity in capacitor banks, their economics and leading companies.

Download