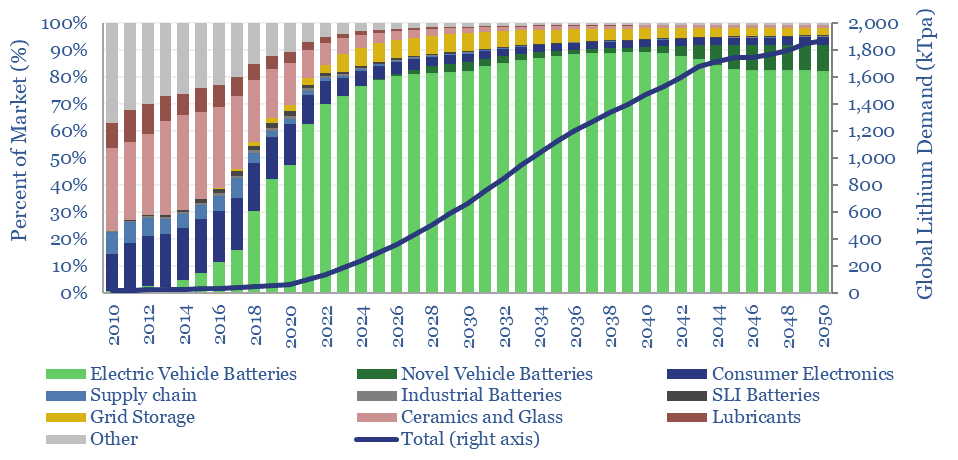

This data-file estimates global lithium demand under our roadmap to net zero, and integrates with our oil market models. The data are disaggregated across electric vehicles, new vehicle types, consumer electronics, grid-scale batteries and conventional material uses.

Demand for lithium has already trebled from 23kTpa in 2010 to 65kTpa in 2020, while we see the ascent continuing to 500kTpa in 2030 and almost 2MTpa in 2050.

This data-file estimates global lithium demand across electric vehicle batteries, industrial batteries, consumer electrics, grid storage, ceramics, glass, lubricants and other end uses.

80-90% of demand in the 2040s is driven by transportation, especially electric vehicles. Categories such as ceramics, glasses and lubricants, which historically comprised one half of the market are crowded out.

There are sufficient lithium resources globally to meet this ascent, with 14MT of reserves and a 10-year reserve replacement ratio of 1000%. A 50% reserve replacement ratio should suffice for our forecasts to 2050.

The largest reason for rising global lithium demand is our outlook on electric vehicles, plus helping to resolve power grid bottlenecks. The model is flexible so that inputs and outputs can be stress-tested.

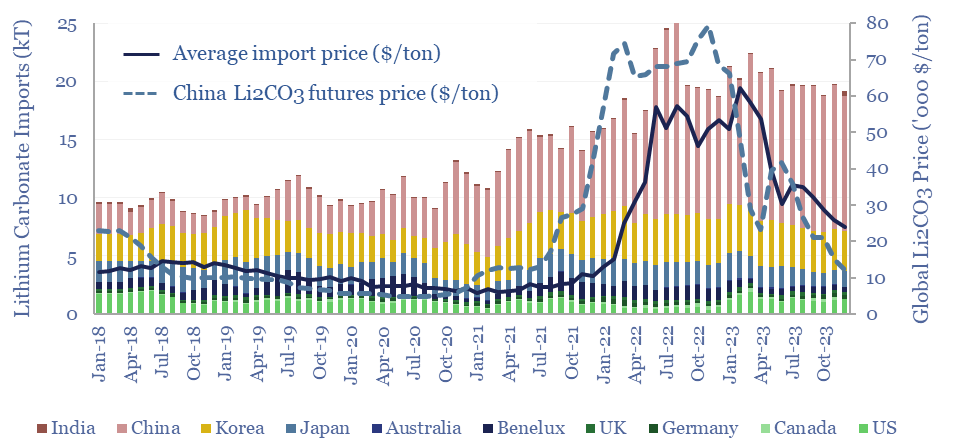

We have also tabulated data on lithium carbonate imports by country (in kTpa), lithium import prices and lithium futures prices (in $/ton).

Short notes on the market follow in the final tab of the data-file. We see a growing role for lithium mining and lithium from brines. We have also screened leading lithium producers.