This data-file reviews Bloom Energy’s solid oxide fuel cell technology. What surprised us most was a particularly candid overview of the degradation pathways of solid oxide fuel cells, a focus on improving the longevity of fuel cells, albeit this sometimes seems to be via heavy uses of Rare Earth metals, and increasing complexity. The specificity of the patents does suggest a moat around Bloom Energy fuel cell technology.

Bloom Energy is a leading manufacturer of solid oxide fuel cells, founded in 2001, headquartered in San Jose, California with 1,700 employees, $1.2bn pa of revenues and $3.1bn market cap at the time of this patent assessment in August-2023. Fuel cells matter as we see an increasing need for clean, small-scale generation in the energy transition (note here).

How does a solid oxide fuel cell work? A solid oxide fuel cell draws in air at the cathode, where oxygen ‘gains electrons’ and reduces to yield oxide ions. These oxide ions pass through the electrolyte of the cell towards the anode. At the anode, a fuel oxidizes, surrendering electrons to complete the electrical circuit, then reacts with oxide ions.

What materials are used in solid oxide fuel cells? Electrolytes for solid oxide fuel cells tend to involve stabilized zirconias, such as yttria-stabilized zirconia (YSZ) although Bloom also uses scandia-stabilized zirconia (SSZ or ScSZ). The anode is commonly made of nickel-YSZ cermet. The cathode is often Lanthanum Strontium Manganite (LSM) (or similar). And the metallic interconnects between adjacent cells in a fuel cell stack tend to comprise high-grade chromium alloys.

Why are solid oxide fuel cells so hot? One of Bloom Energy’s patents notes the importance of cubic SSZ as an electrolyte. However, below 580C, this material undergoes a cubic-to-rhombohedral phase transition. Fuel cells run at 650-850C because these high temperatures are needed to open up crystalline electrolyte configurations that enable oxygen permeability.

What are the costs of fuel cells? Capex costs of fuel cells are a challenge, modeled here and here, and Bloom has disclosed production costs in the range of $2,500-4,000/kW from 2017 to 2023 (margins come on top). Materials are a key reason for high costs. Especially scandium. Bloom Energy is sometimes quoted as being the largest scandium consumer in the world (examples here and here). Scandia costs have ranged from $1,000-5,000/kg. Other Rare Earths mentioned in Bloom’s patents include Lanthanum, Yttrium, Cerium, Ytterbium, Samarium and Gadolinium.

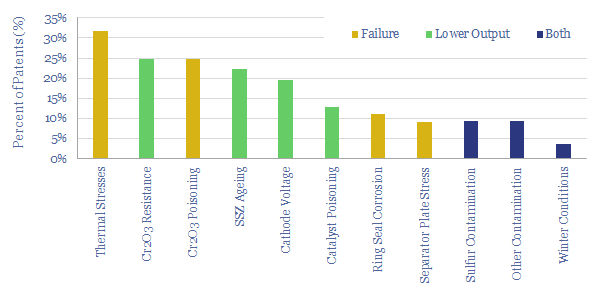

What degradation rates for fuel cells? The other key challenge for fuel cells is longevity. We have tracked 160 historical fuel cell deployments in the US (data here), which have tended to see their output decline by 5% per year on average, and most have been retired after an average of c10-12 years.

Does Bloom Energy’s technology help to avoid degradation? The purpose of this data-file is to review patents filed by Bloom Energy, for explanations of why solid oxide fuel cells degrade, and what technology has been developed to address this. The patents we reviewed give very good, clear and candid details into degradation drivers. A table in the data-file explains each one, and how Bloom’s patents address it.

The analysis does, however, raise an important question about the trajectory of future fuel cell costs, which is also discussed in the data-file.

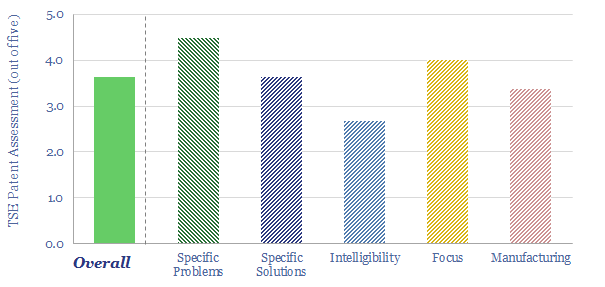

Does Bloom Energy have an edge in solid oxide fuel cell technology? The data-file also assessed Bloom’s patents using our usual framework. Generally, the patents are specific, high-quality, and make it unlikely that any other SOFC producer will be able to encroach about Bloom’s IP. Some useful details are disclosed over materials and manufacturing methods. Although we also have an observation about focus shifting.